Weekly Expense Report

What this document covers

The Weekly Expense Report is a specialized form designed to document employee expenses incurred during the workweek. Unlike general expense forms, this report is structured for weekly submissions, capturing each day's expenses separately for clarity and ease of reimbursement processing.

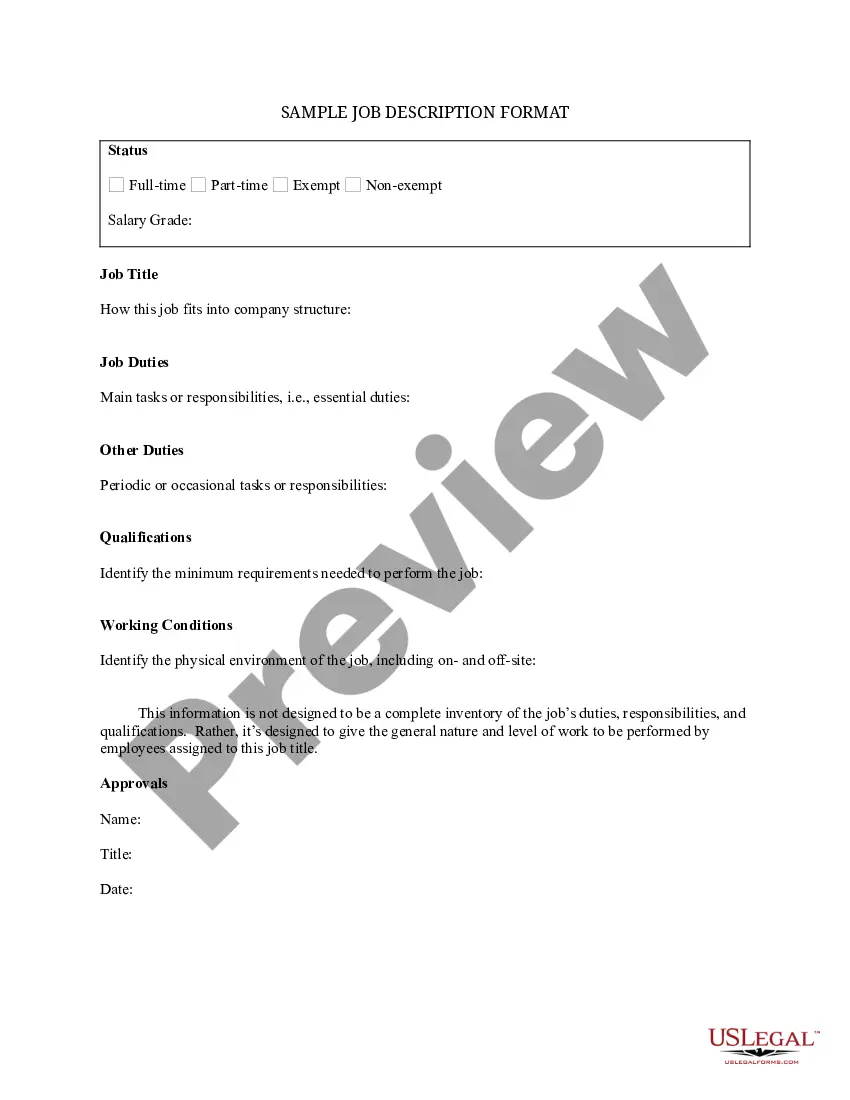

What’s included in this form

- Name of the employee submitting the report.

- Period covered by the expenses, including start and end dates.

- Position of the employee within the company.

- Details about the client and project, including project number and code.

- Expense breakdown by day, listing various categories such as parking, lodging, and meals.

- Total expenses and reimbursement due amounts.

- Signatures from both the employee and supervisor to validate the report.

Situations where this form applies

This form should be used whenever an employee needs to report and request reimbursement for expenses incurred while performing job duties. Common scenarios include business travel, client meetings, or project-related expenses that require detailed documentation for company records.

Who can use this document

This form is intended for:

- Employees who incur expenses while conducting business activities.

- Managers or team leaders who oversee project budgets and expense approvals.

- Finance or accounting personnel responsible for processing reimbursements.

Steps to complete this form

- Enter your full name and position at the top of the form.

- Specify the reporting period by filling in the start and end dates.

- Provide the client and project details, including project number and code.

- List daily expenses in the appropriate fields for each day of the week.

- Calculate and enter the total expenses for each category and overall.

- Sign and date the report, obtaining your supervisor's signature as well.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all relevant expenses for each day.

- Not obtaining the required supervisor signature before submission.

- Entering incorrect dates for the expense reporting period.

Benefits of using this form online

- Easy access and instant download from any device.

- Editable fields allow for quick updates and accurate data entry.

- Secure storage of completed forms ensures that sensitive information is protected.

Main things to remember

- The Weekly Expense Report streamlines employee expense reporting for reimbursement.

- Ensure accuracy in documenting daily expenses and obtaining necessary signatures.

- This form is versatile and suitable for use across multiple states.

Looking for another form?

Form popularity

FAQ

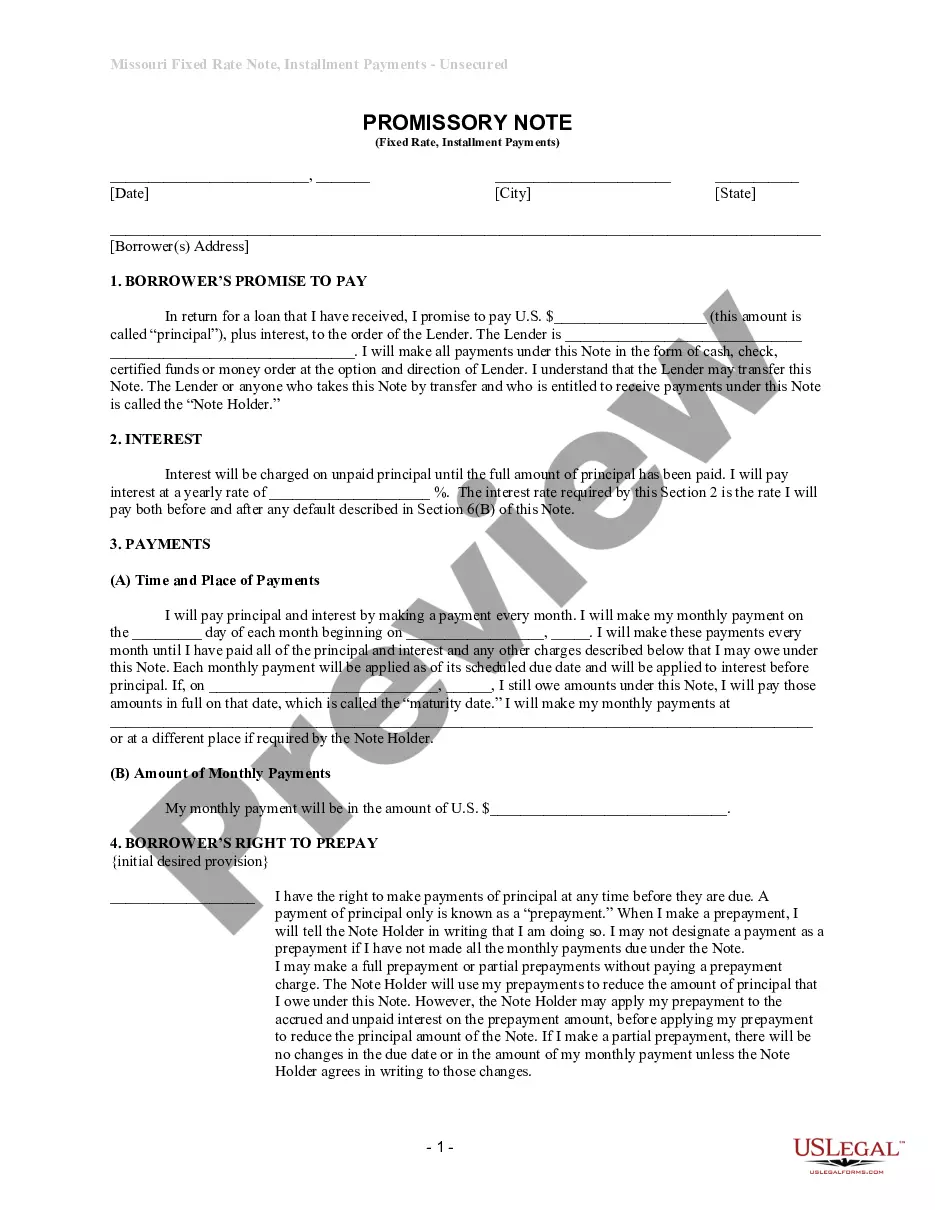

An expense report is a form that itemizes expenses necessary to the functioning of a business. A small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals.

For each expense, enter the date and description. Use the dropdown menus to select payment type and category for each expense. For each expense, enter the total cost. Attach all necessary receipts to the document. Submit for review and approval!

Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

Information identifying the person submitting the report (department, position, contact info, SSN, etc.) A date and dollar amount for each expense, matching the date and dollar amount on the receipt provided for that expense. A brief description of each expense.

Choose a Template (or Software) To make an expense report, you should use either a template or expense-tracking software. Edit the Columns. Add Itemized Expenses. Add up the Total. Attach Receipts, If Necessary. Print or Send the Report.

Have A Clear Expense Policy. Determine what expenses your company is willing to cover and communicate this policy very clearly to your employees. Make Expenses Easy To Report And Track. Issue Corporate Credit Cards. Set Up A Routine Audit.

Review the first receipt to make sure it is legitimate and not questionable. All expenses claimed for reimbursement should have supportive and valid receipts with attached bills. Review all the receipts to make sure that all expense claims abide by the company's policy guidelines.

The employer requires that the paper receipts and expense reports contain information sufficient to substantiate the amount, date, time, place, and business purpose of each expense.

An itemised expense would contain multiple expenses listed as line items. The itemised expense total will be calculated automatically, based on the expense amount of each line item and the tax applied on each of them.