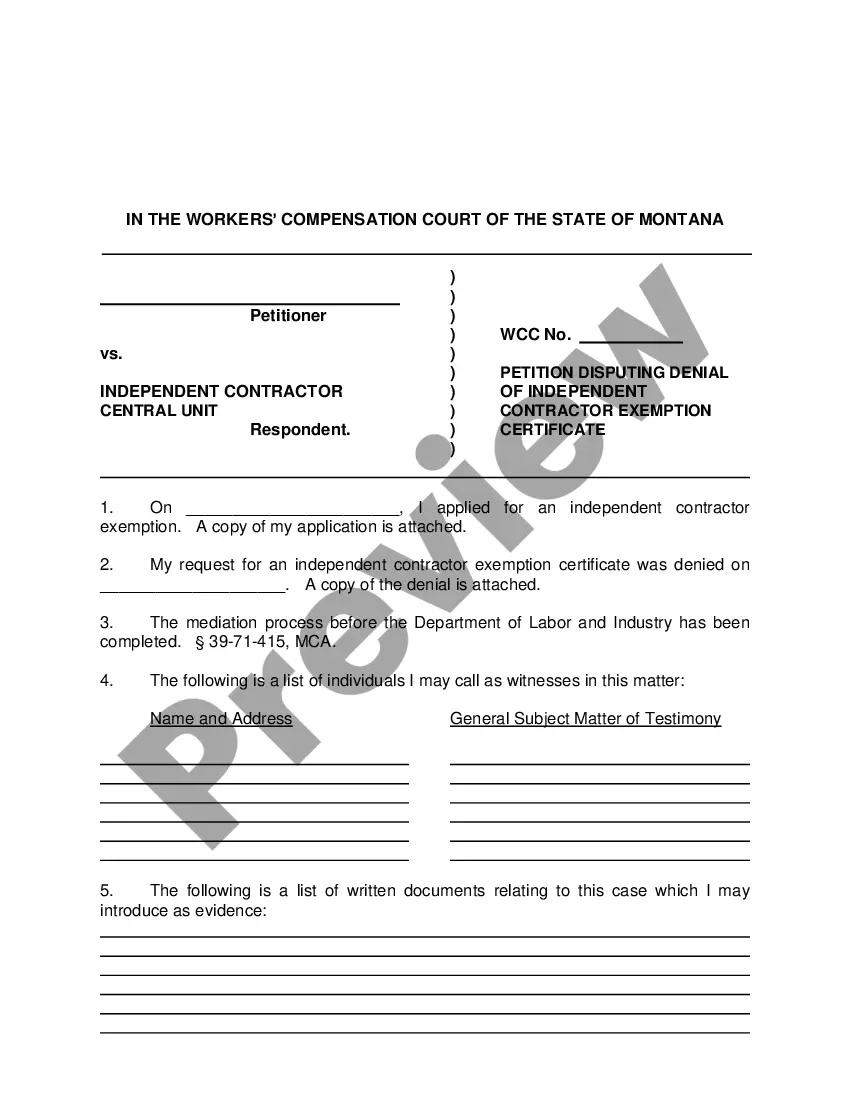

The Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) is a document that is filed with the Delaware Secretary of State to dissolve a Non-Stock Corporation that has not yet started business. It is used to terminate the legal existence of the corporation, and must be signed by all the incorporates or directors of the company. The Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) is available in two different forms: The Standard Form, which is used when the corporation has not issued any shares, and the Special Form, which is used when the corporation has issued shares. The Standard Form must be accompanied by a Certificate of Merger, Certificate of Conversion or Certificate of Exchange, while the Special Form must be accompanied by the issuance of stock certificates. Both forms require the name of the corporation, its Delaware registered office address, and the signature of the incorporated or director. Once the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) is filed with the Delaware Secretary of State, the corporation will be officially dissolved. The filing is not complete until it is accepted and stamped by the Secretary of State.

Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation)

Description

How to fill out Delaware Short Form Certificate Of Dissolution (Before Beginning Business-Non Stock Corporation)?

How much time and resources do you typically allocate for crafting official documentation.

There's a better chance to obtain such forms than recruiting legal experts or spending hours searching online for an appropriate template. US Legal Forms is the premier online repository that provides professionally crafted and validated state-specific legal documents for a variety of purposes, such as the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation).

Another benefit of our service is that you can retrieve previously acquired documents that you securely keep in your profile within the My documents tab. Access them anytime and re-complete your paperwork as needed.

Save time and energy executing formal paperwork with US Legal Forms, one of the most reliable online services. Enroll with us today!

- Review the form content to ensure it aligns with your state's legislation. To do this, examine the form description or utilize the Preview option.

- If your legal template does not satisfy your requirements, search for an alternative using the tab at the top of the page.

- If you are already a member of our service, Log In and download the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation). If not, continue with the following steps.

- Click Buy now when you identify the correct document. Choose the subscription plan that best fits your needs to access the full features of our library.

- Create an account and proceed with payment for your subscription. You can complete the transaction using your credit card or via PayPal - our service is completely secure for transactions.

- Download your Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) to your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

If a corporation is not dissolved, it continues to exist and accumulate obligations. This situation can expose the business owner to ongoing tax liabilities, fees, or fines imposed by the state. Eventually, you might need to file a Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) to formally end your corporation. Engaging with platforms like uslegalforms can simplify this process and help you address any issues effectively.

Failing to file your annual report with Delaware can lead to significant consequences for your corporation. The state may impose fines and eventually dissolve your corporation if the report remains unfiled for an extended period. This can jeopardize your business operations and could complicate the process of obtaining a Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation). To maintain good standing, ensure timely filing.

In Delaware, dissolution refers to the formal process of ending the legal existence of an LLC, while cancellation relates to the termination of the LLC's ability to conduct business. While both actions signify the closure of the business, dissolution involves filing specific paperwork and ensuring all obligations are addressed. If you're navigating this process, understanding the nuances of your Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) can be especially beneficial.

To dissolve a nonprofit corporation in Delaware, you need to file a certificate of dissolution with the Delaware Secretary of State. This process typically involves securing necessary approvals from your board and ensuring that all debts and obligations are settled. Using US Legal Forms can provide you with the proper documentation, including the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation), making the dissolution process more straightforward.

A short form dissolution in Delaware is an expedited process for corporations that have not engaged in business. This method allows for a streamlined approach to formally end your company’s existence, saving time and reducing hassle. If you're looking to close your non-stock corporation efficiently, the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) is an excellent option.

In Delaware, a short form merger refers to a process allowing a parent company to merge with its subsidiary without going through a lengthy approval process. This procedure is typically faster since it requires minimal documentation when both entities meet specific criteria. For those considering corporate restructuring, understanding and applying for a Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation) can be crucial.

A short form dissolution in Delaware allows qualifying corporations to dissolve their business quickly and efficiently. This option is applicable for corporations that have yet to conduct business and can simplify the process by reducing paperwork. By utilizing a Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation), you can achieve a swift resolution to your corporate affairs.

To fill out the articles of dissolution form in Delaware, start by collecting your company's essential details, such as its name and the date of formation. Next, indicate the reason for dissolution and provide the required signatures. You can streamline this process using US Legal Forms, where you can find templates specifically designed for a Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation).

The time it takes to dissolve a Delaware corporation usually depends on various factors, including the filing of the necessary paperwork. Typically, once you submit the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation), it can be processed within a few business days. However, for a smoother experience, consider using a service like uslegalforms, which provides guidance and assistance throughout the dissolution process.

To dissolve a nonprofit organization in Delaware, start by ensuring that all debts and obligations are settled. After that, you should hold a meeting to approve the dissolution, and then prepare the Delaware Short Form Certificate of Dissolution (Before Beginning Business-Non Stock Corporation). Finally, file this certificate with the Delaware Division of Corporations and ensure compliance with any state requirements.