Split-Dollar Agreement - Non-Equity Collateral Assignment Arrangement - Economic Benefit Approach-Minority Owner orSplit-Dollar Agreement -- Non-Equity Collateral Assignment Arrangement - Economic Benefit Approach - Minority Owner or Key Executive Owned

Overview of this form

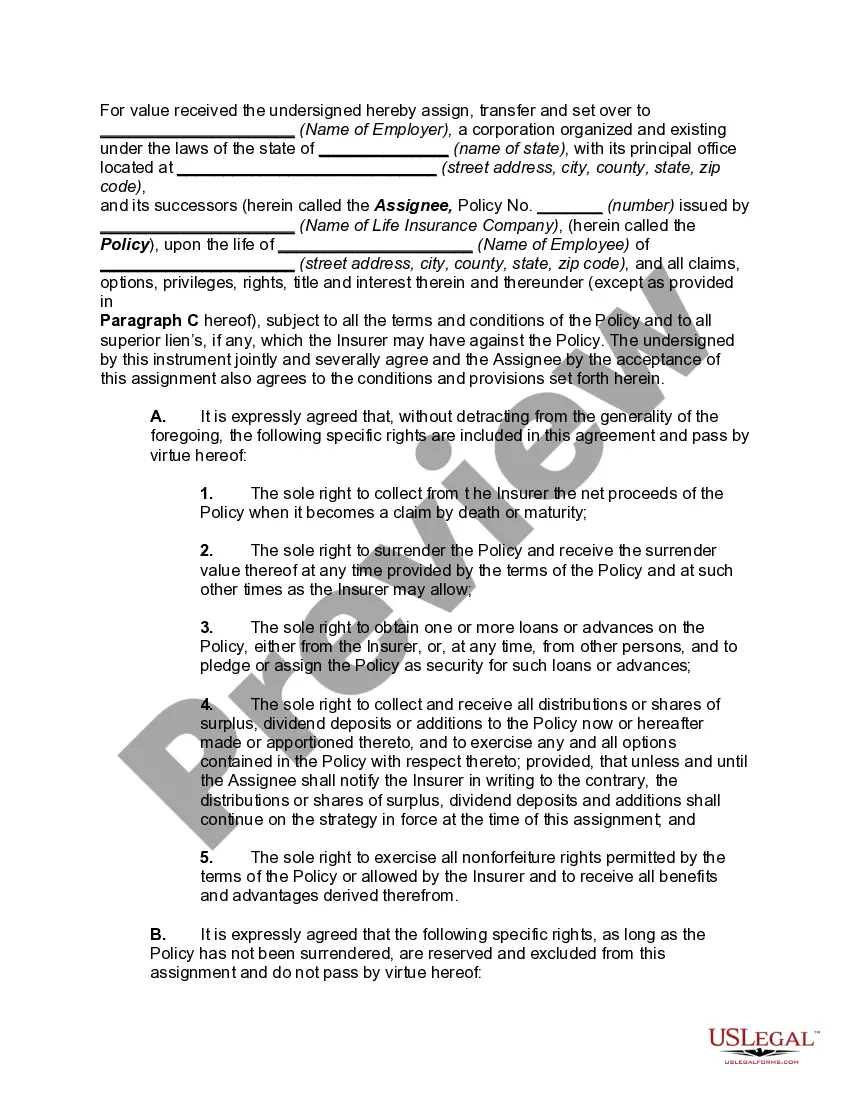

A split-dollar agreement is a financial strategy where the premium, cash value, and death benefits of a life insurance policy are shared between two parties, typically an employer and an employee. This specific form, the Split-Dollar Agreement - Non-Equity Collateral Assignment Arrangement - Economic Benefit Approach - Minority Owner, allows the employee to own the policy while providing the employer with collateral in the form of the policy. This arrangement is primarily used to facilitate life insurance financing, making it easier for the employee to benefit from life insurance coverage while ensuring the employer's premiums are secured.

Main sections of this form

- Policy Ownership: Specifies that the employee will purchase and own the life insurance policy.

- Premium Payment Method: Outlines the premium payments made by the employer and their tax implications for the employee.

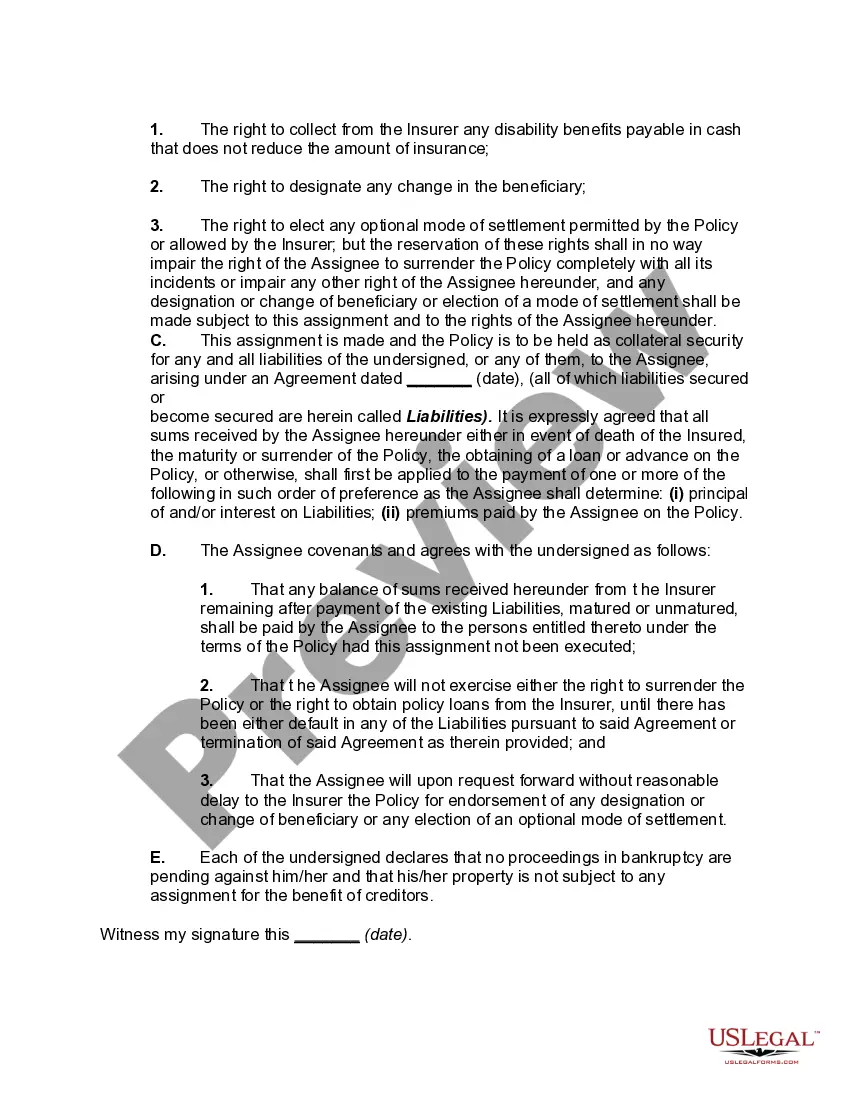

- Collateral Assignment: Details how the policy will be assigned as collateral for the premiums paid by the employer.

- Division of Death Proceeds: Clarifies how the death benefits will be divided between the employer and the employee's named beneficiaries.

- Termination of Agreement: Lists events leading to the termination of the agreement and the subsequent actions required.

When to use this document

This form is suitable in situations where an employer wishes to provide life insurance benefits to an employee, particularly in minority ownership or key executive scenarios. It is beneficial when the employer has the financial resources to pay for the life insurance premiums while the employee requires coverage. This agreement can help establish a clear structure for premium payment and benefits distribution, while securing the employer's interests.

Who this form is for

- Employers looking to offer life insurance benefits to key employees or minority owners.

- Employees who need life insurance coverage and want to structure the payments with their employer's assistance.

- HR professionals and legal advisors facilitating employee benefit plans.

How to prepare this document

- Identify the parties involved: the employer and employee.

- Enter the date of the agreement and details of the insurance policy, including policy number and insurer.

- Specify how premiums will be calculated and paid by the employer.

- Outline the division of death proceeds to define beneficiary rights.

- Sign the agreement, ensuring both parties have copies for their records.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Not clearly defining the premium payment method and tax implications.

- Failing to identify beneficiaries accurately, which can lead to disputes.

- Neglecting to specify the responsibilities of both parties in the event of policy termination.

Benefits of using this form online

- Immediate access to a correctly structured agreement template tailored for split-dollar arrangements.

- Convenience of filling out and customizing the form as per specific needs.

- Reliability from a legally vetted resource, ensuring compliance with applicable regulations.