General Form of Inter Vivos Irrevocable Trust Agreement

Overview of this form

The General Form of Inter Vivos Irrevocable Trust Agreement is a legal document that establishes a trust during the lifetime of the Trustor. Unlike a revocable trust, this form cannot be altered or revoked once executed. This agreement allows the Trustor to manage their property for the benefit of designated beneficiaries, ensuring that assets are distributed according to their wishes. It is essential for individuals looking to plan their estate while maintaining control over their assets during their lifetime.

Key components of this form

- Transfer in Trust: Details the property being transferred into the trust.

- Disposition of Principal and Income: Outlines how the income and principal are to be managed and distributed.

- Powers of Trustee: Specifies the authority and responsibilities granted to the trustee.

- Spendthrift Provision: Protects the trust assets from beneficiaries' creditors during the trust's duration.

- General Rules Regarding Disbursements: Addresses how and when beneficiaries receive distributions from the trust.

Situations where this form applies

This form is beneficial in various scenarios, including: - Establishing a trust for estate planning to ensure that your assets are managed according to your wishes while you are alive and distributed after your death. - Providing long-term financial support for minor children or dependents. - Protecting your assets from creditors or ensuring that beneficiaries cannot access funds until certain conditions are met. - Minimizing estate taxes and avoiding probate, making the transfer of assets more efficient.

Who should use this form

- Individuals seeking to create a trust for estate planning purposes.

- Trustors who want to manage their assets for the benefit of their loved ones.

- Parents planning for the financial support of minors or dependents.

- Persons aiming to protect their assets from potential future claims or creditors.

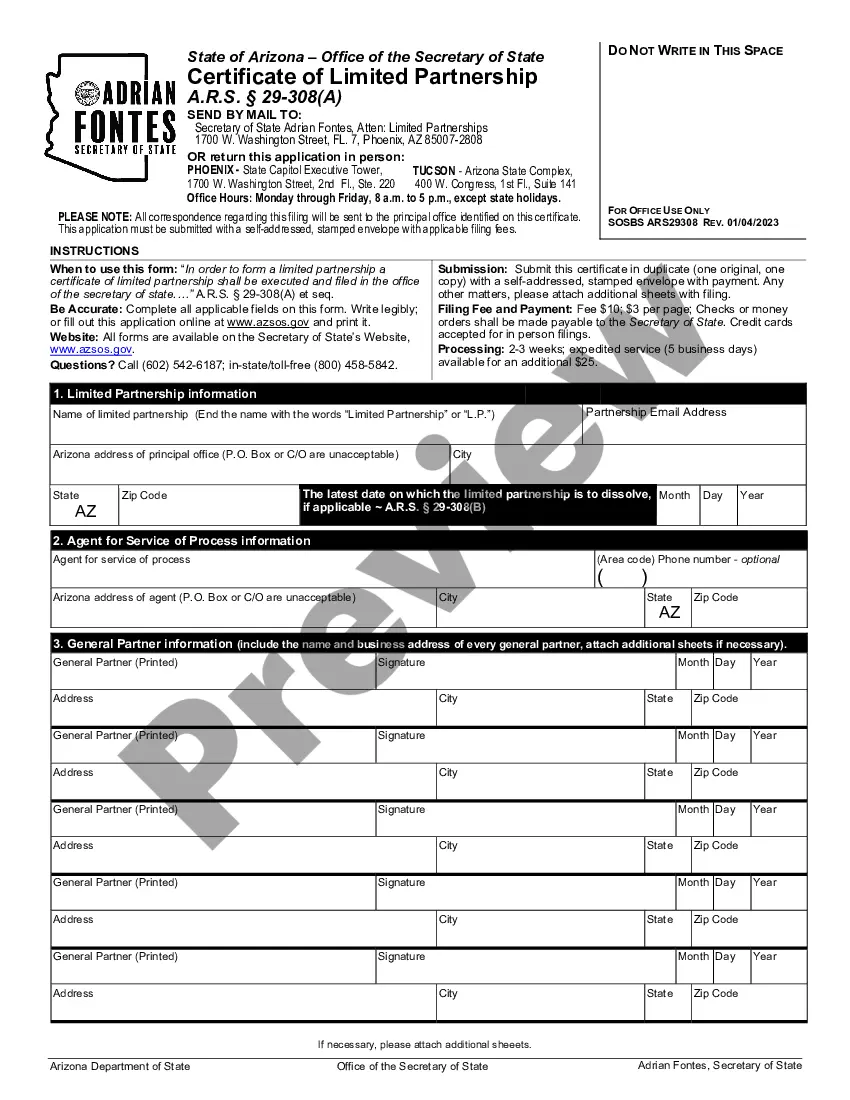

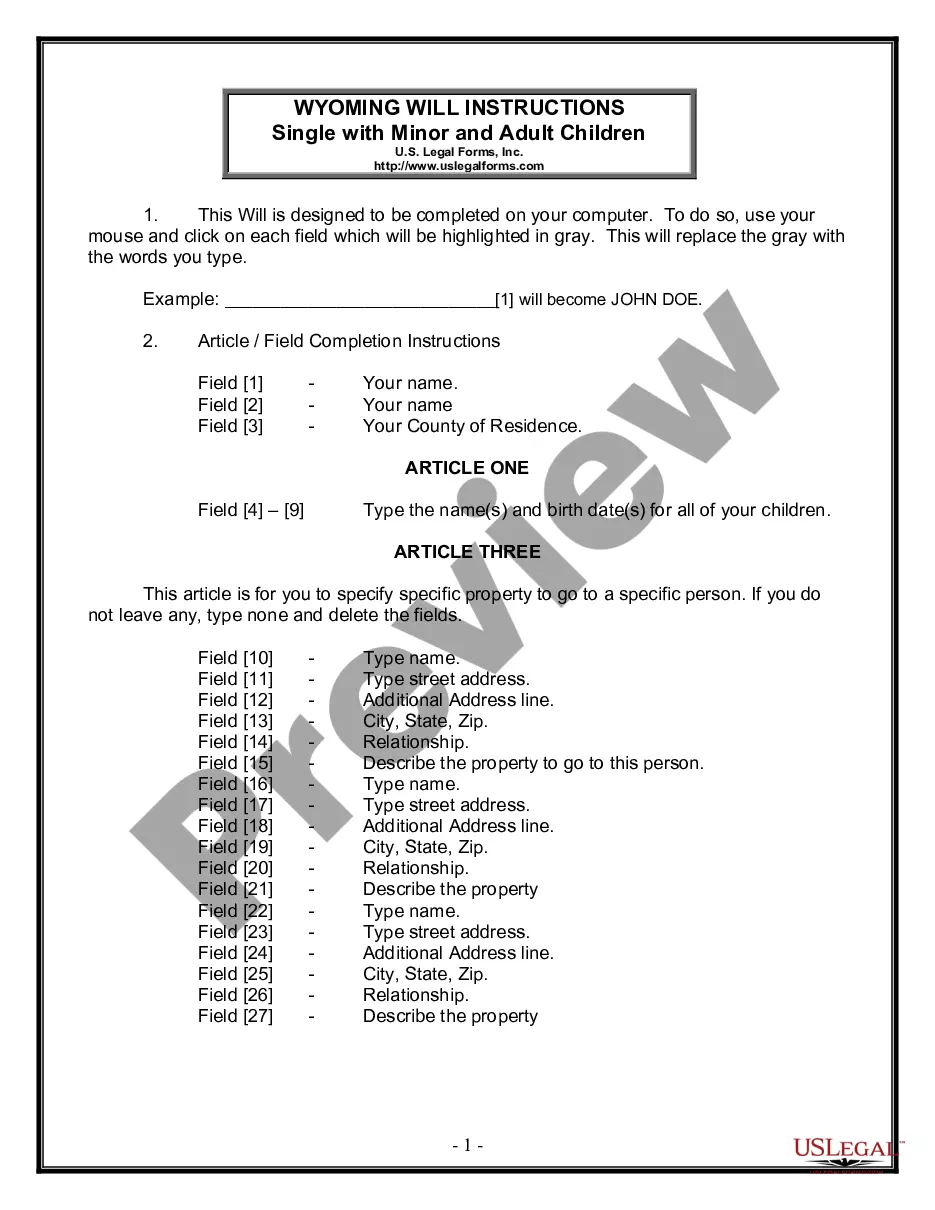

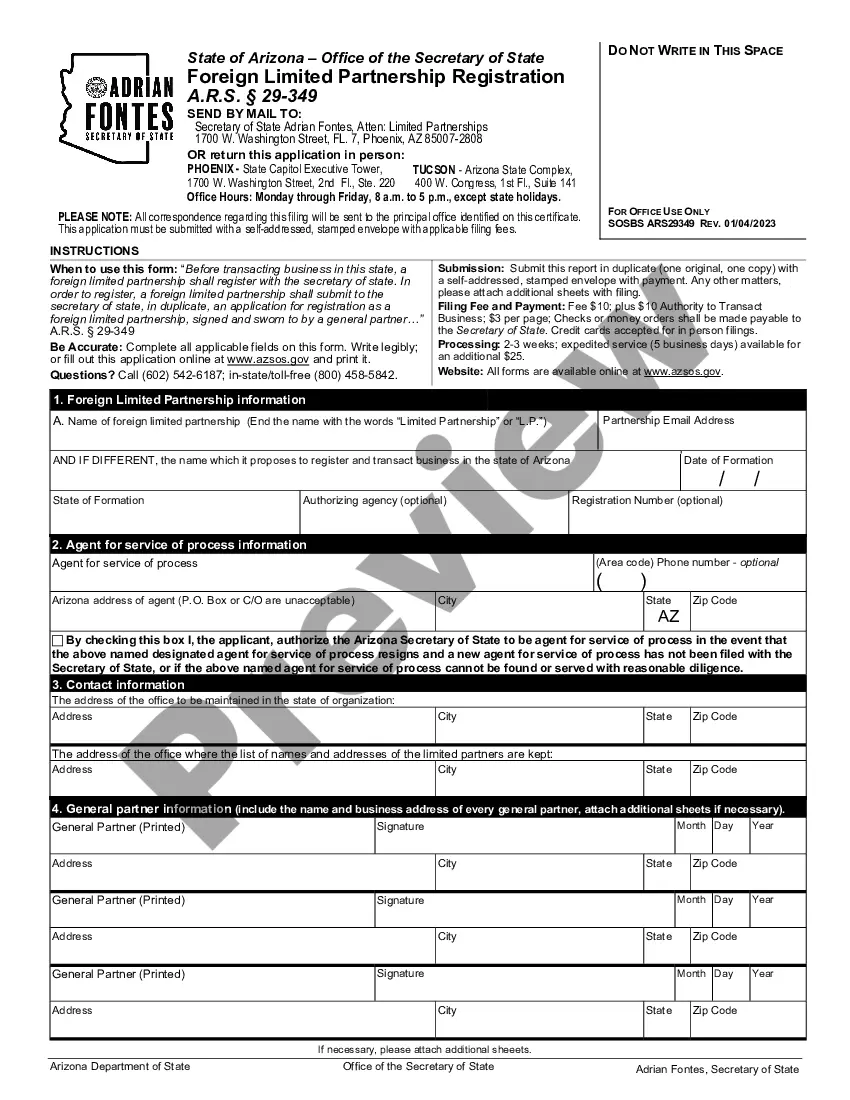

Completing this form step by step

- Identify the parties involved, including the Trustor and Trustee.

- Clearly specify the property being transferred into the trust.

- Outline the rules for income and principal distribution to beneficiaries.

- Detail any powers and responsibilities given to the Trustee.

- Ensure all parties sign and date the document to validate the agreement.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Common mistakes

- Failing to specify all assets to be included in the trust.

- Not understanding the irrevocable nature of the trust.

- Inadequate detailing of Trustee powers, leading to potential confusion.

- Overlooking the need for beneficiary designation.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Access to templates drafted by licensed attorneys to ensure compliance and accuracy.

- Editability to customize the document according to your specific needs.

- Secure electronic storage and retrieval of your completed forms.

Form popularity

FAQ

The step-up in basis is equal to the fair market value of the property on the date of death. In our example, if the parents had put their home in this irrevocable income only trust, and the fair market value upon their demise was $300,000, the children would receive the home with a basis equal to this $300,000 value.

Testamentary Trust: What's the Difference? explains that an inter vivos or living trust is drafted as either a revocable or irrevocable living trust and allows the individual for whom the document was established to access assets like money, investments and real estate property named in the title of the trust.

With an inter vivos trust, the assets are titled in the name of the trust by the owner and are used or spent down by him or her, while they are alive. When the trust owner passes away, the remainder beneficiaries are granted access to the assets, which are then managed by a successor trustee.

A living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.In a testamentary trust, property must pass into the trust by way of the will and, thus, must go through the probate court process.

An inter vivos trust is a legal document created while the individual for which the trust is drawn up is still living.Once the trust owner passes away, the designated beneficiaries of the trust are granted access to the assets, which are then managed by a successor trustee.

In order to set up a living trust, you should first create a document stating your intention to create a trust, and name the people who you want to benefit from the trust. You should then create another document that states the property that you want to begin the creation of the trust with.

Plan the purpose and scope of the irrevocable trust. Choose a trustee. Prepare an irrevocable trust agreement. Obtain a taxpayer identification number for the trust from the Internal Revenue Service.

Irrevocable Trusts The trust assets will carry over the grantor's adjusted basis, rather than get a step-up at death. Assets held in an irrevocable trust that has its own tax identification number (i.e., nongrantor trust status) do not receive a new basis when the grantor dies.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.