A Mortgage Entity is an entity that issues, transfers, services, and/or holds mortgages. It is typically a financial institution such as a bank, mortgage company, or credit union. Mortgage Entities are responsible for originating, servicing, and/or securitizing mortgages and are subject to extensive regulation. Examples of Mortgage Entities include: -Primary Mortgage Lenders: These are financial institutions that originate mortgages. —MortgagServicesrs: These entities are responsible for handling payments to lenders, collecting payments from borrowers, and overseeing the terms of the loan. —Secondary Market Entities: These entities purchase mortgages from lenders and securitize them into mortgage-backed securities (MBS). —Mortgage-Backed Security (MBS) Trustees: These entities act as trustees for mortgage-backed securities (MBS) and are responsible for administering and managing the MBS. —Mortgage Guarantors: These entities provide guarantees to lenders in the event of a borrower default. —Mortgage Insurers: These entities insure mortgages against the risk of borrower default.

Mortgage Entity

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

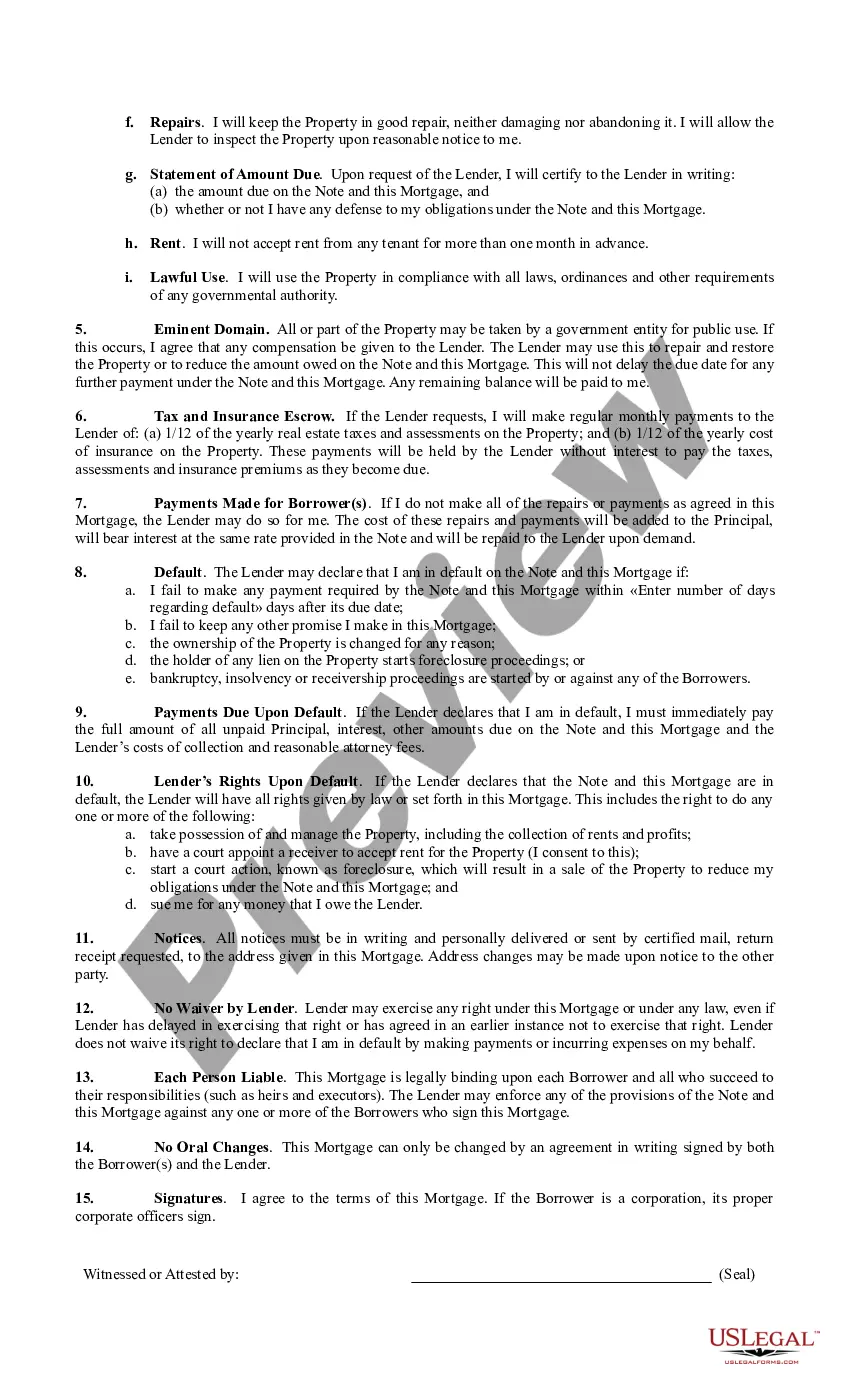

How to fill out Mortgage Entity?

Dealing with legal paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Mortgage Entity template from our service, you can be sure it complies with federal and state regulations.

Working with our service is easy and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to obtain your Mortgage Entity within minutes:

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Mortgage Entity in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Mortgage Entity you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

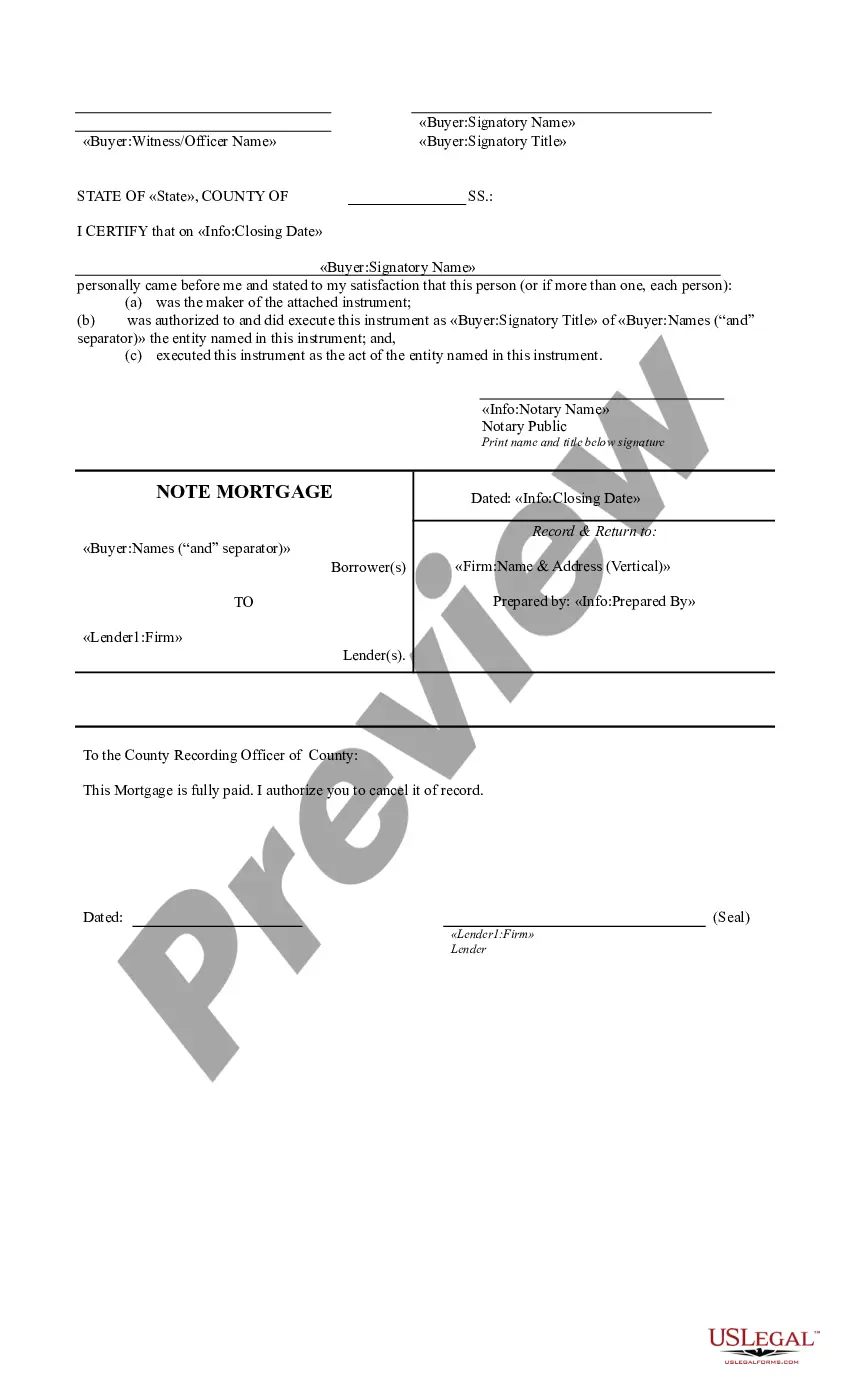

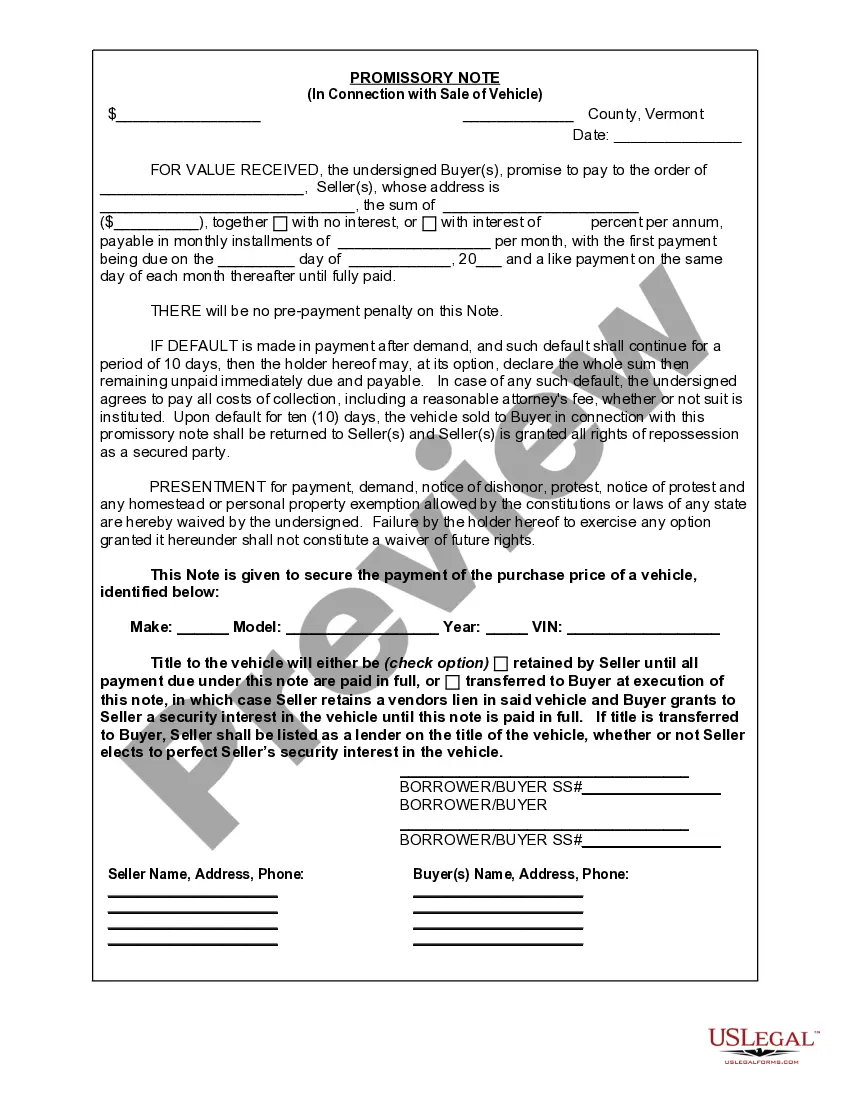

A mortgage holder is an individual or entity who owns the mortgage loan that was extended to a homeowner, and is the party entitled to enforce the terms of the mortgage.

Mortgagee definition A mortgagee holds security interest in a property ? usually in the form of a lien ? in exchange for loaning money to the homebuyer. In other words, the mortgagee is the bank or lender that provides financing to the borrower to buy a house.

In a real estate agreement, the mortgagor is the borrower of a mortgage loan, and the mortgagee is the lender. The mortgagor makes regular payments on the loan and agrees to a lien on the mortgaged property as collateral for the mortgagee.

Mortgagee vs Loss Payee For example, a lending institution that offers a loan to purchase a home is a mortgagee.

Lending Entity means any Person (other than a natural Person) that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its activities.