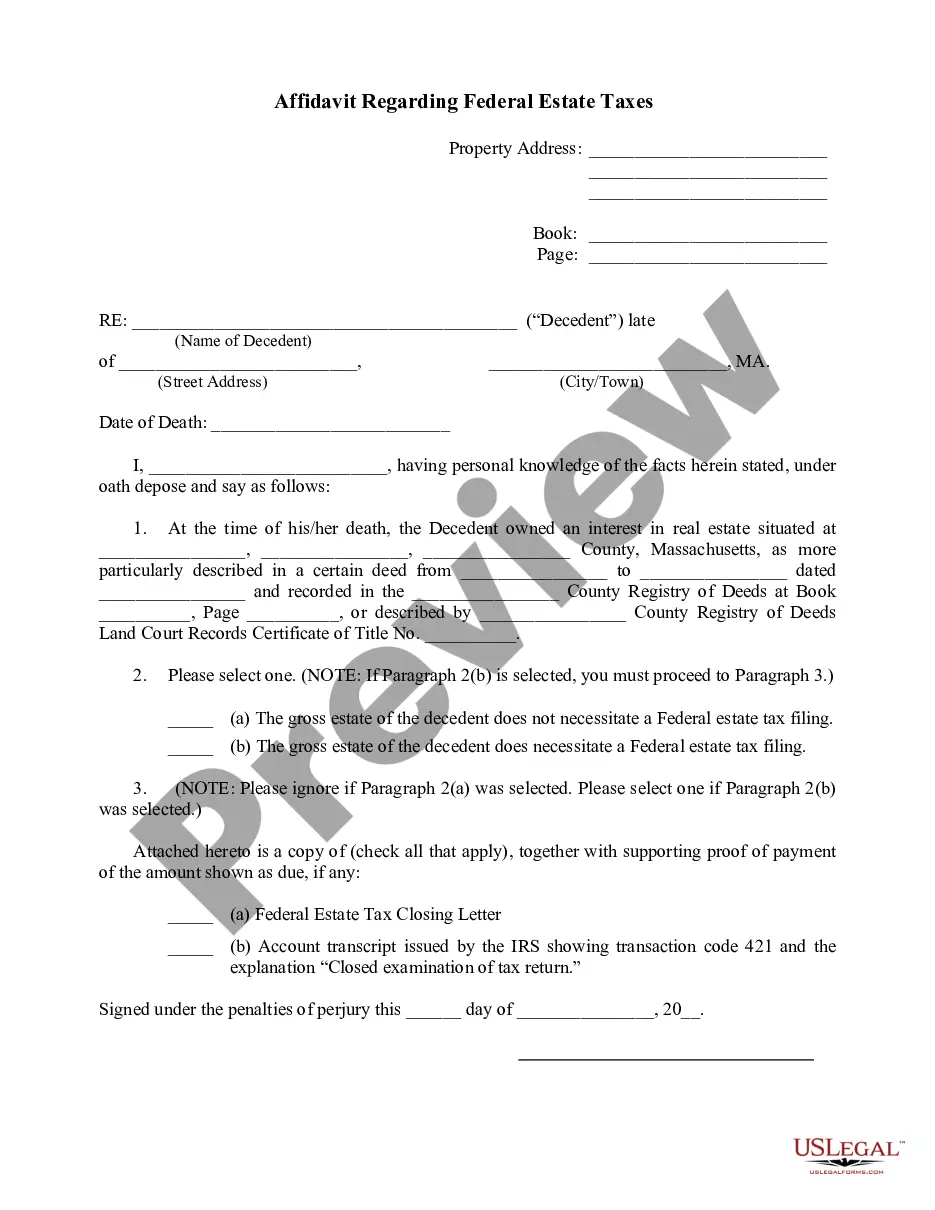

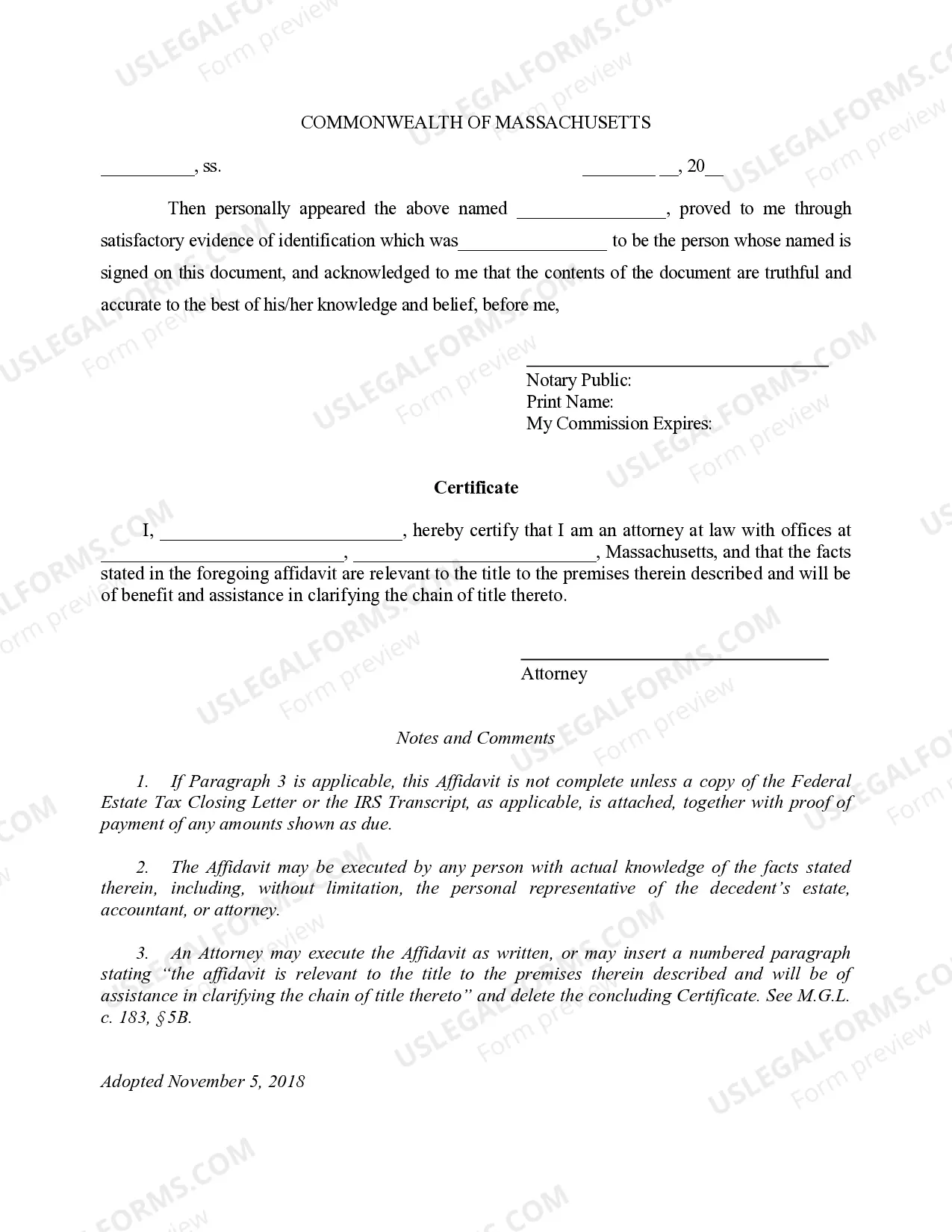

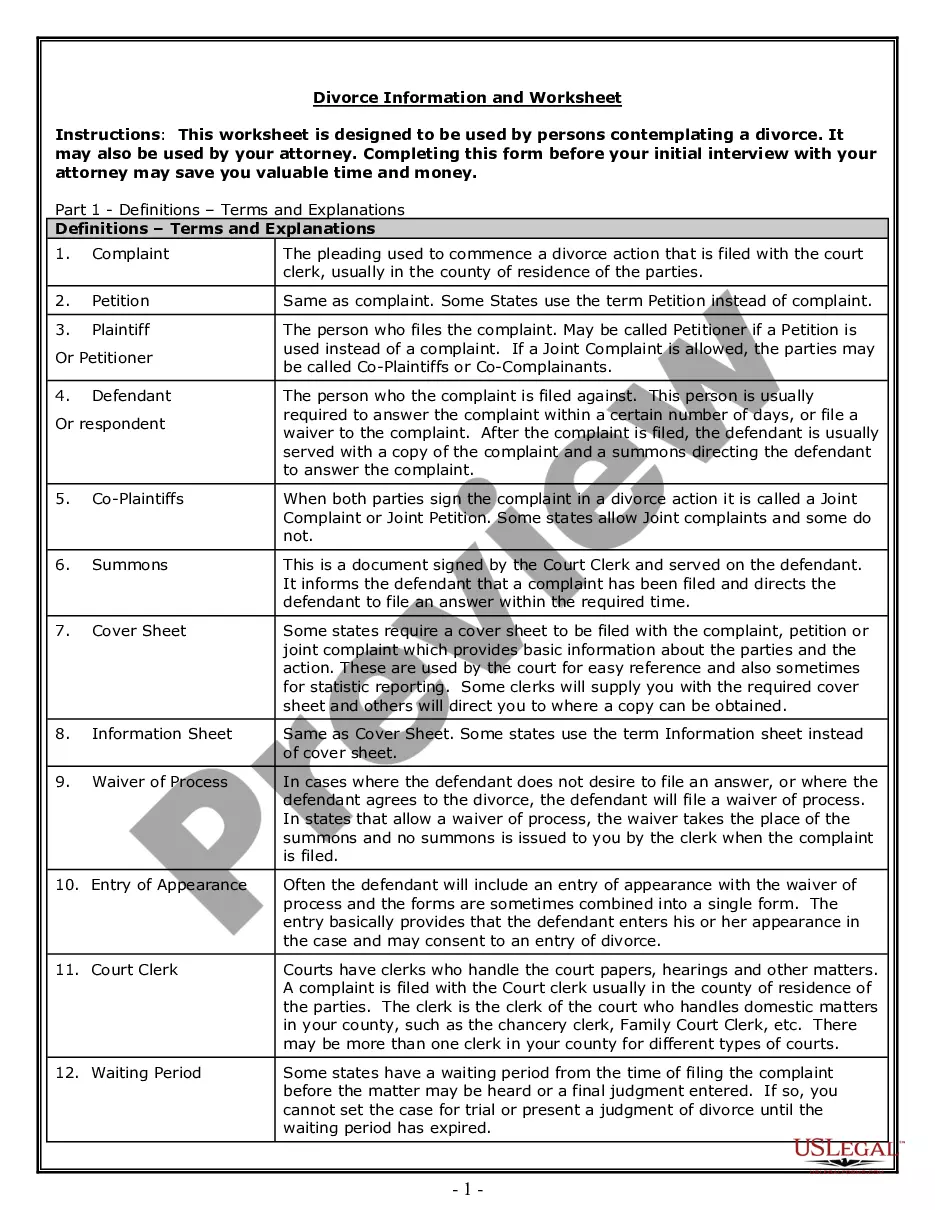

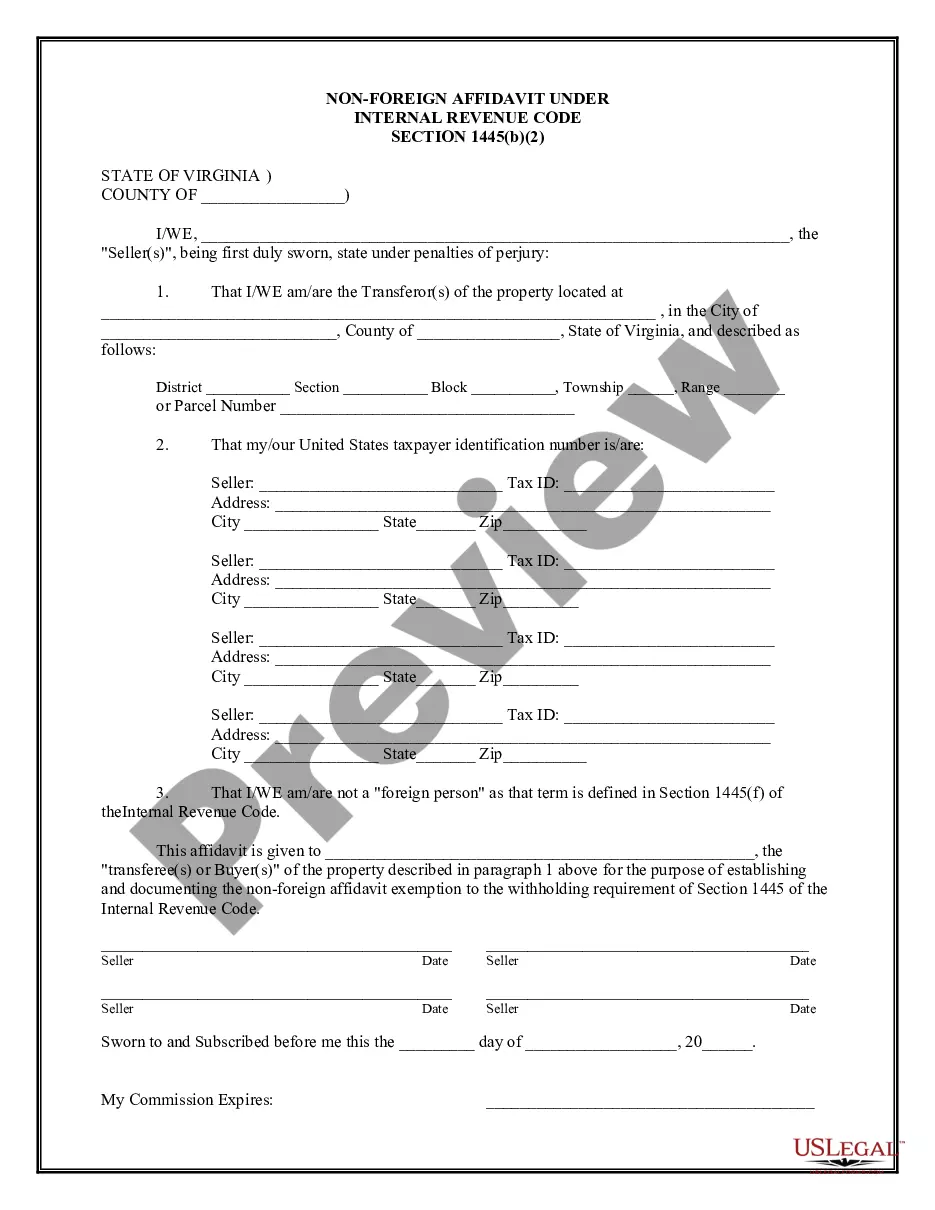

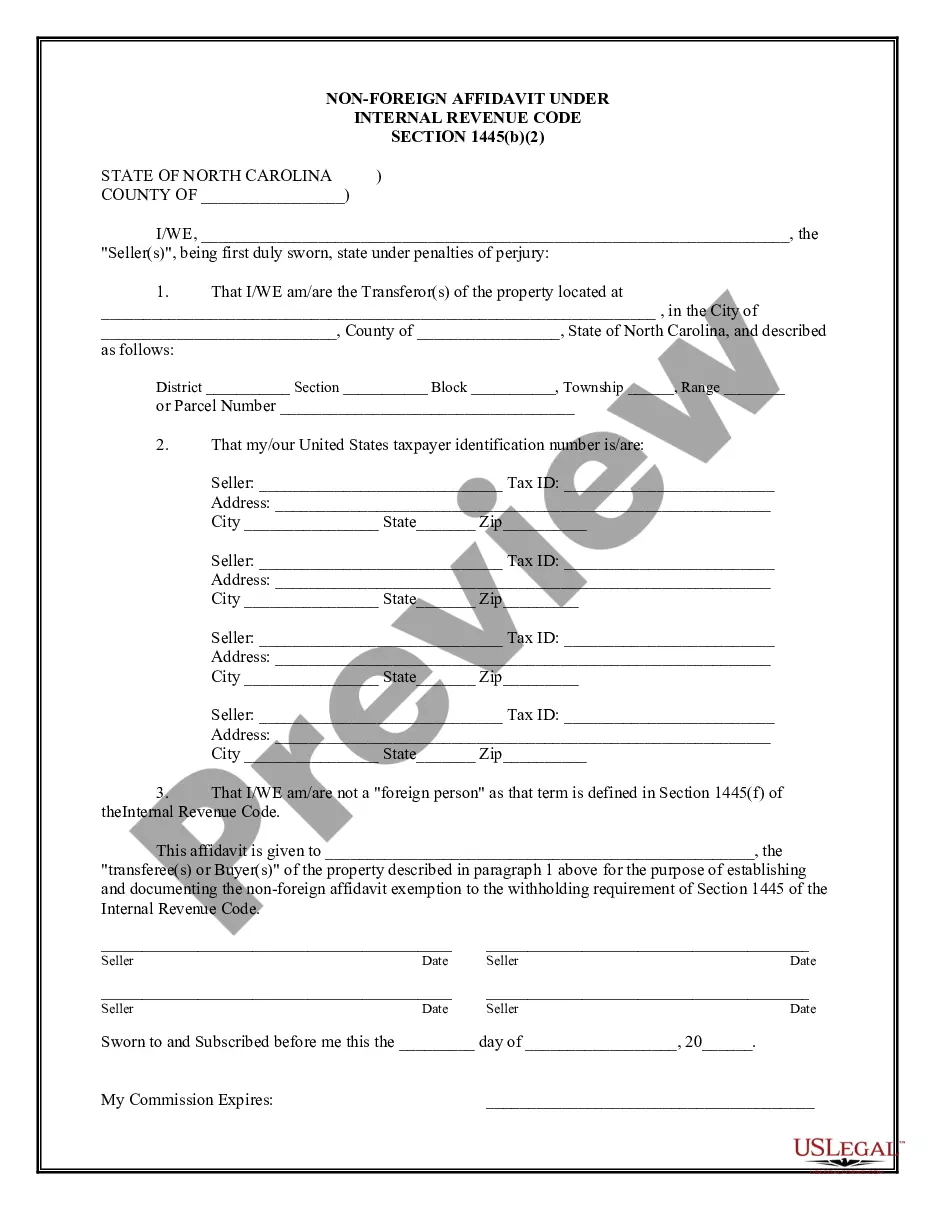

Massachusetts Affidavit Regarding Federal Estate Taxes is a legal document used in the state of Massachusetts to certify that the estate of a deceased person is not subject to federal estate taxes. There are two types of Massachusetts Affidavit Regarding Federal Estate Taxes: the Short Form Affidavit and the Long Form Affidavit. The Short Form Affidavit is used when the estate is not subject to federal estate tax due to the applicable exclusion amount, or if the estate's gross value is below the federal estate tax threshold. The Long Form Affidavit is required for estates with a gross value greater than the federal estate tax threshold. This form requires the estate executor to provide detailed information about the estate, such as the names of heirs or beneficiaries, the values of each asset, and other relevant financial information. Both forms must be signed by the estate executor and a qualified witness, such as an attorney or a notary public. The completed affidavit must be filed with the Massachusetts Department of Revenue within nine months of the date of death.

Massachusetts Affidavit Regarding Federal Estate Taxes

Description

How to fill out Massachusetts Affidavit Regarding Federal Estate Taxes?

Managing official documents necessitates diligence, precision, and employing well-prepared templates. US Legal Forms has assisted individuals nationwide for 25 years, so when you select your Massachusetts Affidavit Concerning Federal Estate Taxes template from our platform, you can trust that it complies with federal and state regulations.

Utilizing our service is straightforward and swift. To acquire the needed document, all you require is an account with an active subscription. Here’s a brief guide for you to obtain your Massachusetts Affidavit Concerning Federal Estate Taxes in a matter of minutes.

All documents are designed for multiple uses, including the Massachusetts Affidavit Concerning Federal Estate Taxes you see on this page. Should you need them again, you can complete them without a second payment—just access the My documents tab in your profile and finalize your document whenever you require it. Experience US Legal Forms and prepare your business and personal documentation promptly and in complete legal adherence!

- Ensure to thoroughly review the form content and its alignment with general and legal standards by previewing it or reading its description.

- Search for a different official blank if the previously accessed one doesn't meet your needs or local regulations (the option for that is located on the top page corner).

- Log in to your account and download the Massachusetts Affidavit Concerning Federal Estate Taxes in your preferred format. If this is your first time using our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and make a payment using your credit card or PayPal account.

- Select the format in which you wish to receive your form and click Download. Print the document or incorporate it into a professional PDF editor for electronic submission.

Form popularity

FAQ

A Massachusetts small estate affidavit is a legal document used to present a claim on the estate or part of the estate of a deceased loved one. The petitioner, or affiant, must provide detailed information about the estate, the property in question, the decedent, and any other potential heirs.

The estate tax, sometimes also called the "death tax," is a tax that's levied on a deceased person's assets. In 2023, the federal estate tax ranges from rates of 18% to 40% and generally only applies to assets over $12.92 million. In 2022, the exemption was $12.06 million.

2023 Massachusetts estate tax filing threshold = $1 million. It is not indexed for inflation. Once the threshold is met, a Massachusetts estate tax return must be filed (Form M-706). The estate tax rate is a graduated rate that starts at 0.8% and caps out at 16%.

Massachusetts does not have an inheritance tax. If you're inheriting money from someone who lived out of state, though, check the local laws. In Kentucky, all in-state property is subject to the inheritance tax, regardless of where the heir lives. Massachusetts also does not have its own gift tax.

The affidavits are prepared by the personal representative of the estate, any person in actual or constructive possession of any real property of the decedent or by some person acting on his or her behalf. The affidavits are filed in the Registry of Deeds for the county in which the real property is located.

Massachusetts Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip And the will if it exists. Step two fill out the affidavit. Complete the affidavit using theMoreAnd the will if it exists. Step two fill out the affidavit. Complete the affidavit using the information collected. And get it notarized. Step three file with the probate court filed the affidavit.

This means, if the value of an estate exceeds the $1 million threshold, anything above $40,000 will be taxed. Massachusetts uses a graduated tax rate, which ranges between 0.8% and a maximum of 16%. Your estate will only attract the 0% tax rate if it's valued at $40,000 and below.

For example, the estate tax on a $2 million estate would be $103,920. This is approximately 10.4% of the portion over $1 million, but is only 5.2% of the entire value of the estate. This is still a significant tax, but does not approach the highest rate of 16%.