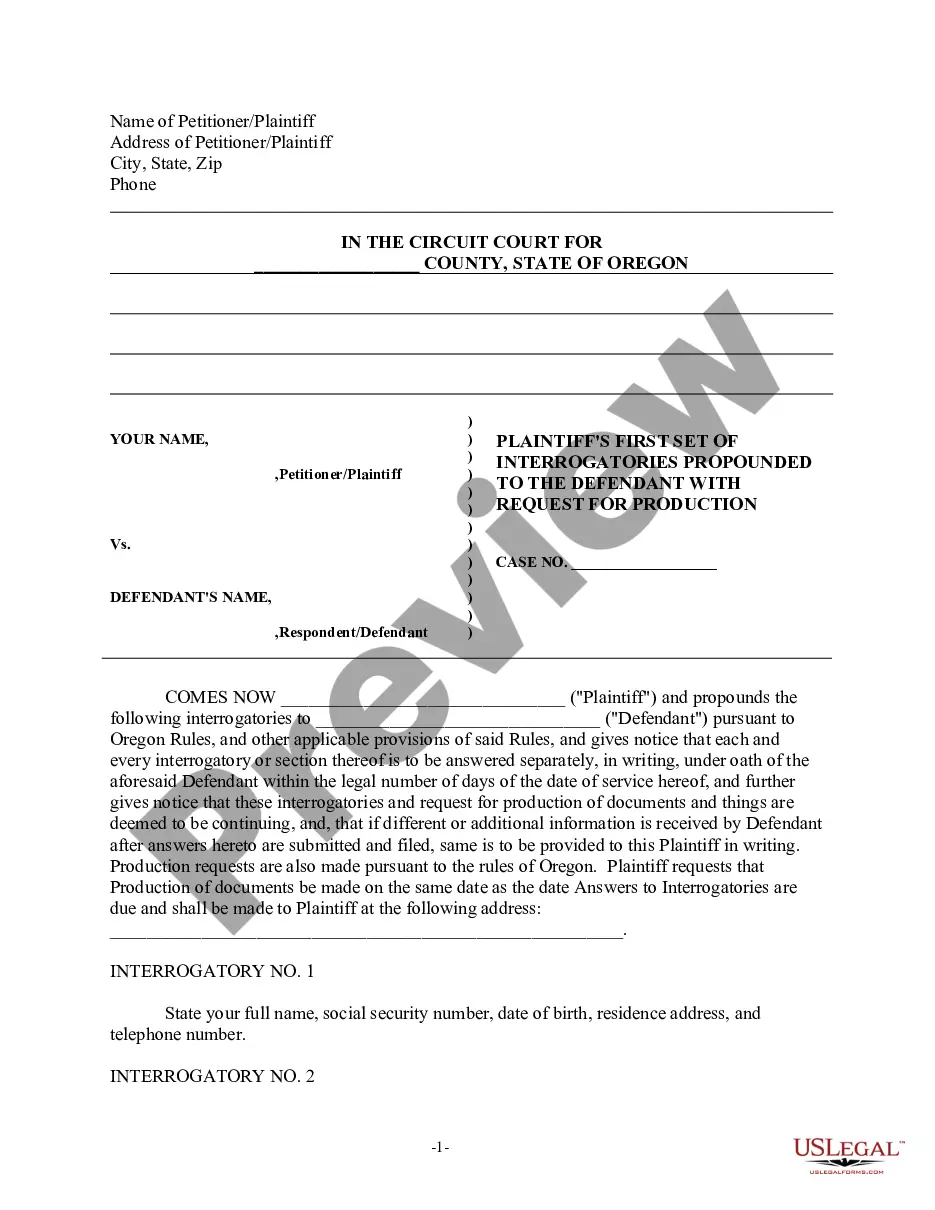

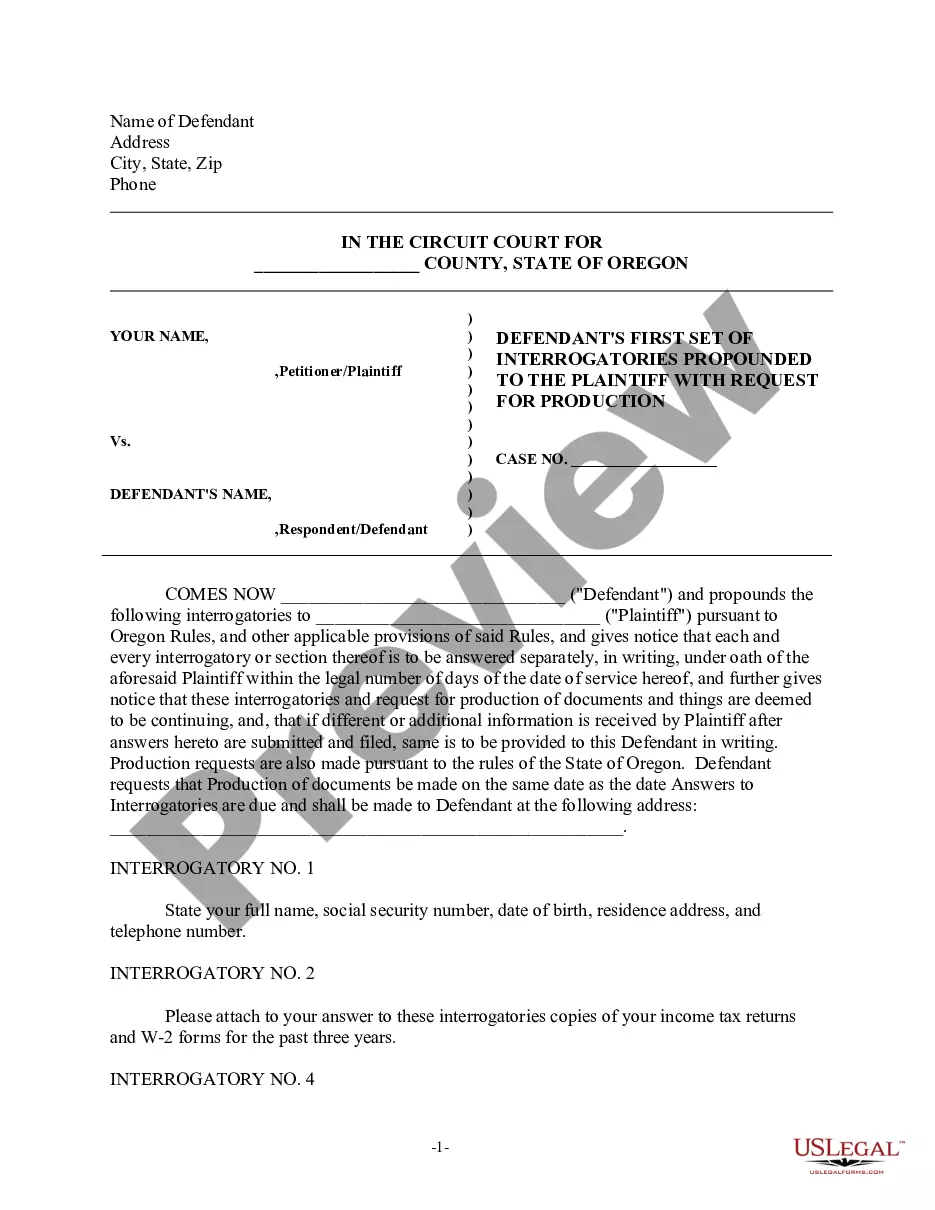

This form documents the daily mileage report for projects. The report consists of the date, location (from/to) and the odometer reading (begin/end), and the total.

Daily Mileage Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Daily Mileage Report?

When it comes to drafting a legal document, it’s better to delegate it to the experts. Nevertheless, that doesn't mean you yourself can not find a template to use. That doesn't mean you yourself can not get a sample to use, however. Download Daily Mileage Report right from the US Legal Forms website. It offers numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you’re signed up with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Daily Mileage Report promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description prior to buying it.

- Hit Buy Now.

- Select the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Daily Mileage Report is downloaded you can fill out, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Beginning January 1, 2020, the standard mileage rates for the use of a car (van, pickup or panel truck) will be: 57.5 cents per mile for business miles driven, down from 58 cents in 2019. 17 cents per mile driven for medical or moving purposes, down from 20 cents in 2019.

You can claim mileage on your tax return if you kept diligent track of your drives throughout the year. In 2019, you can write off 58 cents for every business mile. You have two options for deducting your vehicle expenses: the standard mileage rate or the actual expense method.

If you use your car only for your job or business, you may deduct all of the miles driven or actual vehicle expenses. But if you also use the car for other purposes, you can only deduct the portion used for business purposes. Normal commuting from your home to your regular workplace and back is not deductible.

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be written off." Just make sure to keep a detailed log and all receipts, he advises, or keep track of your yearly mileage and then deduct the

Standard Mileage methodActual Expenses might produce a larger tax deduction one year, and the Standard Mileage might produce a larger deduction the next. If you want to use the standard mileage rate method, you must do so in the first year you use your car for business.

The standard mileage rate is 56 cents per mile. To find your reimbursement, you multiply the number of miles by the rate: miles rate, or 175 miles $0.56 = $98. B: You drive the company's vehicle for business, and you pay the costs of operating it (gas, oil, maintenance, etc.).

Mileage Rate Calculator Multiply the number of miles you drove by your company's approved mileage reimbursement rate. For example, if you drove 1,000 miles for work and the reimbursement rate is 54.5 cents per mile, you would multiply 1,000 by . 545 which equals $545.

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be written off." Just make sure to keep a detailed log and all receipts, he advises, or keep track of your yearly mileage and then deduct the

IRS announced that Beginning on January 1, 2020, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) would be: 57.5 cents per mile driven for business use, 17 cents per mile driven for medical or moving purposes, 14 cents per mile driven in service of charitable organizations.