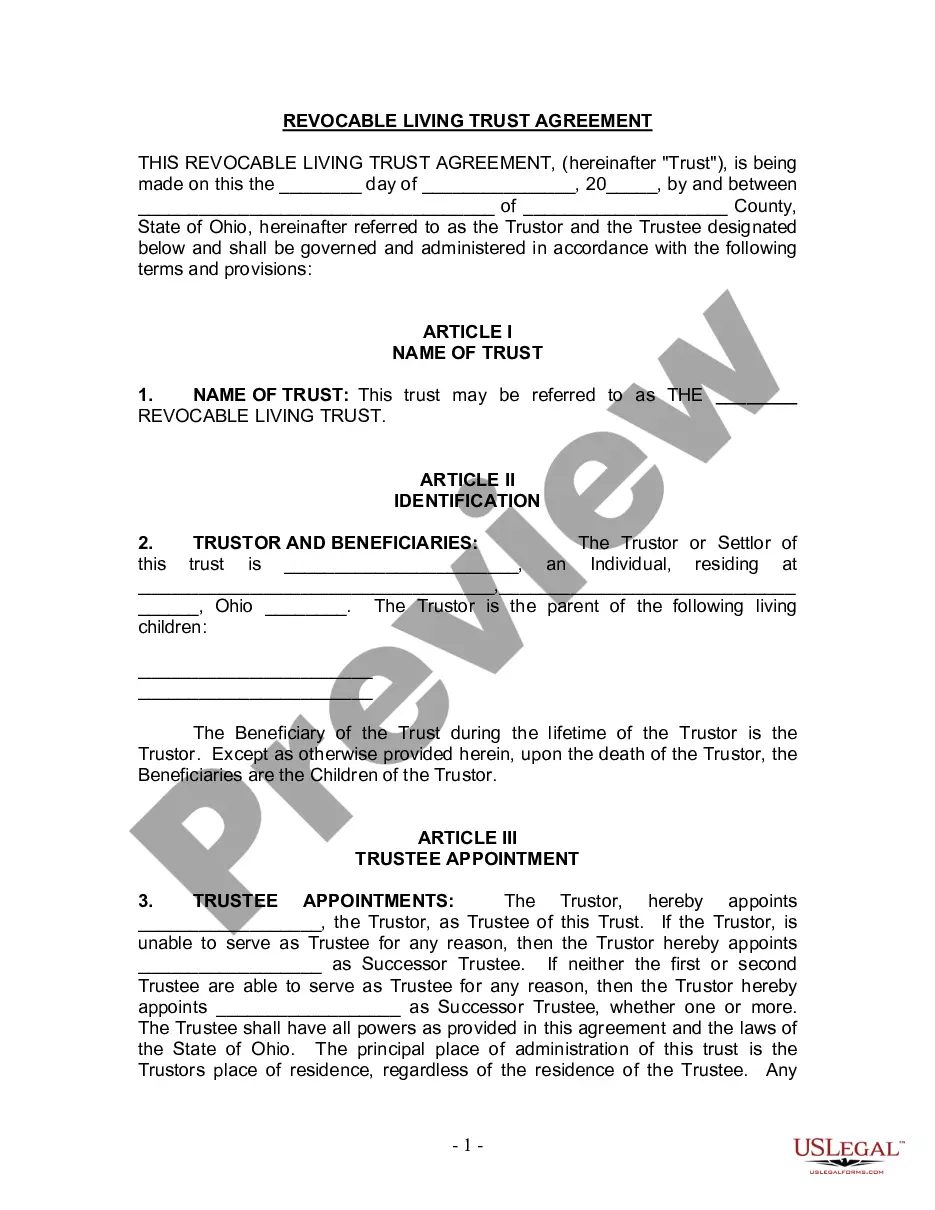

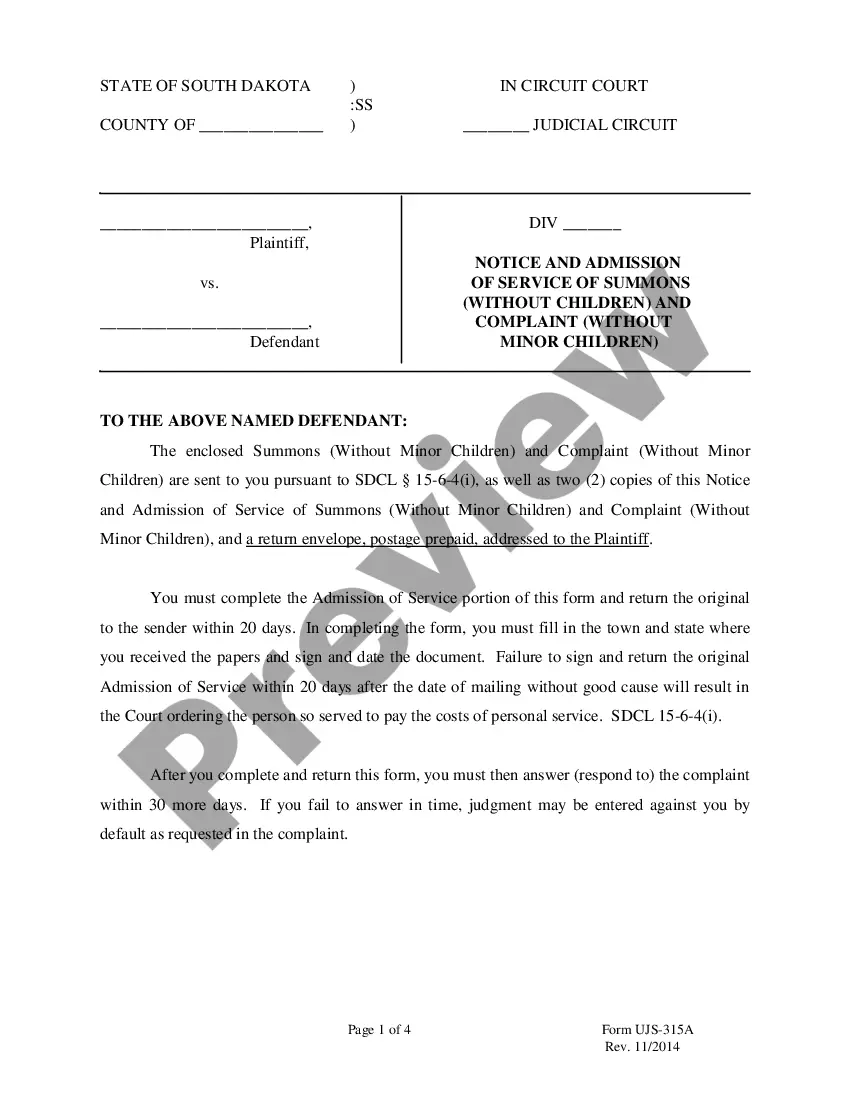

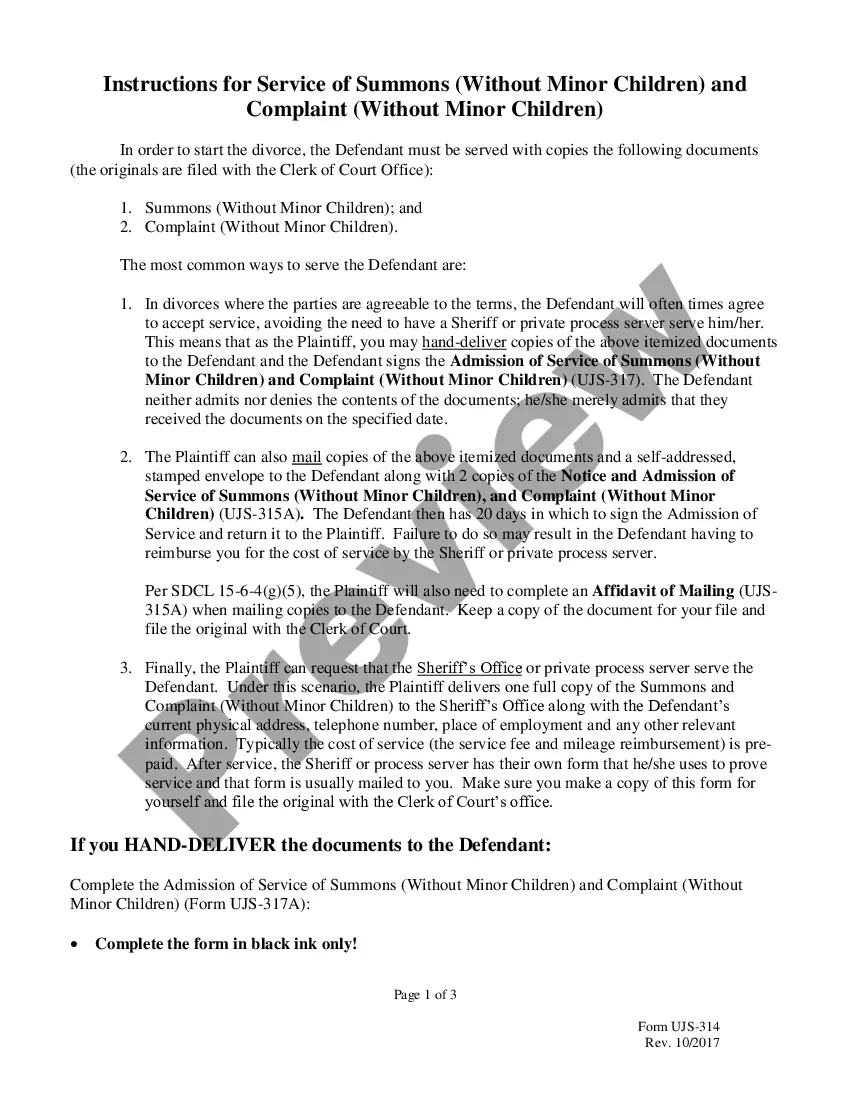

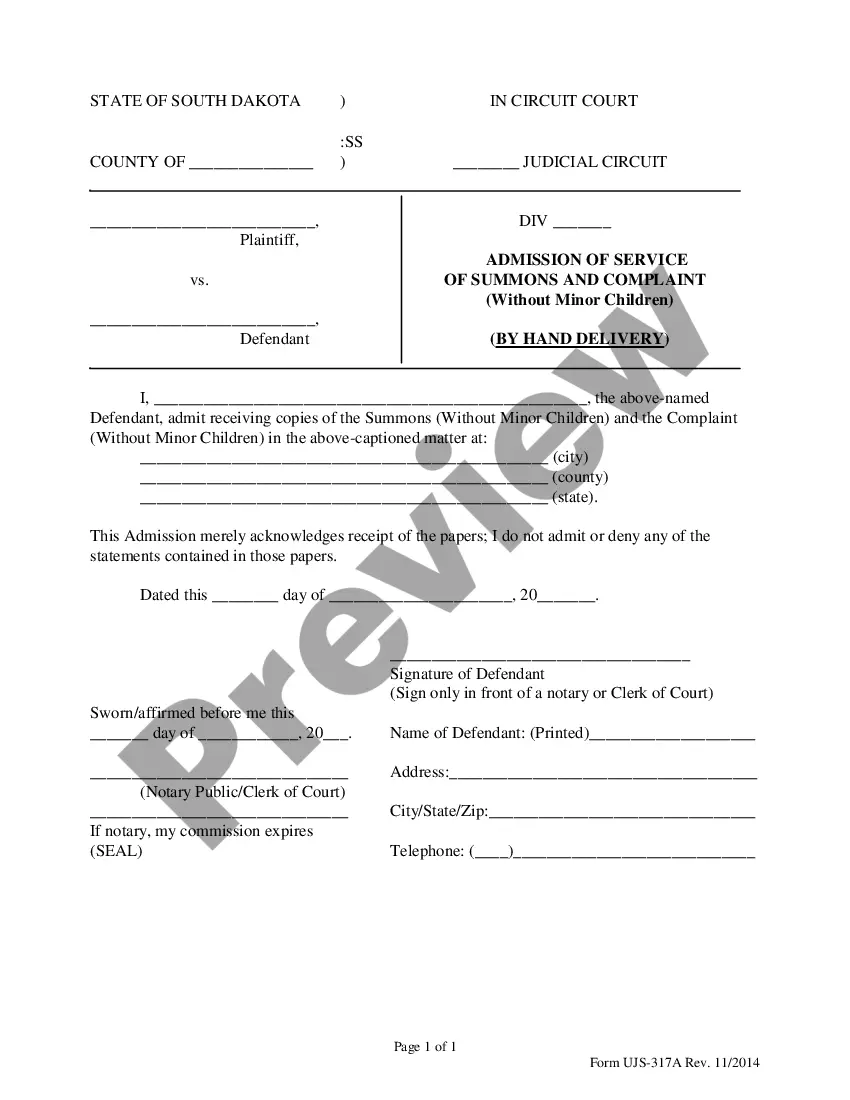

Delaware Dissolution — Section 27— - before issuance of shares — Short Form is a dissolution option available in Delaware for unincorporated businesses that have not yet issued shares. This short form is less comprehensive than the full form and is a more simplified version of dissolution. It is often used for businesses that are inactive and have minimal assets or liabilities. This short form requires the filing of a Certificate of Cancellation with the Delaware Division of Corporations and payment of a filing fee. The filing must include the business name, the business purpose, and the Delaware registered agent. There is no requirement to create a plan of dissolution or to provide notice to creditors. Once the Certificate of Cancellation is filed and accepted, the business is officially dissolved. The forms of Delaware Dissolution — Section 27— - before issuance of shares — Short Form are: • Certificate of Cancellation • Registered Agent Change Form • Filing Fee Payment • Registered Agent AcknowledgemenForrrrm.rm.

Delaware Dissolution - Section 274 - before issuance of shares - Short Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Dissolution - Section 274 - Before Issuance Of Shares - Short Form?

US Legal Forms is the most straightforward and economical method to locate suitable legal templates.

It is the most comprehensive online collection of business and personal legal documents prepared and reviewed by attorneys.

Here, you can locate printable and fillable forms that adhere to federal and local regulations - just like your Delaware Dissolution - Section 274 - prior to issuance of shares - Short Form.

Review the form description or preview the document to ensure you’ve located the one that fulfills your criteria, or search for another using the search tab above.

Press Buy now once you’re confident of its suitability for all the requirements, and select the subscription plan that best suits you.

- Acquiring your template only takes a few easy steps.

- Users who already possess an account with an active subscription merely need to Log In to the online service and download the document onto their device.

- Subsequently, they can find it in their profile in the My documents section.

- And here’s how to obtain a properly created Delaware Dissolution - Section 274 - prior to issuance of shares - Short Form if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

To dissolve a Delaware limited liability company, you must file a Certificate of Cancellation with the Delaware Division of Corporations. This process is relatively straightforward, especially with the help of professional services that specialize in Delaware Dissolution - Section 274 - before issuance of shares - Short Form. You should ensure all outstanding obligations are settled before completing this step. Leveraging platforms like uslegalforms can simplify this process, providing you with the necessary guidance and documents to facilitate your company's dissolution.

Section 276 of the Delaware General Corporation Law (DGCL) details the procedures for corporate dissolution. This section allows companies to dissolve under certain circumstances, including situations where shares have yet to be issued. Expressing a clear intention to dissolve, a company can follow the necessary steps to complete its Delaware Dissolution - Section 274 - before issuance of shares - Short Form. Understanding this section is essential for any entity planning to efficiently navigate its dissolution process.

To increase authorized shares in Delaware, a corporation must typically amend its certificate of incorporation. This process involves drafting an amendment that specifies the new number of authorized shares and obtaining approval from the board of directors and shareholders. In the context of Delaware Dissolution - Section 274 - before issuance of shares - Short Form, this amendment can be particularly beneficial as it allows for the expansion of shares as the business evolves. Utilizing a platform like uslegalforms can simplify the amendment process and ensure compliance with state regulations.

Authorized shares refer to the maximum number of shares a corporation can issue, as outlined in its charter documents. This definition is critical, especially in discussions around Delaware Dissolution - Section 274 - before issuance of shares - Short Form, since the authorized shares set the legal boundaries for share issuance. Authorized shares do not include shares that are issued and held; they merely indicate the potential for shares that can be made available. Understanding this concept is vital for proper corporate governance.

The number of shares a corporation should authorize in Delaware can vary based on its specific needs and goals. Generally, companies may choose to authorize a reasonable number of shares to ensure they have flexibility for future growth or investment opportunities. However, in the context of Delaware Dissolution - Section 274 - before issuance of shares - Short Form, it is crucial to plan and authorize the right amount initially to avoid complications later. Consulting with experts can provide clarity in making this decision.

The authorized shares method in Delaware refers to the process by which a corporation designates a specific number of shares it is allowed to issue. This method is particularly important in the context of Delaware Dissolution - Section 274 - before issuance of shares - Short Form, as it determines the available shares prior to any issuance. Understanding this process helps businesses plan their capital structure effectively. Additionally, this approach allows for greater flexibility in managing shares as the company grows.

To dissolve a nonprofit corporation in Delaware, you first need to follow the guidelines set forth under Delaware Dissolution - Section 274 - before issuance of shares - Short Form. Initiate the process by ensuring that the corporation has no outstanding debts or liabilities. Next, file the certificate of dissolution with the Delaware Secretary of State, which formally ends your nonprofit’s existence. Using the services available on the uslegalforms platform can make this process easier, guiding you through the necessary forms and requirements.

To dissolve a Delaware corporation resolution, the board of directors must adopt a resolution to dissolve the company. Following the resolution, you must file the appropriate paperwork with the Delaware Secretary of State. By understanding Delaware Dissolution - Section 274 - before issuance of shares - Short Form, you can ensure a smooth and compliant dissolution process.

If you do not dissolve a Delaware corporation, it remains active and potentially incurs ongoing fees and tax obligations. Furthermore, failure to dissolve may result in legal liabilities for the owners or shareholders. It is advisable to seek information about Delaware Dissolution - Section 274 - before issuance of shares - Short Form to avoid unnecessary complications.

To issue shares in a corporation, begin by following your state's incorporation guidelines. Organize a board meeting to approve the issuance and document this decision. The process is essential in compliance with Delaware Dissolution - Section 274 - before issuance of shares - Short Form, reassuring your corporation's legal standing.