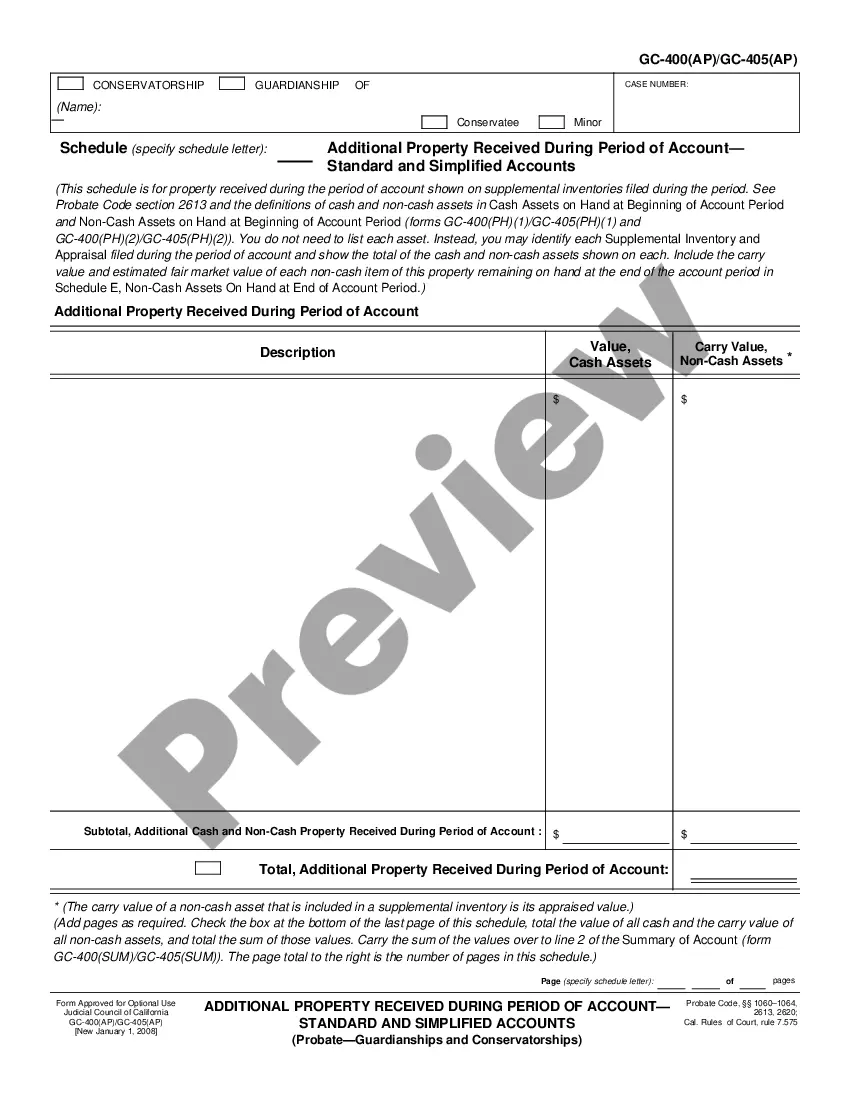

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Additional Property Received During Period of Account - Standard and Simplified Accounts

Description

How to fill out California Additional Property Received During Period Of Account - Standard And Simplified Accounts?

If you're seeking to locate accurate California Additional Property Received During Period of Account - Standard and Simplified Accounts examples, US Legal Forms is precisely what you require; obtain documents produced and verified by state-licensed attorneys.

Utilizing US Legal Forms not only saves you from issues related to legal paperwork; additionally, you conserve time, effort, and money! Downloading, printing, and completing a professional template is significantly less expensive than hiring an attorney to draft it for you.

And that’s all! In just a few simple clicks, you’ll have an editable California Additional Property Received During Period of Account - Standard and Simplified Accounts. Once you create an account, all subsequent purchases will be even simpler. If you have a US Legal Forms subscription, just Log In to your account and click the Download option available on the form’s page. Then, when you need to use this form again, you will always be able to find it in the My documents section. Don’t waste your time searching through countless forms on various sites. Obtain accurate documents from one reliable source!

- To start, complete your registration by providing your email and creating a secure password.

- Follow the steps outlined below to establish your account and obtain the California Additional Property Received During Period of Account - Standard and Simplified Accounts sample to address your situation.

- Utilize the Preview feature or review the document description (if available) to ensure the sample is what you need.

- Verify its validity in your state.

- Click on Buy Now to place your order.

- Select your preferred pricing plan.

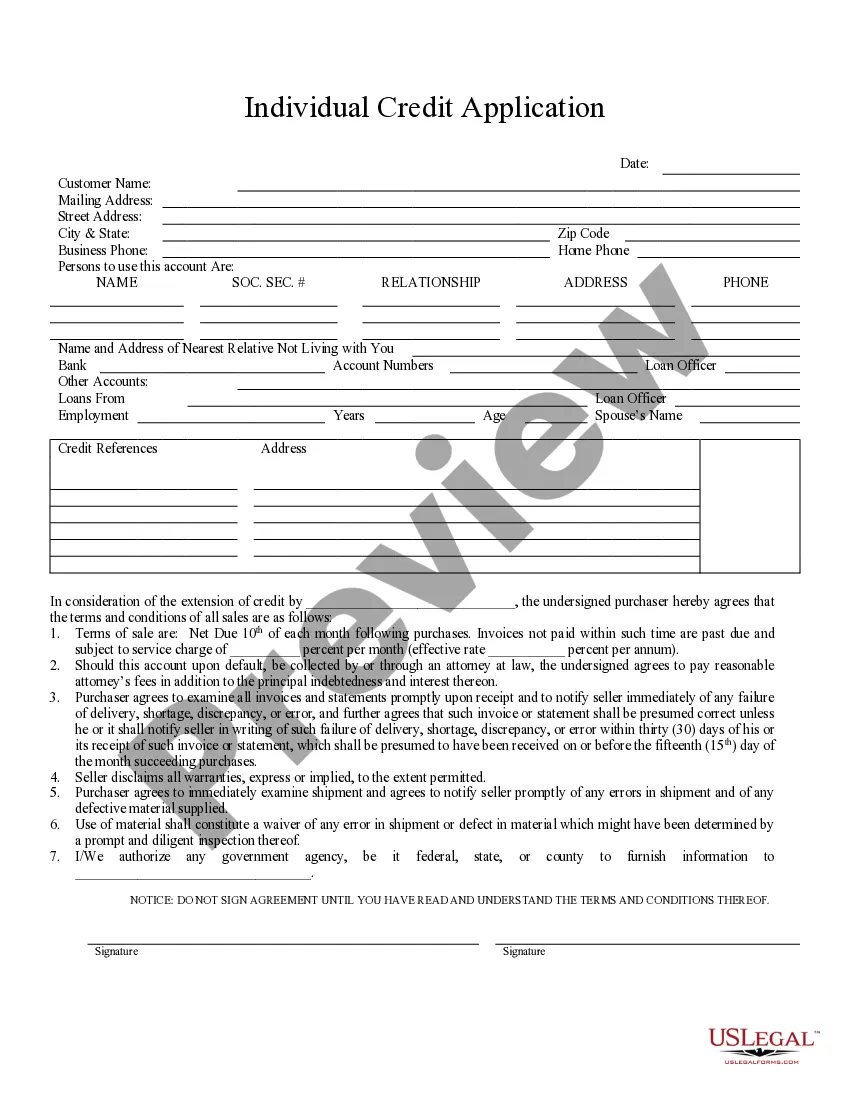

- Create an account and pay using your credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

Use Form 593-V, Payment Voucher for Real Estate Withholding, to remit real estate withholding payments to the FTB. Submit Form 593-V when Form(s) 593 is submitted electronically or by mail. The remitter must use Form 593-V when remitting a payment by check or money order.

Where to Find the Deed. In California, property deeds are in the County Recorders Office or Office of the Assessor-Recorder in the county in which the property is located. In some counties, if you request an older record, you may be redirected to yet another department that maintains archived records.

The escrow agent may withhold and remit to the Franchise Tax Board if the parties agree. If the withholding amount is higher than the amount that should be owed to the Franchise Tax Board, what should the seller do?

Please contact the Unclaimed Property Division by telephone at (916) 323-2827 for further instructions. Also, if you are filing a claim and know there are multiple owners on the account, please note that each owner/ claimant must sign the claim form and submit the required documentation.

A Purpose. Use Form 593, Real Estate Withholding Tax Statement, to report real estate withholding on sales closing in 2018, installment payments made in 2018, or exchanges that were completed or failed in 2018. Use a separate Form 593 to report the amount withheld from each seller/transferor.

Buyers must withhold 3 1/3 percent of the gross sales price on sales of California real property interests from both individuals (e.g., "natural" persons) and non-individuals (e.g., corporations, trusts, estates) and pay this amount to the Franchise Tax Board (FTB).

Residents and business owners can search the database of unclaimed assets and submit a claim at the state's website, claimit.ca.gov, or by calling (800) 992-4647.

Unclaimed Property is generally defined as any financial asset that has been left inactive by the owner for a period of time specified in the law, generally three (3) years. The California Unclaimed Property Law does NOT include real estate.