Texas Executor's Deed - Estate to Two Beneficiaries

Overview of this form

This Executor's Deed is a legal document that allows an executor of an estate to transfer property ownership to two beneficiaries or heirs. This form serves as a critical instrument for conveying real estate title in accordance with state laws, distinguishing it from other types of deeds by emphasizing the obligations of the executor and the rights of the beneficiaries. It complies with all relevant state statutes, ensuring a legally sound transfer of property.

Key components of this form

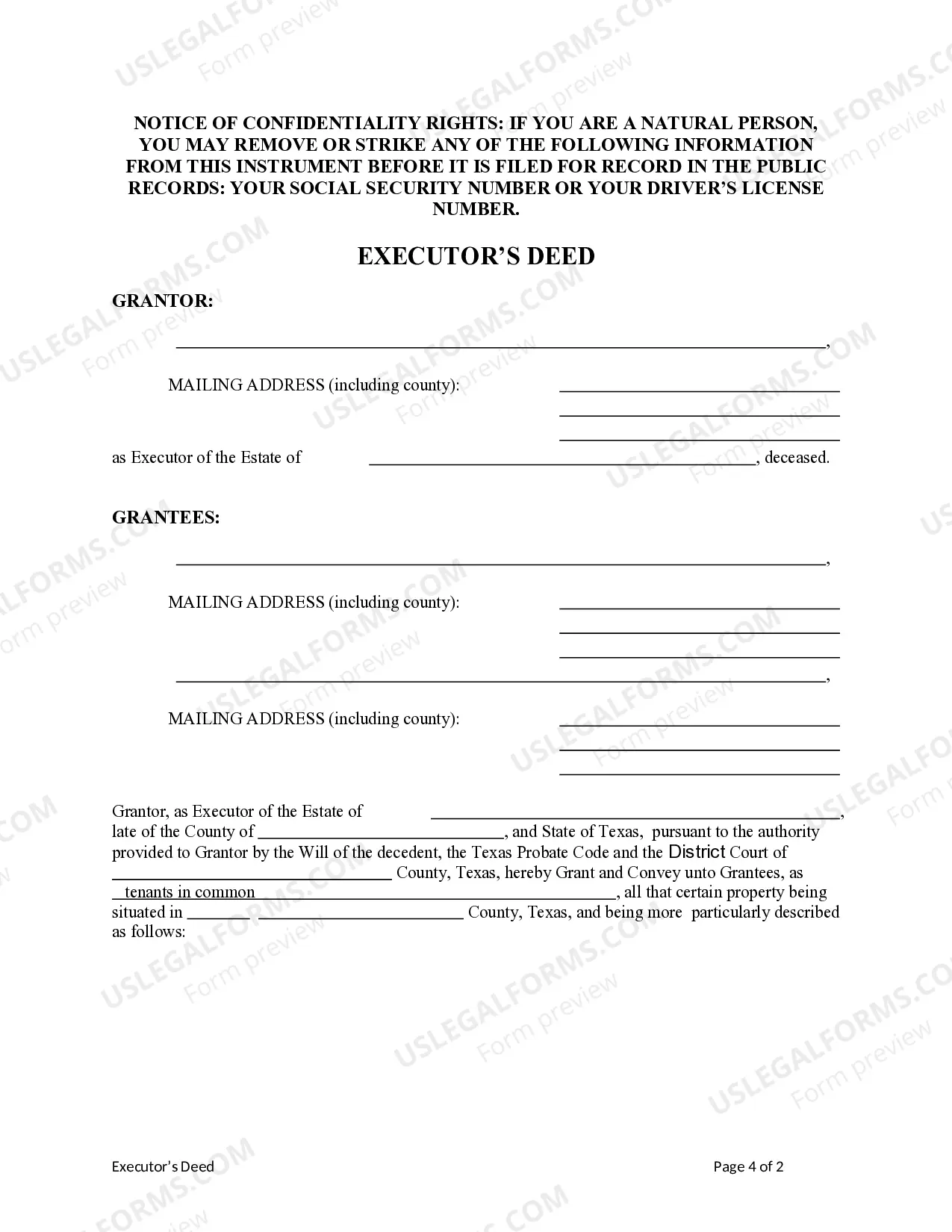

- Identification of the Grantor (executor) and Grantees (beneficiaries)

- Description of the property being conveyed

- Options for how Grantees will hold the property (e.g., tenants in common or joint tenants with the right of survivorship)

- Space for signatures and dates, validating the deed

- Compliance with state-specific statutory requirements

When to use this form

This form is necessary when an estate is settled, and an executor needs to transfer property ownership to beneficiaries. It is particularly relevant in situations where real property is part of the estate, and a clear legal title is required for the heirs to take possession. Using this form helps avoid potential disputes about property ownership after the executor fulfills their duties.

Who this form is for

- Executors of estates who need to transfer property to beneficiaries

- Beneficiaries or heirs designated to receive property from an estate

- Legal professionals assisting clients with estate settlements

- Individuals involved in probate proceedings related to estate administration

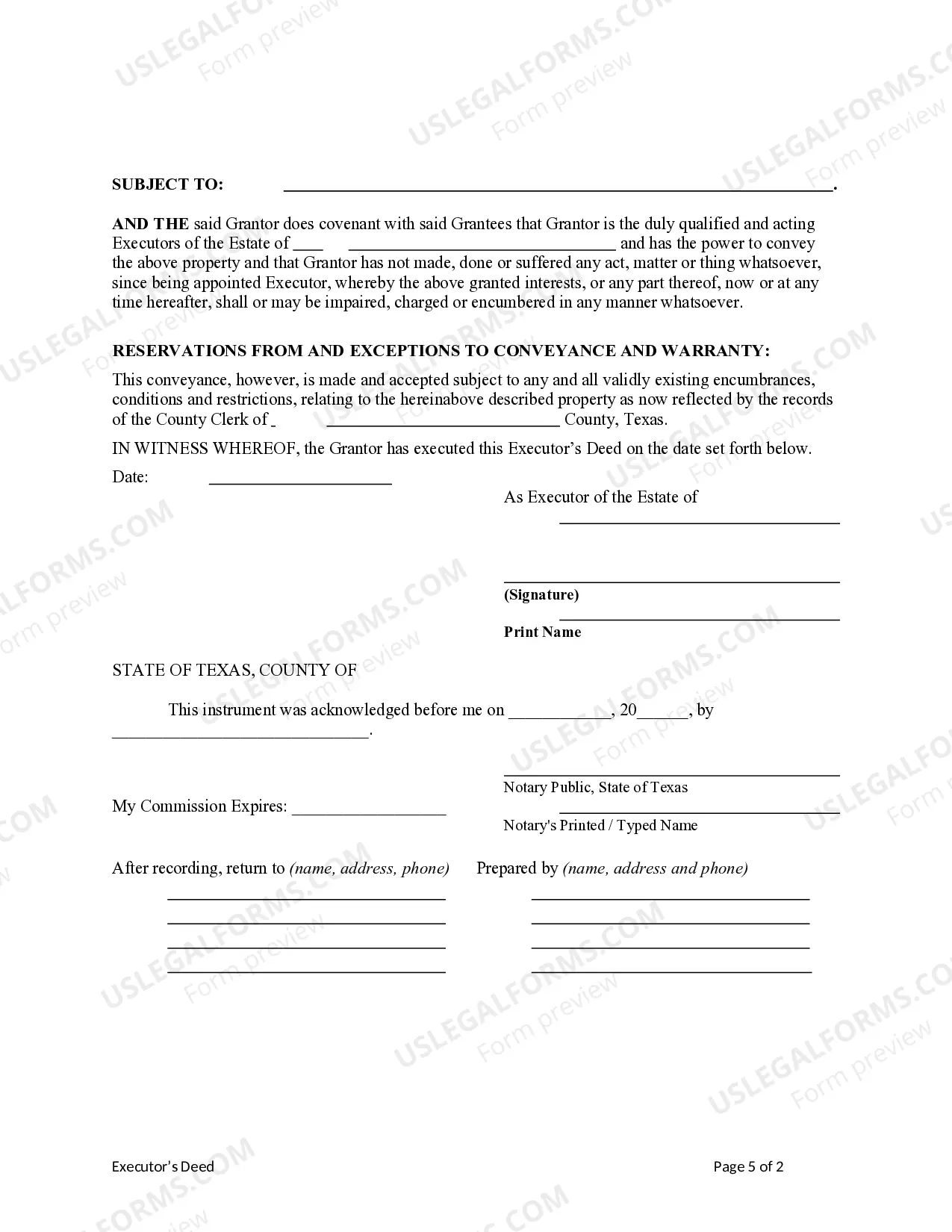

How to prepare this document

- Identify the Grantor as the executor of the estate and enter the names of the Grantees (beneficiaries).

- Clearly describe the property to be transferred, including the legal description and address.

- Select how the Grantees will hold the property (e.g., tenants in common, joint tenants with right of survivorship).

- Ensure all parties sign and date the document in designated areas to validate the transfer.

- Consult with a legal professional if there are questions about the provisions or requirements.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include complete property descriptions.

- Not designating how the Grantees will hold the property.

- Omitting signatures of the involved parties, which renders the deed invalid.

- Using outdated versions of the form that may not comply with current laws.

Looking for another form?

Form popularity

FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

It is possible for one person to be both sole heir and executor. This occurs when one person inherits an entire estate under a state's intestacy laws and the probate court also appoints that person to be the executor of the deceased's estate.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

The short answer is yes. It's actually common for a will's executor to also be one of its beneficiaries.Someone close enough to the decedent to be a beneficiary would have that familiarity and more. The probate court system actually favors beneficiaries serving as executors in some cases.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright.In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title.

There's no rule against people named in your will as beneficiaries being your executors. In fact this is very common. Many people choose their spouse or civil partner or their children to be an executor. But that doesn't mean they have to write them out of the will.

Yes, an executor can override a beneficiary's wishes as long as they are following the will or, alternative, any court orders. Executors have a fiduciary duty to the estate beneficiaries requiring them to distribute estate assets as stated in the will.

Secondly, if the executor is ALSO a beneficiary, then they are entitled to their inheritance distribution as dictated by the will, trust, or state intestacy law. Plus, they are entitled to be paid for their time and effort.