This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

California Summary of Account - Standard and Simplified Accounts

Description

How to fill out California Summary Of Account - Standard And Simplified Accounts?

If you are looking for suitable California Summary of Account - Standard and Simplified Accounts templates, US Legal Forms is precisely what you require; find documents created and reviewed by state-certified legal professionals.

Utilizing US Legal Forms not only prevents you from complications related to legal documents; you also conserve time, effort, and money! Acquiring, printing, and completing a professional template is certainly more cost-effective than hiring an attorney to do it for you.

And that’s all. With a few simple steps, you receive an editable California Summary of Account - Standard and Simplified Accounts. Once you create an account, all future orders will be processed even more smoothly. When you have a US Legal Forms subscription, just Log In to your account and click the Download button you can find on the form's page. Then, when you need to access this template again, you'll always be able to find it in the My documents section. Don't waste your time comparing numerous forms across different web sources. Order precise copies from a single trusted service!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the California Summary of Account - Standard and Simplified Accounts template to address your concerns.

- Use the Preview feature or review the document details (if available) to verify that the template is the one you need.

- Check its relevance in your state.

- Click Buy Now to place an order.

- Select a recommended pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a convenient file format and save the form.

Form popularity

FAQ

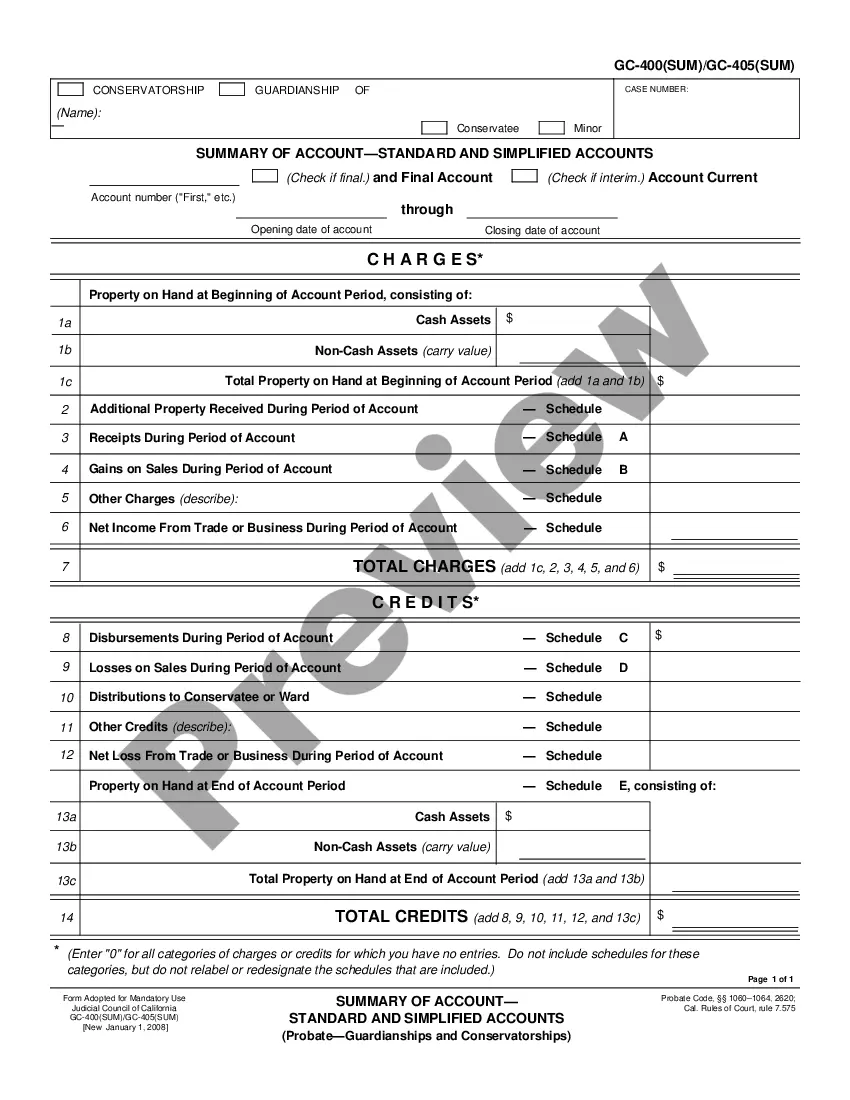

In California, the elements of an account stated involve a mutual agreement between parties regarding the amount due and owing as reflected in a summary of account. This agreement typically arises after one party presents an account for payment, and the other party accepts that account without dispute. It is essential for establishing an enforceable account stated to have evidence of both the agreement and the acknowledgment of debt. Understanding these elements is crucial when navigating California Summary of Account - Standard and Simplified Accounts, ensuring clear communication and record keeping to support legal transactions.

Yes, in California, executors are generally required to provide an accounting to beneficiaries, detailing the management of estate assets. This accounting builds trust and ensures that beneficiaries are aware of how the estate is being handled. However, if all beneficiaries agree, they may waive this requirement, facilitating a more straightforward process. Consider using the resources provided by US Legal Forms to help you navigate a California Summary of Account - Standard and Simplified Accounts effectively.

A trust accounting in California must include a comprehensive report detailing all trust activities, including income, expenses, distributions, and changes in asset values. It is crucial to keep beneficiaries informed and uphold transparency regarding how the trust assets are handled. Utilizing a California Summary of Account - Standard and Simplified Accounts format ensures that trustees meet legal obligations while making the information easily digestible. You can find templates on platforms like US Legal Forms to help you prepare.

To waive accounting means that beneficiaries agree to forgo the right to receive a formal accounting of the estate’s finances. This facilitates a smoother and quicker settlement process, provided that all parties are amenable to this approach. By waiving the accounting, heirs often express trust in the executor's management of the estate, which can simplify procedures related to a California Summary of Account - Standard and Simplified Accounts.

In California, probate accounting requires a detailed summary of all assets, liabilities, and transactions during the estate administration. An executor must provide an accurate representation of the financial activities conducted on behalf of the estate. Ensuring transparency helps maintain trust with beneficiaries, and adhering to a California Summary of Account - Standard and Simplified Accounts will guide executors in preparing their reports properly. Accessing templates through US Legal Forms can greatly assist during this process.

A waiver of account in probate allows an executor or administrator to bypass the formal accounting process. This means that rather than providing a detailed account of all transactions, the personal representative can request that beneficiaries waive their right to an accounting. This can simplify the probate process, and can often be an efficient alternative if all parties are in agreement. Utilizing resources like US Legal Forms can provide access to necessary forms for managing a California Summary of Account - Standard and Simplified Accounts.

In California, certain assets are exempt from probate, including property held in joint tenancy, life insurance policies with named beneficiaries, and assets in trust. These assets can pass directly to the designated beneficiaries without going through probate court. Understanding these exemptions can simplify your estate planning and accounting, making use of tools like the California Summary of Account - Standard and Simplified Accounts advantageous.

Yes, in California, an executor is required to provide an accounting to beneficiaries unless they have obtained a waiver. This accounting helps ensure that all beneficiaries are aware of the estate's financial activities. Using a California Summary of Account - Standard and Simplified Accounts can make this process easier and more transparent, fostering trust among all parties.

A waiver of accounting in probate California allows an executor to skip the detailed accounting process if all beneficiaries agree. This agreement can streamline the probate process significantly and depends on the beneficiaries’ trust in the executor's management of the estate. Even with a waiver, you may still want to use a California Summary of Account - Standard and Simplified Accounts to maintain clarity.

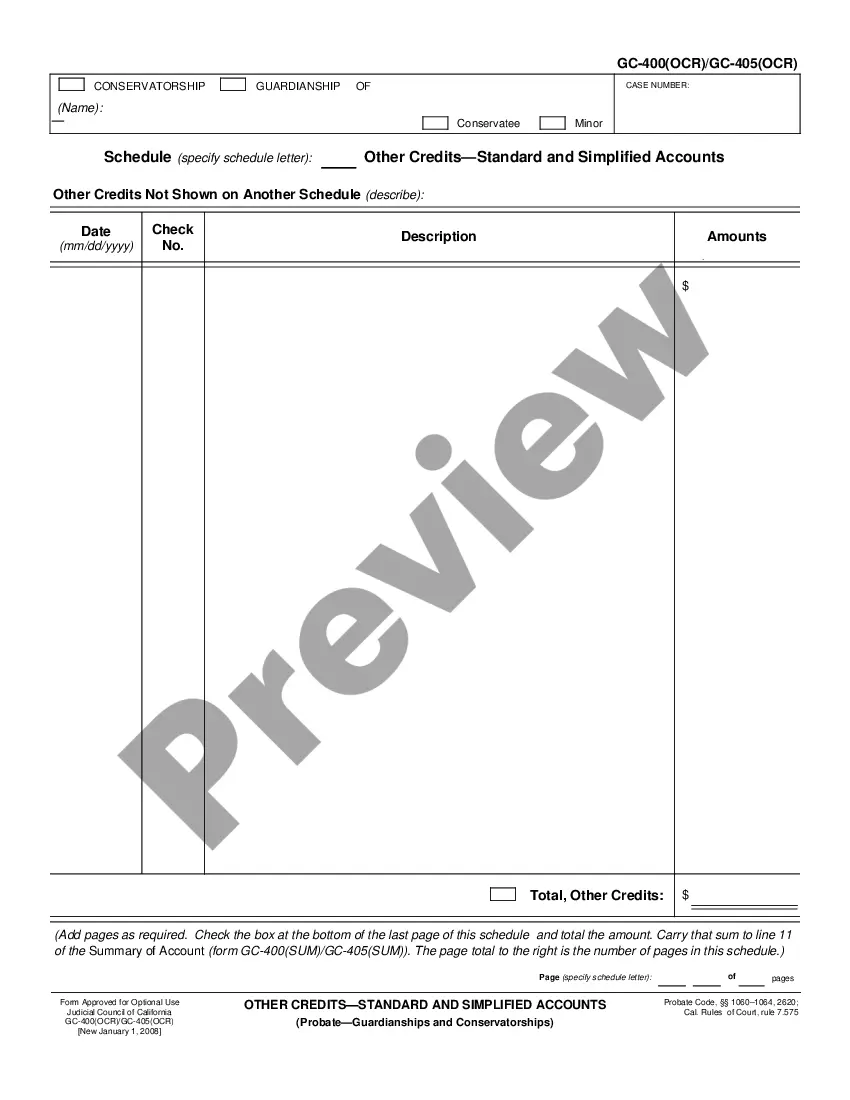

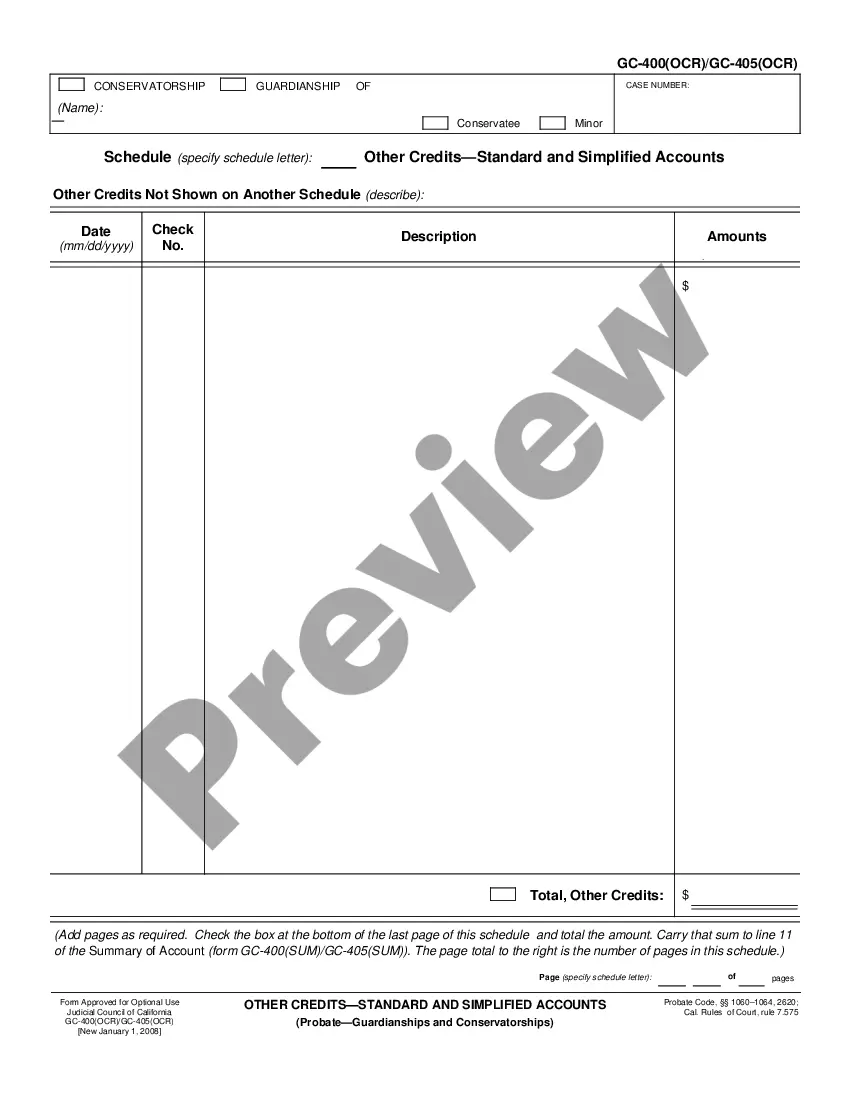

To initiate the conservatorship process in California, you must file a petition with the court, detailing why the conservatorship is necessary. Include necessary documentation, such as a California Summary of Account - Standard and Simplified Accounts, showing any relevant financial details. This process ensures the protection of the individual needing assistance, while also addressing all financial responsibilities.