This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

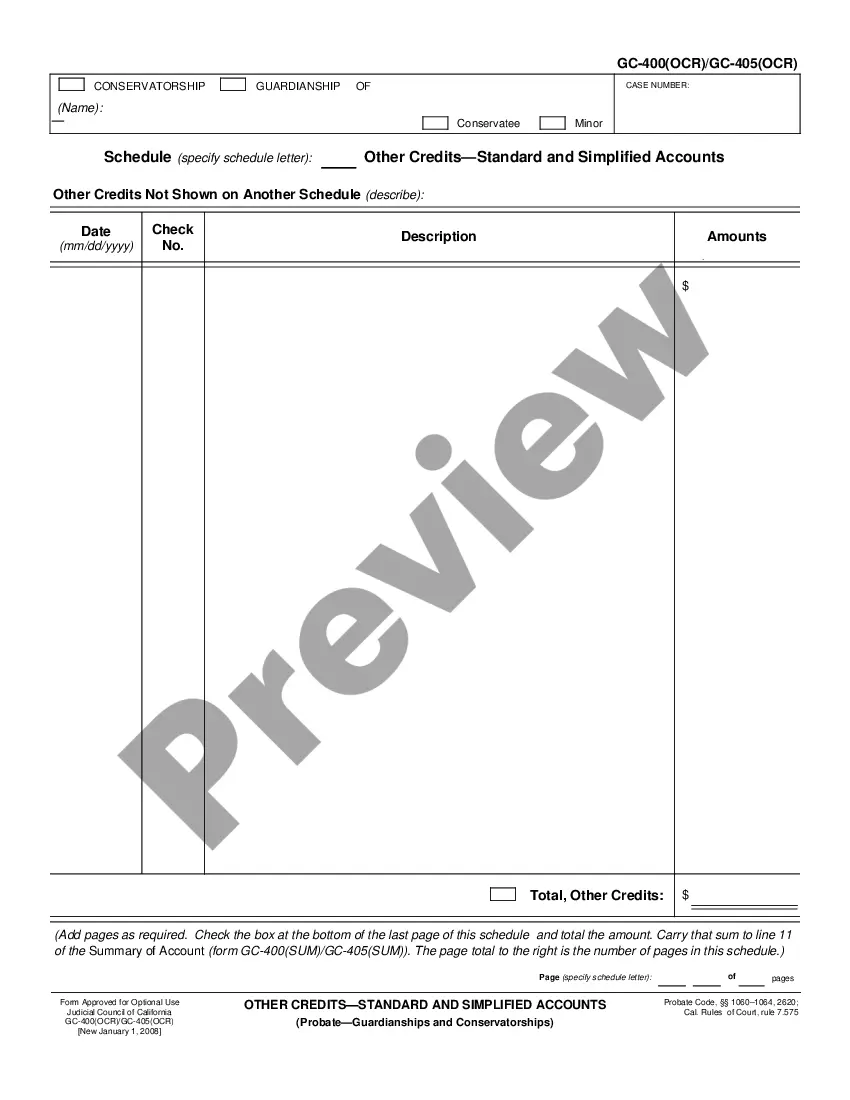

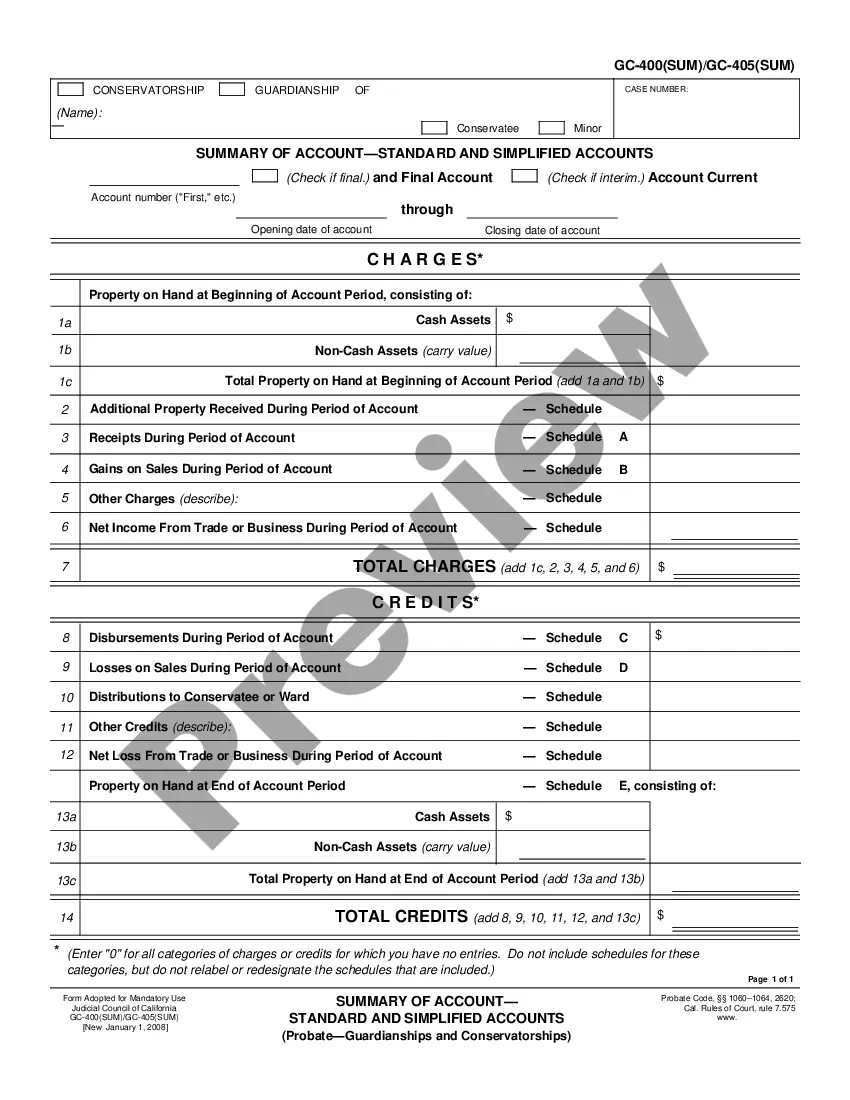

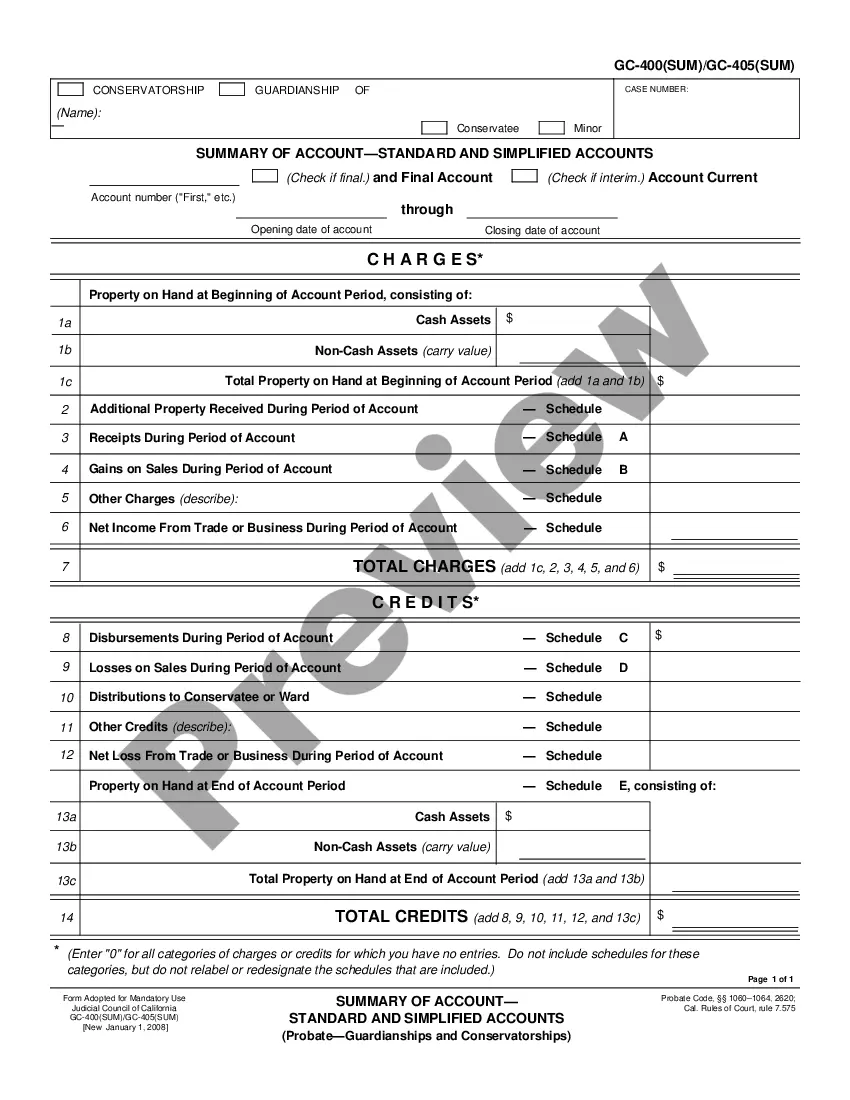

California Other Credits - Standard and Simplified Accounts

Description

How to fill out California Other Credits - Standard And Simplified Accounts?

If you're searching for precise California Other Credits - Standard and Simplified Accounts web forms, US Legal Forms is what you require; access documents created and verified by state-licensed attorneys.

Utilizing US Legal Forms not only alleviates concerns related to legal documents; additionally, you conserve time, effort, and funds! Downloading, printing, and filling out a professional document is considerably cheaper than hiring a lawyer to handle it for you.

And that's it! In just a few simple clicks, you possess an editable California Other Credits - Standard and Simplified Accounts. Once you establish an account, all future orders will be processed even more easily. If you have a US Legal Forms subscription, simply Log In and then click the Download option you see on the form's webpage. Then, whenever you need to use this document again, you'll always be able to find it in the My documents section. Don't waste your time and energy comparing numerous forms on different websites. Purchase accurate templates from a single secure platform!

- To begin, complete your registration by providing your email and creating a password.

- Follow the steps below to set up an account and locate the California Other Credits - Standard and Simplified Accounts web template to address your needs.

- Utilize the Preview tool or review the document details (if available) to ensure that the template is the one you require.

- Verify its legitimacy in your state.

- Click Buy Now to place your order.

- Select a recommended payment plan.

- Create your account and pay using your credit card or PayPal.

Form popularity

FAQ

California has specific adjustments for itemized deductions compared to federal deductions. For instance, certain state taxes may not be fully deductible on your California tax return. Moreover, California places limitations on miscellaneous itemized deductions that were subject to a floor. Being informed about California Other Credits - Standard and Simplified Accounts ensures you optimize your itemized deductions accurately.

In addition to the well-known credits such as the Child Tax Credit and Earned Income Tax Credit, you may also qualify for various others specific to California. Depending on your situation, you might find credits for rehabilitation costs, residential energy improvements, or college expenses. Understanding California Other Credits - Standard and Simplified Accounts will help you identify all potential credits you might claim.

Certain items are 100% tax deductible, including donations to qualifying charities and specific business expenses. For example, if you operate a business, costs associated with materials and supplies can often be fully deducted. It’s essential to document these expenses appropriately. Exploring California Other Credits - Standard and Simplified Accounts will reveal further deductions that can boost your overall financial benefit.

To receive a bigger tax refund, you should consider all eligible deductions and credits. You might claim expenses related to education, medical costs, or certain work-related expenses. By fully understanding the California Other Credits - Standard and Simplified Accounts, you can potentially enhance your tax refund. Using the US Legal Forms platform can simplify this process by providing tailored information and forms.

To qualify for the $2500 American Opportunity credit, you must be enrolled at least half-time in a degree program for the first four years of higher education. You can receive this credit for qualified expenses such as tuition, fees, and course materials. Additionally, your modified adjusted gross income must not exceed certain limits. Utilizing California Other Credits - Standard and Simplified Accounts effectively can help you maximize your education-related tax benefits.

California state standard deductions are fixed amounts that reduce your taxable income. For the tax year, the standard deduction for single filers and married individuals filing separately is a specific amount. If you choose to take this deduction, you will not need to itemize your deductions, simplifying your tax filing. Understanding how California Other Credits - Standard and Simplified Accounts interplay with these deductions can enhance your tax savings.