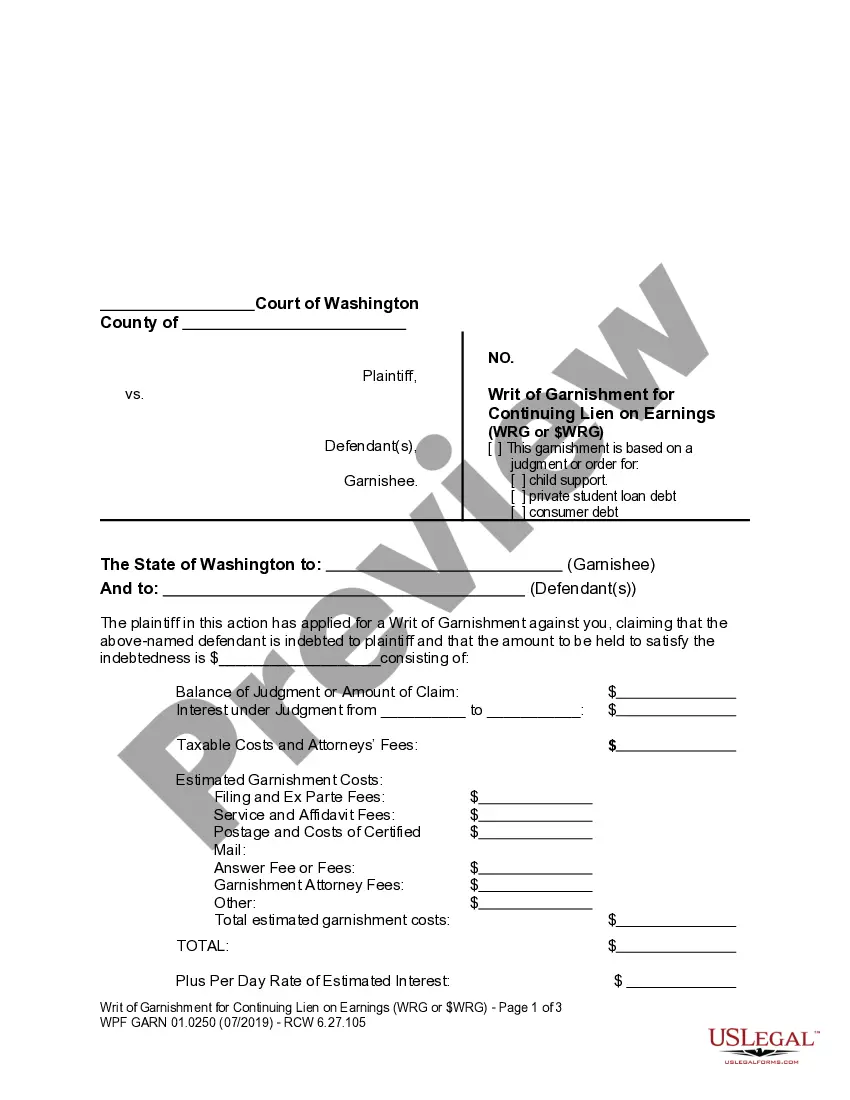

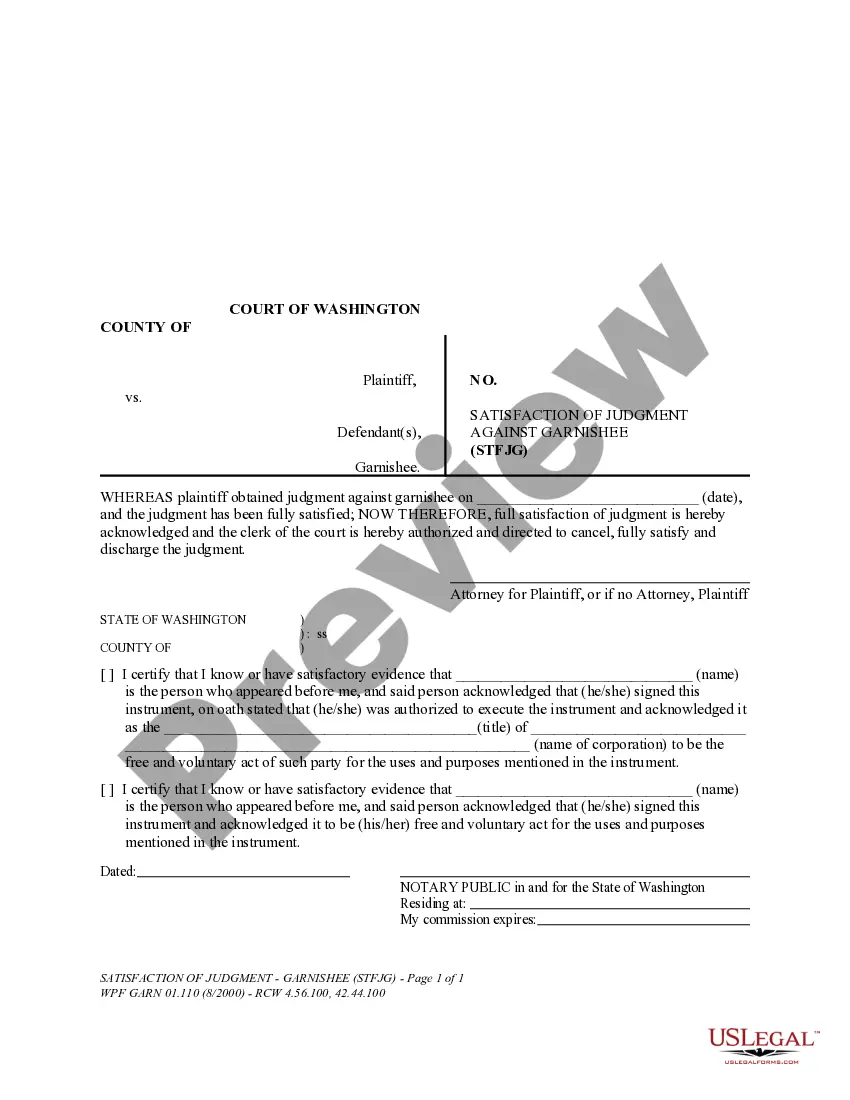

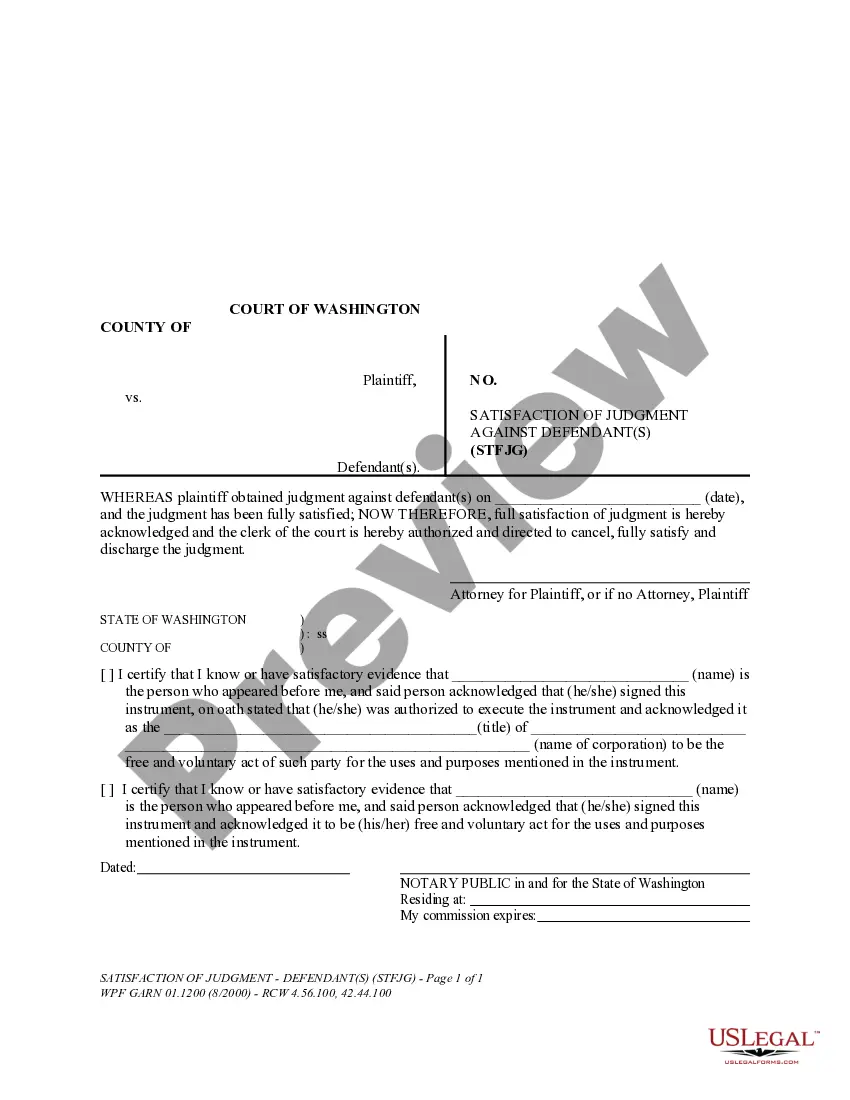

This is an official Washington court form for use in Garnishment cases, a Partial Satisfaction of Judgment Against Defendant(s). Available in Word or rich text format.

Washington WPF GARN 01.1250 - Partial Satisfaction of Judgment Against Defendants

Description

How to fill out Washington WPF GARN 01.1250 - Partial Satisfaction Of Judgment Against Defendants?

Out of the multitude of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive library of 85,000 templates is grouped by state and use for efficiency. All the documents on the service have already been drafted to meet individual state requirements by qualified lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, press Download and gain access to your Form name in the My Forms; the My Forms tab holds all of your downloaded documents.

Stick to the tips below to get the form:

- Once you discover a Form name, make sure it’s the one for the state you need it to file in.

- Preview the form and read the document description prior to downloading the sample.

- Search for a new sample using the Search engine in case the one you’ve already found is not proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it in an web-based editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform provides fast and easy access to samples that fit both lawyers as well as their customers.

Form popularity

FAQ

If your wages are being garnished or you are about to be garnished and you live in Washington State, give Symmes Law Group a call at 206-682-7975 to stop your wage garnishment immediately or use our contact form to tell us about your case.

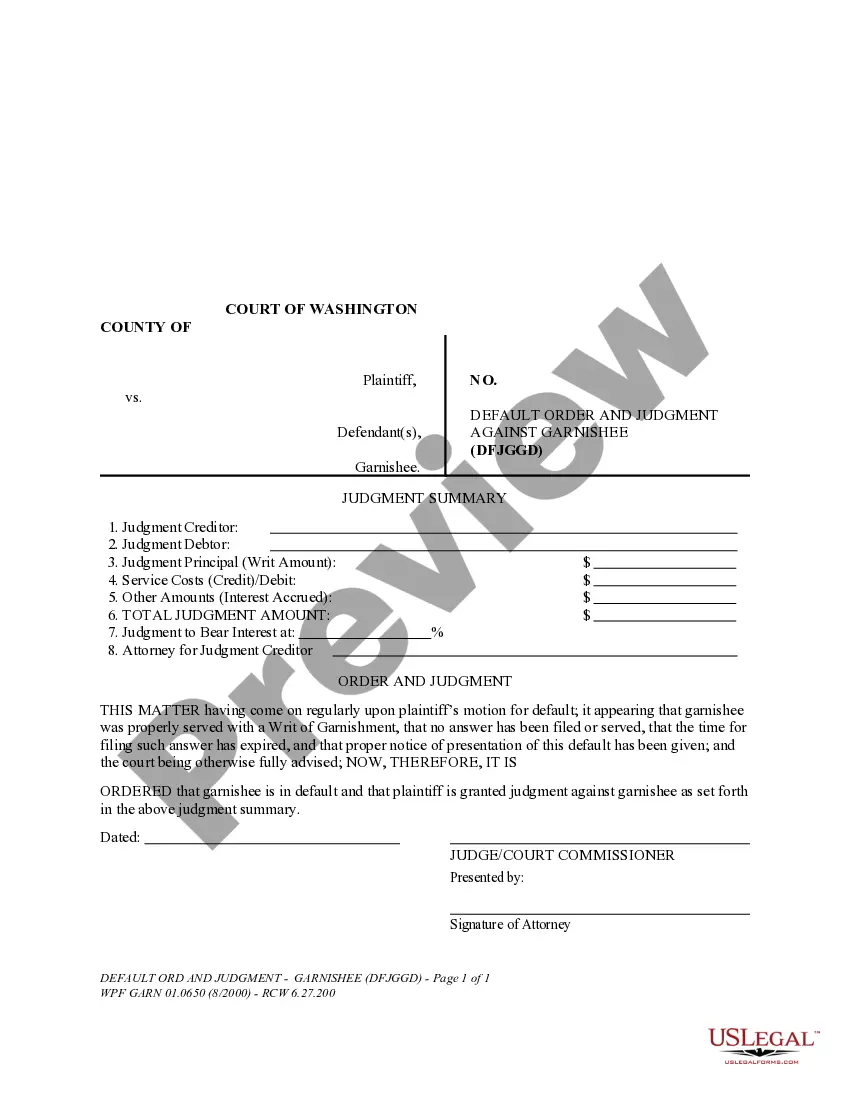

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

There are several avenues to collect on a judgment if the debtor has assets in Washington state. A popular way to collect on your judgment award is by a writ of garnishment. A garnishment entitles a judgment creditor to garnish and take the proceeds belonging to the debtor.

Washington State Suspends Wage Garnishments of Consumer Debt Judgments During COVID-19 Pandemic.

In Washington, most creditors can garnish the lesser of (subject to some exceptionsmore below): 25% of your weekly disposable earnings, or. your weekly disposable earnings less 35 times the federal minimum hourly wage.

Written proof of service is required, such as an affidavit of service or the signed return receipt. The writ must be served with 4 answer forms, 3 stamped envelopes addressed to the court, judgment debtor, and judgment creditor, and a $20 check payable to the garnishee defendant (except wage garnishments).