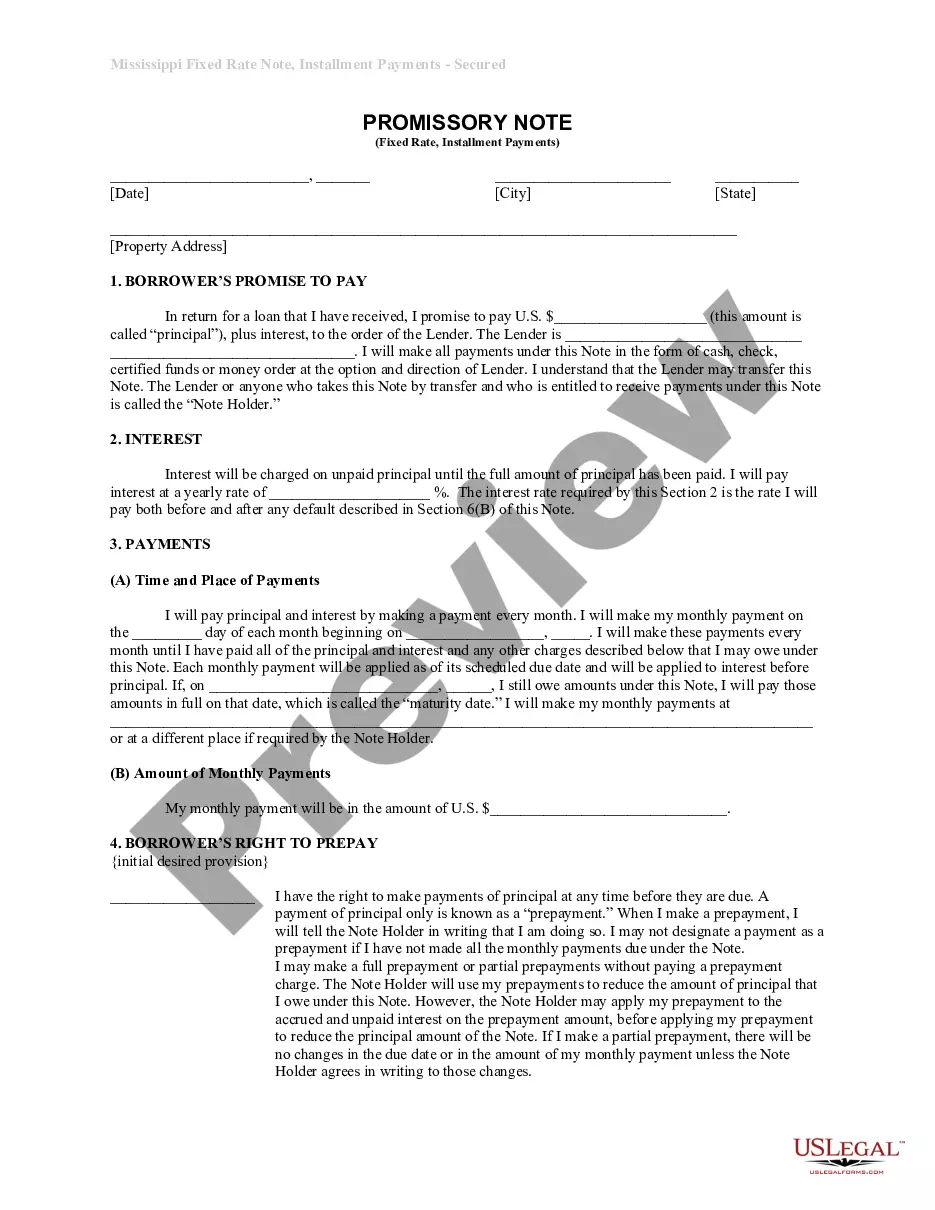

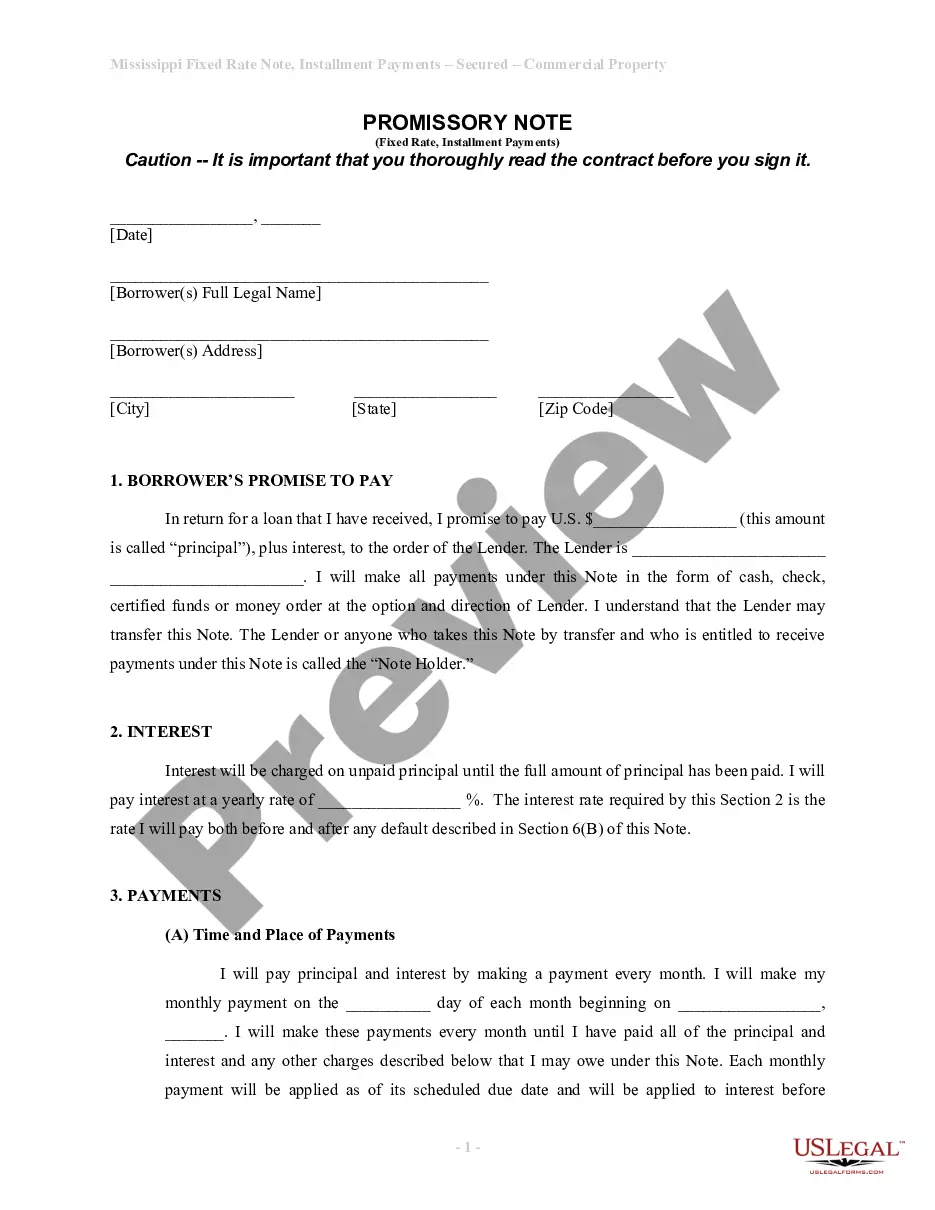

Mississippi Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Installments Fixed Rate Promissory Note Secured By Personal Property?

Acquire a printable Mississippi Installments Fixed Rate Promissory Note Secured by Personal Property in just a few clicks in the most comprehensive collection of legal electronic files.

Discover, download, and print expertly crafted and validated samples on the US Legal Forms website. US Legal Forms has been the leading provider of economical legal and tax documents for US citizens and residents online since 1997.

After you have downloaded your Mississippi Installments Fixed Rate Promissory Note Secured by Personal Property, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to gain access to 85,000 expertly drafted, state-specific documents.

- Clients who already hold a subscription must Log In to their US Legal Forms account, download the Mississippi Installments Fixed Rate Promissory Note Secured by Personal Property, and find it stored in the My documents section.

- Users without a subscription should adhere to the instructions listed below.

- Ensure your template aligns with your state's regulations.

- If possible, read the description of the form for more information.

- If available, examine the form to learn more details.

- Once you are certain the form meets your needs, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Whether a promissory note is a security is one of the most vexatious issues in US securities laws.In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.