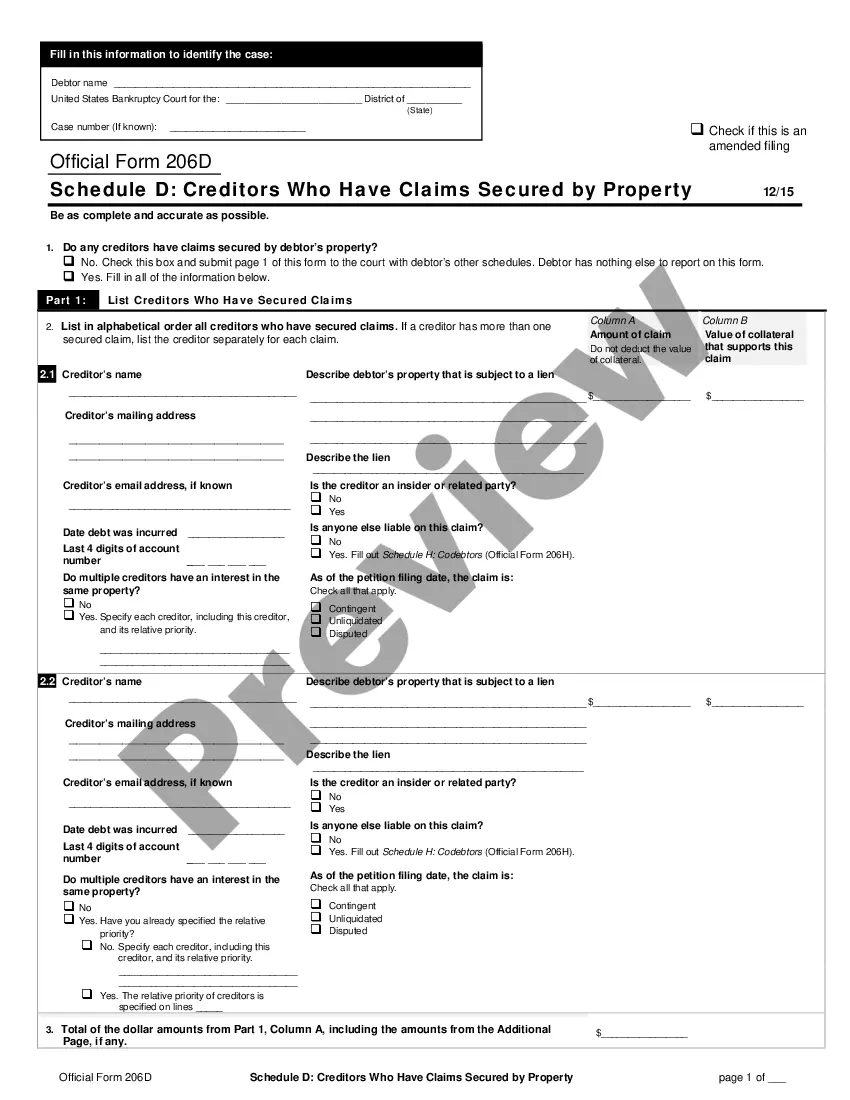

Schedule D: Creditors Who Hold Claims Secured by Property (individuals) is a form used by bankruptcy filers to list creditors who have secured claims against the debtor's property. It includes the name, address, phone number, and type of claim for each creditor. It must be filed with the court in order to have these claims discharged in the bankruptcy case. There are two types of Schedule D: Creditors Who Hold Claims Secured by Property (individuals): secured creditors (those who have a claim secured by a lien or other interest in the debtor's property) and unsecured creditors (those who have a claim without a lien or other interest in the debtor's property).

Schedule D: Creditors Who Hold Claims Secured by Property (individuals)

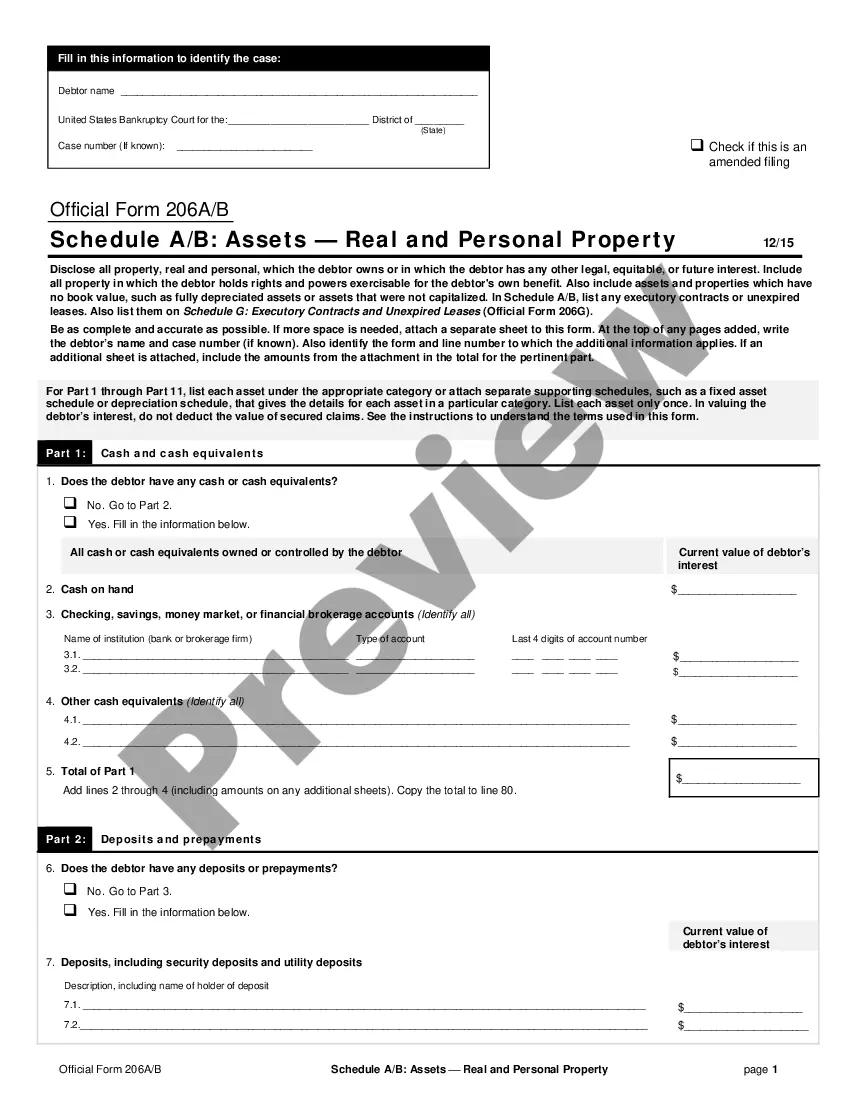

Description

Key Concepts & Definitions

Schedule D in bankruptcy refers to the form used in the United States to list all creditors who hold claims secured by property of the debtor. Secured claims are those backed by collateral, such as a mortgage on a home or a lien on a car. This schedule is a crucial part of the filing procedure in federal court under the federal rules.

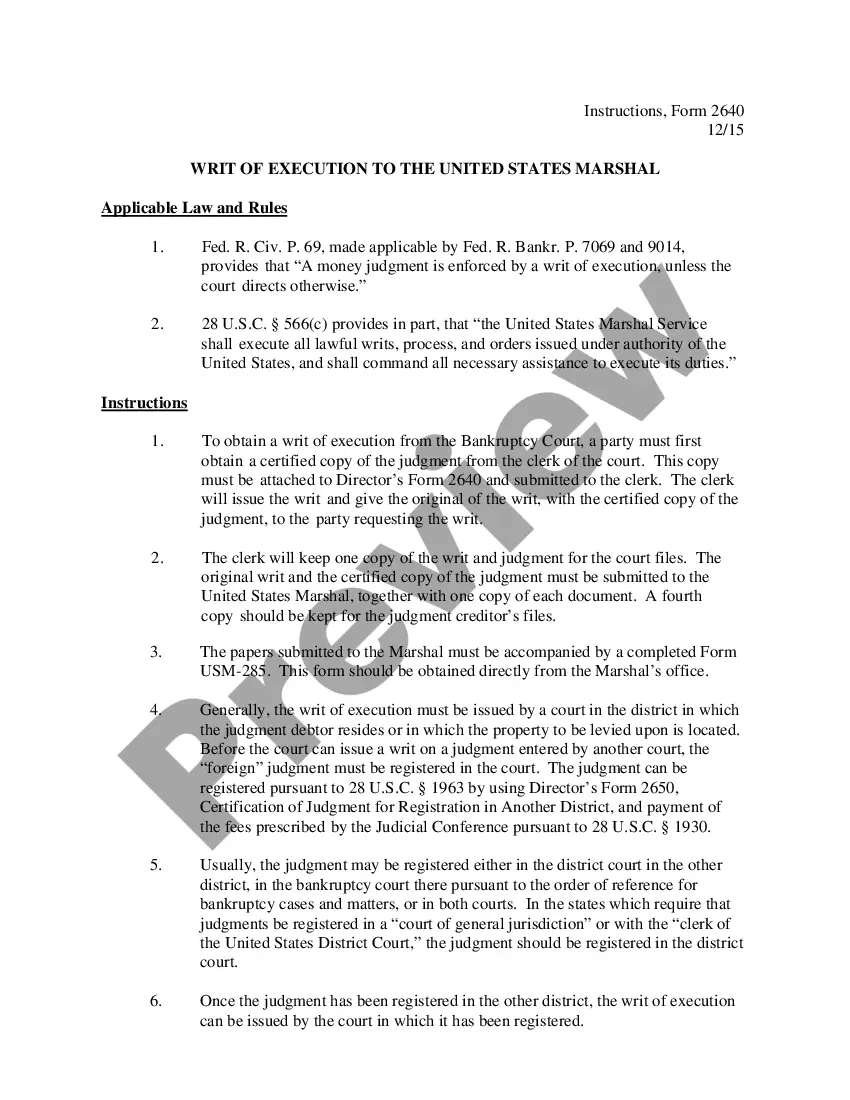

Step-by-Step Guide to Filing Schedule D

- Identify Secured Creditors: Gather information about all creditors holding claims secured by property. This includes names, contact details, and the nature of each claim.

- Complete Schedule D Form: Accurately fill out the Schedule D form, available through online judicial platforms of US courts.

- Legal Representation: Consider finding an attorney specializing in consumer law and bankruptcy to ensure accuracy and compliance with legal standards.

- Submit to Federal Court: File the completed form with the federal court overseeing your bankruptcy case.

- Stay Informed on Court Proceedings: Keep track of all related court proceedings through the online judicial system or through your lawyers updates.

Risk Analysis

- Inaccuracy Risks: Errors in the schedule can lead to legal complications, potentially causing delays or issues in the bankruptcy process.

- Legal Risks: Non-compliance with federal rules can result in penalties or the denial of claim discharges.

- Property Risk: Incorrect reporting of secured property could lead to disputes or loss of property rights.

Pros & Cons of Filing Schedule D

- Pros: Provides a clear record of all secured debts, potentially simplifying the bankruptcy process.

- Cons: Requires detailed and accurate information which can be cumbersome to compile and verify.

Best Practices

- Accurate Documentation: Always ensure that all information provided on Schedule D is accurate and up-to-date.

- Lawyer Representation: Engage a specialized lawyer to help navigate the complexities of bankruptcy filings.

- Regular Updates: Keep track of any changes in your debt situation and update the court accordingly.

Common Mistakes & How to Avoid Them

- Mistake: Failing to list all secured creditors. Prevention: Regularly review and update your financial records before filing.

- Mistake: Incorrect classification of claims. Prevention: Seek clear guidance from a consumer law attorney to understand the nature of each claim.

FAQ

- What is a secured claim? A secured claim is a debt backed by collateral, giving the creditor a lien on the debtor's asset.

- How often should I update Schedule D? Update as frequently as any changes occur in your financial situation or at least before every major court proceeding.

Summary

Successfully managing the 'Schedule D: Creditors Who Hold Claims Secured by Property' in bankruptcy filings is crucial for ensuring the smooth progression of bankruptcy proceedings in US courts. Adhering to the correct filing procedure, keeping detailed records, and having skilled legal representation are key to avoiding common pitfalls and risks.

How to fill out Schedule D: Creditors Who Hold Claims Secured By Property (individuals)?

US Legal Forms is the most straightforward and profitable way to find appropriate legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Schedule D: Creditors Who Hold Claims Secured by Property (individuals).

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Schedule D: Creditors Who Hold Claims Secured by Property (individuals) if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one meeting your demands, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Schedule D: Creditors Who Hold Claims Secured by Property (individuals) and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reputable assistant in obtaining the required formal paperwork. Try it out!

Form popularity

FAQ

A secured creditor is ? at the very basic level ? a creditor that has lent assets that are backed by collateral. In bankruptcy cases, being a secured creditor comes with lots of privileges not reserved for the great unwashed general unsecured creditors.

A secured debt is a debt that is secured by property. If you don't repay the debt ing to your contract?for example, you fail to make your monthly payment?the creditor has the right to take back the secured property, such as your home or car. In contrast, your unsecured creditors don't have the same rights.

Examples of secured debt include homes loans and car loans. The loan is secured by the car or home, which means that the person you owe the debt to can repossess the car or foreclose on the home if you fail to pay the debt.

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.

A claim held by a creditor who has a perfected lien or a right of set-off against the debtor's property. A claim is secured to the extent of the creditor's interest in the debtor's property or to the extent of the amount subject to set-off.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

Secured creditors can be various entities, although they are typically financial institutions. A secured creditor may be the holder of a real estate mortgage, a bank with a lien on all assets, a receivables lender, an equipment lender, or the holder of a statutory lien, among other types of entities.

Secured Creditors are creditors that hold a lien on its debtor's property, whether that property is real property or personal property. The lien gives the secured creditor an interest in its debtor's property that provides for the property to be sold to satisfy the debt in cases of default.