This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

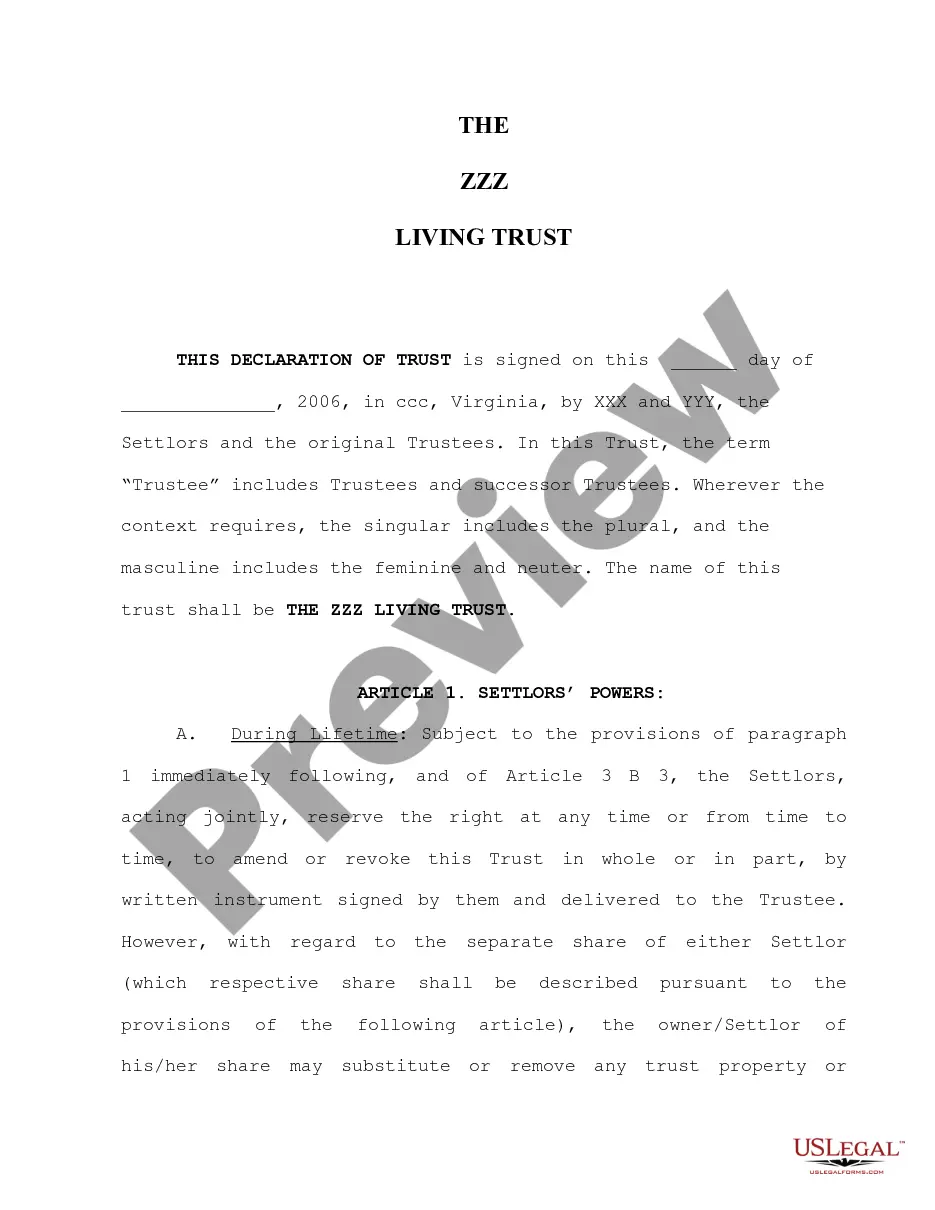

Virginia Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Virginia Complex Will With Credit Shelter Marital Trust For Large Estates?

Searching for a Virginia Complex Will with Credit Shelter Marital Trust for Large Estates on the internet can be stressful. All too often, you see documents that you just think are fine to use, but discover later on they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any form you’re looking for quickly, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be added in in your My Forms section. In case you don’t have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step instructions below to download Virginia Complex Will with Credit Shelter Marital Trust for Large Estates from the website:

- See the form description and press Preview (if available) to verify whether the template meets your expectations or not.

- In case the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. Besides professionally drafted templates, users may also be supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

First, in a standard credit shelter trust, there is no step-up in basis at the death of the surviving spouse.Second, the credit shelter trust is a separate taxpayer and requires its own tax return, Form 1041.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax free. It can also shield the estate of the surviving spouse before the remaining assets pass on to your children.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

The trust qualifies for the marital deduction. In a QTIP trust, the surviving spouse must receive all income generated by the trust property for life, paid at least annually.After the surviving spouse's death, the property passes to the remainder beneficiaries of the trust, who usually are the children of the couple.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

Key points. Death after 75 doesn't mean that a spousal bypass trust is no longer relevant. It is the government's intention that from a tax perspective the new rules mean that the position would be broadly the same for the beneficiary of a bypass trust, as those receiving benefits directly from the pension.

A Trust (or Marital Trust) It is a trust that takes advantage of the unlimited marital deduction in order to avoid estate taxes at the time of the first spouse's death in the event that the first spouse's individual estate is more than the individual exemption amount.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away.The first part is the marital trust, or A trust. The second is a bypass, family or B trust. The marital trust is a revocable trust that belongs to the surviving spouse.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.