Chattel Mortgage on Mobile Home

Description

How to fill out Chattel Mortgage On Mobile Home?

Get access to high quality Chattel Mortgage on Mobile Home samples online with US Legal Forms. Avoid hours of wasted time searching the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Find above 85,000 state-specific authorized and tax samples that you can download and complete in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Verify that the Chattel Mortgage on Mobile Home you’re considering is appropriate for your state.

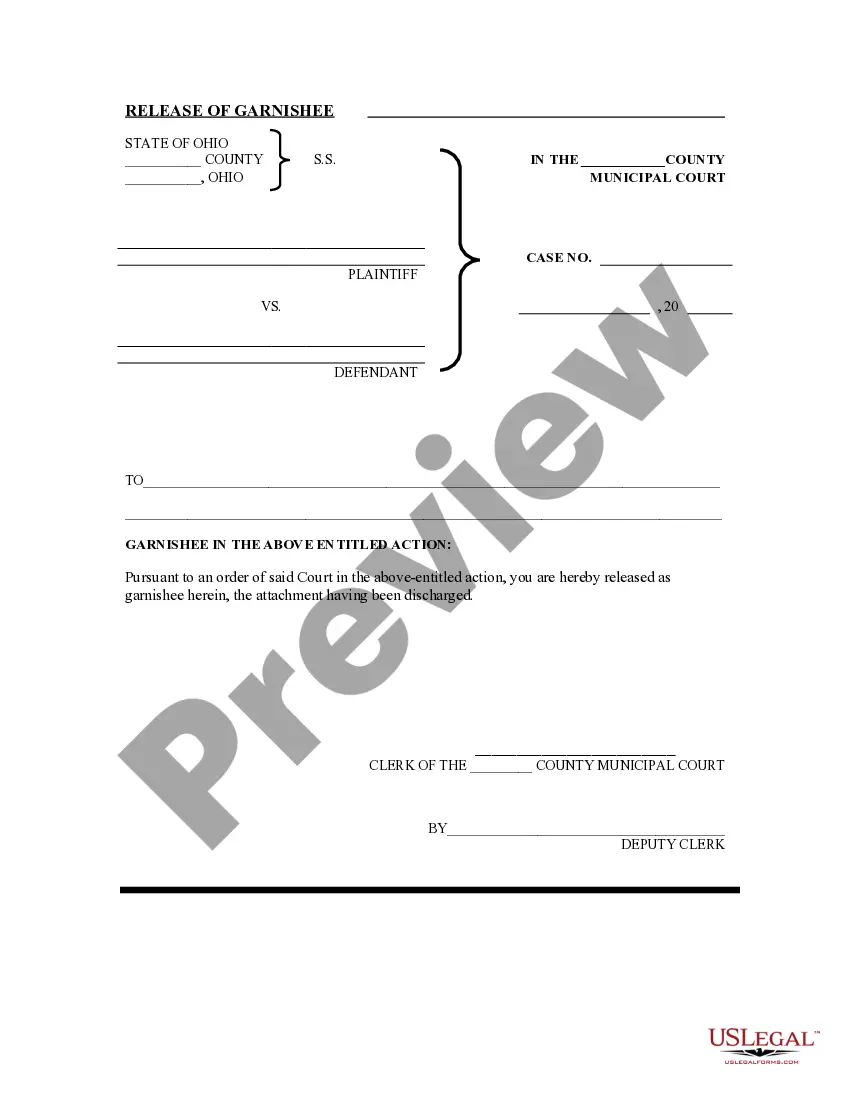

- View the sample utilizing the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Select a favored format to download the document (.pdf or .docx).

You can now open up the Chattel Mortgage on Mobile Home sample and fill it out online or print it out and do it by hand. Consider sending the papers to your legal counsel to make sure things are filled in appropriately. If you make a error, print out and fill application again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

The substantial difference between the two forms of agreements is that a Hire-Purchase Agreement involves renting the Lender's goods through the payment of regular instalments (with an option to purchase at the end of the Hiring Period); whereas a Chattel Mortgage Agreement involves an actual loan of monies for the

A chattel mortgage is a type of finance used by sole traders and businesses predominantly for the purchase of a vehicle, often due to the significant financial advantages it offers over a standard car loan. To qualify, the vehicle must be used at least 51% of the time for business.

Cars, boats, RVs, heavy equipment and manufactured homes are all considered chattel.Interest rates on these loans are typically much higher than traditional mortgages and during an active chattel loan, the lender has conditional ownership of the property (Investopedia).

Mobile homes are far cheaper than traditional homes, so you may be able to finance your purchase through a personal loan. Personal loans are flexible loans you can use for almost any purpose. However, personal loan interest rates tend to be higher than those of other types of loans, such as mortgages or auto loans.

Pay the down payment and other loan-related fees such as chattel mortgage fee (2% to 3% of your loan amount), handling fee, and one-month advance payment (if applicable)

You'll need a permanent foundation. Your mobile home will likely need to be permanently affixed to your land to qualify for a home equity loan program.

Both businesses and individuals are eligible for a chattel mortgage, as long as the car is being used predominantly for business purposes.A chattel mortgage involves a finance company lending you the money to purchase a vehicle that will be primarily used for business purposes.

You'll need a permanent foundation. Your mobile home will likely need to be permanently affixed to your land to qualify for a home equity loan program.

How does a chattel mortgage work? Much like a secured car loan, the lender will provide the funds for you to purchase the vehicle and you'll take ownership at the time of purchase. The lender takes a 'mortgage' over the vehicle as security for the loan. Once the contract is completed you'll own the vehicle outright.