Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will

About this form

The Executor's Deed is a legal document used to transfer property from the executors of an estate to the beneficiaries as outlined in the will. This form ensures that the property is conveyed in accordance with the terms of the will, and it provides a warranty of title only for actions taken while the property is held by the executors. It is distinct from other property transfer forms because it specifically addresses the responsibilities of executors and the rights of beneficiaries following the death of the estate owner.

Key components of this form

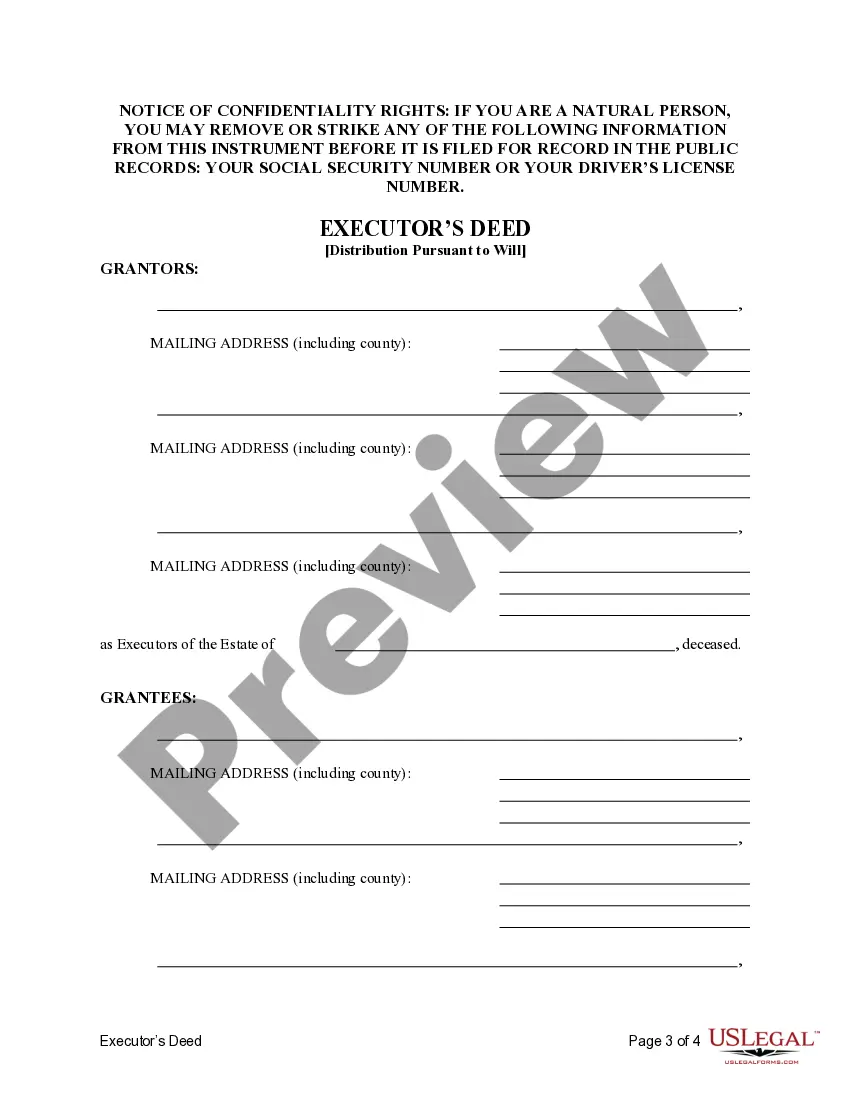

- Identification of grantors (executors) and grantees (beneficiaries).

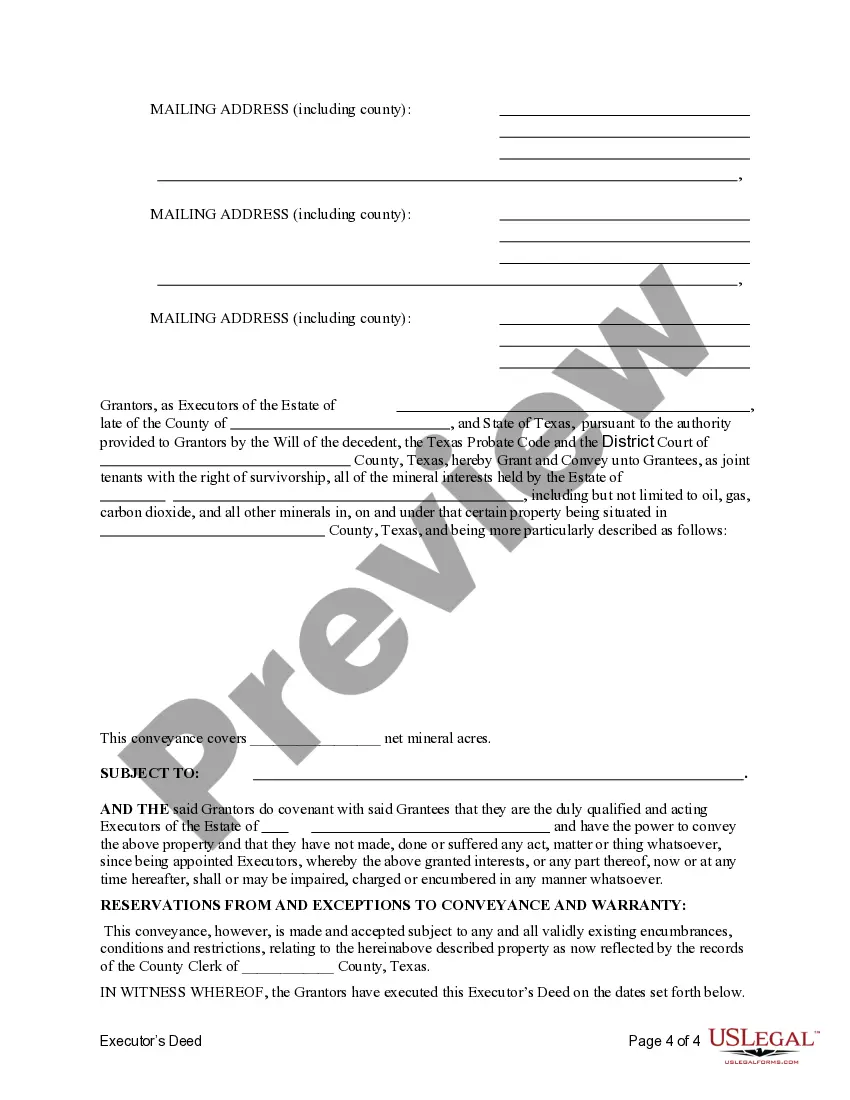

- Description of the property being transferred.

- Warranties provided by the executors regarding the title.

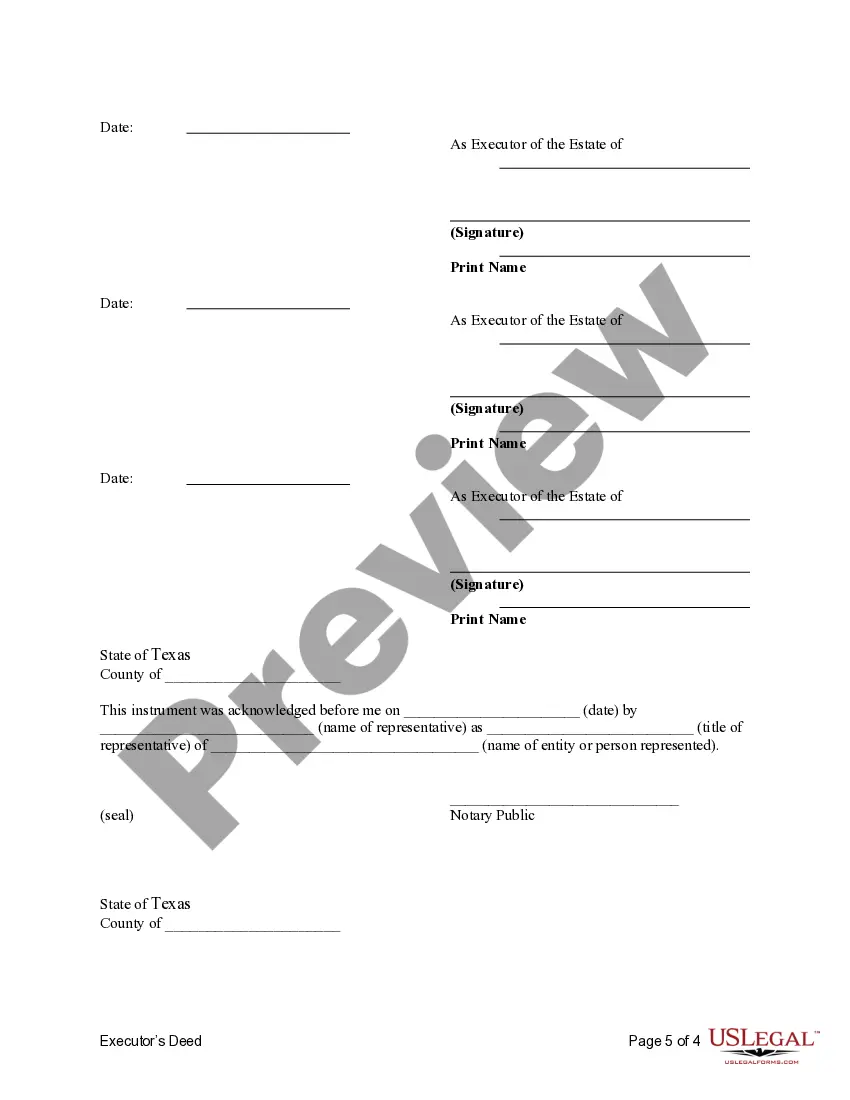

- Signatures of the executors to validate the transfer.

- Compliance with state statutory laws regarding property conveyance.

When to use this form

You should use the Executor's Deed when the estate of a deceased person is being settled, and it is necessary to transfer ownership of property to the beneficiaries as specified in the will. This form is particularly useful in situations where there are multiple executors and several beneficiaries, as it clearly outlines the transfer process and provides legal assurances regarding the title.

Who should use this form

This form is intended for:

- Executors named in a will who are responsible for managing the estate.

- Beneficiaries entitled to inherit property from the estate.

- Individuals involved in the settling of an estate with multiple executors and beneficiaries.

Steps to complete this form

- Identify the parties involved: List the names and addresses of the executors (grantors) and beneficiaries (grantees).

- Describe the property: Clearly specify the property being conveyed, including its legal description.

- Enter the date of the transaction: Include the date on which the deed is executed.

- Obtain signatures: Have all executors sign the deed to validate the transfer.

- Ensure all information is accurate: Double-check the details provided before finalizing the form.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Forgetting to include the legal description of the property.

- Not having all executors sign the deed.

- Failing to date the document properly.

- Incorrectly identifying beneficiaries or executors' names.

Why use this form online

- Convenience of downloading and filling out the form from home.

- Editability allows you to make changes easily before finalizing.

- Access to forms drafted by licensed attorneys ensures reliability.

Looking for another form?

Form popularity

FAQ

When multiple Executors act together on the administration of an Estate, disagreements can sometimes arise.If an agreement cannot be reached through negotiations, and a Grant of Representation has already been issued by the Probate Court, then it is possible for one Executor to apply to the Court to remove the other.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

Your will can dictate how co-executors fulfill their duties. For example, your will can designate three co-executors and provide that decisions be made by a majority vote, that all co-executors must take action together, or that any one of them has authority to act alone.

When multiple Executors act together on the administration of an Estate, disagreements can sometimes arise.If an agreement cannot be reached through negotiations, and a Grant of Representation has already been issued by the Probate Court, then it is possible for one Executor to apply to the Court to remove the other.

Because co-executors must agree and act together, naming multiple executors can cause delays and inconvenience.In cases of extreme disagreements, one executor (or a beneficiary) can even ask the probate court to remove one or more of the other executors, so the estate can be settled without too much delay.

Usually, the person making the will (in legal terms, the testator) nominates one or more executors in his or her will, having already asked each whether he or she is willing to act. But being named in someone's last will and testament as an executor does not necessarily confer automatic appointment.

Why Might Joint Executors Disagree? The problems occur when all of your executors are alive, present and involved in handling your estate by all being named on the probate application. If that's the case, then all decisions must be agreed by all executors.