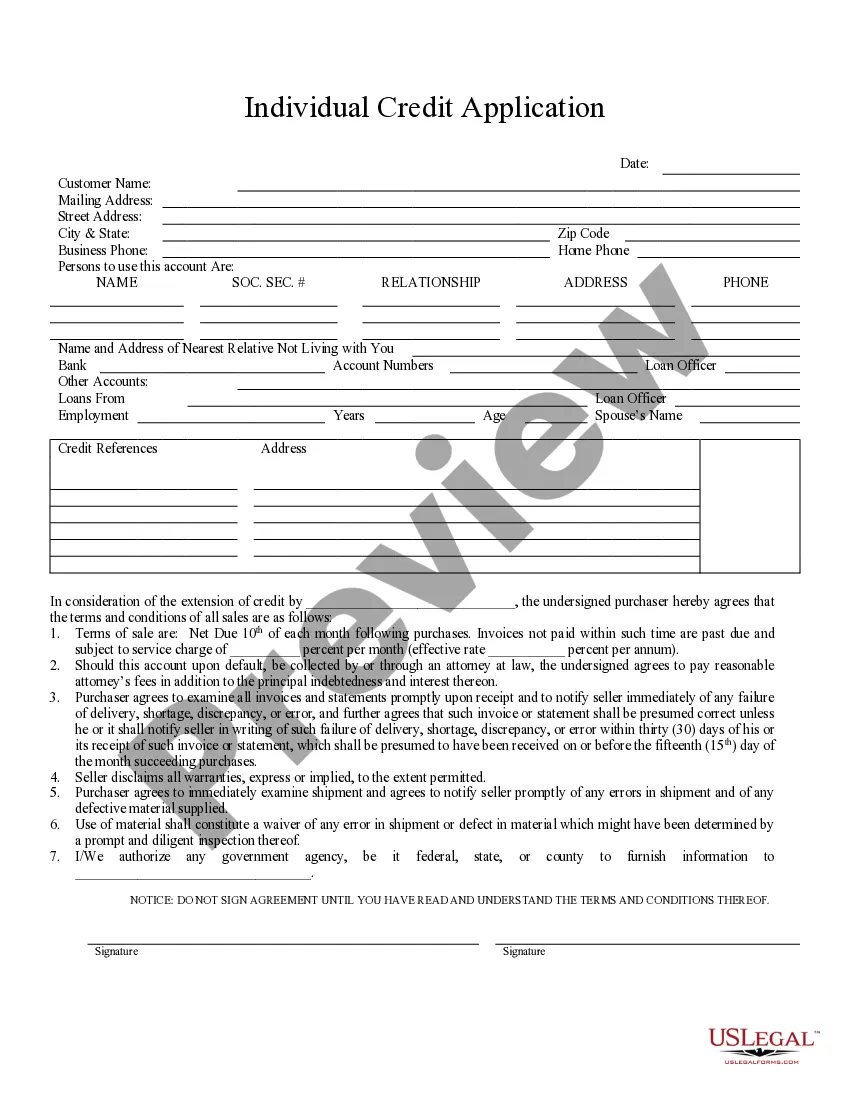

North Carolina Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Individual Credit Application?

Steer clear of expensive lawyers and locate the North Carolina Individual Credit Application you require at an affordable cost on the US Legal Forms website.

Utilize our straightforward grouping feature to search for and acquire legal and tax documents. Review their explanations and preview them prior to downloading.

Select to receive the document in PDF or DOCX format. Click on Download and locate your form in the My documents section. You are welcome to save the template to your device or print it out. After downloading, you can fill out the North Carolina Individual Credit Application either manually or using editing software. Print it and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms provides users with detailed guidance on how to download and fill out each template.

- US Legal Forms members simply need to Log In and retrieve the specific document they seek from their My documents section.

- Those who have not subscribed yet must adhere to the following instructions.

- Verify that the North Carolina Individual Credit Application is valid for use in your jurisdiction.

- If possible, examine the description and utilize the Preview feature before downloading the template.

- If you’re certain the template meets your needs, click Buy Now.

- If the form is incorrect, use the search tool to find the appropriate one.

- Subsequently, create your account and choose a subscription option.

- Complete payment via credit card or PayPal.

Form popularity

FAQ

The extra credit grant is a $335 payment to you from the State of North Carolina.The payment is to help families with qualifying children in North Carolina by providing economic support to assist with virtual schooling and child-care costs during the COVID-19 pandemic.

A fiduciary required to pay an income tax to North Carolina for a trust for which he acts may claim a credit for tax imposed and paid to another state or country on income from sources within that state or country under the provisions of G.S. § 105-160.4(a).

Pay individual income tax. Pay a balance due on your Individual Income Tax Return for the current tax year, and prior years through tax year 2003.

Yes, you should include it as income on your federal return. (Whether the grant is included in federal gross income is determined under federal law. Generally, however, all income is taxable for federal tax purposes unless specifically exempted by federal law.)

North Carolina families with qualifying children who were 16 or younger at the end of 2019 who did not already receive the $335 check from the NC Department of Revenue. Qualifying individuals who were not required to file a 2019 state tax return and have NOT already received the $335 grant.

Use Form NC-1105 to apply for the payment authorized under the Extra Credit Grant Program if you did not file a 2019 North Carolina individual income tax return, Form D-400, solely because your gross income (and your spouse's gross income, if applicable) for 2019 did not exceed the State's filing requirement for your

To grant credit to someone is to trust that person and to take a risk in handing over a sum of money or goods, on the undertaking that the sum of money or goods will be repaid by a certain date plus an additional amount (of money or goods), called interest.