This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

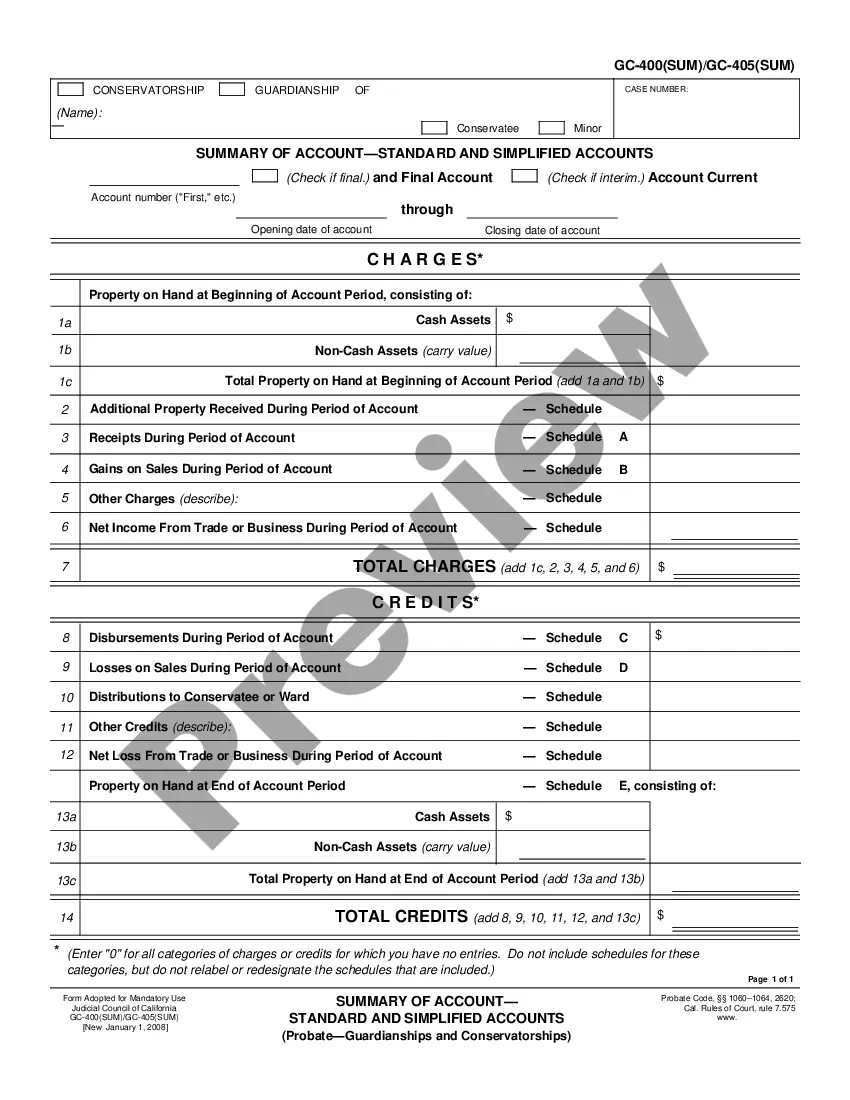

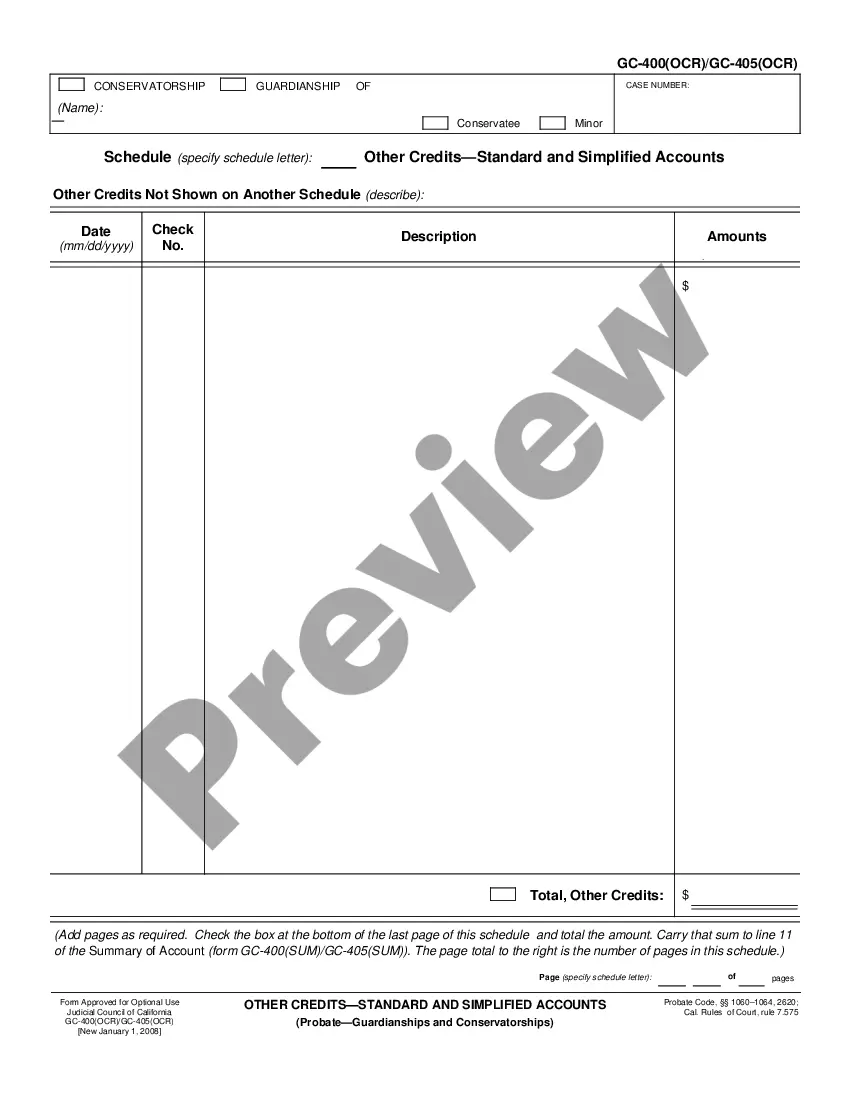

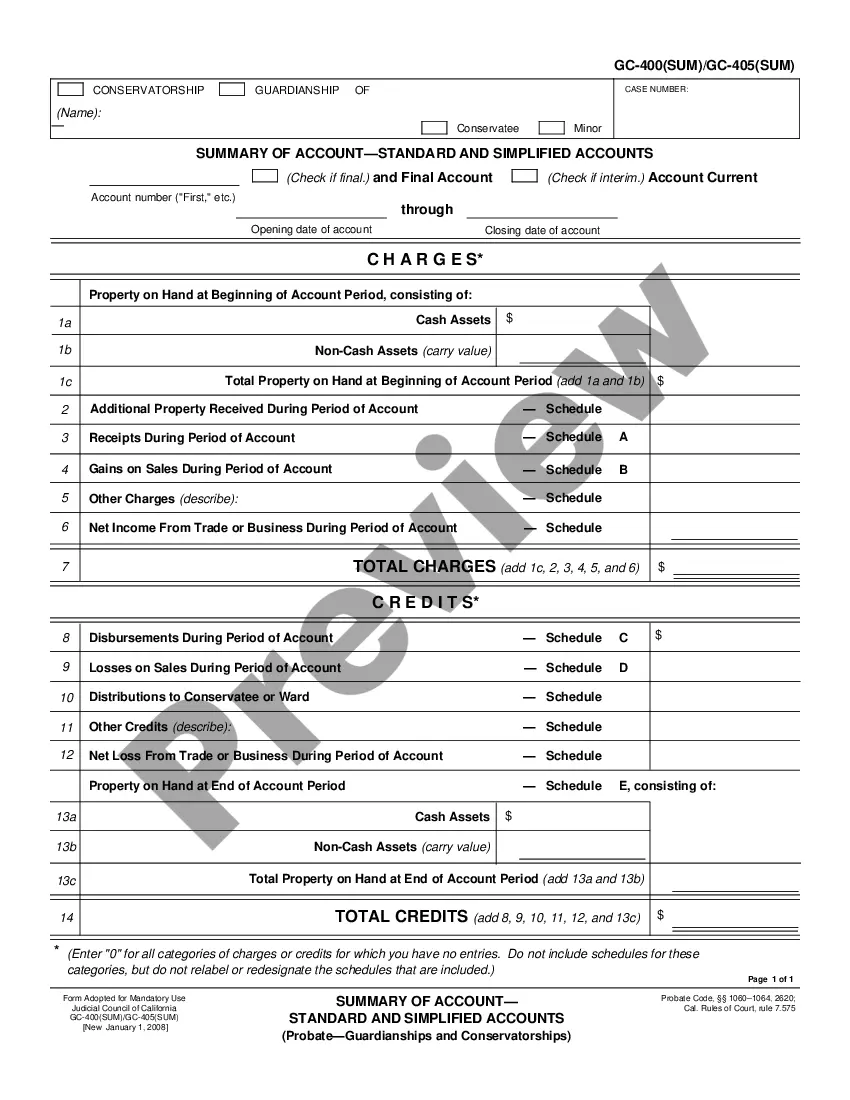

California Other Credits - Standard and Simplified Accounts

Description

How to fill out California Other Credits - Standard And Simplified Accounts?

If you're seeking accurate California Other Credits - Standard and Simplified Accounts templates, US Legal Forms is precisely what you require; discover documents crafted and verified by state-certified legal professionals.

Using US Legal Forms not only spares you from challenges related to legal paperwork; you also conserve time, effort, and money! Downloading, printing, and filling out a professional template is far more cost-effective than hiring an attorney to handle it for you.

And there you have it. With just a few simple clicks, you will obtain an editable California Other Credits - Standard and Simplified Accounts. After creating your account, all subsequent requests will be processed even more smoothly. Once you have a US Legal Forms subscription, just Log In and click the Download option available on the form's page. Then, whenever you need to access this template again, it will always be available in the My documents section. Don't waste your time comparing numerous forms across different platforms. Acquire precise copies from one reliable source!

- Initiate your registration process by providing your email and setting up a password.

- Follow the instructions below to create your account and locate the California Other Credits - Standard and Simplified Accounts template that meets your requirements.

- Utilize the Preview feature or read the document description (if available) to ensure that the form is exactly what you need.

- Verify its relevance for the state you reside in.

- Click Buy Now to place an order.

- Select a desired pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

An itemized deduction adjustment refers to the necessary changes made to your deductibles to align with California's unique tax laws. This is important for ensuring you don't overstate your deductions and face penalties. Understanding these adjustments is a vital part of maximizing your strategy with California Other Credits - Standard and Simplified Accounts. Consider guidance from uslegalforms to manage these adjustments effectively.

California adjustments to itemized deductions involve alterations to specific expenses that don't comply with federal rules. For example, California limits some medical expenses and personal property taxes. These adjustments can affect your overall tax liability and refund within California Other Credits - Standard and Simplified Accounts. Consulting with tax software or a tax professional can clarify these complexities.

Certain business expenses are fully deductible, such as qualified travel expenses and supplies used directly for your work. Items like charitable donations and some medical expenses also qualify. Knowing what is 100% deductible can help you strategize effectively within California Other Credits - Standard and Simplified Accounts. Always keep comprehensive documentation of these items for tax filing.

To potentially receive a larger tax refund, consider maximizing all eligible deductions and credits available to you. Use expenses like medical costs, education, and home office costs to your advantage. Remember, the more deductions and credits you claim, the more significant your refund may be within California Other Credits - Standard and Simplified Accounts. Using a reliable platform like uslegalforms can streamline this process for you.

Apart from the American Opportunity credit, you can explore several tax credits, including the Earned Income Tax Credit and the Child Tax Credit. Each credit comes with specific eligibility requirements based on income, family size, and more. Knowing all available options can greatly enhance your benefits within California Other Credits - Standard and Simplified Accounts. Resources like uslegalforms can help you identify and claim these credits accurately.

One unique itemized deduction allowed in California is the mortgage interest deduction on a home equity line of credit. Unlike federal regulations, California provides specific allowances for this. It's beneficial to understand these unique provisions to maximize your tax situation within California Other Credits - Standard and Simplified Accounts. Make sure to consult a tax professional if you're unsure.

The itemized deduction adjustment for California typically involves reducing the amount of certain deductions to comply with state rules. California has specific rules about what expenses qualify, and it differs from federal regulations. This adjustment is crucial for ensuring compliance and optimizing your claims with California Other Credits - Standard and Simplified Accounts. Keeping detailed records will help you in this process.

California offers standard deductions for single filers and married couples filing jointly, which can reduce your taxable income. For the current year, the standard deduction is adjusted periodically. This deduction simplifies the tax filing process and can increase your potential refund. It's essential to consider standard deductions when exploring California Other Credits - Standard and Simplified Accounts.

To qualify for the $2,500 American Opportunity credit, you must be enrolled at least half-time in an eligible college or university. Make sure you meet the income limits and have qualified tuition expenses. This credit helps offset education costs, and you can apply it on your federal tax return. Remember, this credit is a vital part of California Other Credits - Standard and Simplified Accounts.