This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

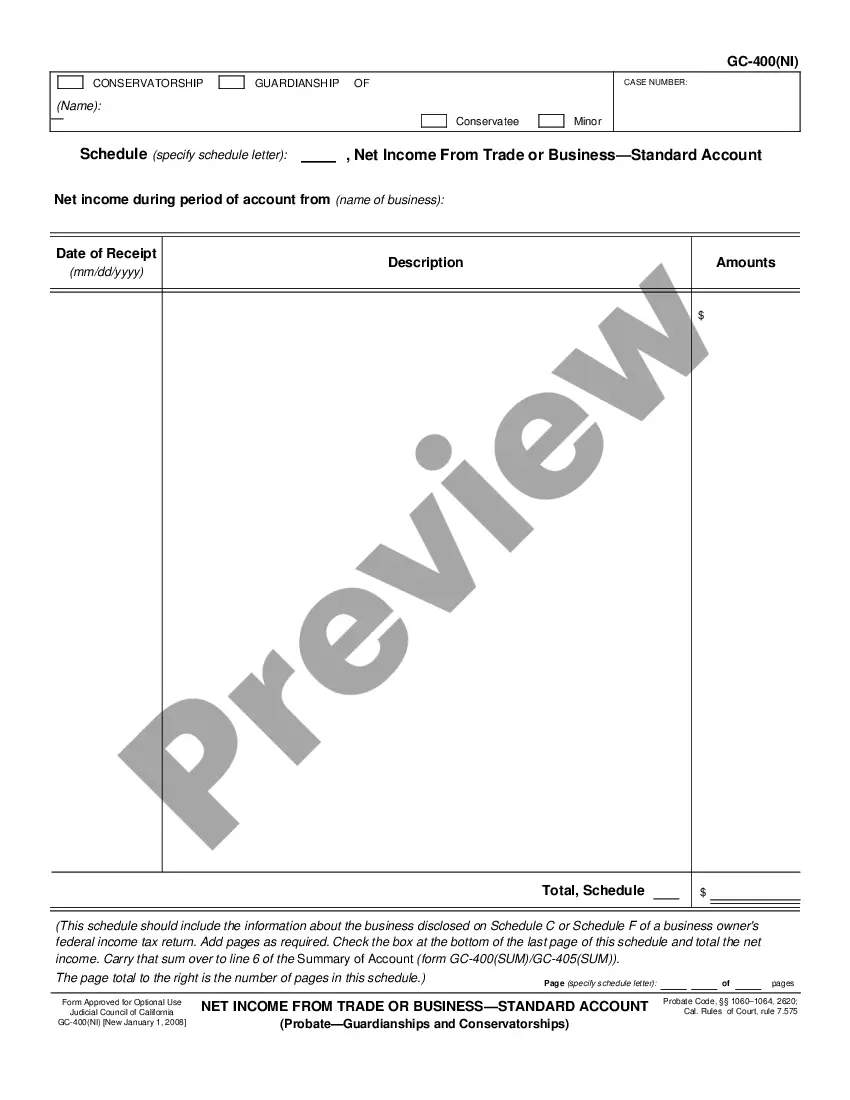

California Net Loss From a Trade or Business-Standard Account

Description

How to fill out California Net Loss From A Trade Or Business-Standard Account?

If you're looking to locate accurate California Net Loss From a Trade or Business-Standard Account web templates, US Legal Forms is what you require; access documents produced and verified by state-licensed legal professionals.

Utilizing US Legal Forms not only protects you from concerns related to legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional template is significantly more economical than hiring an attorney to do it for you.

And that's it. In just a few simple steps, you obtain an editable California Net Loss From a Trade or Business-Standard Account. After creating your account, all future transactions will be processed even more effortlessly. When you have a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form's page. Then, whenever you need to use this template again, you’ll always be able to find it in the My documents menu. Don’t waste your time sifting through countless forms on various websites. Purchase accurate templates from just one secure platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the steps below to establish your account and locate the California Net Loss From a Trade or Business-Standard Account template to address your needs.

- Use the Preview option or review the document description (if available) to ensure that the form is what you need.

- Verify its relevance in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create your account and pay using a credit card or PayPal.

Form popularity

FAQ

Net operating losses typically do not appear directly on the balance sheet but are noted as deferred tax assets. They represent potential tax savings that the business can utilize in future periods. By understanding how NOLs are treated, especially in the context of California Net Loss From a Trade or Business-Standard Account, you can better assess your company's financial health.

Valuing net operating losses involves calculating the total amount of losses that can be carried forward to offset future taxable income. It’s essential to maintain accurate records of business income and expenses to determine this figure. Utilizing a California Net Loss From a Trade or Business-Standard Account can help you keep track of and value your NOLs effectively.

You can use your net operating loss to offset up to 80% of your taxable income in California each year. This rule ensures that you cannot completely eliminate your taxable income with NOLs in a given year. Understanding how much NOL you can utilize is critical in planning your finances with a California Net Loss From a Trade or Business-Standard Account.

Entering a net operating loss on your tax return involves filling out specific sections related to NOL on your California tax forms. It's crucial to follow the instructions carefully to ensure that your losses are reported correctly. Using a California Net Loss From a Trade or Business-Standard Account simplifies this process, making it easier to track and report your losses accurately.

In California, there is no maximum limit on the total amount of net operating losses you can accumulate. However, the amount you can apply each year is restricted by the 80% limitation mentioned earlier. Keeping track of your NOL usage in a California Net Loss From a Trade or Business-Standard Account can ensure you maximize your tax benefits over time.

The 80% rule for net operating losses means that taxpayers can only use up to 80% of their taxable income to offset their NOL in any year. This regulation affects how much of your NOL you can apply to reduce your taxes. Knowing this rule is vital when managing the California Net Loss From a Trade or Business-Standard Account.

Yes, California imposes an 80% limitation on using net operating losses to offset taxable income in any given year. This means you cannot fully eliminate your taxable income using your NOL in a single year. Awareness of this limitation with California Net Loss From a Trade or Business-Standard Account helps ensure your calculations are precise.

In California, you cannot carry back a net operating loss for most businesses. However, you can carry it forward to future tax years, which can provide substantial tax relief later on. This aspect of the California Net Loss From a Trade or Business-Standard Account is essential for planning your financial strategy.

The NOL rule in California allows businesses to use their net operating losses to reduce taxable income in future years. California law has specific provisions on how NOLs can be applied, particularly the requirement that losses are only available for carry-forward, not carry-back. Understanding this rule is key, especially when dealing with California Net Loss From a Trade or Business-Standard Account.

To account for a net operating loss (NOL) in California, you generally report it on your state tax return. This involves completing the California Schedule CA (540) and ensuring that your NOL is accurately reflected. By utilizing the California Net Loss From a Trade or Business-Standard Account, you can clearly outline your losses and carry them forward to offset future taxable income.