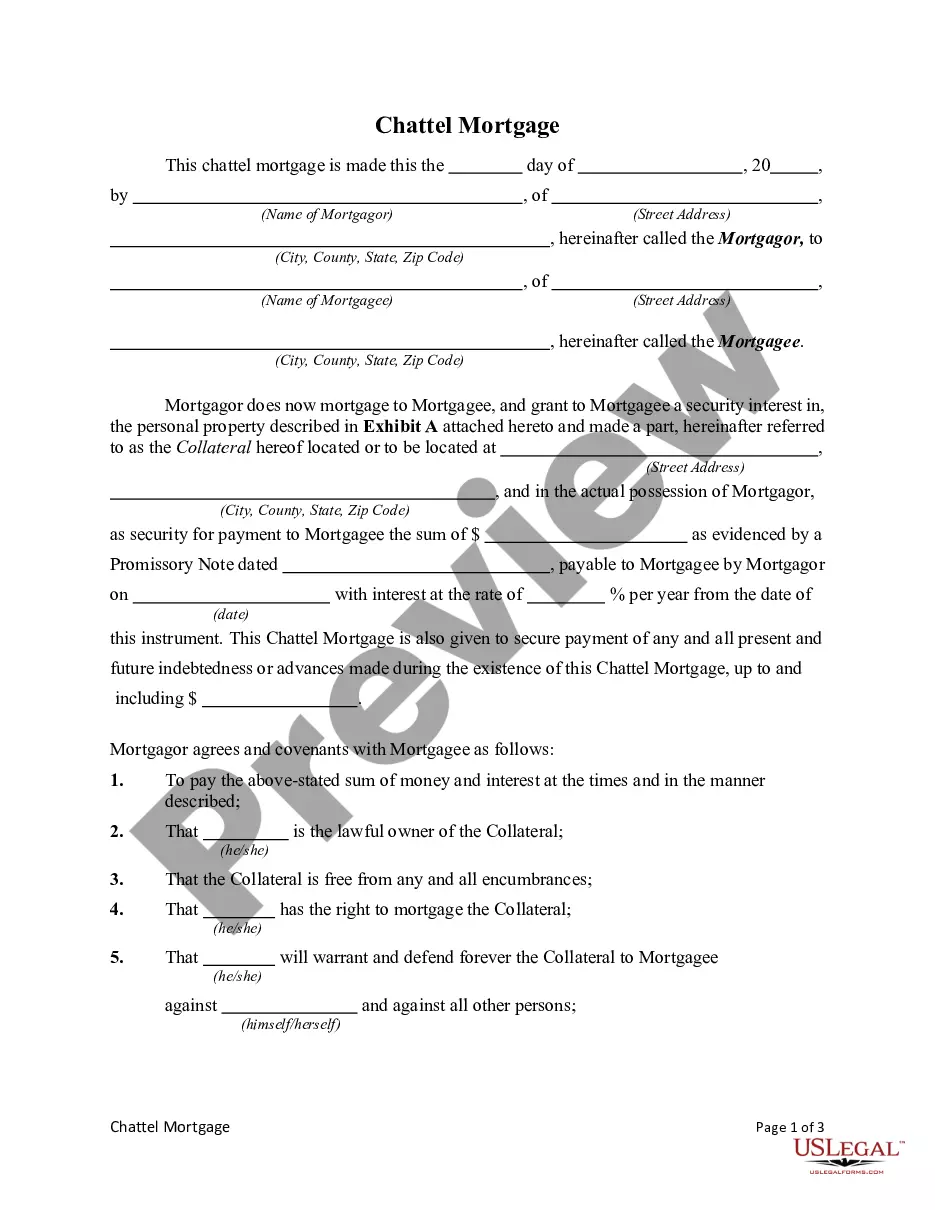

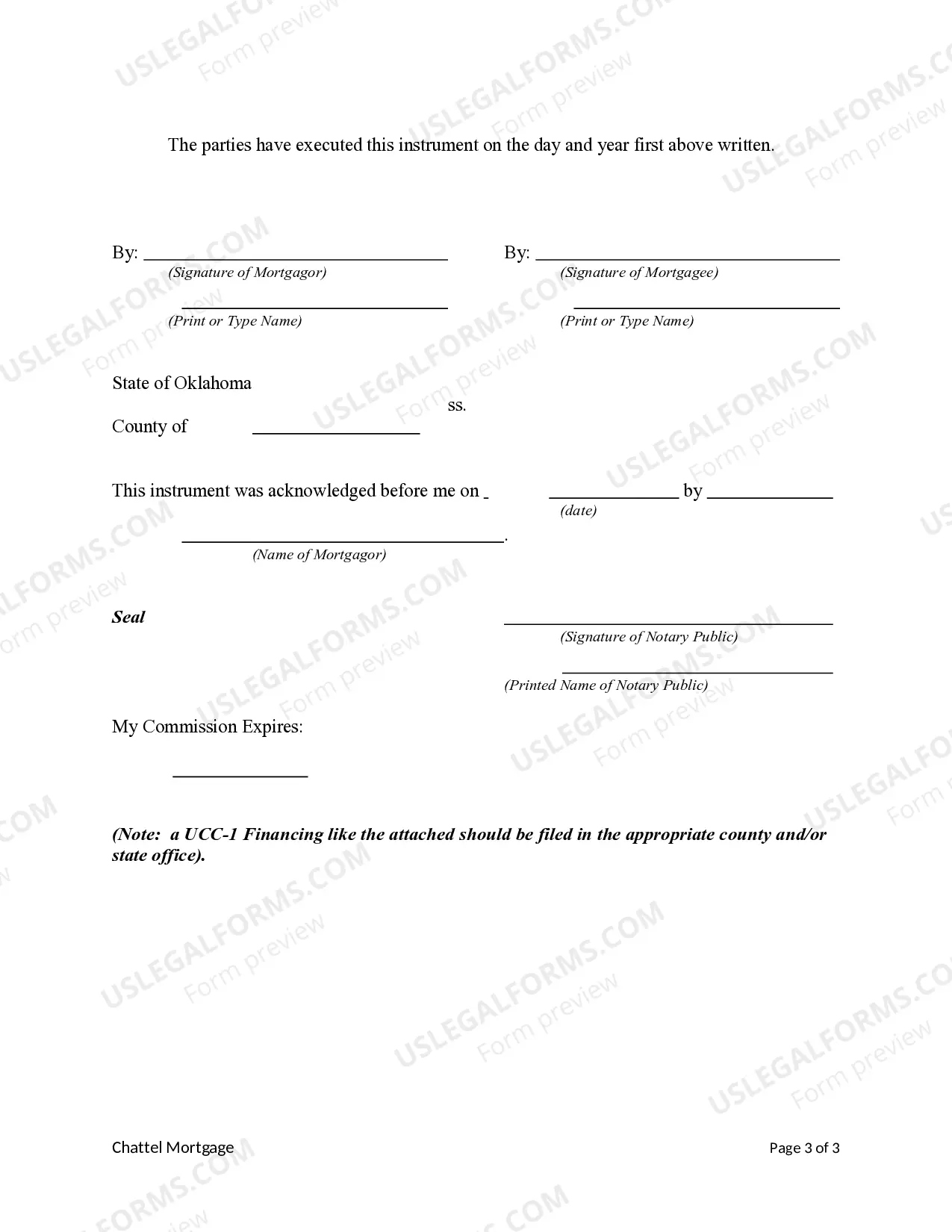

Oklahoma Chattel Mortgage

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

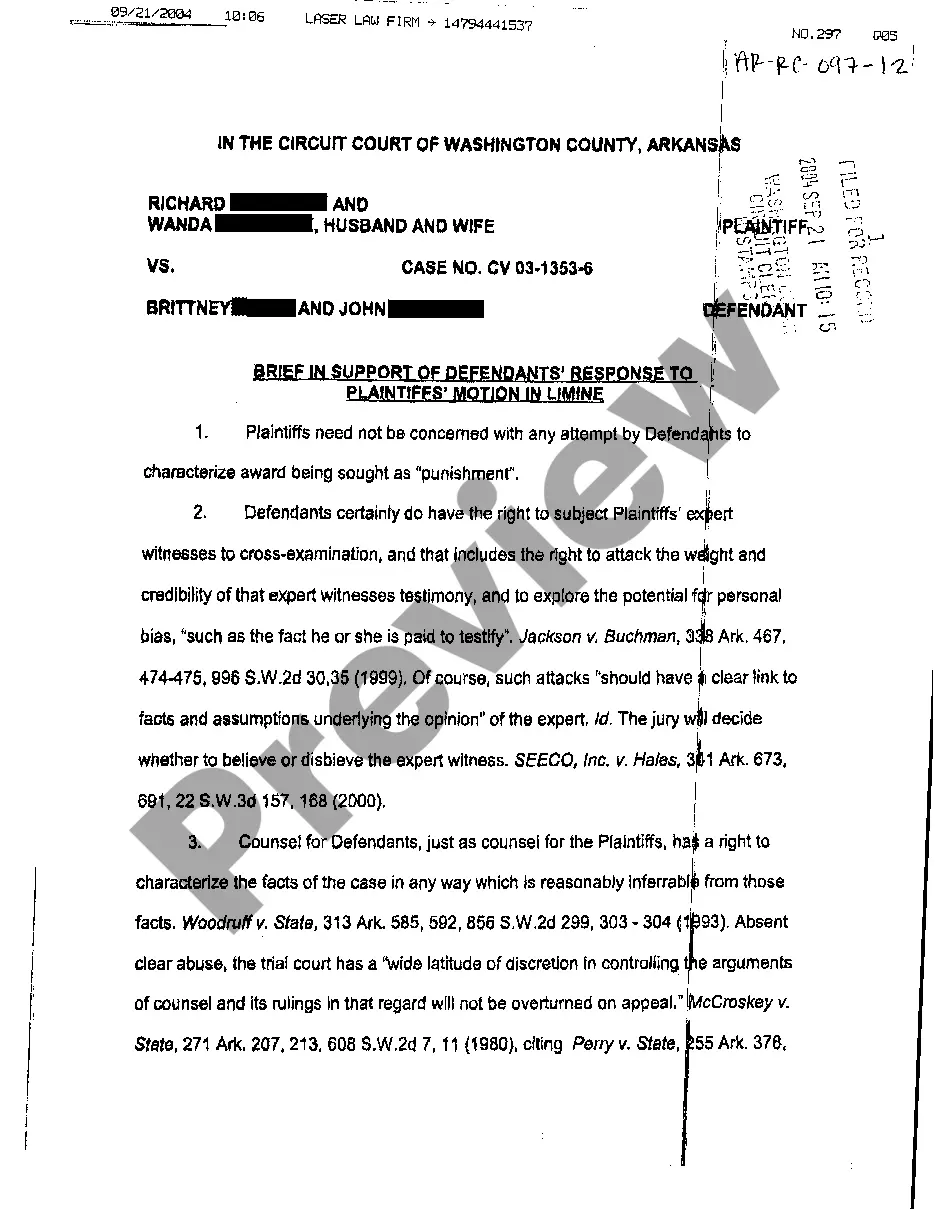

How to fill out Oklahoma Chattel Mortgage?

When it comes to completing Oklahoma Chattel Mortgage, you most likely imagine a long procedure that requires choosing a appropriate sample among a huge selection of similar ones and then needing to pay out legal counsel to fill it out to suit your needs. In general, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

For those who have a subscription, just log in and click Download to find the Oklahoma Chattel Mortgage sample.

In the event you don’t have an account yet but need one, keep to the step-by-step guideline below:

- Be sure the file you’re getting is valid in your state (or the state it’s required in).

- Do this by reading the form’s description and by clicking the Preview function (if available) to see the form’s content.

- Click on Buy Now button.

- Find the suitable plan for your budget.

- Subscribe to an account and select how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys draw up our samples so that after saving, you don't have to bother about enhancing content outside of your individual information or your business’s information. Be a part of US Legal Forms and get your Oklahoma Chattel Mortgage sample now.

Form popularity

FAQ

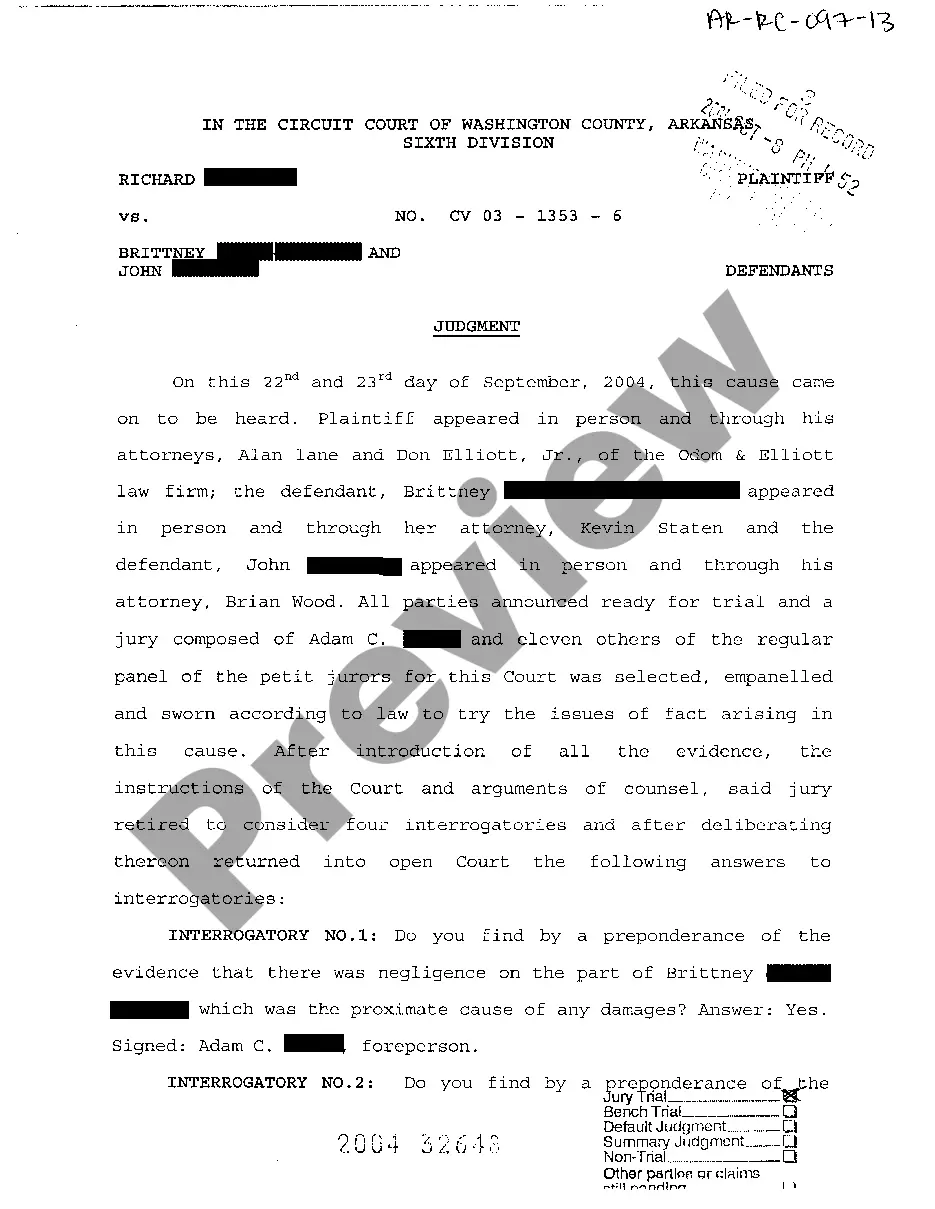

There are only two types of manufactured home financing: a traditional mortgage and a chattel mortgage. Most people understand the traditional mortgage: find an existing home or build one, then apply for a 30-year fixed mortgage or another mortgage type and lock in a highly favorable interest rate.

Advantages of a Home Equity Loan They include:Access to a lot of Funds: You can get more funds to meet your financial issues by taking out a mobile home equity loan than a credit card or a personal loan. Tax Benefits: You can deduct the interest rate when itemizing your taxes if you use the loan to renovate your home.

If you need help buying a mobile home, you'll want to secure financing. Because mobile homes are not traditional real estate, obtaining financing for one can be a challenge. Most traditional lenders won't give you a mortgage to buy a mobile home, but there are other options to obtain loans for mobile homes.

There are only two types of manufactured home financing: a traditional mortgage and a chattel mortgage. Most people understand the traditional mortgage: find an existing home or build one, then apply for a 30-year fixed mortgage or another mortgage type and lock in a highly favorable interest rate.

Chattel Mortgage refers to a contract by virtue, which involves recording the personal property in the Chattel Mortgage Register as security for the performance of an obligation. The Chattel Mortgage can either be a formal contract or an accessory contract. It is required if the debtor has to retain the property.

You typically cannot get a home equity loan on a double-wide mobile home unless you own the land it resides on or you convert it to a home that is attached to the property beneath it.

A chattel mortgage is a loan for a movable piece of personal property, such as machinery, a vehicle or a manufactured home.

A conventional mortgage is a home loan that's not insured by the federal government. There are two types of conventional loans: conforming and non-conforming loans. A conforming loan simply means the loan amount falls within maximum limits set by the Federal Housing Finance Agency.

A chattel mortgage differs from a traditional mortgage in that the lender can take possession of the property that serves as security when a conventional loan is in default. The legal relationship is reversed with a chattel mortgage. The lender does not hold a lien against the movable propertythe chattel.