Debt Conversion Agreement with exhibit A only

Understanding this form

The Debt Conversion Agreement is a legal document used to restructure existing debt into a new format, often converting that debt into equity. This particular form includes an exhibit detailing specific terms and conditions associated with the conversion process. It is primarily used in corporate settings to align the interests of debt holders and company stakeholders, distinguishing it from standard loan agreements or promissory notes.

Form components explained

- Recitals: Detailed background information on the parties involved and the nature of the debt being converted.

- Definitions: Clarifies key terms used throughout the agreement for consistency and understanding.

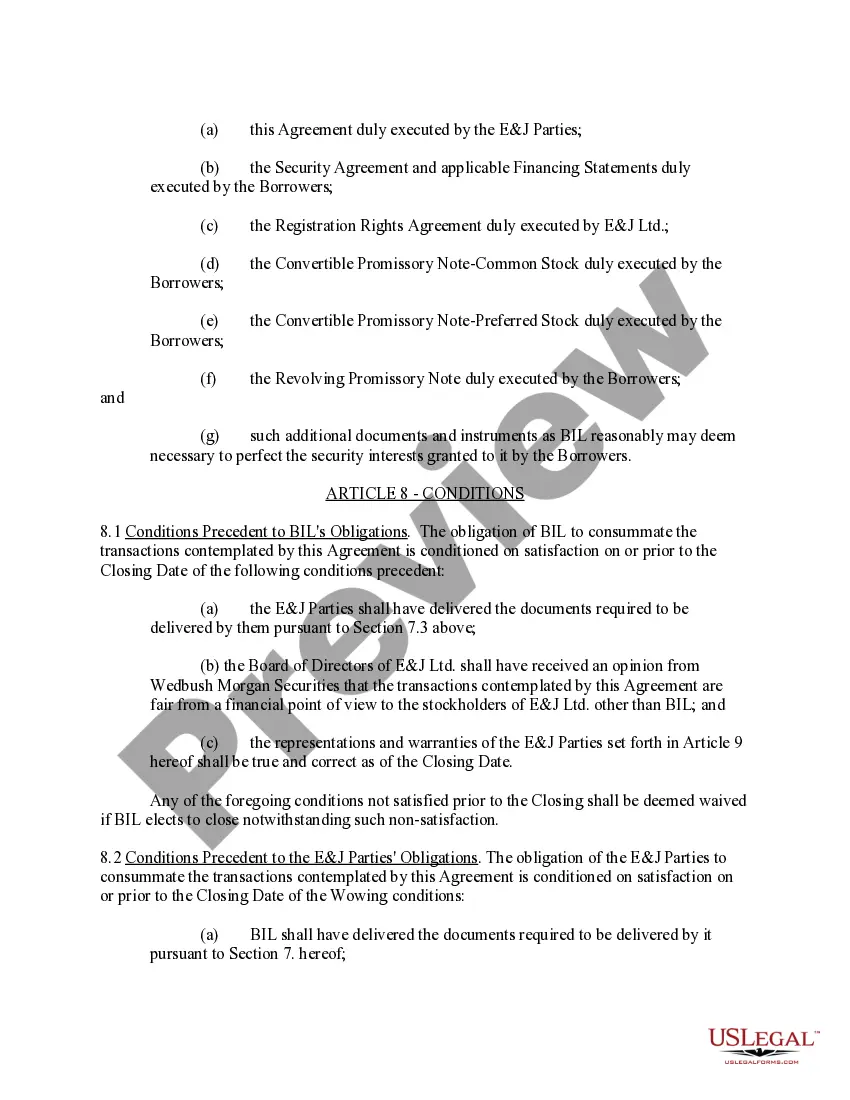

- Restructuring clauses: Describes how existing debts will be converted into new financial instruments, such as convertible promissory notes.

- Security provisions: Lists the collateral backing the obligations under the agreement.

- Conditions precedent: Outlines the necessary conditions that must be met before the agreement can be executed.

- Signature sections: Specifying the parties who must sign to validate the agreement.

Situations where this form applies

This form should be used when a corporation seeks to convert its existing debt into equity, allowing creditors to become shareholders. Common scenarios include financial restructuring, negotiations with creditors during liquidity crises, and facilitating additional investment by converting debt into equity stakes.

Who can use this document

Eligible users of this form include:

- Corporations looking to restructure their debt.

- Businesses negotiating terms with creditors.

- Investors interested in converting their loans into equity to gain ownership interest.

- Legal representatives and financial advisors facilitating debt conversions on behalf of clients.

Completing this form step by step

- Identify the parties involved: Clearly state the names and roles of all entities participating in the agreement.

- Detail the debts being converted: Specify the amounts and types of existing debts that will be restructured.

- Include definitive terms: Clarify the new terms of the converted debt, including any equity components.

- Ensure all parties sign: Collect signatures from authorized representatives of each party as required.

- Attach Exhibit A: Ensure that any relevant exhibits detailing additional terms or conditions are included with the main agreement.

Notarization requirements for this form

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include required signatures from all parties involved.

- Neglecting to attach necessary exhibits that provide critical details.

- Omitting clear definitions for financial terms used in the agreement.

Advantages of online completion

- Convenient access to a legally vetted format tailored for user needs.

- Editable templates allowing users to customize terms according to specific situations.

- Secure storage and easy retrieval of documents without physical paperwork.

Looking for another form?

Form popularity

FAQ

Debt for debt exchange means the exchange of an existing debt with a new debt by the debtor. An existing debt can be exchanged even by combining debt and equity securities. A debt for debt exchange procedure benefits both the creditor and the debtor.

The debt to equity ratio shows a company's debt as a percentage of its shareholder's equity. If the debt to equity ratio is less than 1.0, then the firm is generally less risky than firms whose debt to equity ratio is greater than 1.0.

Debt conversion is the exchange of debt - typically at a substantial discount - for equity, or counterpart domestic currency funds to be used to finance a particular project or policy. Debt for equity, debt for nature and debt for development swaps are all examples of debt conversion.

The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0. While some very large companies in fixed asset-heavy industries (such as mining or manufacturing) may have ratios higher than 2, these are the exception rather than the rule.

Debt-to-Assets Ratio = Total Debt / Total Assets. Debt-to-Equity Ratio = Total Debt / Total Equity.

Updated October 04, 2019. Debt-to-equity swaps are common transactions in the financial world. They enable a borrower to transform loans into shares of stock or equity. Most commonly, a financial institution such as an insurer or a bank will hold the new shares after the original debt is transformed into equity shares.

At its simplest, a debt for equity swap is an exchange of (usually lender) debt for shares in the borrower, and has the advantage of improving the capital position of the borrower as it results in reduced leverage and a lower interest bill whilst offering the lender a share in any upside when the restructured

Conversion Agreement means any agreement entered into from time to time between the Borrower or Guarantor (or their respective agents) and any maintenance facility with respect to the conversion of an ACS Group Aircraft to a freighter or mixed-use aircraft.