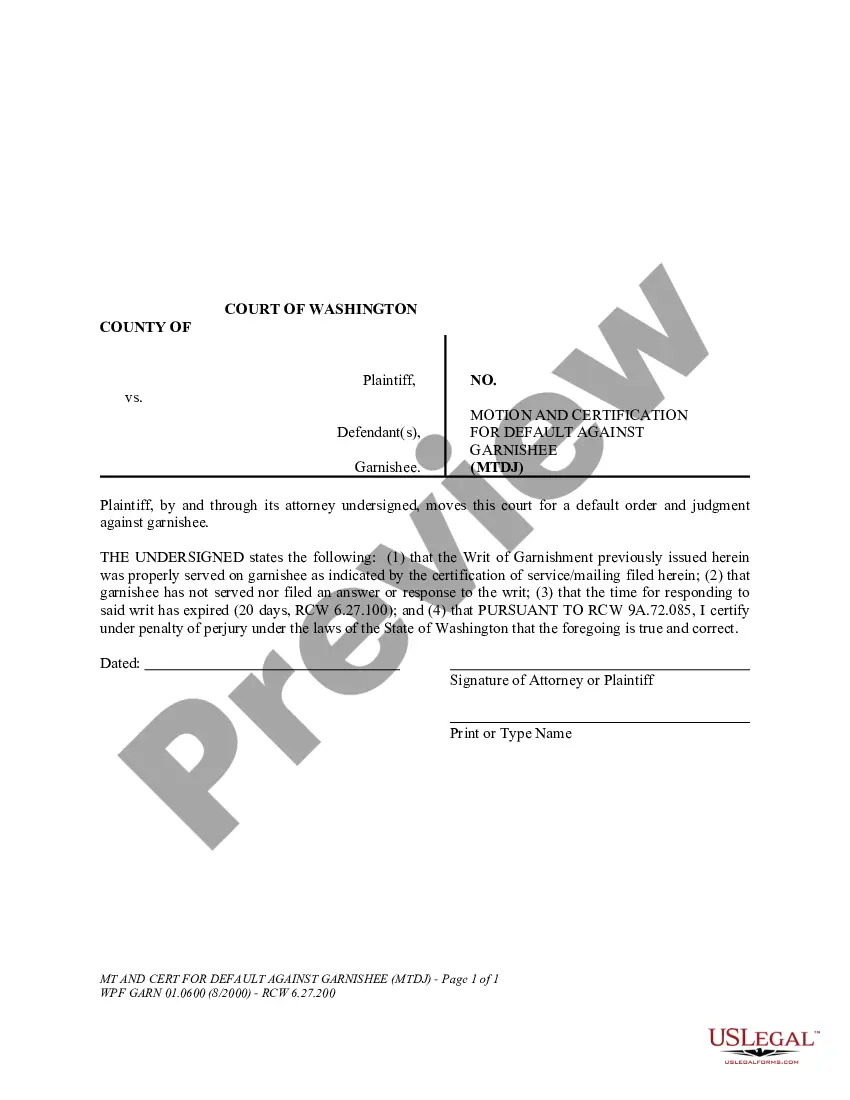

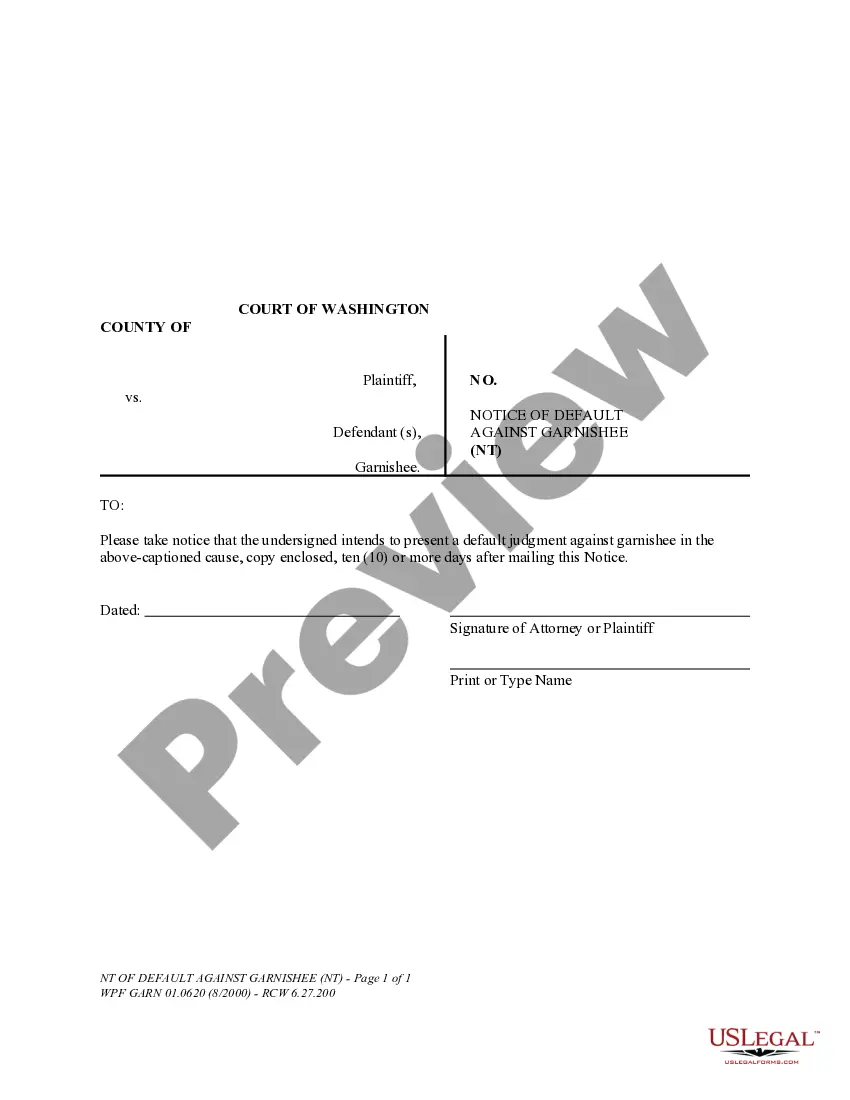

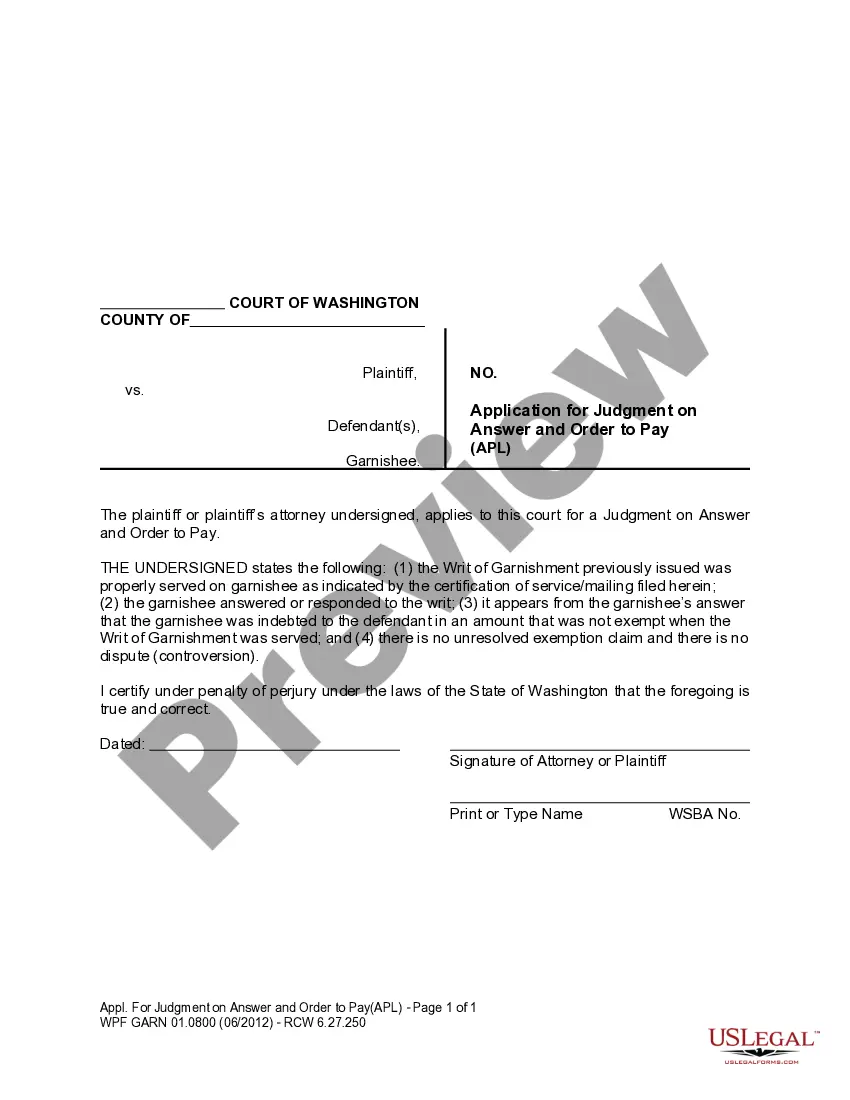

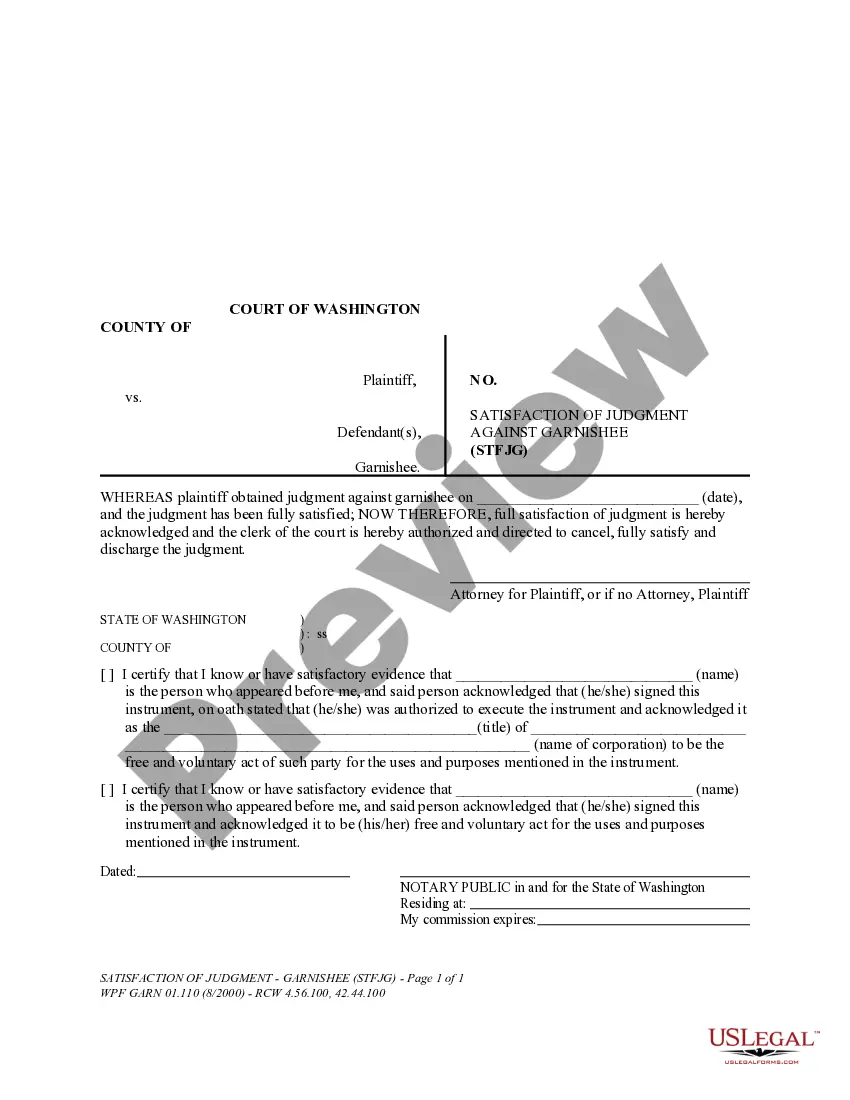

This is an official Washington court form for use in Garnishment cases, a Default Order and Judgment Against Garnishee. Available in Word or rich text format.

Washington WPF GARN 01.0650 - Default Order and Judgment Against Garnishee

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington WPF GARN 01.0650 - Default Order And Judgment Against Garnishee?

Out of the multitude of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its complete library of 85,000 samples is grouped by state and use for efficiency. All the forms available on the service have been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, press Download and gain access to your Form name in the My Forms; the My Forms tab holds your saved documents.

Follow the tips below to obtain the form:

- Once you find a Form name, make sure it is the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Search for a new sample using the Search engine if the one you have already found is not proper.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

After you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our platform offers easy and fast access to templates that suit both attorneys as well as their clients.

Form popularity

FAQ

There are some creditors that may garnish your wages without a judgment. Those are: collectors of federally-guaranteed student loans. people and agencies to whom you owe child support or alimony, and.

If you owe a creditor on a debt like a loan, hospital bill, or credit card, it can't automatically garnish your wages.Once that happens, then the judgment creditor must file papers with the court to start the garnishment process.

When there is a court judgment against you, the creditor has the right to garnish your wages.With the exception of a student loan debt or a debt owed the government, garnishment can take place only after the creditor obtains a court judgment against you.

Garnishment is the legal process whereby money or property that is owed to the Debtor or that is being held by someone (the Garnishee) for the Debtor, is taken to pay a Judgment.When the Creditor files an Application with the court, the clerk will issue a Writ of Garnishment.

Written proof of service is required, such as an affidavit of service or the signed return receipt. The writ must be served with 4 answer forms, 3 stamped envelopes addressed to the court, judgment debtor, and judgment creditor, and a $20 check payable to the garnishee defendant (except wage garnishments).

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

If your wages are being garnished or you are about to be garnished and you live in Washington State, give Symmes Law Group a call at 206-682-7975 to stop your wage garnishment immediately or use our contact form to tell us about your case.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.