Contractor Indemnification

What is this form?

The Contractor Indemnification form is a legal document used to protect a community association and its property manager from claims and lawsuits arising from the work of contractors. This form establishes that the contractor agrees to indemnify the association from any damages caused by their work or the work of their employees, keeping the association shielded from potential liabilities. It differs from general contractor agreements by specifically addressing indemnification concerns and the obligations of the contractor regarding legal claims made by their employees.

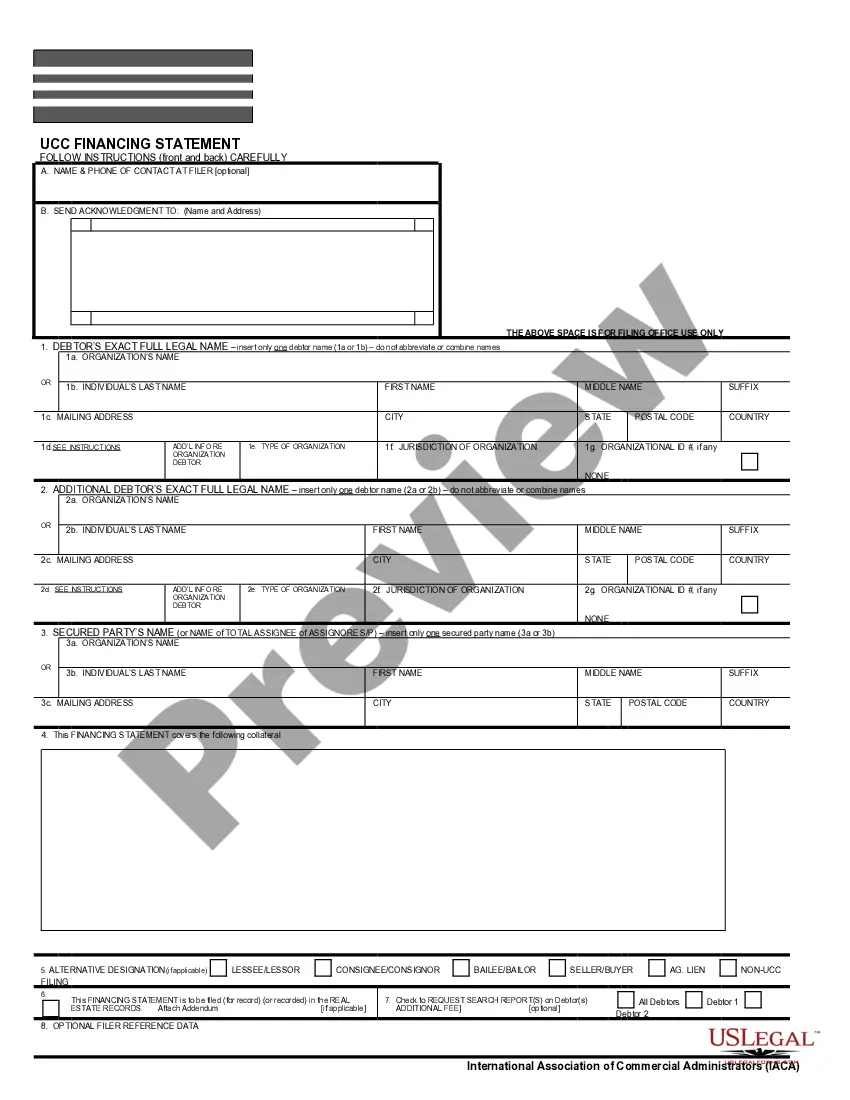

Form components explained

- Identification of the contractor (indemnitor) and the community association.

- Clarity on the scope of work being performed by the contractor.

- Indemnification clause detailing the contractor's obligations to defend and compensate the association.

- Provisions for covering attorney fees and legal costs incurred in upholding the indemnity.

- Governing law section specifying which state's laws will apply.

Common use cases

This form is particularly useful when a community association hires a contractor for services that may expose them to legal claims from employees of the contractor. It is ideal in scenarios involving construction projects, maintenance services, or any contractor work that could lead to potential liabilities such as accidents, injuries, or damages on the community property.

Who can use this document

Eligible users of the Contractor Indemnification form include:

- Community association managers

- Board members of homeowner associations

- Property owners hiring contractors

- Contractors providing services to communities

How to prepare this document

- Identify the contractor and the community association by filling in their names and addresses.

- Describe the scope of work to be performed by the contractor.

- Specify the governing state where the agreement will be enforced.

- Include signatures and dates from all parties involved to validate the agreement.

- Ensure any additional clauses, if necessary, are also included in the agreement.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a detailed description of the contractor's work, leading to confusion about indemnification scope.

- Not ensuring all parties sign the form, which may result in enforceability issues.

- Leaving the governing law section blank, which can complicate legal proceedings.

Benefits of completing this form online

- Convenience of downloading and completing the form at any time.

- Editability allows for customization based on specific project needs.

- Access to professionally drafted templates ensures legal compliance.

Looking for another form?

Form popularity

FAQ

A government agency may not indemnify its contractors for claims brought against them by reason of their own negligence. Nor may the United States agree in advance to assume liability for the negligence of its employees for which it may not otherwise be responsible under the Federal Tort Claims Act.

You should look to limit indemnification clauses by narrowing their scope, putting in caps on damages, and clearly defining the indemnifiable acts (i.e. the representations and warranties in the example above). Also consider purchasing insurance as a means to limit your financial risk.

An indemnification is a contractual obligation by one party (indemnitor) to pay or compensate for the losses, damages or liabilities incurred by another party to the contract (indemnitee) or by a third party.

It's a legally binding promise to protect another person against loss from an event or series of events: they are indemnified and protected from liability. Sometimes, indemnities are implied into the terms of contracts automatically, due to the nature of the legal relationship between the two parties.

An indemnity contract is a legal arrangement between two parties in which one party agrees to pay another party for a loss or harm that meets certain requirements and conditions unless other circumstances are specified.

Indemnification provisions are generally enforceable. There are certain exceptions however. Indemnifications that require a party to indemnify another party for any claim irrespective of fault ('broad form' or 'no fault' indemnities) generally have been found to violate public policy.

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

Building Blocks of an Indemnification Clause. Typical indemnification provisions will be long sentences with many clauses, legal-sounding words, and long lists of specific details. Insurance Implications and Other Contractual Matters. Other Technical Elements of an Indemnification Provision. Takeaway.