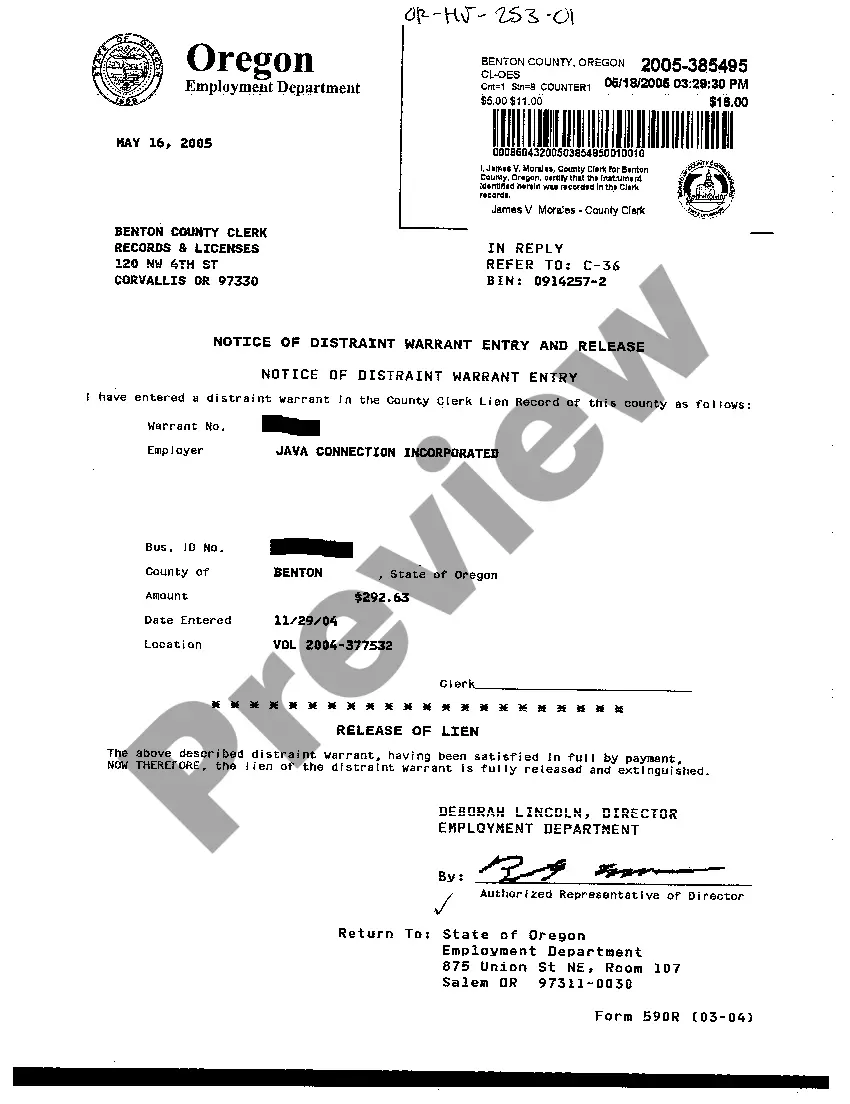

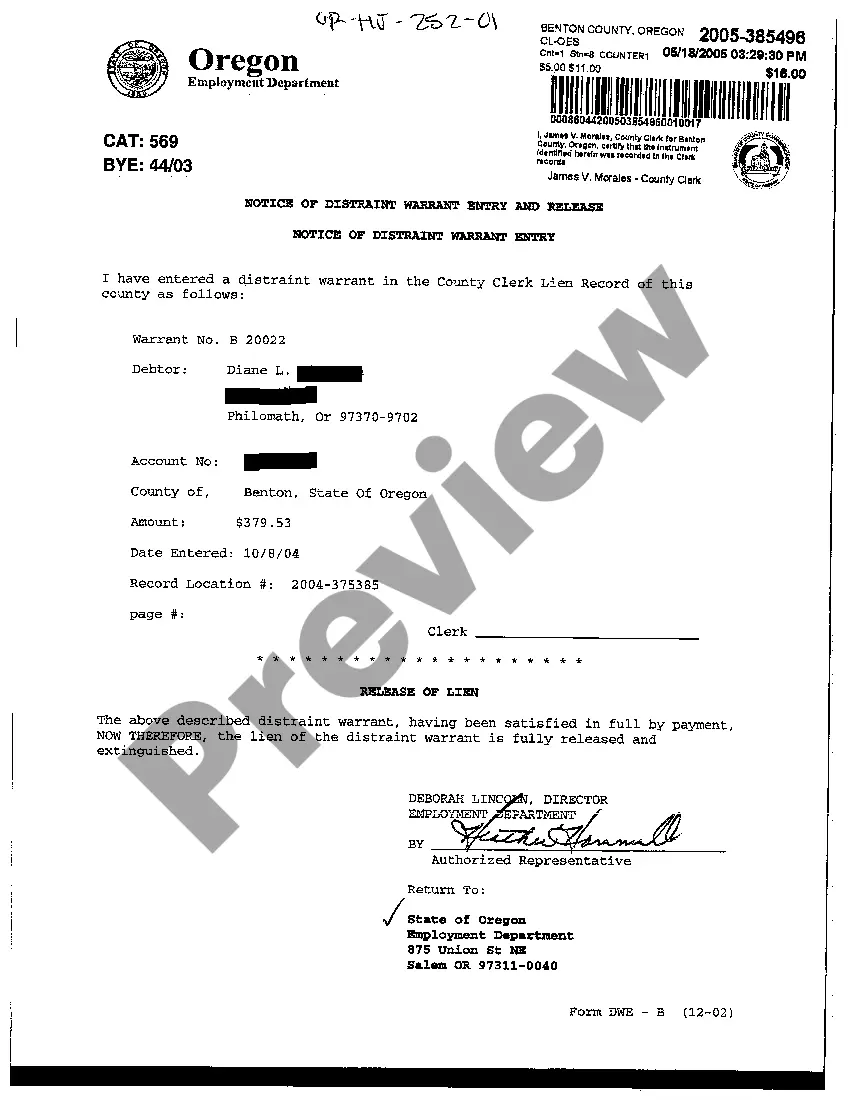

Oregon Notice of Distraint Warrant Entry and Release for an Individual

Description

Key Concepts & Definitions

Notice of Distraint Warrant Entry and Release: A legal notification issued by authorities, typically related to tax enforcement or personal finance issues. It signifies that property may be seized due to unpaid payments. Distraint Warrant: An official document authorizing the seizure of property to settle debts. Release Individual: The process whereby an individual or entity is freed from financial or legal obligations once the debt is settled or terms are met.

Step-by-Step Guide to Handling a Notice of Distraint Warrant

- Understand the notice: Read thoroughly to understand why it was issued and the amount due.

- Assess your financial situation: Determine if you can pay the full amount or need to seek payment arrangements.

- Contact the issuing agency: Discuss your situation and explore options such as installment plans.

- Seek professional advice: Consult with a tax advisor or attorney experienced in personal finance and property taxes.

- Comply with the terms: Make payments on time or fulfill any agreed-upon terms to release the distraint warrant and avoid property seizure.

Risk Analysis of Ignoring a Distraint Warrant

Financial Consequences: Ignoring the warrant can lead to increased penalties and interest. Legal Implications: Non-compliance may result in the forcible seizure of property or further legal actions. Impact on Credit Score: Unresolved debts reflected on your credit report can adversely affect your credit score, impacting future financial opportunities.

Best Practices for Managing Notices of Distraint

- Always keep personal financial documents organized and easily accessible.

- Regularly review property taxes and other obligations to avoid surprises.

- Utilize community resources and transition programs for financial support and advice.

- Communicate proactively with tax authorities to address issues before they escalate into warrants.

Common Mistakes & How to Avoid Them

- Ignoring notices: Always respond to notices of distraint promptly to avoid further complications.

- Poor communication: Maintain open lines of communication with the involved parties. Lack of communication can worsen the situation.

- Lack of documentation: Keep detailed records of all transactions and communications related to the notice.

FAQ

What triggers a notice of distraint warrant? Typically, it's triggered by unpaid property taxes or other financial liabilities. Can a distraint warrant affect other aspects of personal finance? Yes, it can influence credit scores and eligibility for certain financial services. Is it possible to reverse a distraint warrant? Yes, by settling the outstanding debt or proving that the warrant was issued in error.

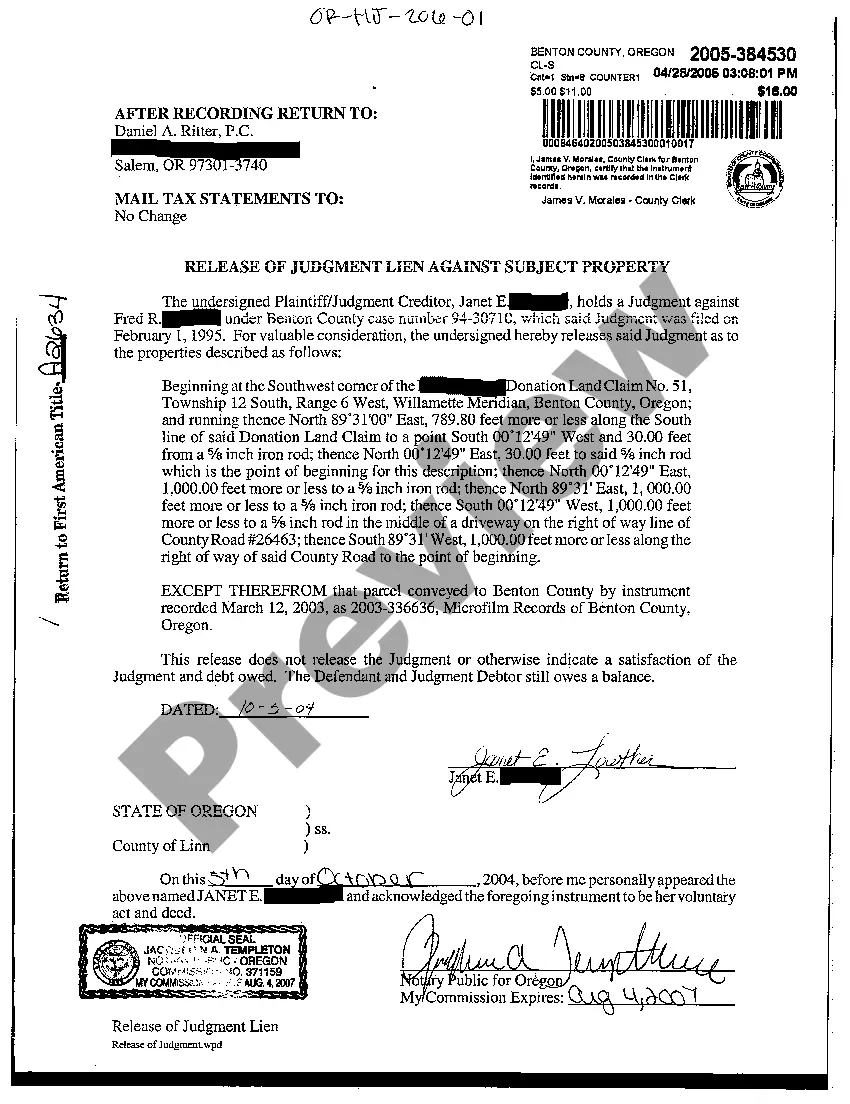

How to fill out Oregon Notice Of Distraint Warrant Entry And Release For An Individual?

Creating documents isn't the most straightforward process, especially for those who rarely work with legal papers. That's why we recommend making use of correct Oregon Notice of Distraint Warrant Entry and Release for an Individual templates made by skilled lawyers. It allows you to prevent troubles when in court or dealing with official institutions. Find the samples you need on our site for high-quality forms and exact information.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the file page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Customers with no a subscription can easily get an account. Utilize this simple step-by-step help guide to get the Oregon Notice of Distraint Warrant Entry and Release for an Individual:

- Be sure that the document you found is eligible for use in the state it’s needed in.

- Confirm the file. Use the Preview feature or read its description (if offered).

- Buy Now if this template is the thing you need or return to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these simple actions, you can complete the form in an appropriate editor. Recheck completed data and consider asking a lawyer to examine your Oregon Notice of Distraint Warrant Entry and Release for an Individual for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

Oregon. Oregon's statute is three years after the return is filed, regardless of whether it's filed on or after the due date. 6feff So if the return is filed earlier than April 15, the limitations period will end earlier, as well.

Distraint or distress is "the seizure of someone's property in order to obtain payment of rent or other money owed", especially in common law countries.

Call us at 503-945-8200. Or sign in to Revenue Online.

Distraint warrant: This is not a warrant for your arrest. Rather, it's a legal document that establishes our right to collect the tax debt from you. Federal offset letter: If you have tax debt, your federal tax refund or certain federal payments may be sent to us to apply to your debt.

Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt.

(1) The Department of Revenue is authorized to continuously garnish up to 25 percent of an employee's disposable earnings to recover delinquent state tax debt.

You might owe state taxes because you have a different personal tax situation. Usually, if you got a refund the previous year, you should be able to have another one this year as long as you have the same situation.Therefore, if you owe taxes, the withholding situation that came into place may tell you why.

If you are in a two-earner family, or you have more than one job, it's possible that you will still owe tax even if you claim zero allowances. This is because both the federal and Oregon withholding formulas are based on each person or family having just one job and filing a simple tax return each year.

To avoid paying interest, penalties, and legal issues, pay your tax bill in full and on time. If you cannot pay in full, pay as much as possible to reduce the interest and penalty liability.