An Estoppel Affidavit is a legal document used to prevent someone from denying or contradicting a previous statement or agreement. It is a sworn statement that sets forth the terms of a contract, promise, or agreement that has been made between two or more parties. This document can be used to confirm and validate the terms of an agreement for a variety of purposes, such as mortgage loans, tenant and landlord agreements, and other contracts. There are three types of Estoppel Affidavit: Commercial Estoppel Affidavit, Residential Estoppel Affidavit, and Leasehold Estoppel Affidavit. A Commercial Estoppel Affidavit is used when the agreement involves a commercial entity, such as a business, and sets out the terms of the agreement. A Residential Estoppel Affidavit is used when the agreement involves a residential property, such as a home, and sets out the terms of the agreement. A Leasehold Estoppel Affidavit is used when the agreement involves a leasehold property, such as an apartment, and sets out the terms of the agreement.

Estoppel Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Estoppel Affidavit?

If you’re looking for a way to appropriately prepare the Estoppel Affidavit without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business scenario. Every piece of documentation you find on our web service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Estoppel Affidavit:

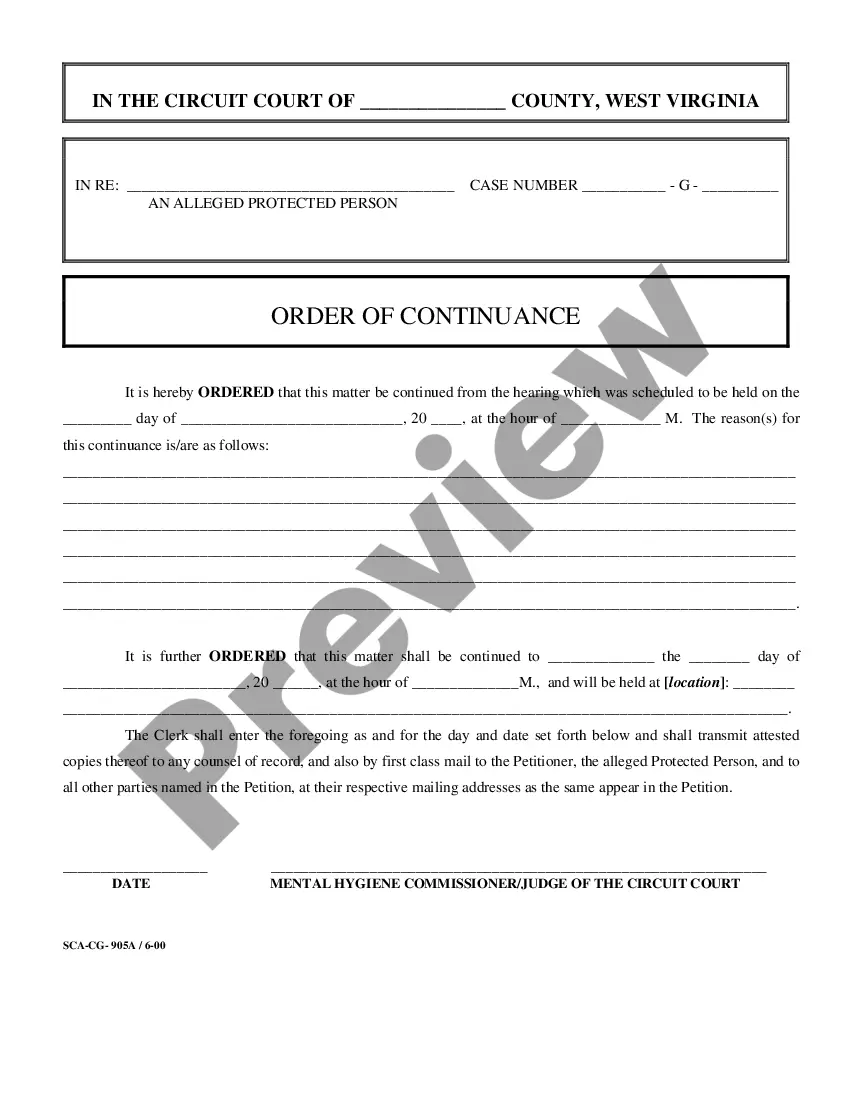

- Ensure the document you see on the page meets your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Estoppel Affidavit and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

An estoppel certificate gives landlords, investors and lenders additional security that the tenant's promises will be kept. They also benefit tenants as the document confirms that the landlord will not change any agreed-upon terms to the lease.

What is an estoppel certificate? An estoppel certificate establishes the current status of the lease terms for a third party. Generally, the certificate requests that the Tenant verify that the rent is current or whether the Tenant has any potential claims against the Landlord.

An estoppel certificate is typically requested when the owner of a multifamily property is either selling or refinancing the property. It's an important piece of a buyer or lender's due diligence. A property owner may be required to request an estoppel certificate from their tenants when they're selling the property.

Estoppel by deed is a doctrine that precludes individuals from arguing in court a position counter to what that person stated in a previous deed. The doctrine arises most frequently where someone deeded property they did not own, and later, they are involved in a dispute involving that property.

?The purpose of an estoppel statement is twofold: (1) to give a prospective purchaser or lender information about the lease and the leased premises and (2) to give assurance to the purchaser or lender that the les- see at a later date will not make claims that are inconsistent with the statements contained in the

Equitable estoppel For example, someone selling a piece of real estate at a high price may know nonpublic facts that will decrease the value of the property. By intentionally failing to disclose that information to a prospective buyer, the seller can earn a larger amount from the sale.

What is an Estoppel Certificate? Estoppel Certificate or Estoppel Letter is a document verifying the amount of the unpaid balance, rate of interest and date to which interest had been paid prior to assignment of a mortgage.