This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

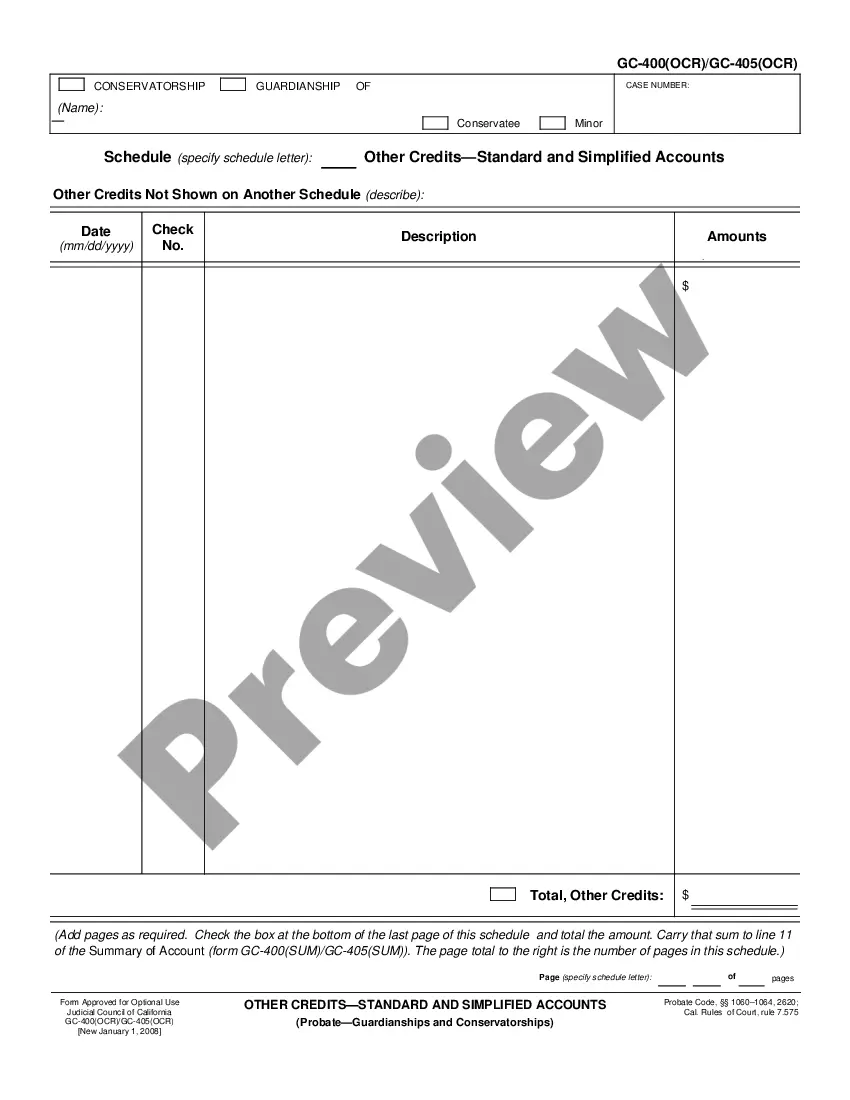

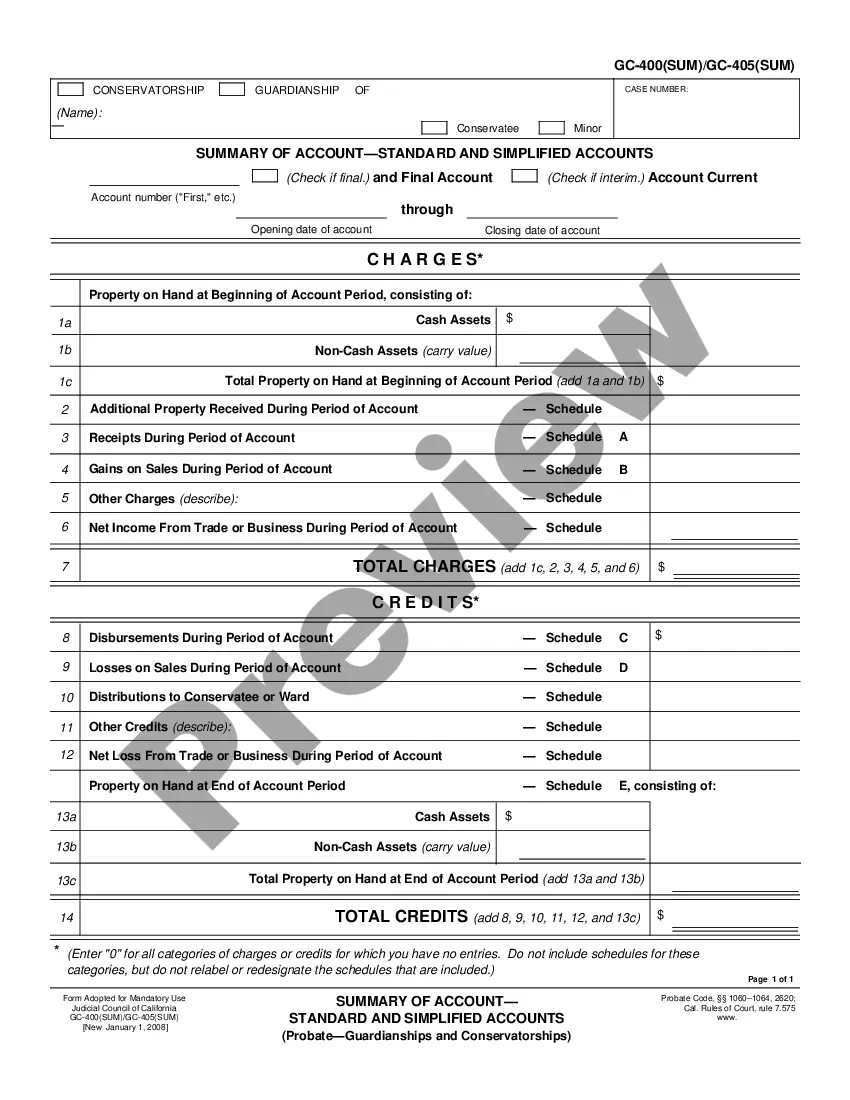

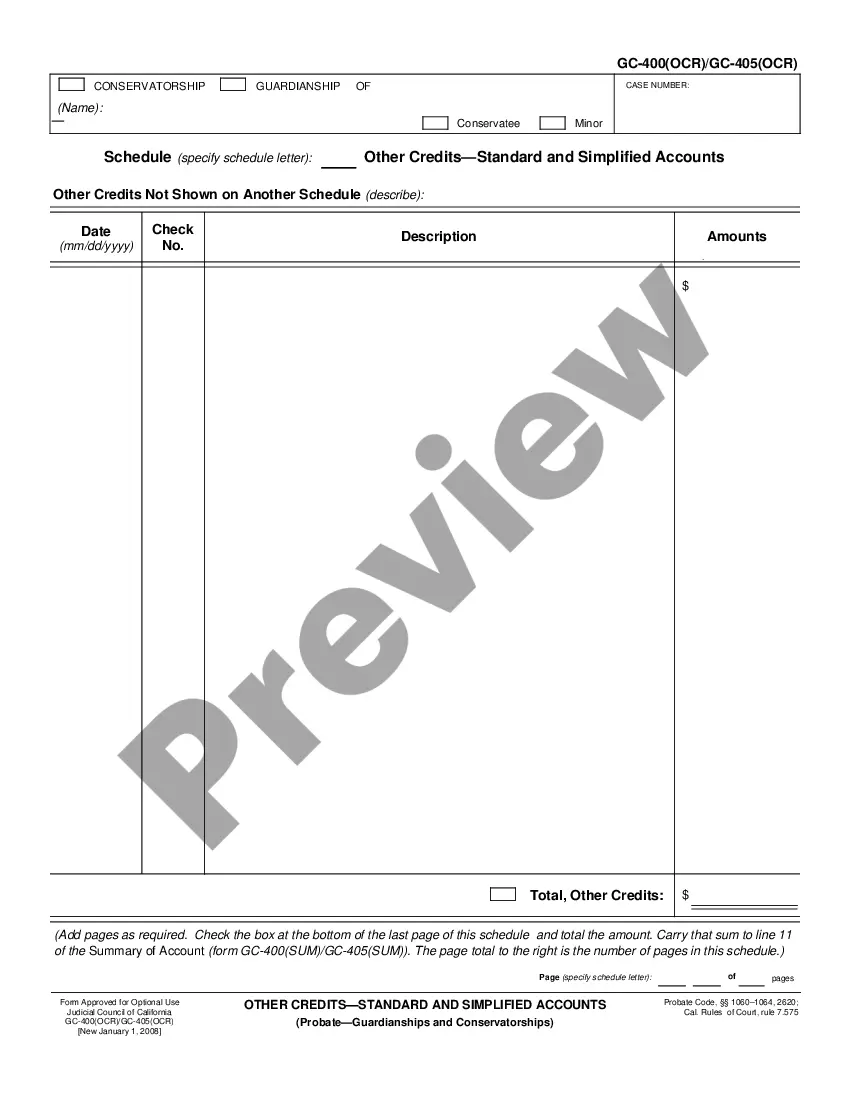

California Summary of Account - Standard and Simplified Accounts

Description

How to fill out California Summary Of Account - Standard And Simplified Accounts?

If you are searching for accurate California Summary of Account - Standard and Simplified Accounts templates, US Legal Forms is precisely what you require; access documents supplied and verified by state-licensed legal experts.

Employing US Legal Forms not only spares you from hassles regarding appropriate documentation; furthermore, you save on effort, time, and funds! Acquiring, printing, and completing a professional document is truly less expensive than seeking legal advice to have it arranged for you.

Select an appropriate format and save the documents. And there you have it. In just a few straightforward steps, you have an editable California Summary of Account - Standard and Simplified Accounts. After creating your account, all future purchases will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button you can find on the form’s page. Then, whenever you need to use this template again, you will always be able to access it in the My documents menu. Don’t waste your time and energy sifting through numerous forms on various websites. Obtain precise documents from just one reliable source!

- Initiate the registration process by entering your email and creating a password.

- Follow the steps outlined below to establish your account and locate the California Summary of Account - Standard and Simplified Accounts sample to address your needs.

- Utilize the Preview feature or examine the file description (if available) to ensure that the form is what you require.

- Verify its relevance in your state.

- Click Buy Now to place your order.

- Select a recommended pricing plan.

- Create an account and make your payment via credit card or PayPal.

Form popularity

FAQ

Probate accounting in California requires executors to provide a full account of the estate's financial transactions. This includes a summary of all assets, liabilities, and the California Summary of Account - Standard and Simplified Accounts. Clear and precise accounting protects the estate's integrity and provides beneficiaries with vital information about the distribution of assets.

A trust accounting in California must include a comprehensive report detailing all financial activities of the trust. Essential elements include income received, expenses incurred, and a California Summary of Account - Standard and Simplified Accounts. This documentation not only helps beneficiaries understand the trust's status but also serves to maintain trust and clarity among all parties involved.

Yes, in California, executors are required to provide an accounting to beneficiaries. This ensures transparency regarding the management of the estate. Typically, this accounting includes a detailed California Summary of Account - Standard and Simplified Accounts. By offering this report, executors affirm their commitment to honoring the rights of beneficiaries.

A waiver of account in probate is an agreement by the beneficiaries to bypass the standard accounting requirements set for executors. This option allows the executor to manage the estate without needing to submit a formal California Summary of Account - Standard and Simplified Accounts. Choosing a waiver can facilitate a quicker resolution of the probate process, provided all beneficiaries agree.

Yes, an executor is generally required to provide accounting to beneficiaries in California. This includes a detailed California Summary of Account - Standard and Simplified Accounts, which outlines financial activities related to the estate. Transparency in accounting builds trust and ensures that all beneficiaries are aware of the estate's financial standing.

While you can file for conservatorship in California without an attorney, having legal representation is highly recommended. An attorney can help you navigate the complexities of the legal process and ensure that all necessary documentation, including the California Summary of Account - Standard and Simplified Accounts, is prepared correctly. This can save you time and reduce the risk of errors.

Waiving accounting means that the beneficiaries agree to forgo the detailed financial reporting normally required in probate. It signifies trust in the executor's management of the estate, allowing for a smoother process without the need for a California Summary of Account - Standard and Simplified Accounts. This can expedite the closing of the estate for all parties involved.

In California, certain assets are exempt from probate, including life insurance policies, retirement accounts, and property held in joint tenancy. These assets can transfer directly to the beneficiaries without the need for a California Summary of Account - Standard and Simplified Accounts. It's essential to identify exempt assets early to streamline the probate process.

To perform probate accounting, the executor must track all estate transactions meticulously. This involves documenting all income, expenses, and distributions and preparing a California Summary of Account - Standard and Simplified Accounts for the court and beneficiaries. Using a structured approach will help ensure accuracy and clarity throughout the probate process.

Starting the conservatorship process in California requires filing a petition and notifying all interested parties. You will also need to submit a proposed conservatorship plan to the court, outlining how you intend to manage the individual's affairs. Utilizing the California Summary of Account - Standard and Simplified Accounts can help simplify your financial reporting during this process.