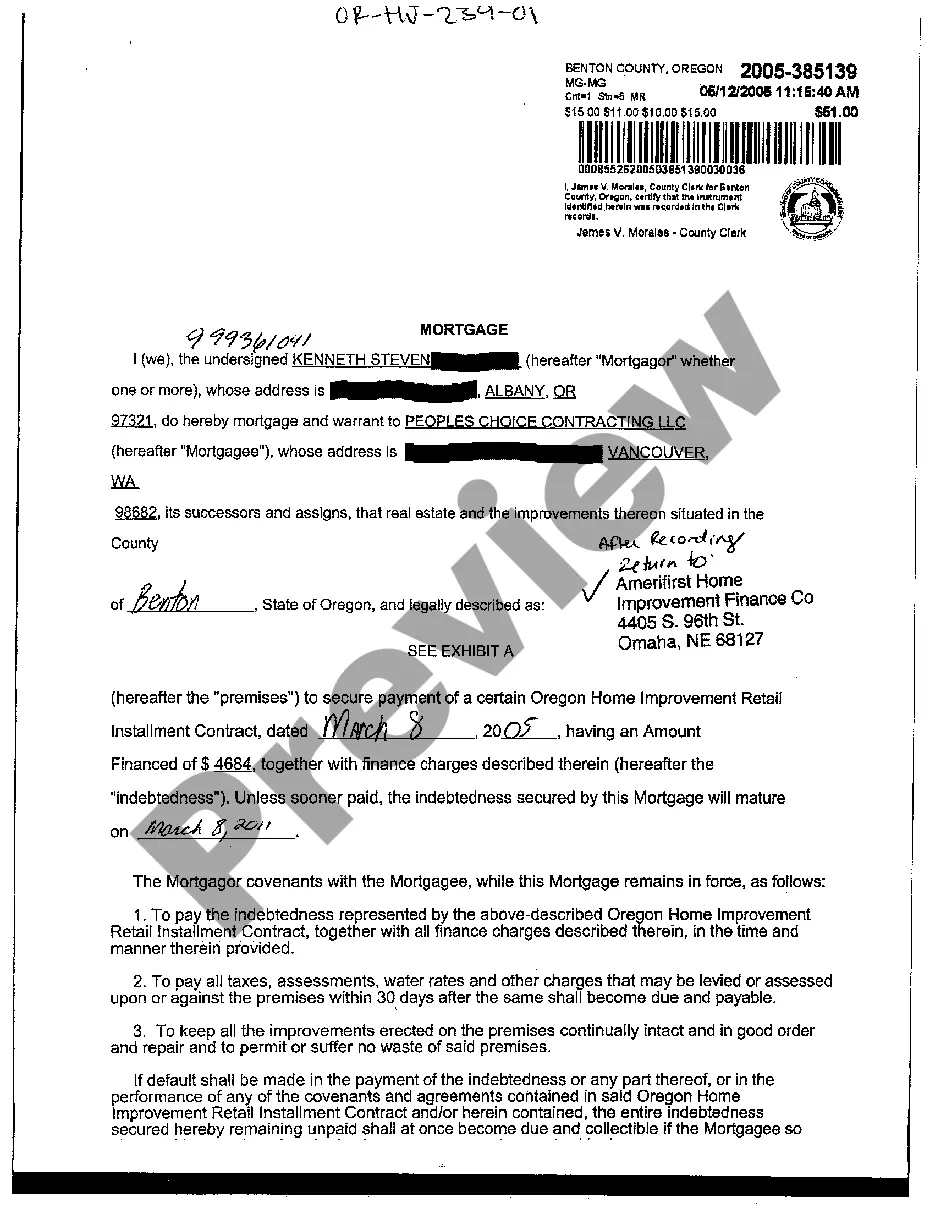

Oregon Sample Mortgage for a Company

Description

How to fill out Oregon Sample Mortgage For A Company?

Creating documents isn't the most simple job, especially for those who rarely deal with legal papers. That's why we advise using accurate Oregon Sample Mortgage for a Company samples made by skilled attorneys. It allows you to prevent difficulties when in court or working with formal organizations. Find the samples you require on our website for top-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will automatically appear on the template web page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can easily create an account. Utilize this short step-by-step help guide to get the Oregon Sample Mortgage for a Company:

- Ensure that the form you found is eligible for use in the state it is needed in.

- Verify the document. Use the Preview option or read its description (if readily available).

- Click Buy Now if this form is what you need or go back to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple steps, you can fill out the sample in an appropriate editor. Recheck filled in information and consider requesting a legal professional to review your Oregon Sample Mortgage for a Company for correctness. With US Legal Forms, everything gets much easier. Test it now!

Form popularity

FAQ

Racking up Debt. Forgetting to Check Your Credit. Falling Behind on Bills. Maxing out Credit Cards. Closing a Credit Card Account. Switching Jobs. Making a Major Purchase. Marrying Someone With Bad Credit.

In order for you to qualify for a commercial mortgage, you'll need to pass the lender's eligibility checks which usually includes: The cash flow and any debts you may owe to assess the financial health of your company. Your businesses' projected income to determine whether you can cover the cost of the loan.

Which Type of Loan Is Best for You? What Is the Interest Rate and Annual Percentage Rate? How Much of a Down Payment Is Required? What Are the Discount Points and Origination Fees? What Are All the Costs? Can You Get a Loan Rate Lock? Is There a Prepayment Penalty? How Much Time Do You Need to Fund?

These are some of the common reasons for being refused a mortgage: You've missed or made late payments recently. You've had a default or a CCJ in the past six years. You've made too many credit applications in a short space of time in the past six months, resulting in multiple hard searches being recorded on your

DON'T: Make large deposits or withdrawals. Part of the mortgage application process includes providing recent bank statements. DON'T: Change jobs. DON'T: Make large purchases on credit. DON'T: Run up a home equity line of credit. DON'T: Close credit accounts. DON'T: Make payments on collection accounts.

1) Anything Untruthful. 2) What's the most I can borrow? 3) I forgot to pay that bill again. 4) Check out my new credit cards! 5) Which credit card ISN'T maxed out? 6) Changing jobs annually is my specialty. 7) This salary job isn't for me, I'm going to commission-based.

Write the title. Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

A press release from 360 Mortgage Group detailing the compensation changes said mortgage brokers generate an average revenue of 2.25 mortgage points on a home loan. For example, on a $500,000 mortgage, they'd make roughly $11,250 in revenue.

Often, lenders won't finance an LLC or corporation mortgage loan based only on business credit unless that business has an excellent and long-established credit history. Banks are well aware that LLC members and shareholders can't be held personally liable for the LLC or corporation's debts.