This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

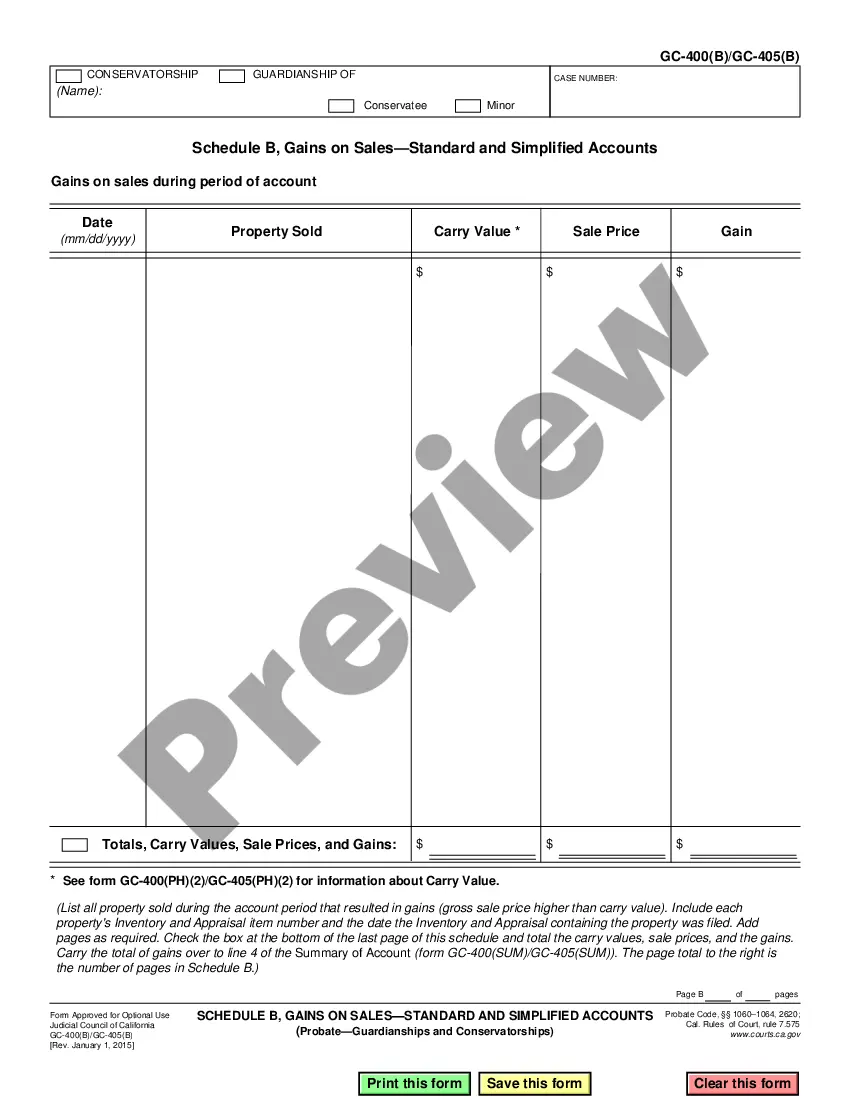

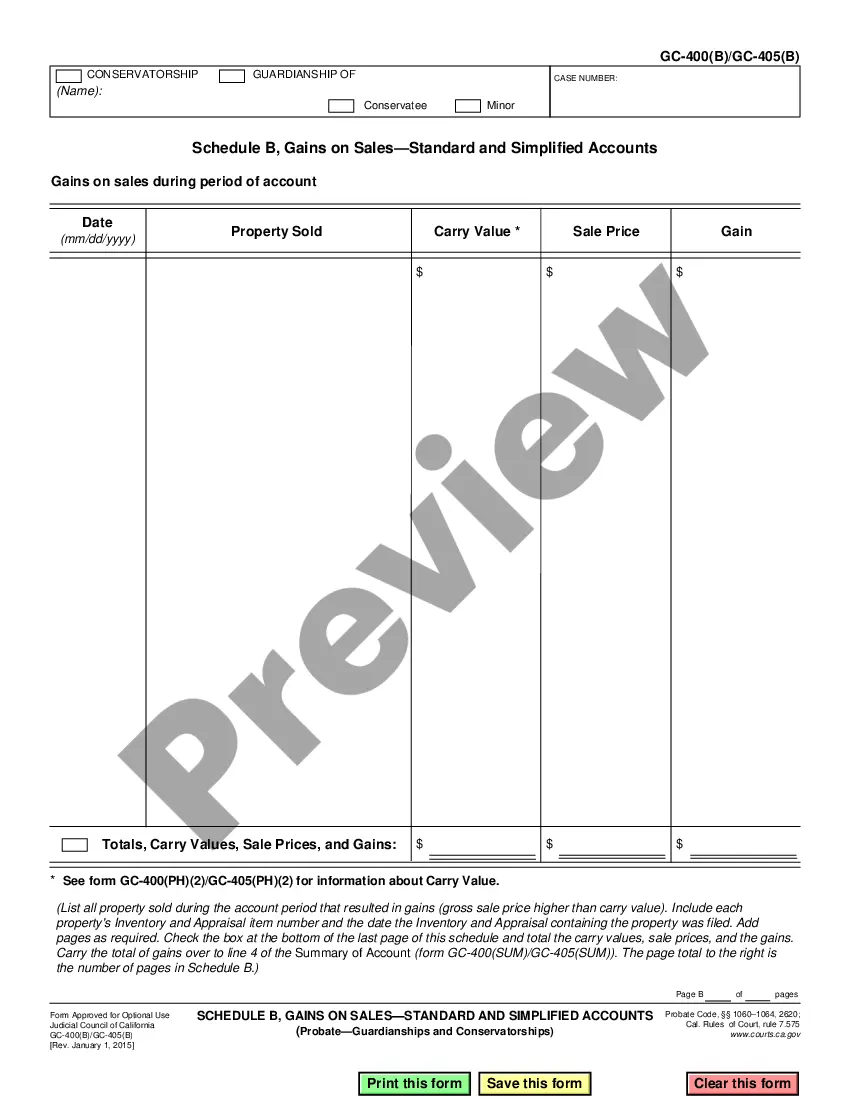

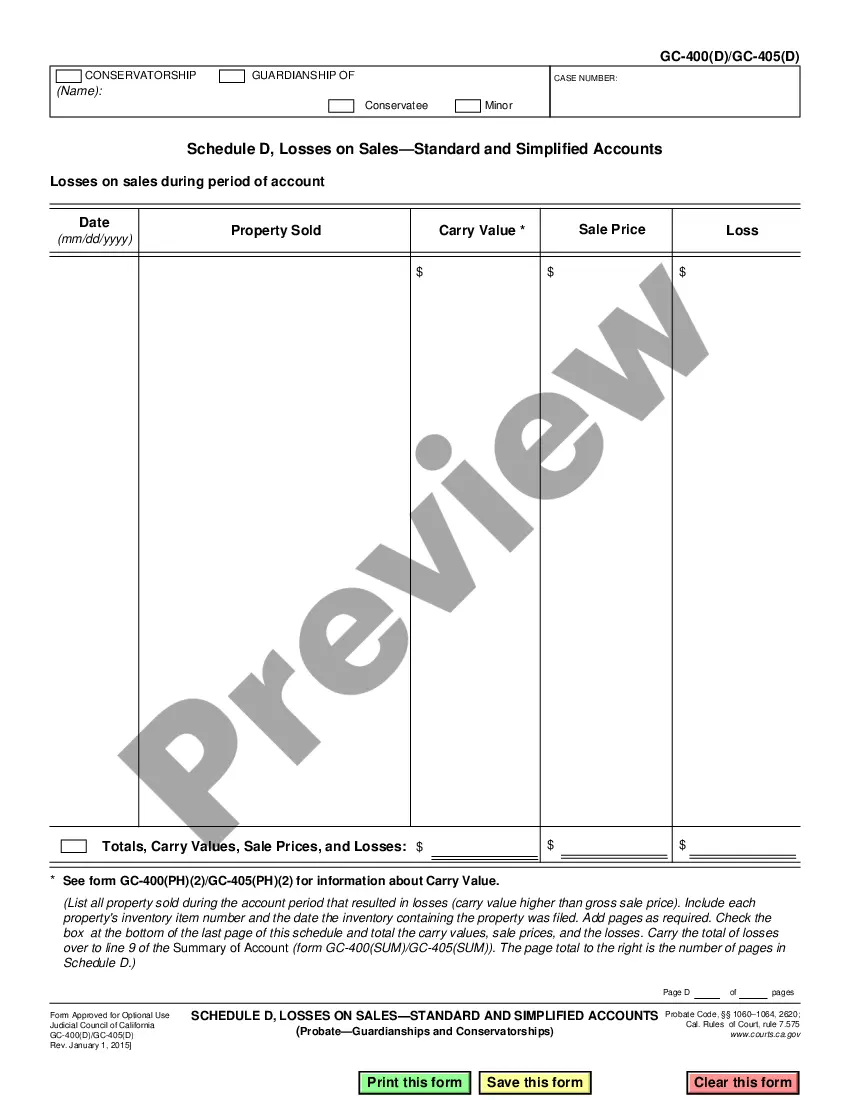

California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D)

Description

How to fill out California Schedule D, Losses On Sales-Standard And Simplified Accounts 405(D)?

If you are seeking specific California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) examples, US Legal Forms is exactly what you require; acquire documents crafted and verified by state-authorized lawyers.

Utilizing US Legal Forms not only spares you from frustrations concerning legal documentation; additionally, it saves you time, effort, and funds! Downloading, printing, and completing a professional template is far less expensive than hiring an attorney to prepare it for you.

And that is all. In just a few simple clicks, you have an editable California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D). Once you set up your account, all subsequent purchases will be processed even more smoothly. With a US Legal Forms subscription, just Log In to your account and then click the Download button available on the form's webpage. Then, when you need to use this template again, you will always be able to find it in the My documents section. Don't waste your time and energy comparing numerous forms across different websites. Purchase accurate templates from one reliable service!

- To begin, complete your registration by entering your email address and setting a password.

- Follow the steps below to establish your account and locate the California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) form to address your needs.

- Use the Preview option or review the document description (if available) to confirm that the form is the one you need.

- Verify its relevance in your residing state.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and pay using your credit card or PayPal.

Form popularity

FAQ

Sales that can be reported on Schedule D include those of capital assets like stocks, bonds, and investment real estate. If you have sold any of these assets and experienced a gain or loss, include that on Schedule D. Using California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) ensures that these transactions are correctly documented for tax purposes.

Directly report sales related to capital assets on Schedule D, such as stocks, bonds, or real estate. If you've sold an asset and realized a gain or loss, it belongs on this form. Furthermore, California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) can simplify your reporting process and enhance your understanding of taxable events.

To report the sale of your residence on Schedule D, you first need to calculate any profit or loss from the sale. If the gain exceeds the exclusion limits, you must report it on the form. Ensure you utilize California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) to ensure appropriate reporting to minimize potential tax liabilities.

If you’re using TurboTax, your California capital loss carryover will typically be calculated automatically as you progress through the sections related to capital gains and losses. Checking the 'Capital Gains and Losses' section should reveal any applicable carryover amounts. California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) is also incorporated into this process for accuracy.

You can find your capital loss carryover amount on your previous year's tax returns, generally noted on Schedule D. If you previously reported significant losses, those amounts are documented for your reference. With California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D), you can track these figures easily and use them for future deductions.

Schedule D losses pertain to the losses you incur from selling capital assets, such as stocks or real estate. These losses are significant because they can offset capital gains or reduce taxable income. Using California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) enables you to report and leverage these losses effectively.

To determine your California capital loss carryover, review your completed Schedule D from previous tax returns. Any carried-over losses from prior years will be noted, allowing you to use them in future tax filings. Utilize California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) to monitor and correctly apply these losses year after year.

California Schedule D captures various types of income, primarily focusing on capital gains and losses from the sale of assets, stocks, or real estate. You report any profits or losses from these transactions to establish your tax liability. Understanding how California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) works can simplify this process for you.

To report direct sales income on your taxes, you need to include the income on your federal and state tax returns. The income should be reported on a schedule appropriate to your business structure. Utilizing California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) will help in accurately reporting any losses identified through your direct sales.

Yes, the sale of your home can be reported on Schedule D if you do not qualify for the home sale exclusion. If you sold your home for a profit and did not meet certain IRS criteria, report the gain or loss using California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D). This helps keep track of your capital loss or gain effectively.