Plan of complete liquidation and dissolution

What this document covers

The Plan of Complete Liquidation and Dissolution is a legal document used by corporations to outline the process of dissolving the company and liquidating its assets. It specifies how the business will cease operations, address outstanding liabilities, and distribute any remaining assets to shareholders. This form is crucial for ensuring compliance with state laws and protecting the interests of stakeholders during dissolution, differentiating it from other corporate forms that may not include liquidation details.

Form components explained

- Adoption of the plan: Details the process for shareholders to approve the dissolution plan.

- Cessation of business: Outlines the cessation of business activities post-approval, except for winding up affairs.

- Determination of shareholder interests: Describes how shareholders will be compensated based on their ownership shares.

- Reserve for taxes and expenses: Specifies the creation of a reserve fund for liabilities and final expenses before asset distribution.

- Dissolution process: Provides instructions for filing the necessary documents to complete the dissolution legally.

- Authorization for necessary acts: Empowers the directors and officers to take all required actions to implement the dissolution.

When to use this document

This form should be used when a corporation decides to cease its business operations entirely and liquidate its assets. It is necessary when the company is no longer viable or when shareholders agree that dissolution is in their best interest. Common scenarios include financial difficulties, a decision to pursue a different business direction, or mergers that require the dissolution of the existing entity.

Who can use this document

This form is intended for:

- Corporate directors and officers looking to liquidate and dissolve their corporation legally.

- Shareholders who need to understand their rights and entitlements during the dissolution process.

- Legal counsel assisting corporations in the dissolution procedure.

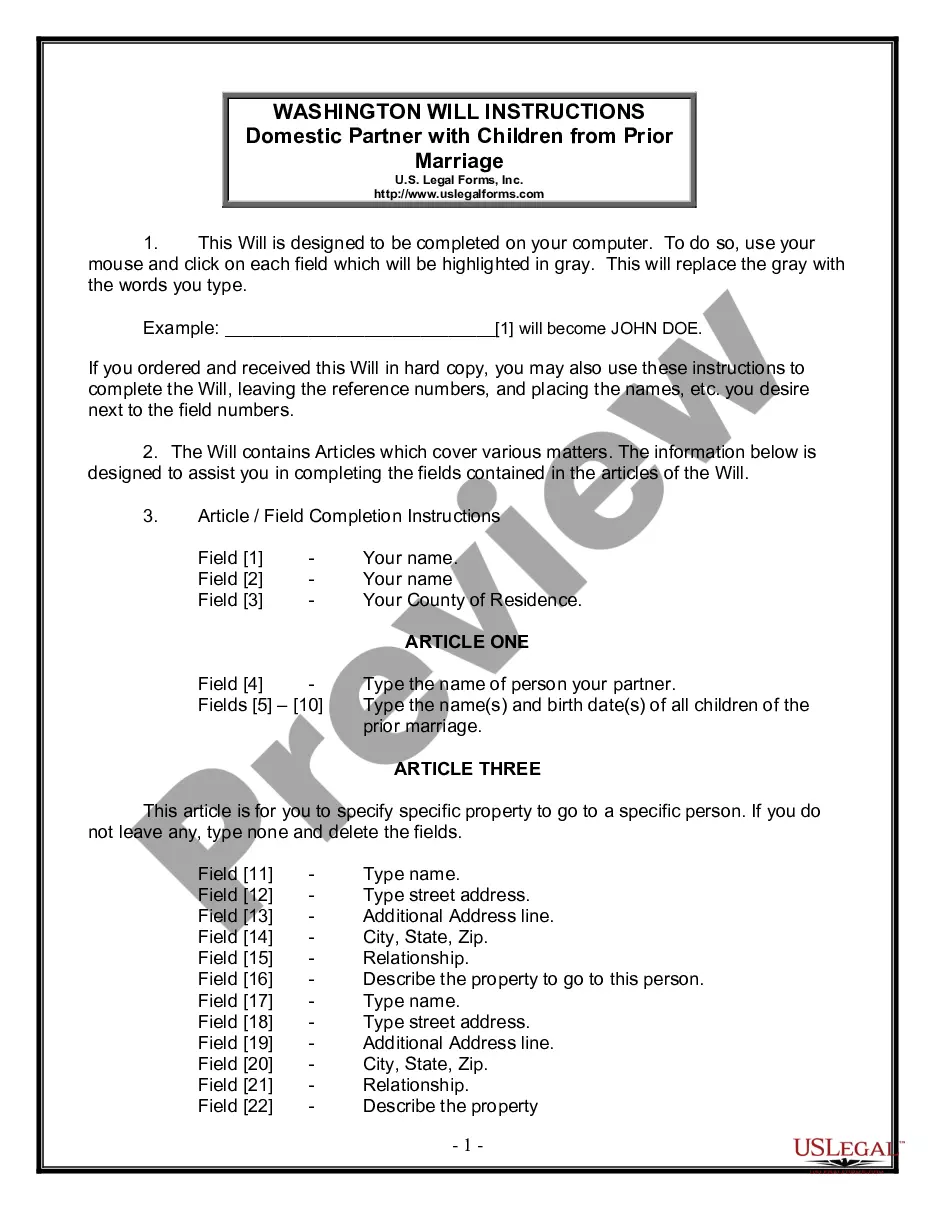

Completing this form step by step

- Gather necessary information about the corporation, including the names of directors, officers, and shareholders.

- Prepare a draft of the plan detailing the dissolution process and distribute it to shareholders for review.

- Schedule a meeting to vote on the adoption of the plan and ensure at least two-thirds of shareholders approve it.

- Set aside a reserve fund to cover any outstanding liabilities and expenses following the Effective Date.

- File all required documents, including the Certificate of Election to Wind Up and Dissolve, according to state laws.

Does this document require notarization?

This form does not typically require notarization unless specified by local law. However, it is important to check your stateâs specific regulations to ensure compliance during the dissolution process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Neglecting to obtain the necessary shareholder approval before proceeding with dissolution.

- Failing to reserve sufficient funds for taxes and expenses, which can lead to legal issues.

- Not filing the required dissolution documents with the appropriate state authorities in a timely manner.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows you to customize the document according to your corporation's specific needs.

- Reliability ensures that you are using a legally compliant and up-to-date template created by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Write your business's name, address, and EIN at the top of the form. Complete Box 1 with the date of incorporation. Complete Box 2 with the location of incorporations. Use Box 3 to indicate whether this is a complete or partial liquidation.

Liquidate means converting property or assets into cash or cash equivalents by selling them on the open market. Liquidation similarly refers to the process of bringing a business to an end and distributing its assets to claimants.

332 provides tax-free treatment to the corporate shareholder's gain or loss from the receipt of the subsidiary's property in liquidation, and Sec.1504(a)(2) (generally 80% by voting power and value) and the distribution was made in complete cancellation or redemption of all the stock of the liquidating corporation.

In that process, the corporation notifies creditors of the impending cessation of business and does all acts appropriate to liquidate its business, such as collecting and selling assets, discharging liabilities, and distributing any remaining assets to shareholders.6 The corporation may, but is rarely required to,

Liquidation is important if a business fails due to anything from a lack of visionary management to increasing debts; from almost-zero revenue inflow to rising costs of unnecessary assets. Absence of profit planning and control on the continuity of losses for extended periods also call for liquidation.

Plan of Liquidation means a plan (including by operation of law) that provides for, contemplates or the effectuation of which is preceded or accompanied by (whether or not substantially contemporaneously) (i) the sale, lease, conveyance or other disposition of all or substantially all of the assets of the referent

After the costs of liquidation, secured creditors and preferential creditors are paid first, and then unsecured creditors. Creditors with valid specific security over stock and equipment (such as retention of title clauses or leases) generally have priority to recover those items where they can be clearly identified.