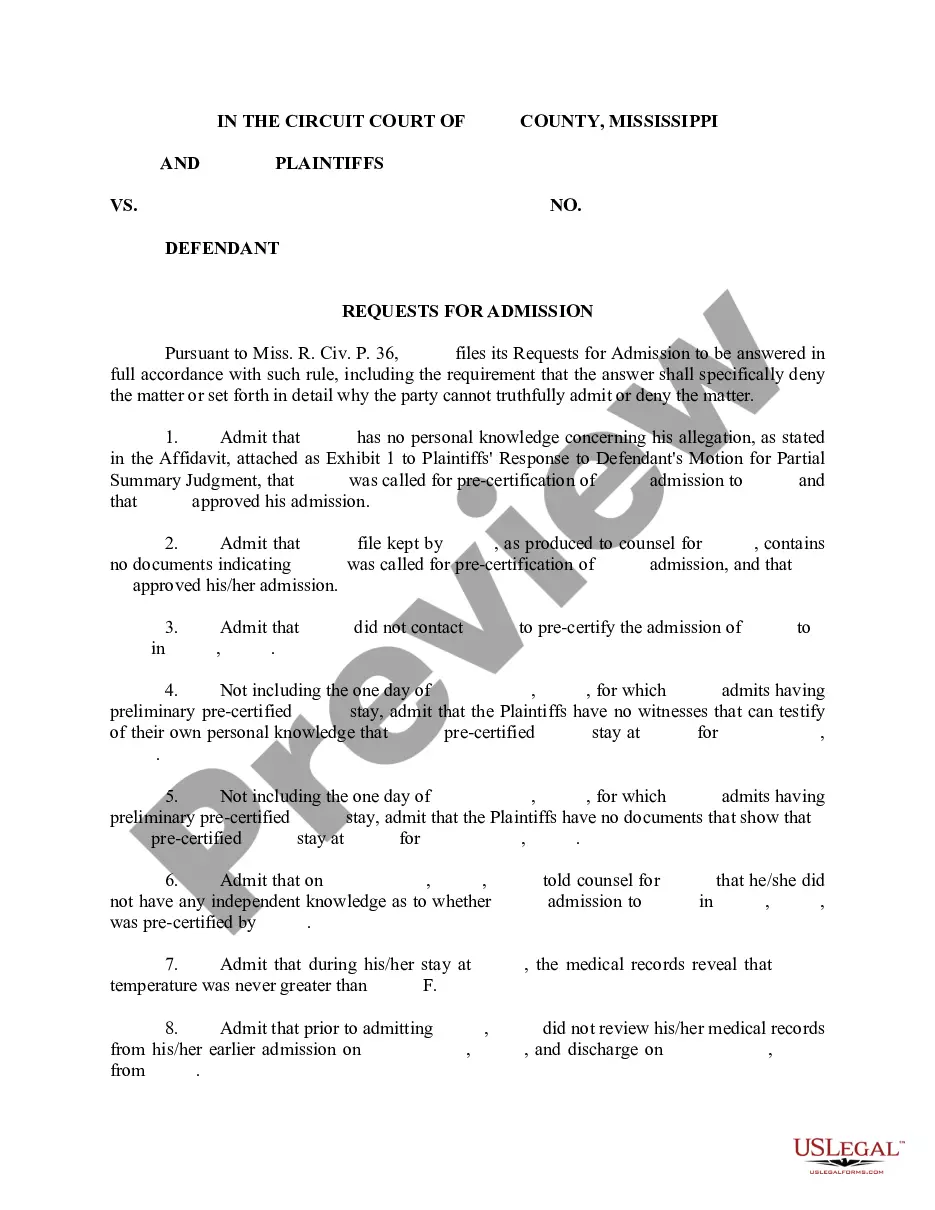

Delaware Dissolution — Section 27— - before beginning of business — Short Form is a document used by a Delaware corporation to officially dissolve its existence before the beginning of its business. This document is filed with the Delaware Secretary of State and must be signed by a majority of the corporation’s directors. It will include the company name, registration number, the date of authorization of dissolution, and the signature of the corporate officers. This short form dissolution can be used if the corporation has not yet begun business or has no assets or liabilities. There are two types of Delaware Dissolution — Section 27— - before beginning of business — Short Form: the standard form and the non-standard form. The standard form is for corporations that have not yet begun business. The non-standard form is for corporations that have already begun business but have no assets or liabilities.

Delaware Dissolution - Section 274 - before beginning of business - Short Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware Dissolution - Section 274 - Before Beginning Of Business - Short Form?

Drafting legal documents can be quite a hassle unless you have accessible fillable templates prepared for use. With the US Legal Forms online collection of official documents, you can have confidence in the forms you receive, as they all adhere to federal and state laws and are verified by our specialists.

Obtaining your Delaware Dissolution - Section 274 - before the commencement of business - Short Form from our service is incredibly straightforward. Existing users with a valid subscription simply need to Log In and click the Download button once they find the correct template. Additionally, if necessary, users can choose the same document from the My documents section of their account.

Haven't tried US Legal Forms yet? Register for our service today to acquire any formal document swiftly and effortlessly whenever needed, and keep your paperwork organized!

- Document compliance confirmation. It's important to thoroughly review the details of the form you require to ensure it aligns with your necessities and fulfills your state’s legal standards. Observing your document and examining its general overview will assist you in this.

- Alternative search (optional). If you encounter any discrepancies, search the library using the Search tab above until you discover a fitting template, then click Buy Now when you find what you require.

- Account creation and document acquisition. Sign up for an account with US Legal Forms. After verifying your account, Log In and select the subscription plan that best fits your needs. Proceed with the payment (PayPal and credit card options are available).

- Template download and subsequent use. Choose the file format for your Delaware Dissolution - Section 274 - before the start of business - Short Form and click Download to save it on your device. You can print it to fill out your documents manually or utilize a feature-rich online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

Filling out an articles of dissolution form requires you to include your business name, the date of dissolution, and the reason for dissolving the business. It is crucial to follow the guidelines provided for Delaware Dissolution - Section 274 - before beginning of business - Short Form. Make sure to review the completion of the form for accuracy and compliance. If you're unsure, consider using uslegalforms for assistance to ensure everything is done correctly.

To write a business dissolution letter, start by clearly stating your intent to dissolve the company. Include the name of your business, the date of dissolution, and reference Delaware Dissolution - Section 274 - before beginning of business - Short Form. Ensure to provide any additional details required by your state, and finally, sign the document to make it official. For guidance, using platforms like uslegalforms can streamline the process.

The consequences of not dissolving a Delaware corporation can be significant, including continued legal requirements, unpaid taxes, and ongoing fees that can accrue over time. Additionally, the existence of an unresolved corporation can hinder any future business plans you might have. Therefore, it's essential to formally dissolve your corporation when it's no longer in use. Engaging with Delaware Dissolution - Section 274 - before beginning of business - Short Form provides a clear solution to this issue.

If you do not dissolve a Delaware corporation, it will continue to exist in the eyes of the law, which may lead to unexpected liabilities and obligations. This can include annual fees or taxes, even if the business is not operational. Running into these problems can complicate future business ventures. To avoid these unnecessary issues, consider utilizing Delaware Dissolution - Section 274 - before beginning of business - Short Form.

To prove a business is dissolved, you typically need a Certificate of Dissolution from the state of Delaware. This document confirms that you have legally dissolved your corporation and outlines your compliance with all necessary procedures. Keeping this certificate as part of your business records is essential for future reference. For a straightforward path to obtaining this document, turn to Delaware Dissolution - Section 274 - before beginning of business - Short Form.

The time it takes to dissolve a Delaware corporation varies based on a few factors, including the method of dissolution chosen. Generally, if you file the short-form procedure, it can be completed relatively quickly, often within a few business days. However, additional time may be needed if there are outstanding obligations to address. For an efficient dissolution process, Delaware Dissolution - Section 274 - before beginning of business - Short Form is an ideal choice.

To shut down a business in Delaware, you typically need to file the appropriate dissolution forms with the state. This ensures that your corporation is legally recognized as dissolved, freeing you from ongoing liabilities. It's important to clear any debts or obligations before filing. For a straightforward approach to dissolution, consider Delaware Dissolution - Section 274 - before beginning of business - Short Form.

Failing to file an annual report in Delaware can result in penalties, including fines and the potential loss of your business entity status. This situation may also complicate any future attempts to legally operate or dissolve your corporation. Regular compliance is crucial, and that includes timely filing of your reports. To streamline your compliance process and explore options for dissolution, you can look into Delaware Dissolution - Section 274 - before beginning of business - Short Form.

If a corporation is not dissolved, it remains legally active, which can lead to ongoing responsibilities. This means the corporation may face unexpected taxes, fees, and potential legal liabilities. Additionally, not dissolving can complicate your business affairs, especially if you plan to operate another business in the future. To avoid these complications, consider utilizing Delaware Dissolution - Section 274 - before beginning of business - Short Form for efficient closure.

A sale of substantially all assets refers to the transfer of the majority of a company's assets to another entity. This can be part of a liquidation process or a strategic business move. In the context of Delaware dissolution under Section 274, this sale requires careful attention to ensure compliance with applicable laws. Knowing this definition aids in navigating your business's next steps effectively.