This form is an official Montana form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

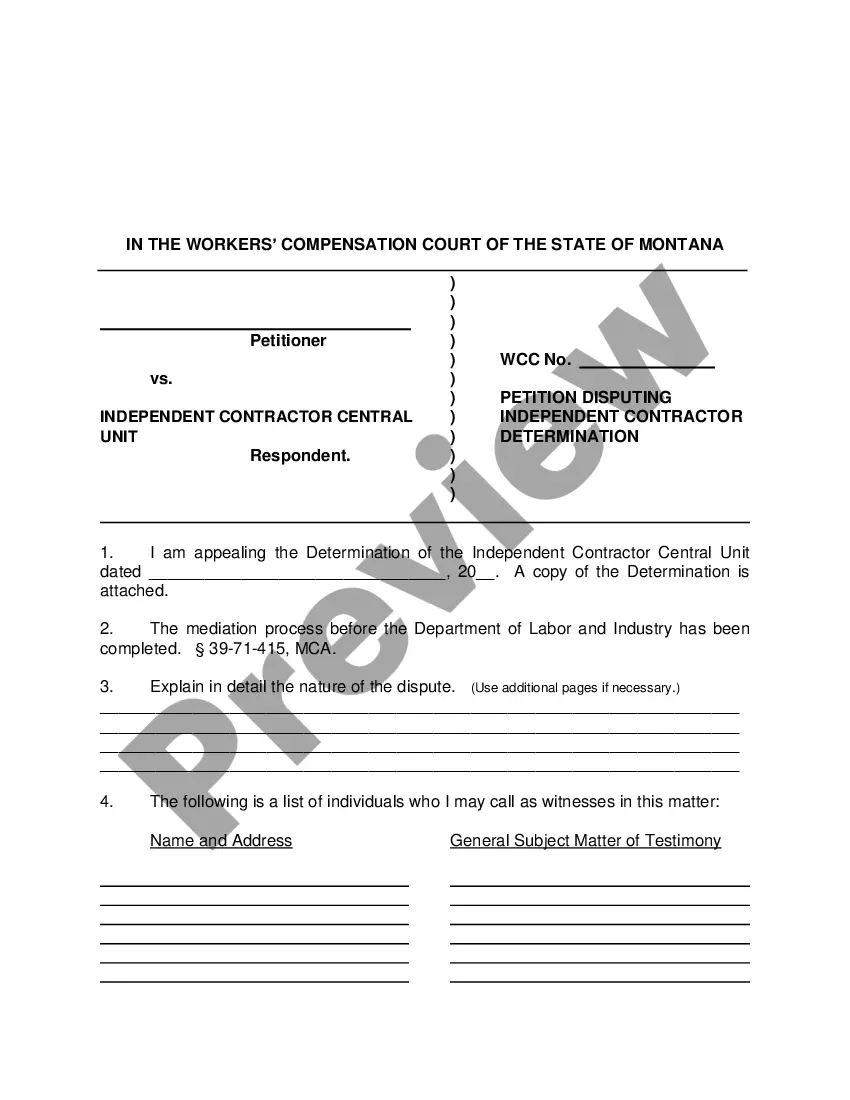

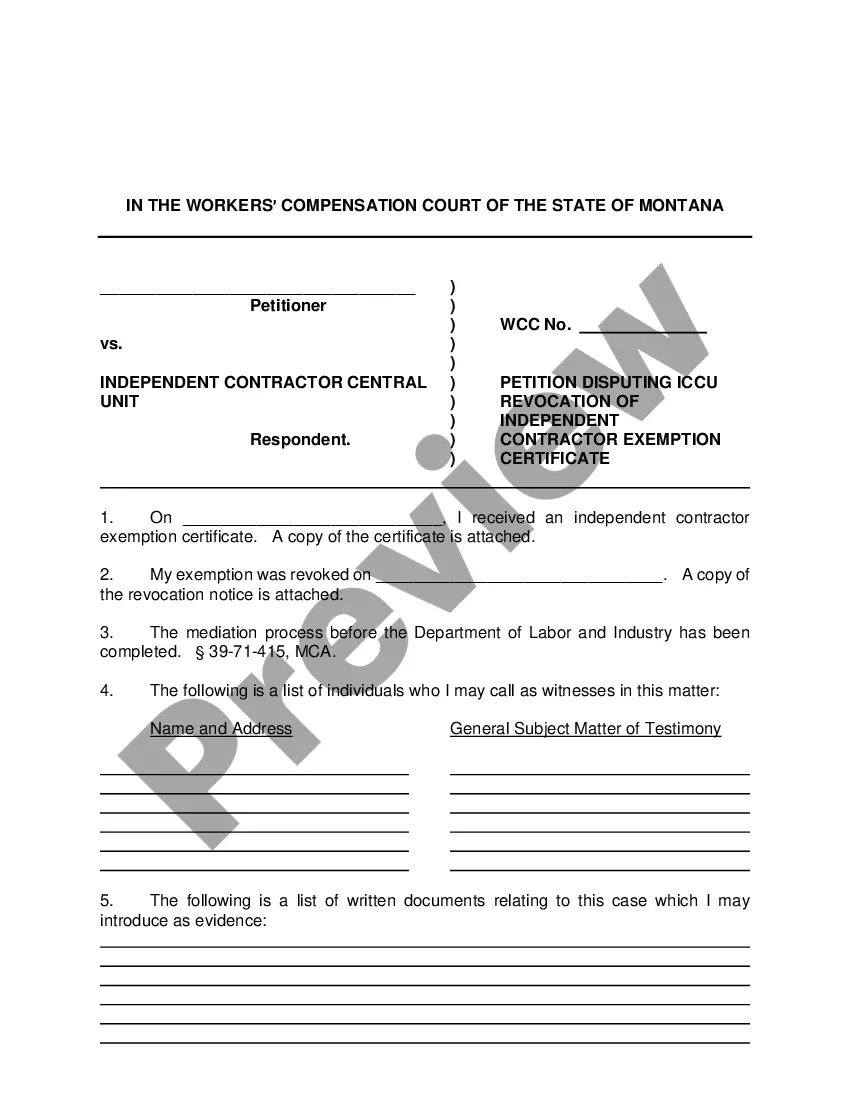

Montana Petition Disputing Denial of Self-Employed Independent Contractor Status - Non-Workers Compensation

Description

How to fill out Montana Petition Disputing Denial Of Self-Employed Independent Contractor Status - Non-Workers Compensation?

Steer clear of costly attorneys and discover the Montana Petition Contesting Rejection of Self-Employed Independent Contractor Classification - Non-Workers Compensation you require at an affordable price on the US Legal Forms platform.

Utilize our straightforward grouping feature to search for and acquire legal and tax paperwork. Review their details and preview them prior to downloading.

Make payment via credit card or PayPal. Select to download the document in PDF or DOCX format. Click Download and locate your form in the My documents section. You are welcome to save the template to your device or print it. After downloading, you can fill out the Montana Petition Contesting Rejection of Self-Employed Independent Contractor Classification - Non-Workers Compensation by hand or with editing software. Print it out and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms provides clients with step-by-step guidance on how to acquire and complete each form.

- US Legal Forms users simply need to Log In and download the specific document they require to their My documents section.

- Those who haven’t secured a subscription yet should adhere to the instructions below.

- Verify that the Montana Petition Contesting Rejection of Self-Employed Independent Contractor Classification - Non-Workers Compensation is permitted for use in your location.

- If accessible, browse the description and utilize the Preview feature before downloading the templates.

- If you are certain the template meets your requirements, click on Buy Now.

- If the form is incorrect, use the search tool to find the appropriate one.

- Subsequently, create your account and choose a subscription plan.

Form popularity

FAQ

First, prove you independently own a business. Get a Montana Tax Identification Number with the Montana Department of Revenue. Then fill out an independent contractor exemption certification. Fill out and mail in the application form.

ICEC are services that are used to evaluate whether a specific company or worker for a particular assignment meets the legal requirements to perform as an independent contractor.

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.