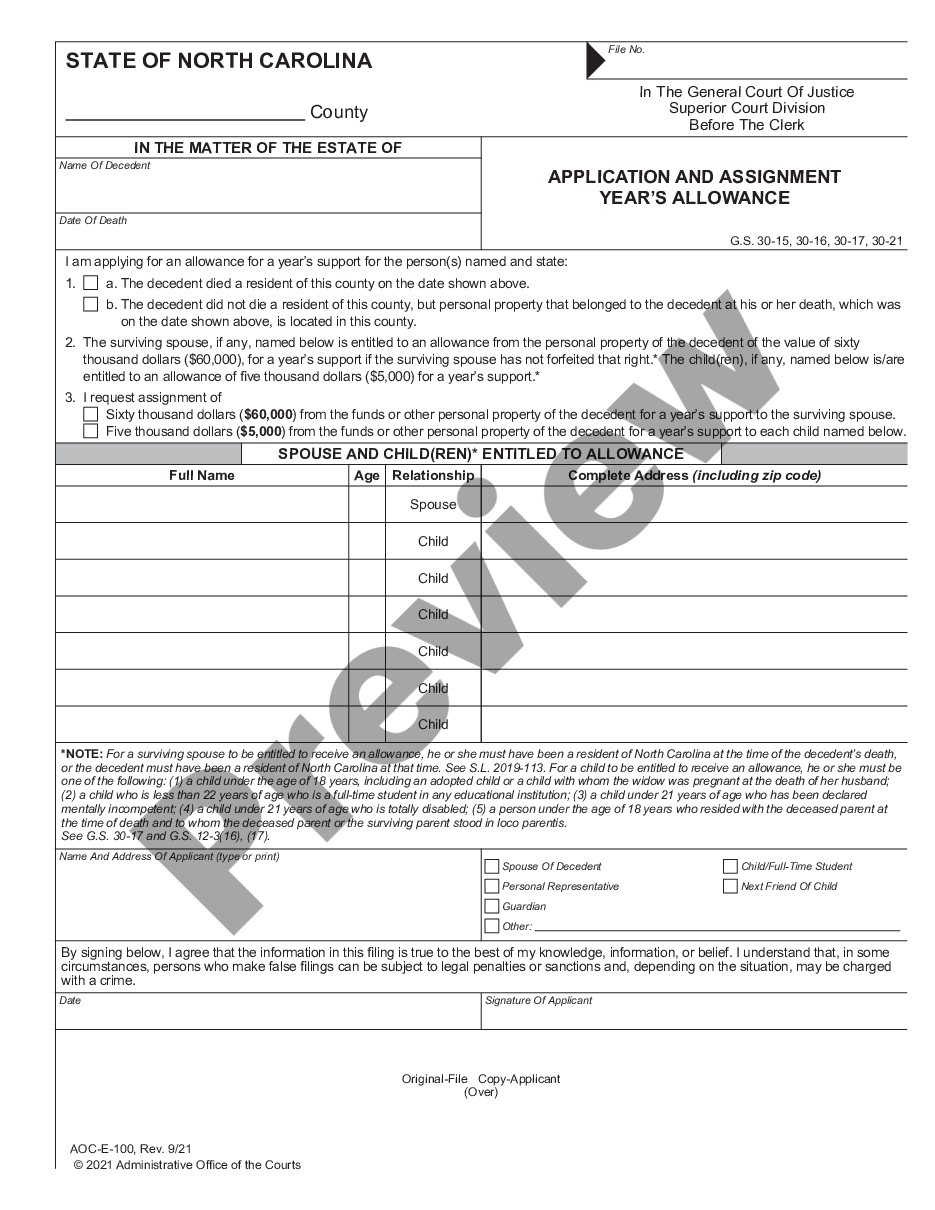

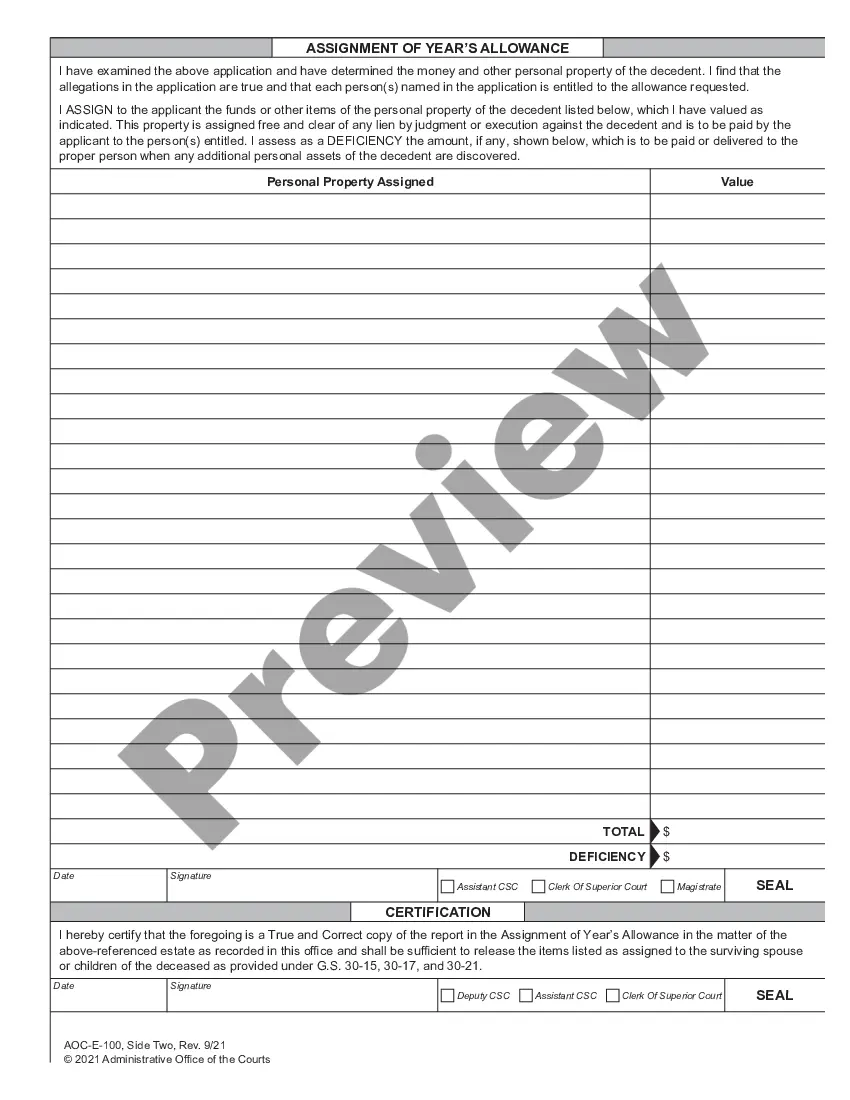

Application And Assignment Year's Allowance: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

North Carolina Application And Assignment Year's Allowance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Application And Assignment Year's Allowance?

Steer clear of expensive lawyers and discover the North Carolina Application And Assignment Year's Allowance you seek at a reasonable cost on the US Legal Forms website.

Utilize our straightforward category feature to locate and acquire legal and tax documents. Examine their details and preview them prior to downloading.

Choose to obtain the form in PDF or DOCX format. Click on Download and locate your form in the My documents section. You can save the template to your device or print it. After downloading, you can fill out the North Carolina Application And Assignment Year's Allowance by hand or using editing software. Print it and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed instructions on how to obtain and complete each template.

- US Legal Forms users simply need to Log In and access the specific form they require in their My documents section.

- Those who have not yet subscribed must follow the steps outlined below.

- Confirm that the North Carolina Application And Assignment Year's Allowance is valid for use in your area.

- If offered, review the description and utilize the Preview feature before downloading the document.

- If you are confident the form meets your needs, click Buy Now.

- If the form is incorrect, use the search bar to find the appropriate one.

- Next, establish your account and select a subscription plan.

- Make payment via card or PayPal.

Form popularity

FAQ

The spousal impoverishment protections are Medi-Cal rules designed to prevent the impoverishment of. one spouse, when the other spouse enrolls in Medi-Cal payment for nursing home care, or Home and. Community Based Services. This means that certain married individuals can be eligible for Medi-Cal.

You must be between 60 and 65 years old. You must have had a spouse or common-law partner who has died, and you must not have remarried or entered into a common-law relationship after their death. Your income must be lower than the maximum allowed income level.

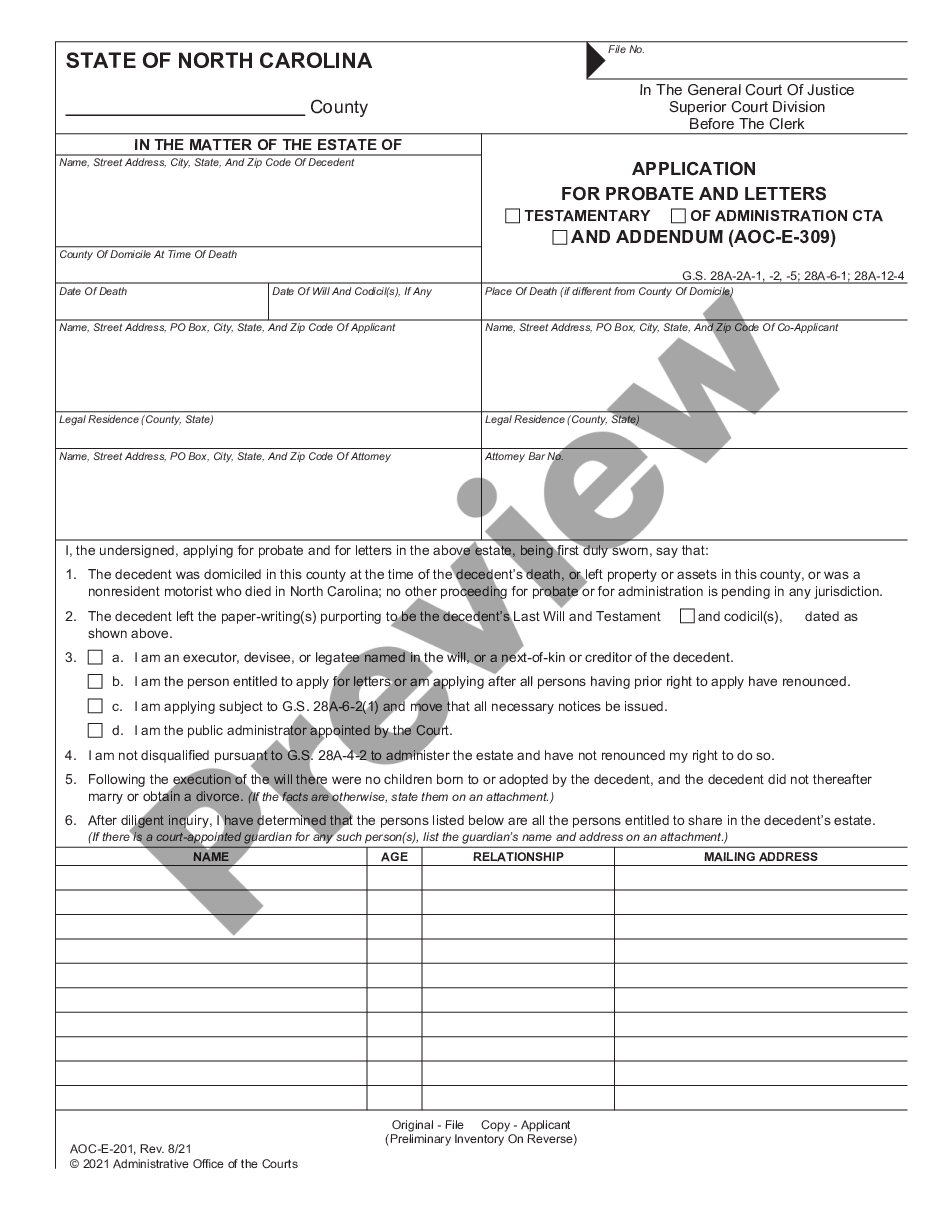

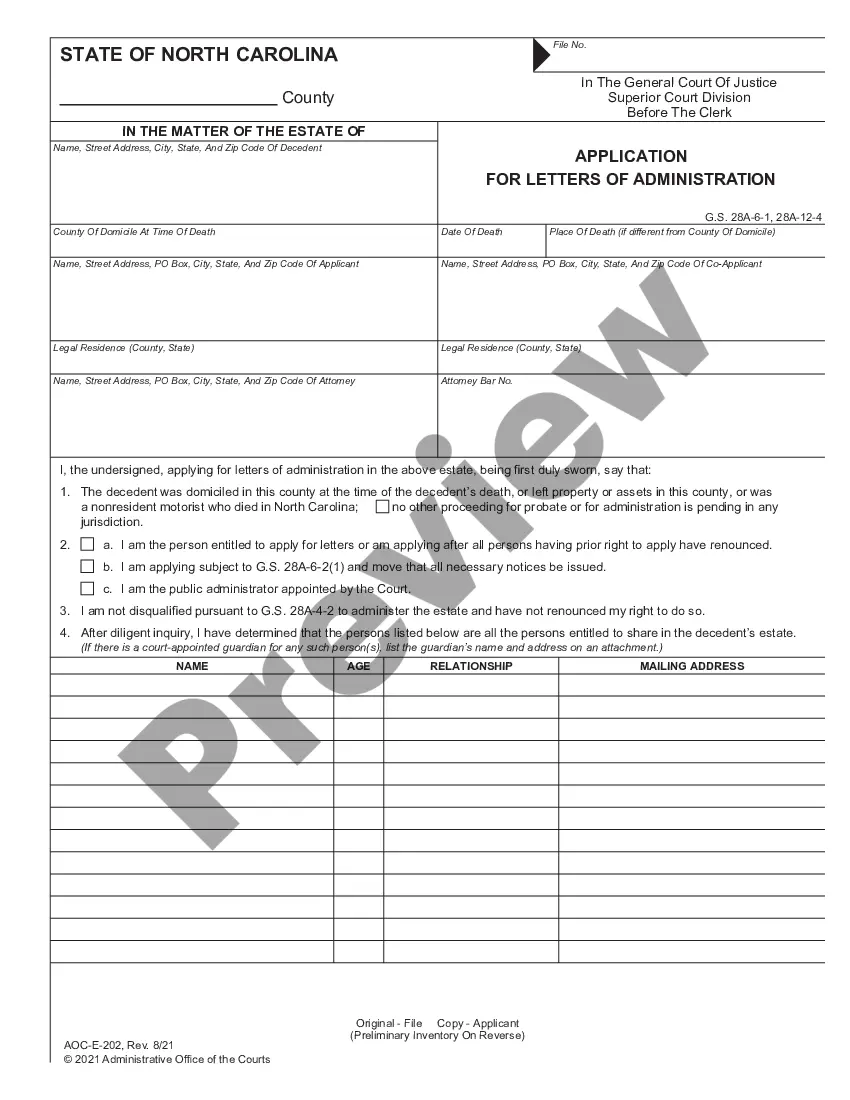

You should expect it to take a minimum of six months to a year to settle an estate because of the legal notice requirements and time that creditors have to submit claims against the estate. Creditors have 90 days from the first publication date of the notice of probate.

In North Carolina, you cannot disinherit your spouse.Even if your Will or your Trust specifically excludes your spouse, your spouse will still have the legal right to share in your estate under the law.

Year's support is a probate petition designed to make sure that a spouse or minor kids do not wind up on the street after the family's primary breadwinner passes away.The purpose of year's support is to put the surviving spouse and/or minor children at the front of the line to receive property from the probate estate.

The spousal allowance is paid from the deceased spouse's personal property.In such a case the surviving spouse or their personal representative can apply for the allowance at the clerk of court or magistrate local to where the personal property is located.

Spousal impoverishment rules include a minimum monthly maintenance needs allowance (MMMNA) and a community spouse resource allowance (CSRA) that protect a portion of a couple's income and assets (including the home) for the non-applicant spouse.

If you prepare a last will and testament, you can name your spouse so they inherit probate assets when you die.Some states' laws provide that a surviving spouse automatically inherits all of the assets whether or not the couple had children together.

15% if the couple was married for less than 5 years; 25% if the couple was married for more than 5 but less than 10 years; 33% if the couple was married for more than 10 but less than 15 years; and. 50% if the couple was married for 15 years or older.