Balloon Secured Note

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Balloon Secured Note?

Aren't you tired of choosing from hundreds of samples every time you require to create a Balloon Secured Note? US Legal Forms eliminates the lost time countless American people spend searching the internet for appropriate tax and legal forms. Our expert crew of attorneys is constantly modernizing the state-specific Templates catalogue, so that it always provides the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete easy actions before being able to download their Balloon Secured Note:

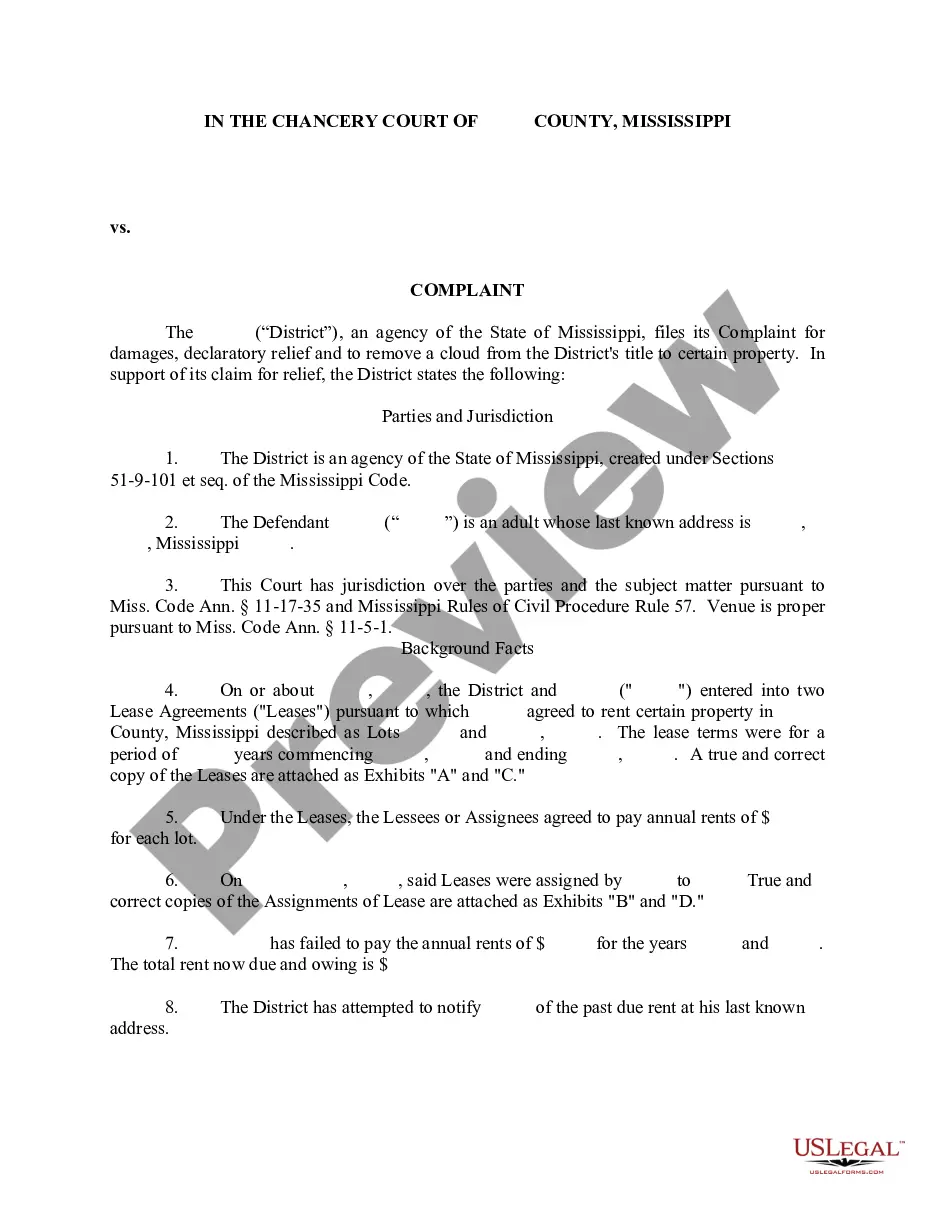

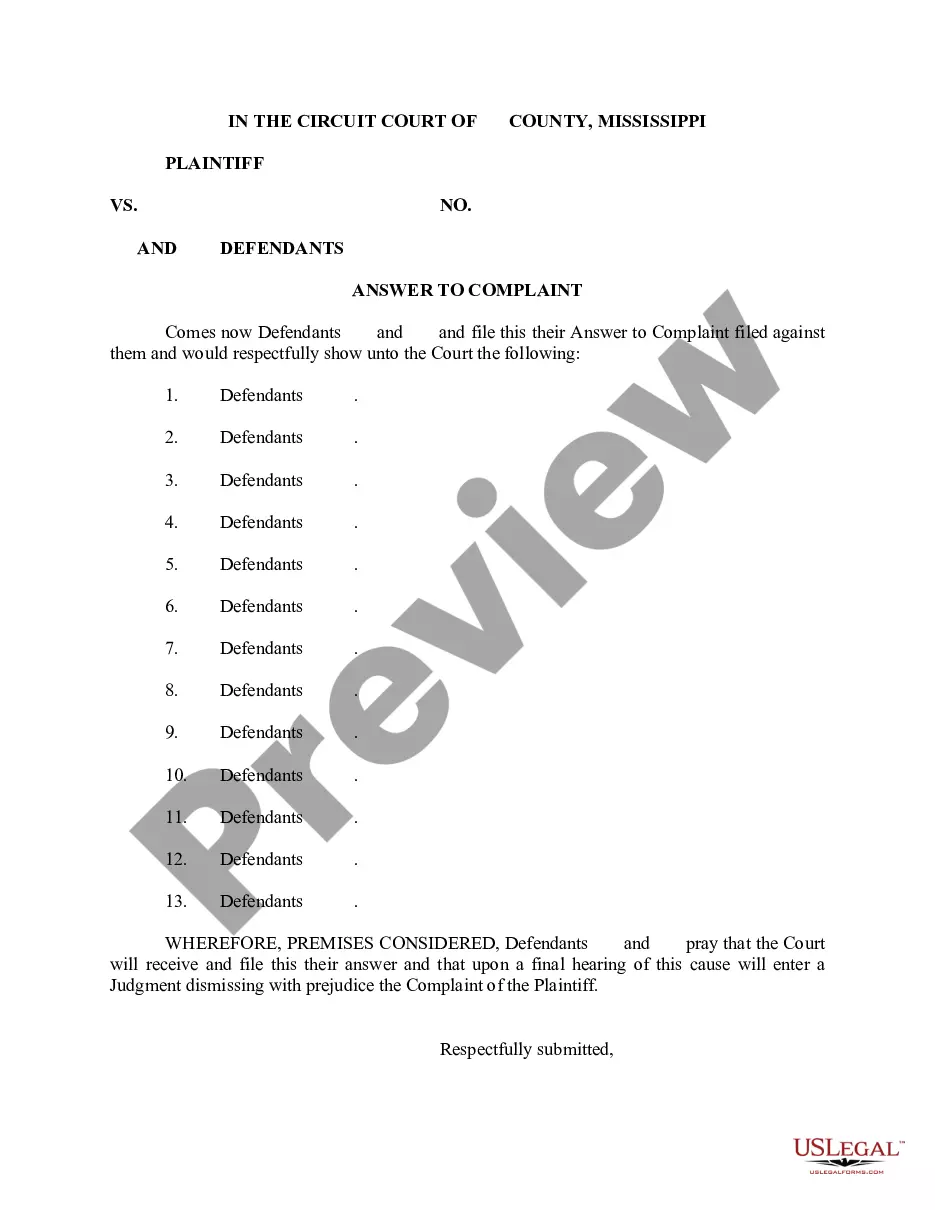

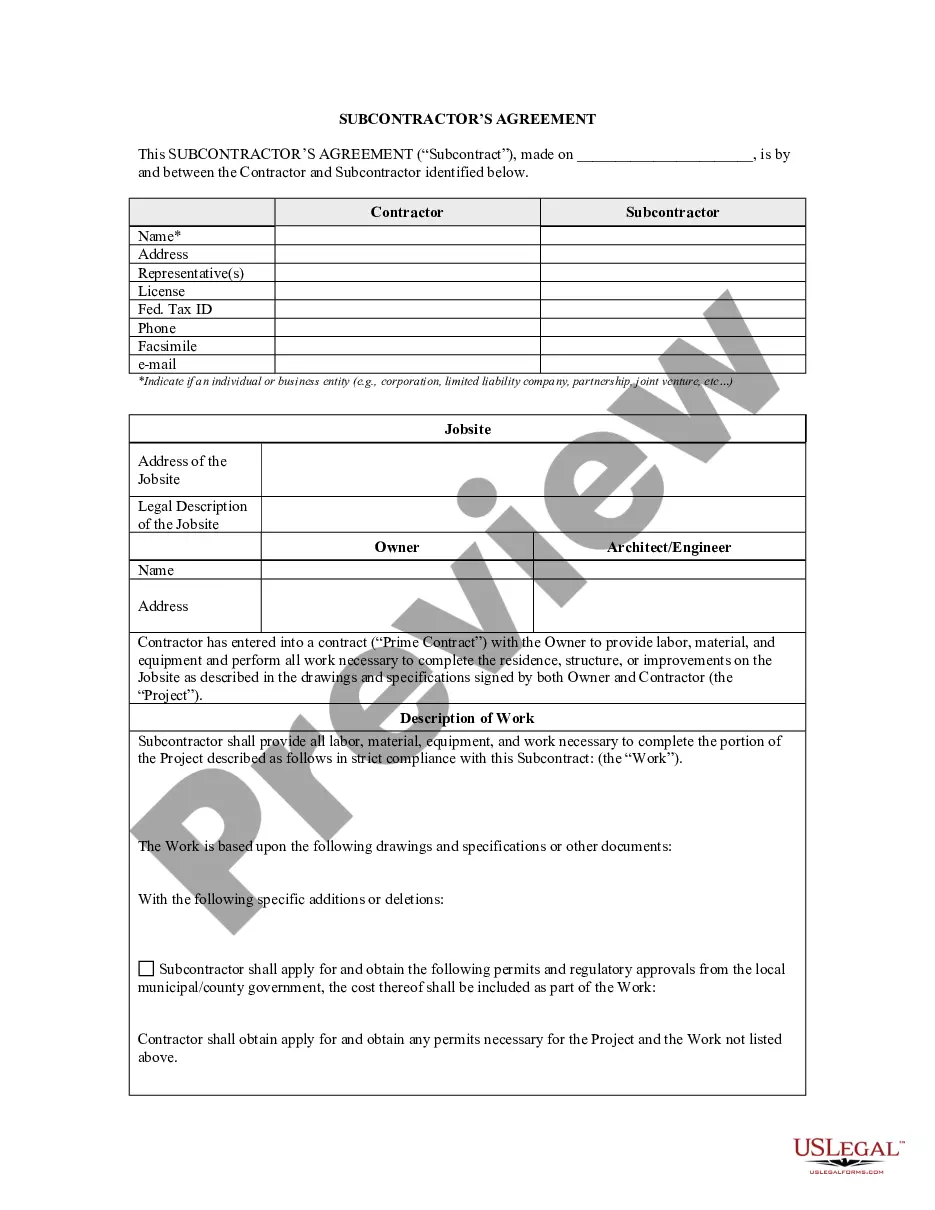

- Make use of the Preview function and read the form description (if available) to make certain that it’s the right document for what you are looking for.

- Pay attention to the validity of the sample, meaning make sure it's the proper example for your state and situation.

- Use the Search field at the top of the web page if you need to look for another document.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Get your template in a needed format to finish, print, and sign the document.

Once you’ve followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, completing Balloon Secured Note samples or any other official paperwork is not hard. Get started now, and don't forget to double-check your samples with accredited lawyers!

Form popularity

FAQ

Benefits of Balloon Payments Reducing the monthly repayment amount; Improving the cash flow of the borrower; Increasing affordability and the ability to upgrade to a better model of car; Enabling you to consider increasing the maximum loan size so that you can purchase a higher quality vehicle; and.

Short-term mortgage: If you know you're not going to be in the house long, you can sell your house before the balloon payment becomes due in a few years.

It is not uncommon for a consumer to be unable to pay the balloon payment when it is due.A balloon payment provision in a loan is not illegal per se. Federal and state legislatures have enacted various laws designed to protect consumers from being victimized by such a loan. The Federal TRUTH IN LENDING ACT (15U.

Your balloon payment will ensure that you can afford your monthly instalment for your vehicle, additional car expenses and be able to sustain your lifestyle. With a percentage of the overall cost paused, you can afford to get the vehicle of your dreams while ensuring that you aren't left strapped for cash every month.

A balloon payment allows a buyer to take an amount owing on the purchase price of a car and set it aside, meaning the monthly instalment amounts are calculated on a lower value in turn making repayments more affordable. Essentially, the buyer is paying off a loan for most of the car, but not all of it.

If a loan has a balloon payment then the borrower will be able to save on the interest cost of the interest outflow every month. For example, person ABC takes a loan for 10 years.The sum total payment which is paid towards the end of the term is called the balloon payment.

What is a Promissory Note with Balloon Payments? A Promissory Note with Balloon Payments can help document and clarify the terms of a loan that's designed to have one or more larger payments due at the end of the repayment period.You're party to a loan that has balloon payments.

Is a balloon payment a good idea? For buyers who can save the amount needed, a balloon payment can work to their advantage, and for investors, it can free up short-term capital. In most cases, however, balloon repayments are an easy way to find yourself in debt.