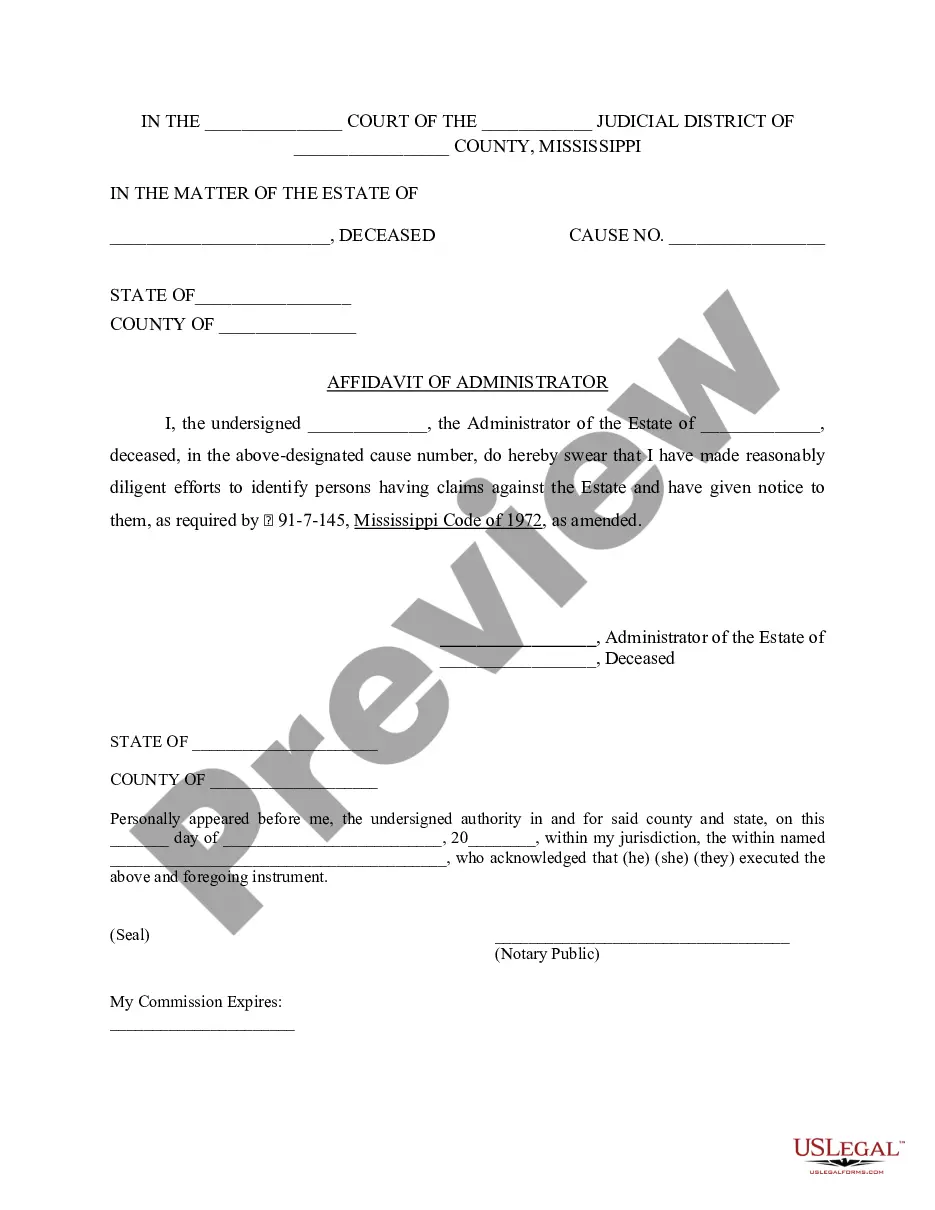

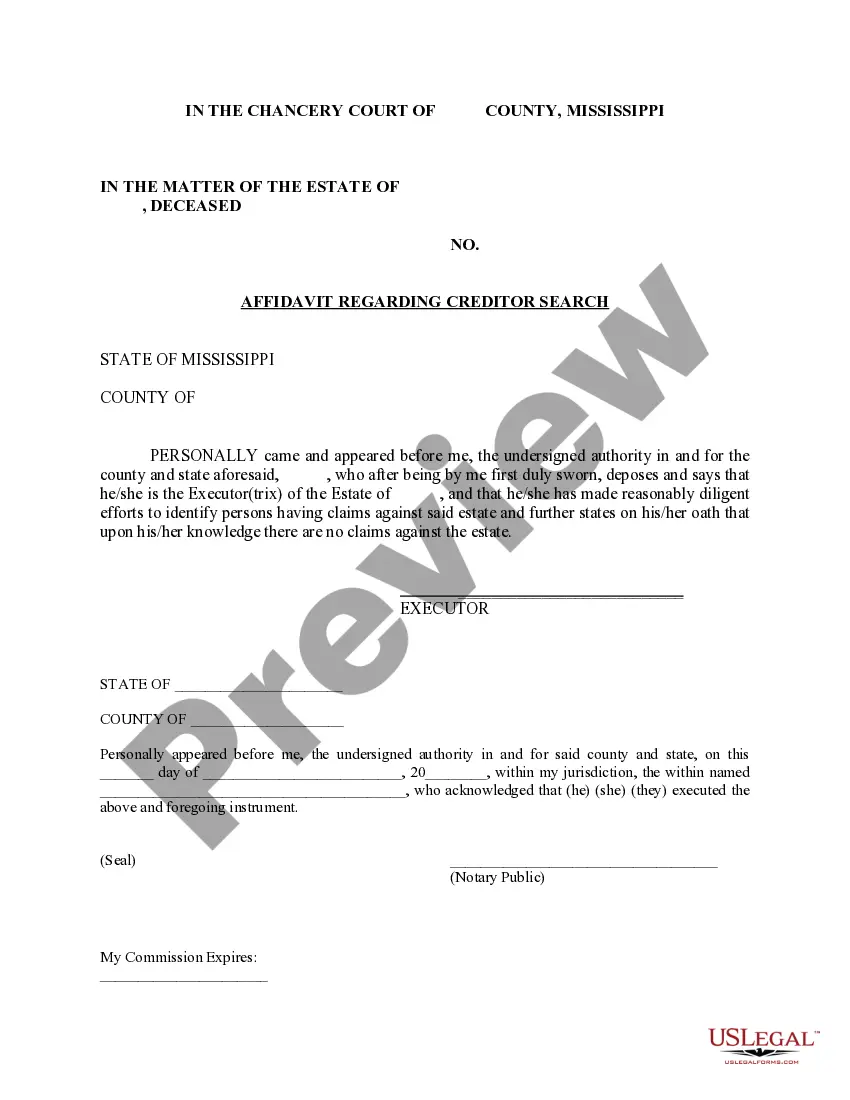

Mississippi Affidavit regarding Creditor Search

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi Affidavit Regarding Creditor Search?

Acquire a printable Mississippi Affidavit concerning Creditor Inquiry with just a few clicks from the most comprehensive directory of legal e-forms.

Discover, download, and print professionally composed and certified examples on the US Legal Forms platform. US Legal Forms has been the leading provider of cost-effective legal and tax documents for US citizens and residents online since 1997.

After downloading your Mississippi Affidavit concerning Creditor Inquiry, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to access 85,000 expertly drafted, state-specific documents.

- Clients who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi Affidavit concerning Creditor Inquiry, and find it saved in the My documents section.

- Users without a subscription need to adhere to the instructions listed below.

- Ensure your form complies with your state's stipulations.

- If available, review the form’s description for additional information.

- If provided, preview the document to see more details.

- Once you confirm the template is suitable for you, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

You can typically find your collector's information on your credit reports from the three major consumer credit bureaus. Since your debt may have been bought and sold by multiple collectors, be sure to look at your most-current credit reports to determine which company to contact.

The quickest way to get your free annual report is to order online at www.annualcreditreport.com. You can also get your free Experian credit report at any time with no credit card required. Your credit report will list detailed information about each account that is reported to Experian.

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.

Typically, the only way to remove a collection account from your credit reports is by disputing it. But if the collection is legitimate, even if it's paid, it'll likely only be removed once the credit bureaus are required to do so by law. There are 3 collection accounts on my credit reports.

Obtain a free copy of your credit report at AnnualCreditReport.com. Make a list of all of the active accounts on your credit report. Call the creditors or sign into your online accounts to find out your current balance.

Check your credit file. The easiest way to find out what you owe is to check your credit file online. Check emails and letters from creditors. Contact your creditors. Check your bank account statements. Find CCJs and court records online.

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.

You can only find your full account number on the paperwork associated with the account, or you can contact the individual creditor that provides that information. Contact information is available on your credit report, under Accounts.