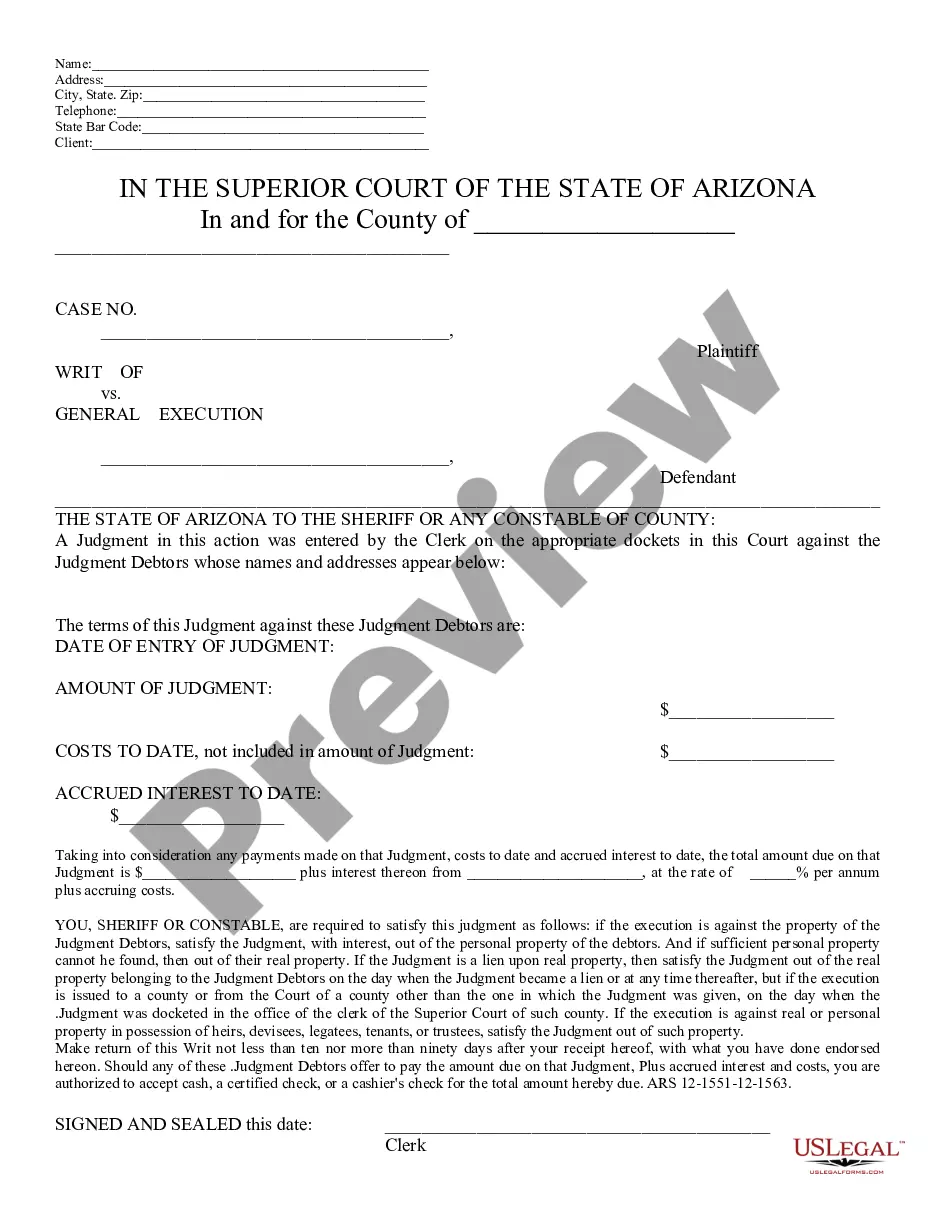

Writ of General Execution: This Writ demands that he Sheriff's office dispose of any real or personal property, of the Debtor, which could satisfy the Judgment against him/ her. The Sheriff is instructed to complete his/ her actions with respect to this Writ, no less than 10 days and no more than 90 days after receipt of this document. This form is available in both Word and Rich Text formats.

Arizona Writ of General Execution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Writ of General Execution: A writ of general execution is a court order that allows the seizure of a debtor's property in order to satisfy a judgment. In the United States, after a creditor wins a judgment against a debtor, this legal document empowers law enforcement officers to take and sell the debtor's non-exempt properties - such as real estate or valuable possessions - to cover the debt.

Step-by-Step Guide

- Obtaining the Judgment: A writ of general execution comes into play after a creditor has successfully won a lawsuit against a debtor and a judgment has been issued by the court.

- Requesting the Writ: The creditor must request the writ of general execution from the court that issued the original judgment.

- Serving the Writ: The writ must be served to the debtor, typically by a sheriff or other law enforcement official.

- Execution of the Writ: Law enforcement may seize assets covered under the writ and may sell them at public auction to recover the amount owed.

- Settling the Debt: Proceeds from the sale of the assets are used to pay the creditor. Any excess after covering the debt and costs of the execution is returned to the debtor.

Risk Analysis

- Legal Repercussions: Incorrect handling of writ of general execution can result in legal penalties, including damages for improperly seized property.

- Financial Risks: For debtors, the risk involves loss of property and potential homelessness or bankruptcy. For creditors, there's a risk of not recovering the full debt amount if the debtor's assets do not cover the full judgment.

- Reputation Risks: Aggressive enforcement actions can harm the creditors public image, especially if debtor hardship stories become public.

Common Mistakes & How to Avoid Them

- Inaccurate Documentation: Always ensure all legal paperwork is accurate and filed correctly to avoid the writ being dismissed or delayed.

- Ignoring Exemption Laws: Understand and respect state-specific exemption laws to avoid legal consequences of seizing exempt assets.

Case Studies / Real-World Applications

In a recent case in Texas, a small business owner successfully recovered a substantial unpaid debt from a contractor through the use of a writ of general execution, leading to the sale of luxury assets owned by the contractor to cover the debt. This case highlighted the efficiency of the execution process in recouping significant amounts when other collection efforts fail.

FAQ

- What are exempt assets under a writ of general execution? Exempt assets typically include basic household goods, certain amounts of equity in a home and automobile, and tools of the debtors trade.

- Can a writ of general execution be contested? Yes, debtors can contest a writ if they believe it was wrongly issued or improperly executed.

- How long does it take to complete the process? The timeline can vary greatly based on local laws, the specifics of the case, and the types of assets being seized.

How to fill out Arizona Writ Of General Execution?

If you're seeking accurate copies of the Arizona Writ of General Execution, US Legal Forms is exactly what you require; obtain documents that have been provided and verified by state-certified legal experts.

Using US Legal Forms not only spares you from hassles related to legal paperwork; it also conserves your time, energy, and money! Downloading, printing, and completing a professional document is considerably less expensive than hiring an attorney to draft it for you.

And that's all. With a few simple clicks, you acquire an editable Arizona Writ of General Execution. Once you set up an account, all future requests will be processed even more effortlessly. After obtaining a US Legal Forms subscription, simply Log In to your account and then click the Download button visible on the form's page. Subsequently, whenever you need to access this template again, you will always be able to find it in the My documents section. Don’t waste your time and effort sifting through countless forms across different platforms. Purchase professional documents from one secure platform!

- To begin, complete your registration process by entering your email and setting up a password.

- Follow the steps outlined below to establish an account and locate the Arizona Writ of General Execution template for your needs.

- Utilize the Preview function or examine the document details (if available) to confirm that the template fits your requirements.

- Verify its legality in your location.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a suitable file format and save the document.

Form popularity

FAQ

In Arizona, a creditor can take your house under certain conditions, but many protections exist. If the property is your homestead, it may be exempt from seizure under the Arizona Writ of General Execution. However, this can depend on the nature of the debt and other factors. It’s vital to consult legal resources to understand your rights and protections regarding your home.

Filing a garnishee answer in Arizona involves responding to a Writ of Garnishment that a creditor sends to a third party, such as your employer or bank. The garnishee must answer the court within a specified time frame, detailing any funds or property they hold belonging to the debtor. Utilizing the Arizona Writ of General Execution can simplify this process and ensure you comply correctly. Consider seeking legal assistance if you need clarity on the process.

In Arizona, certain assets are exempt from seizure under a Writ of General Execution. These typically include necessary personal items, retirement accounts, and a portion of your wages. Additionally, your primary residence may have some protection under specific circumstances. It is essential to understand these exemptions when navigating your rights in relation to a Writ of General Execution.

A writ of execution in Arizona is a legal document that authorizes the enforcement of a court judgment. This writ allows creditors to seize property or garnish wages to satisfy a judgment. Understanding the workings of an Arizona Writ of General Execution is essential for individuals involved in debt collection or those facing debt enforcement actions. Legal assistance can simplify this process for you.

Judgment rules in Arizona stipulate the processes for obtaining a judgment, including filing requirements and timelines. These rules also explain how judgments can be enforced through mechanisms such as the Arizona Writ of General Execution. Familiarizing yourself with these rules can make a substantial difference in the outcome of your case, so leveraging resources from platforms like uslegalforms is beneficial.

A writ of execution in Arizona is generally valid for five years. After this timeframe, you may need to obtain a renewal if the judgment remains uncollected. Knowing this duration is significant when pursuing an Arizona Writ of General Execution, as it helps you strategize your collection process. Staying informed ensures you take timely actions.

In Arizona, certain properties are exempt from judgment, including primary residences, tools necessary for work, and a portion of your wages. Understanding what is protected from an Arizona Writ of General Execution can be crucial in safeguarding your assets. Consulting with a legal professional can further clarify the exemptions and help you protect your financial stability.

Stopping a garnishment can happen quickly, depending on the circumstances. If you have a valid defense or if you successfully file a motion to quash the garnishment, you can halt the process promptly. Engaging with tools available at uslegalforms can guide you in navigating this urgency effectively, especially if you're dealing with an Arizona Writ of General Execution.

A writ of garnishment in Arizona generally remains effective for up to 90 days. After this period, the creditor may need to renew the writ to continue pursuing the garnished funds. Understanding the timeline and limitations of an Arizona Writ of General Execution can help you plan your financial strategy effectively. Always consult a legal expert for tailored advice.

The default judgment rule in Arizona occurs when a party fails to respond to a lawsuit within the required timeframe. In such cases, the court may issue a ruling in favor of the plaintiff. This judgment can lead to an Arizona Writ of General Execution, allowing the plaintiff to collect the owed amount. It's important to respond promptly to legal actions to avoid this situation.