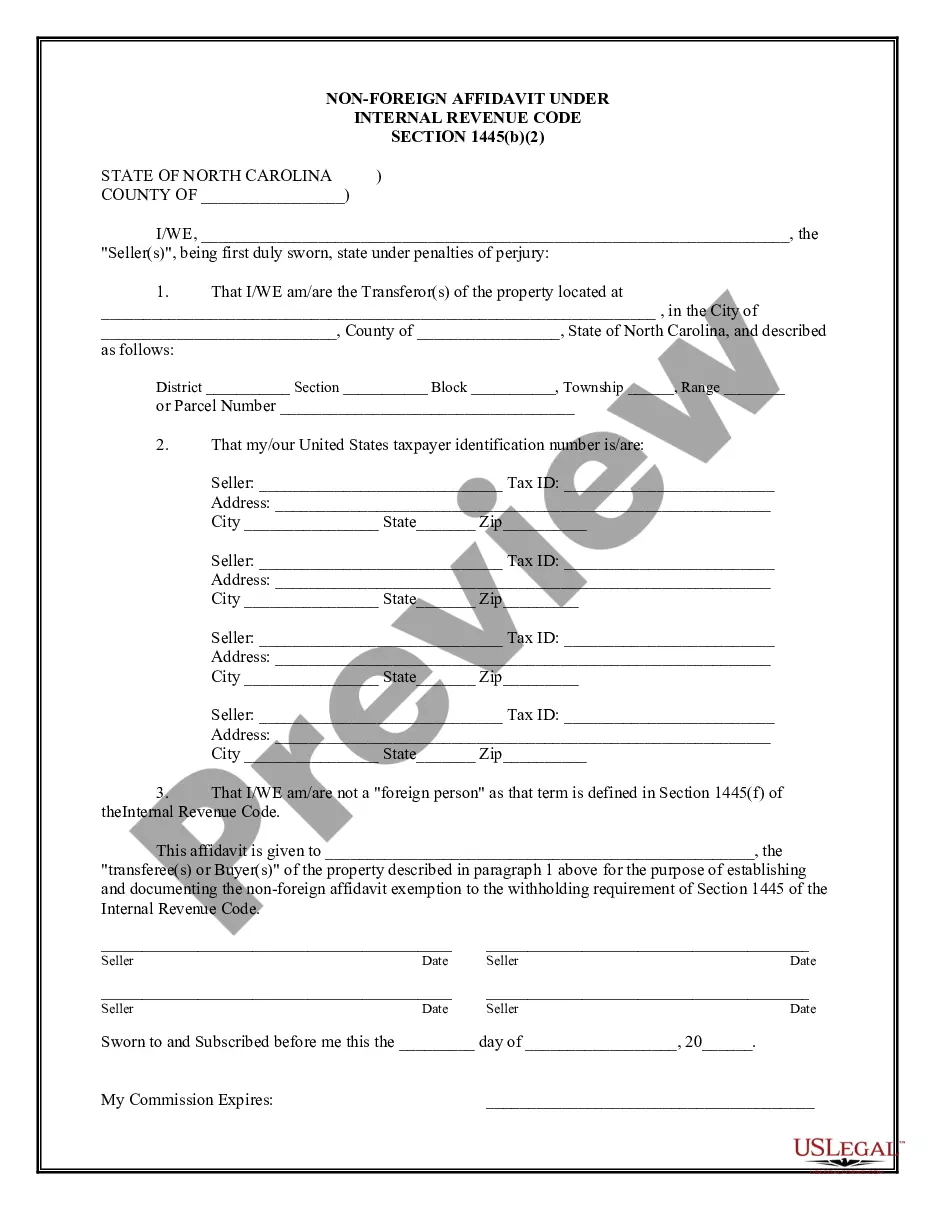

North Carolina Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Non-Foreign Affidavit Under IRC 1445?

Steer clear of expensive attorneys and discover the North Carolina Non-Foreign Affidavit Under IRC 1445 that you require at an affordable cost on the US Legal Forms platform.

Utilize our straightforward groups feature to search for and obtain legal and tax documents. Examine their descriptions and review them thoroughly before downloading.

Select to receive the document in PDF or DOCX format. Click on Download and locate your template in the My documents section. You can easily save the form to your device or print it out. After downloading, you may complete the North Carolina Non-Foreign Affidavit Under IRC 1445 manually or using editing software. Print it and reuse the template multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed guidance on how to download and complete each template.

- US Legal Forms subscribers simply need to Log In and access the specific form they want in their My documents section.

- Individuals who have not yet subscribed should adhere to the instructions listed below.

- Ensure the North Carolina Non-Foreign Affidavit Under IRC 1445 is valid for use in your location.

- If applicable, review the description and utilize the Preview feature thoroughly before downloading the templates.

- If you’re confident the template suits your requirements, click on Buy Now.

- If the template is inaccurate, use the search bar to locate the correct one.

- Subsequently, create your account and choose a subscription plan.

- Complete the payment via credit card or PayPal.

Form popularity

FAQ

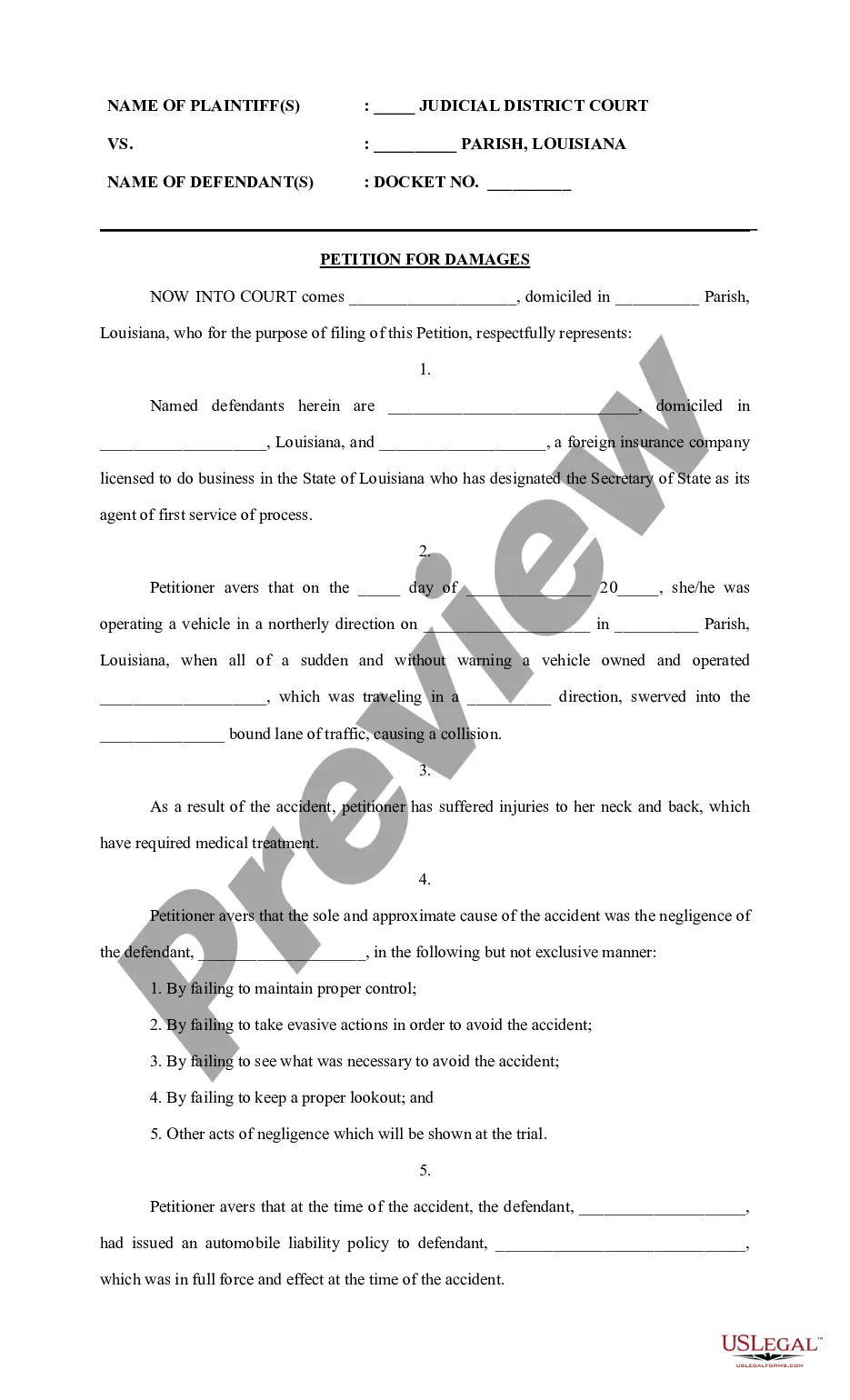

The only other way to avoid FIRPTA is via a withholding certificate. If FIRPTA withholding exceeds the maximum tax liability realized on the sale of the real property, sellers can appeal to the IRS for a lower withholding amount.

FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate. Under FIRPTA, if you buy U.S. real estate from a foreign person, you may be required to withhold 10% of the amount realized from the sale.Along with the form, you submit 10% withholding.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

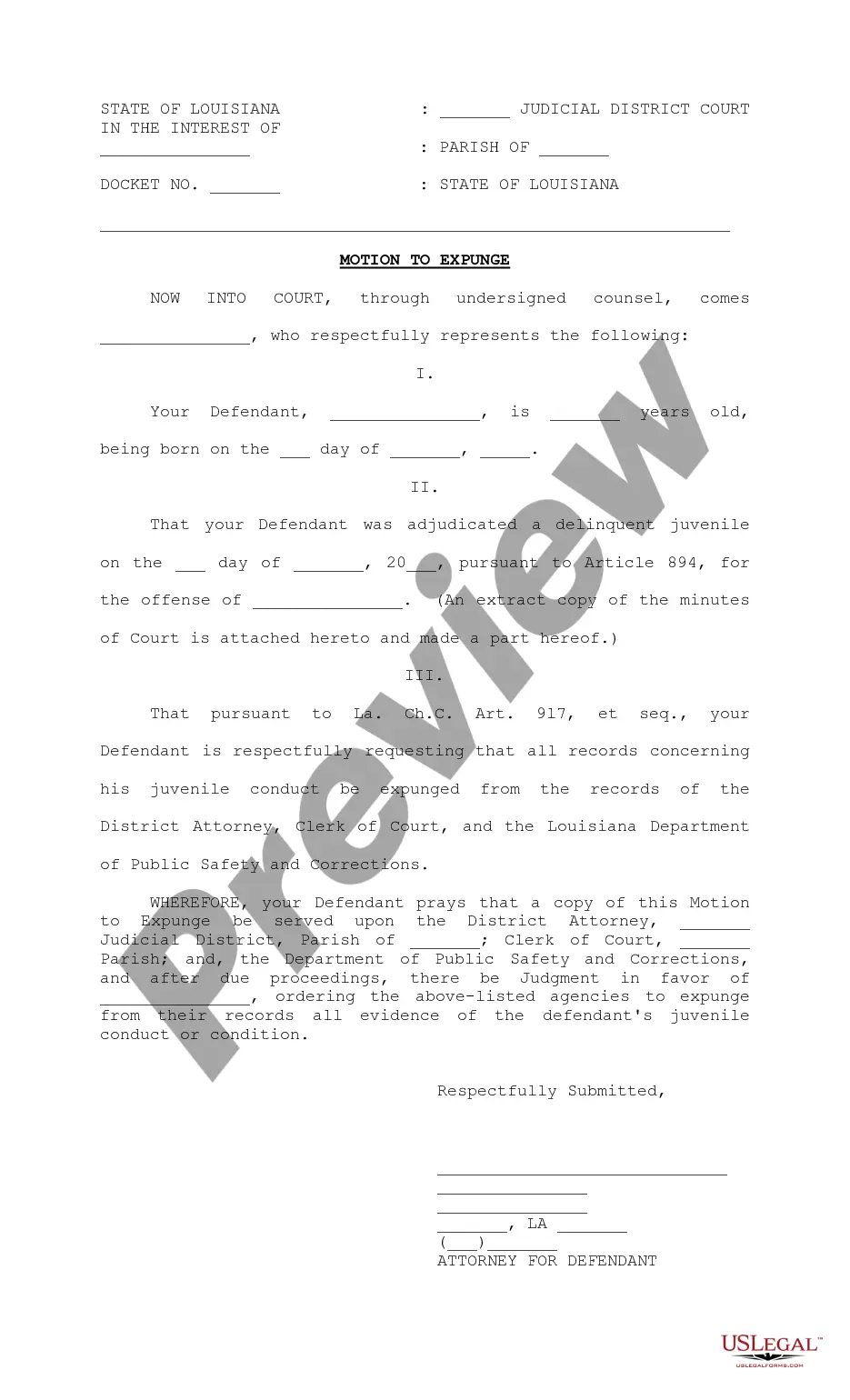

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.