This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

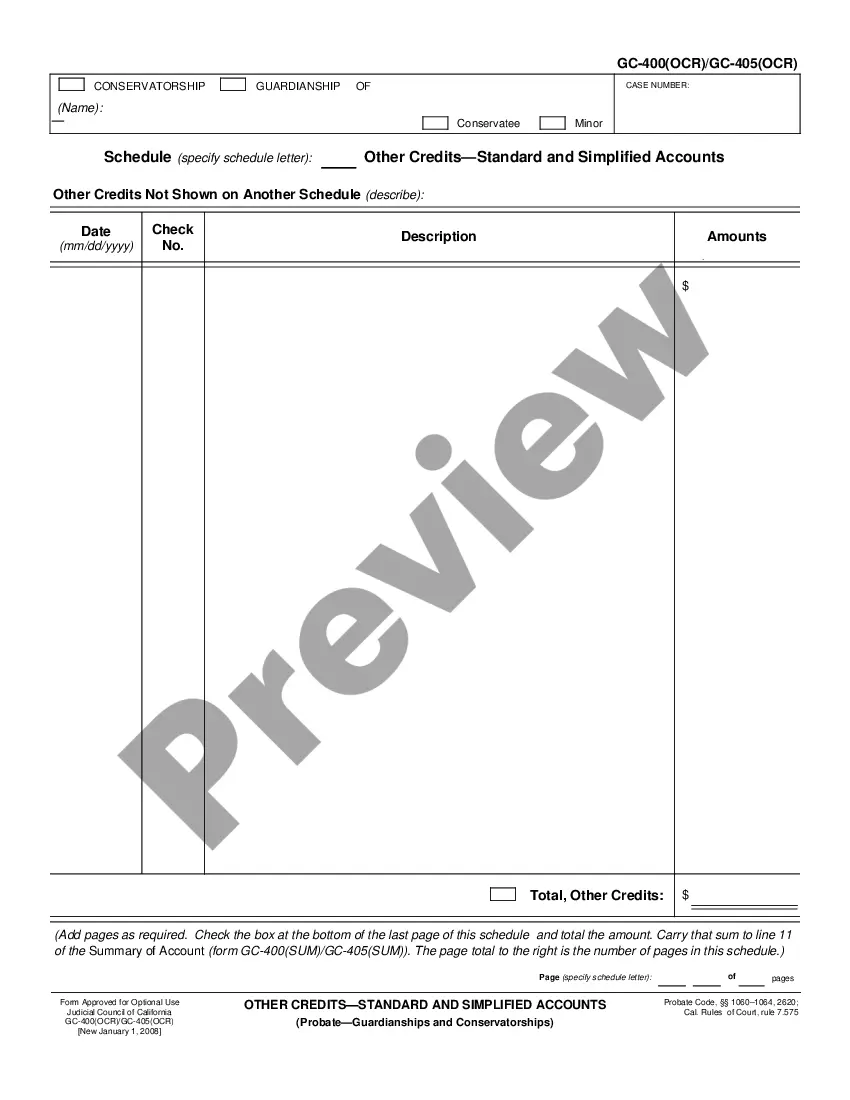

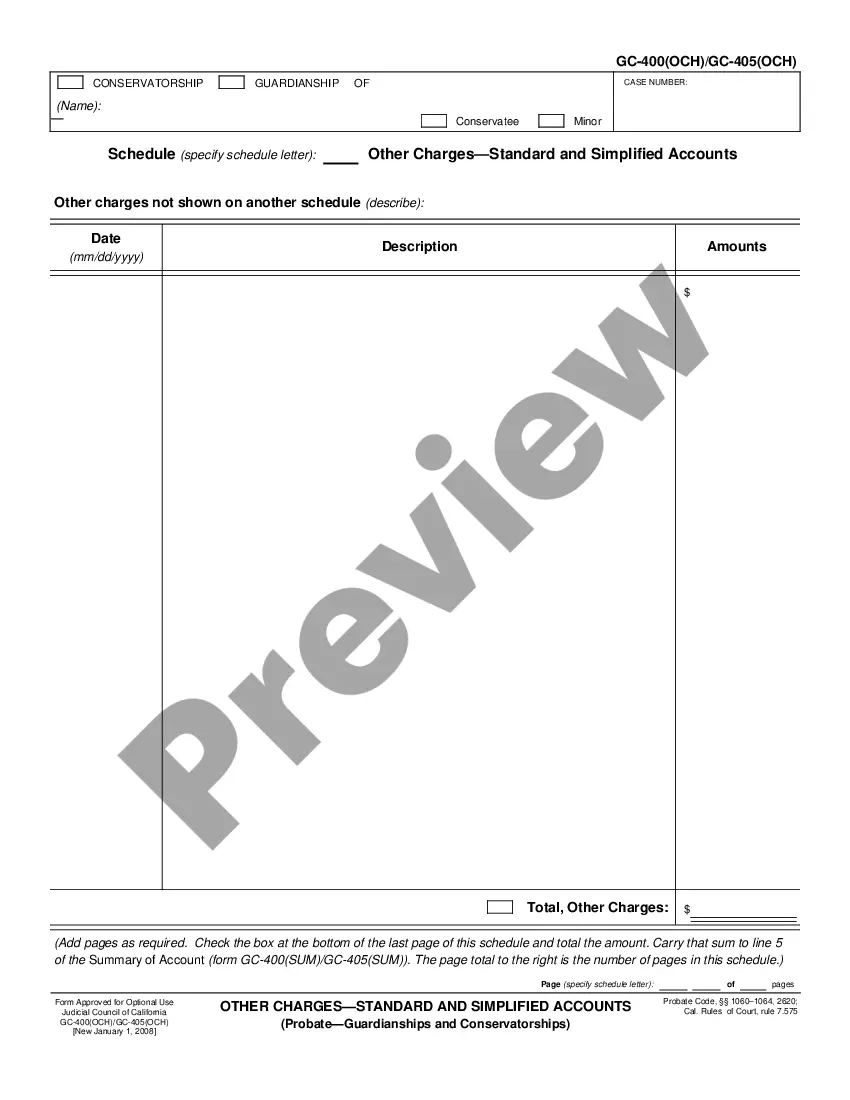

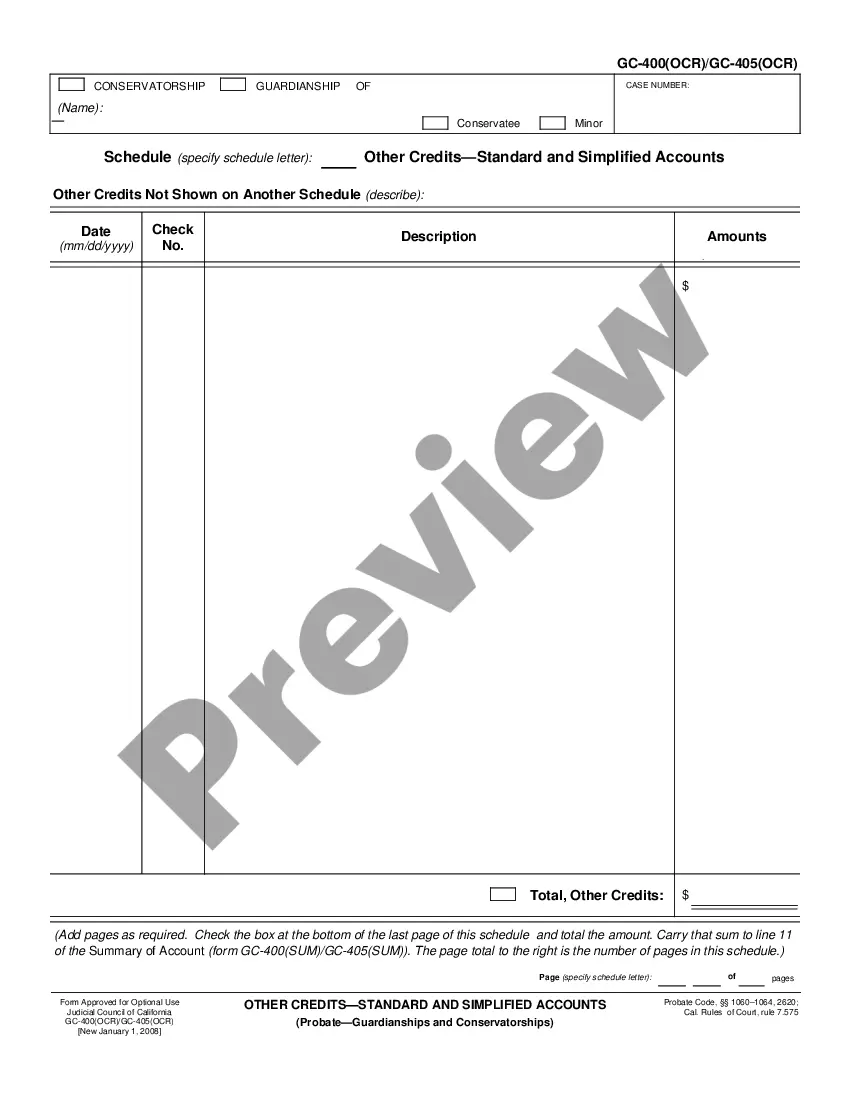

California Other Charges - Standard and Simplified Accounts

Description

How to fill out California Other Charges - Standard And Simplified Accounts?

If you are seeking accurate California Other Charges - Standard and Simplified Accounts samples, US Legal Forms is precisely what you require; discover documents crafted and verified by state-licensed legal professionals.

Utilizing US Legal Forms not only spares you from complications related to lawful documentation; moreover, you don’t squander time, effort, and money! Downloading, printing, and completing a professional document is far less expensive than hiring an attorney to do it for you.

And that’s it. In just a few simple steps, you obtain an editable California Other Charges - Standard and Simplified Accounts. Once you create your account, all future orders will be processed even more effortlessly. After obtaining a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form’s page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort searching through numerous forms across various websites. Order precise templates from a single secure platform!

- To initiate, complete your registration by providing your email and creating a secure password.

- Follow the steps below to set up an account and locate the California Other Charges - Standard and Simplified Accounts sample to meet your requirements.

- Use the Preview option or read the document description (if available) to ensure that the sample is the one you seek.

- Verify its relevance in your state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay with a credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

To set aside an entry of default in California, you must file a motion with the court where the judgment was entered. This motion needs to provide a valid reason for not responding to the lawsuit in a timely manner. Additionally, you should demonstrate a meritorious defense to the original claim. Using resources like USLegalForms can guide you through the necessary steps and required documents related to California Other Charges - Standard and Simplified Accounts, ensuring you follow proper procedures.

Certain assets in California are exempt from probate, including life insurance policies, retirement accounts, and property held in trust. Small estates under a specific value may also qualify for simplified procedures. Familiarizing yourself with these exemptions through resources like US Legal Forms can greatly assist in managing California Other Charges - Standard and Simplified Accounts effectively.

In California, accounting requirements for probate include listing all income, expenditures, and distributions related to the estate. Executors must file a final accounting with the court showing a detailed overview of the estate’s financial activities. Adhering to California Other Charges - Standard and Simplified Accounts will help streamline this process and ensure compliance with state laws.

To set aside a default in California, file a motion with the court that includes evidence showing why the default should be overturned. You must demonstrate a valid reason such as lack of proper notice or an excusable neglect. Utilizing resources through US Legal Forms can provide step-by-step guidance for ensuring compliance with California Other Charges - Standard and Simplified Accounts requirements.

Yes, an executor must provide a clear accounting to the beneficiaries in California. This ensures that all parties are informed about the handling of estate assets and liabilities. By following California Other Charges - Standard and Simplified Accounts guidelines, executors can present a comprehensive report that maintains trust and clarity in the probate process.

To perform probate accounting in California, gather all the financial records related to the estate. Begin by documenting all income and expenses, ensuring transparency throughout the process. Using tools like US Legal Forms can simplify the documentation needed for California Other Charges - Standard and Simplified Accounts, making the accounting process more efficient.

California Penal Code (CPC) §240 Assault California's Assault law (also known as Simple Assault) applies whenever anyone willfully does anything that would result in applying force to another person while having facts that would make a reasonable person realize the act would result in applying force to someone

Penalties for Assault in California A person who is convicted of simple assault faces the following possible penalties: up to six months in jail. a fine up to $1000 (or $2000 if the assault is committed against a parking officer -- someone who issues parking tickets), and. probation up to six months.

In California, criminal histories (rap sheets) compiled by law enforcement agencies are not public record. Only certain employers such as public utilities, law enforcement, security guard firms and child care facilities have access to this information.

Go to the courthouse and ask to look at paper records. Go to the courthouse and look at electronic court records. If your court offers it, look at electronic records over the internet. This is called remote access.