Mississippi Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Understanding this form

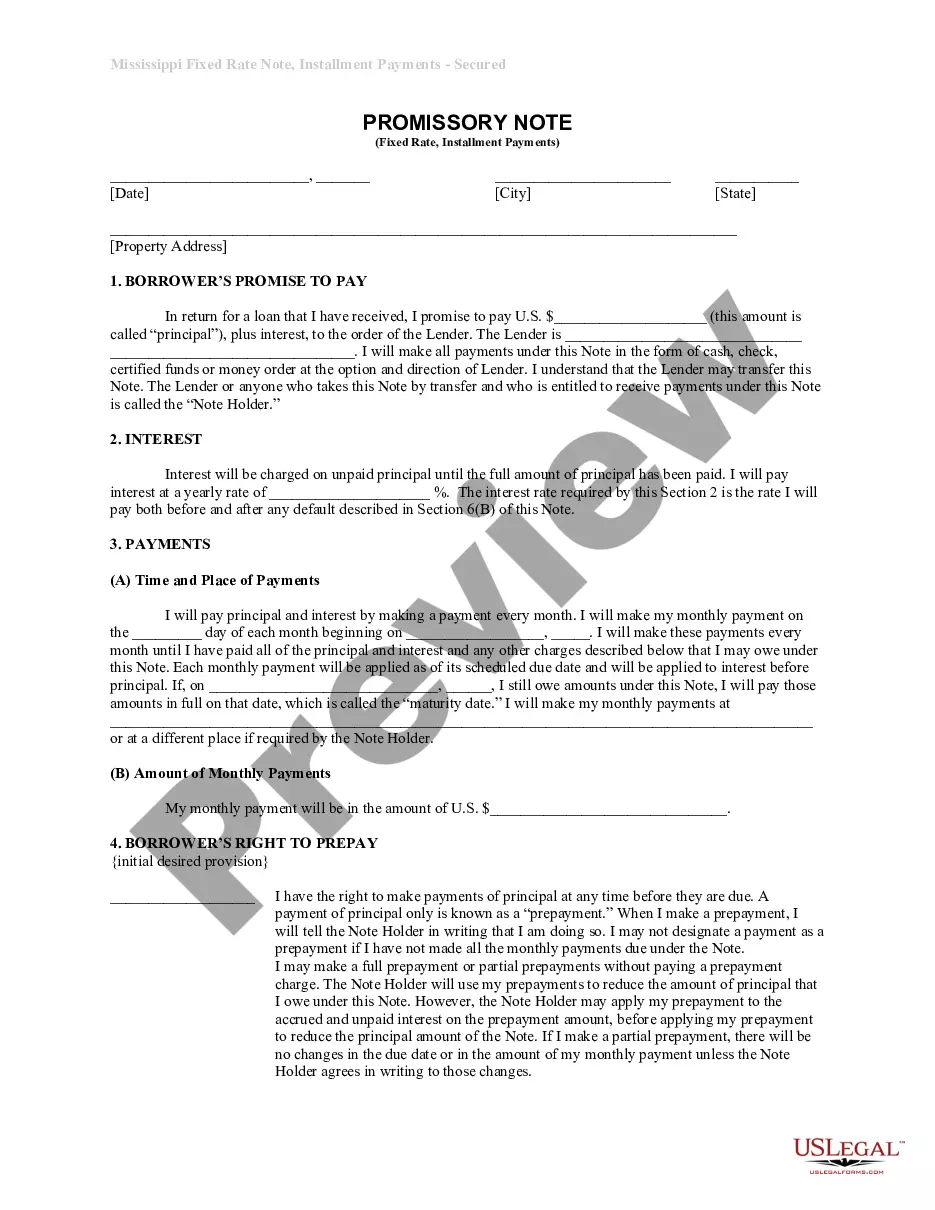

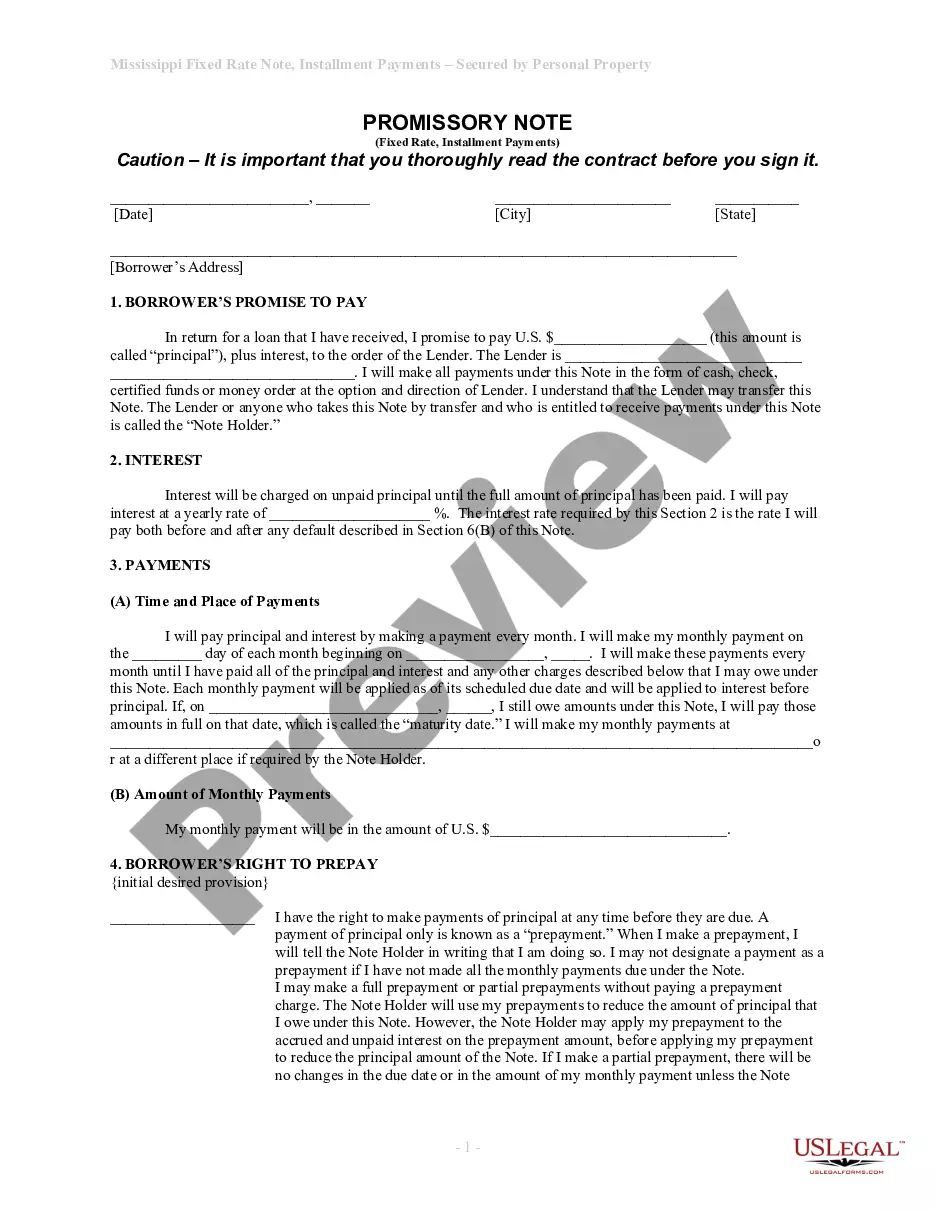

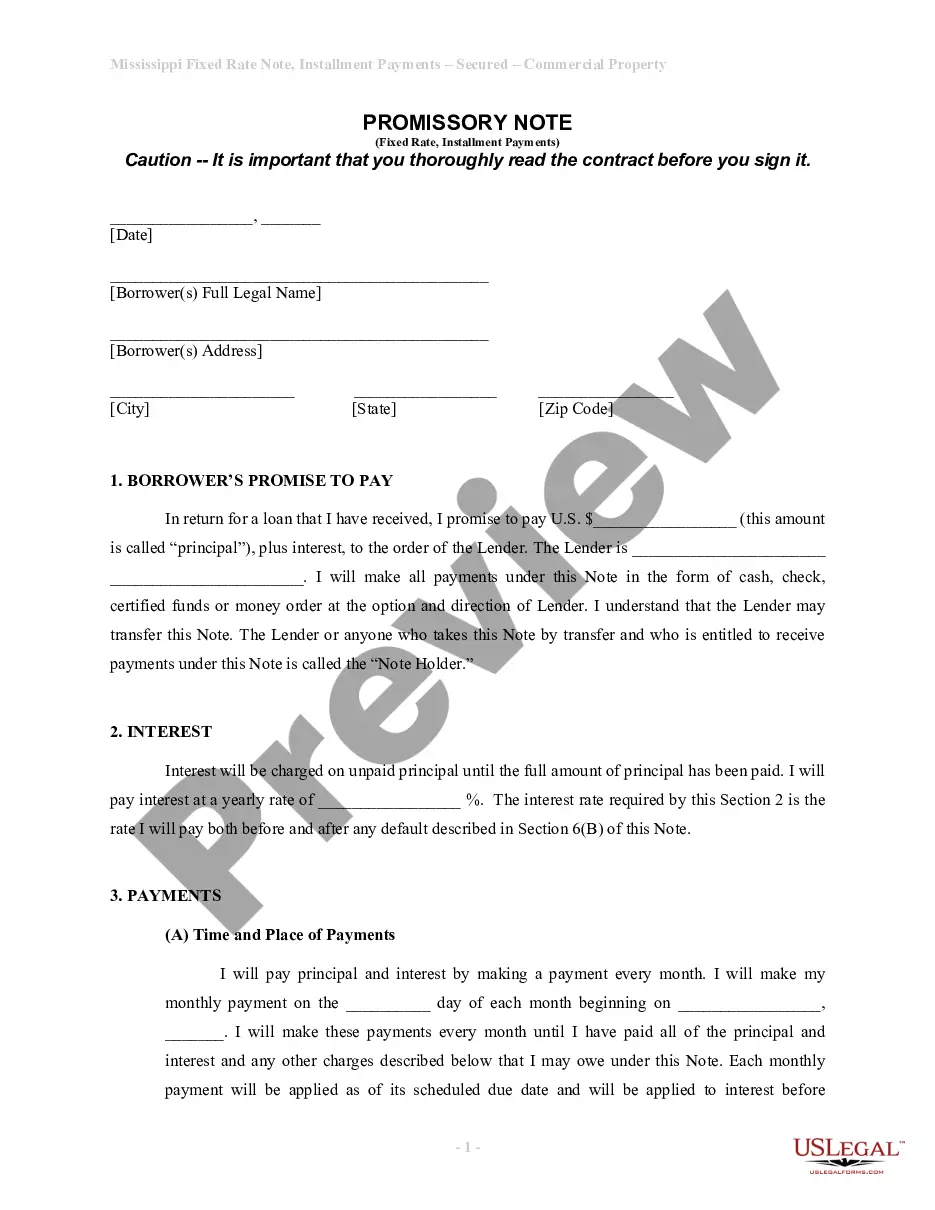

The Mississippi Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document where the borrower agrees to repay a specific sum of money over time, using their residential property as collateral. This form differs from other promissory notes due to its fixed interest rate and installment payment structure, providing clear terms for both parties involved.

Form components explained

- Principal Amount: The total amount borrowed, to be repaid with interest.

- Interest Rate: The yearly rate charged on the unpaid principal, detailed within the form.

- Payment Schedule: Specifies the date and frequency of monthly payments until the loan is fully repaid.

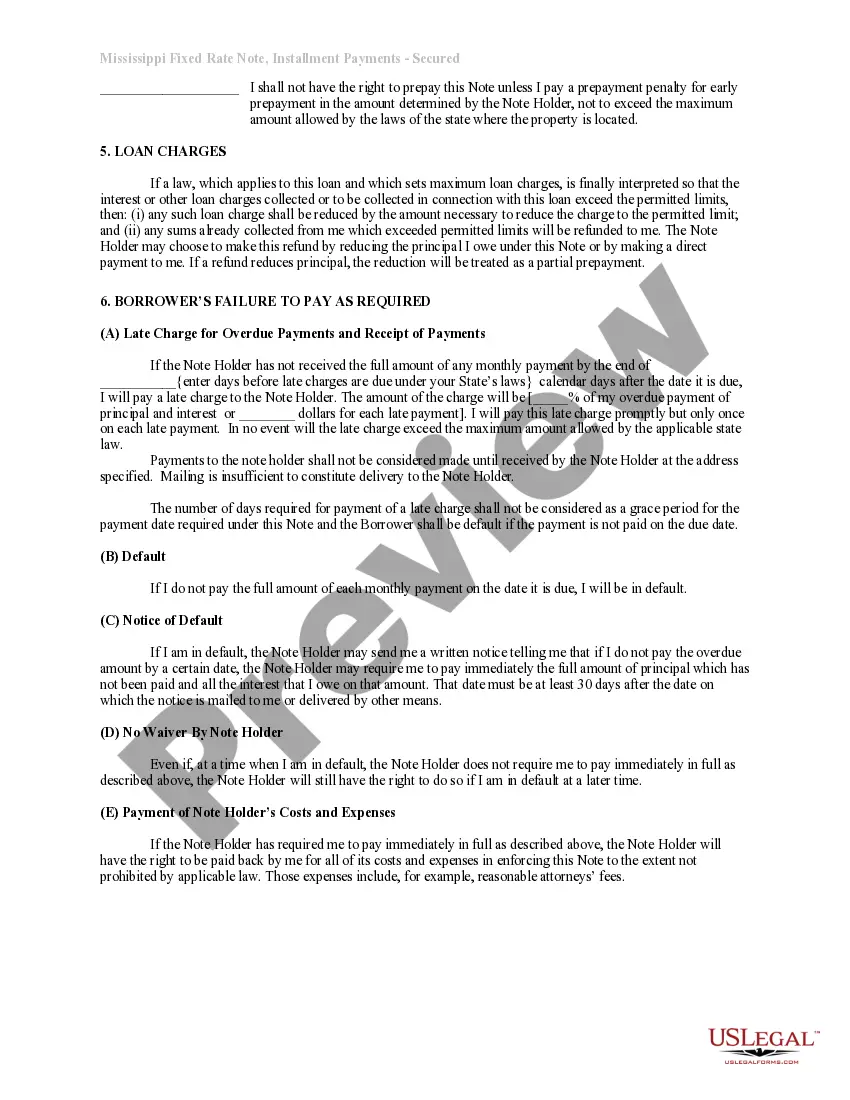

- Prepayment Rights: Outlines conditions under which the borrower can pay off the loan early, including any relevant penalties.

- Default Terms: Describes what constitutes a default and the note holder's rights in such an event.

- Security Clause: Indicates that the loan is secured by a mortgage or deed of trust on the residential property.

When this form is needed

This form is necessary when you need to secure a loan using residential property as collateral. It is commonly used in situations such as purchasing a home, refinancing an existing mortgage, or borrowing against the equity of your home. If you are a lender or borrower seeking clear loan terms, this form will help establish mutual understanding and protection for both parties.

Intended users of this form

- Borrowers seeking financing for residential real estate transactions.

- Lenders who want a legally binding agreement to secure their loan with property.

- Homeowners looking to refinance or access home equity.

- Real estate investors needing clear terms for property-backed loans.

Completing this form step by step

- Identify the parties involved: Enter the names of the borrower and lender.

- Specify the property: Enter the address of the residential property securing the loan.

- Set the principal amount: Clearly state the total loan amount being borrowed.

- Determine the interest rate: Fill in the agreed-upon yearly interest rate.

- Outline the payment schedule: Indicate the start date and the monthly payment amount.

- Obtain signatures: Ensure all parties sign the note to validate the agreement.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not specifying the maturity date clearly, which can cause confusion about when the loan must be fully repaid.

- Failing to detail the interest rate accurately, leading to potential disputes over payment amounts.

- Not obtaining signatures from all parties involved, which can invalidate the agreement.

- Neglecting to review state-specific laws that may impact loan terms and conditions.

Advantages of online completion

- Convenient access: Download the form any time from your device.

- Editable template: Customize the document easily to fit specific needs.

- Expertly drafted: Forms are prepared by licensed attorneys for reliability.

- Time-saving: Fill out and file your forms quickly without the need for office visits.

Legal use & context

- The note is a legally binding contract that obligates the borrower to repay the loan under specified terms.

- Failure to comply with the terms may result in foreclosure or other legal actions by the lender.

- This form provides security for the lender through the collateral of the property, making it enforceable in court.

Quick recap

- The Mississippi Installments Fixed Rate Promissory Note is essential for securing loans with real estate.

- Understanding key components, like payment terms and rights, is crucial for both borrowers and lenders.

- Using this form online offers convenience and ensures the document is drafted by professionals.