This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

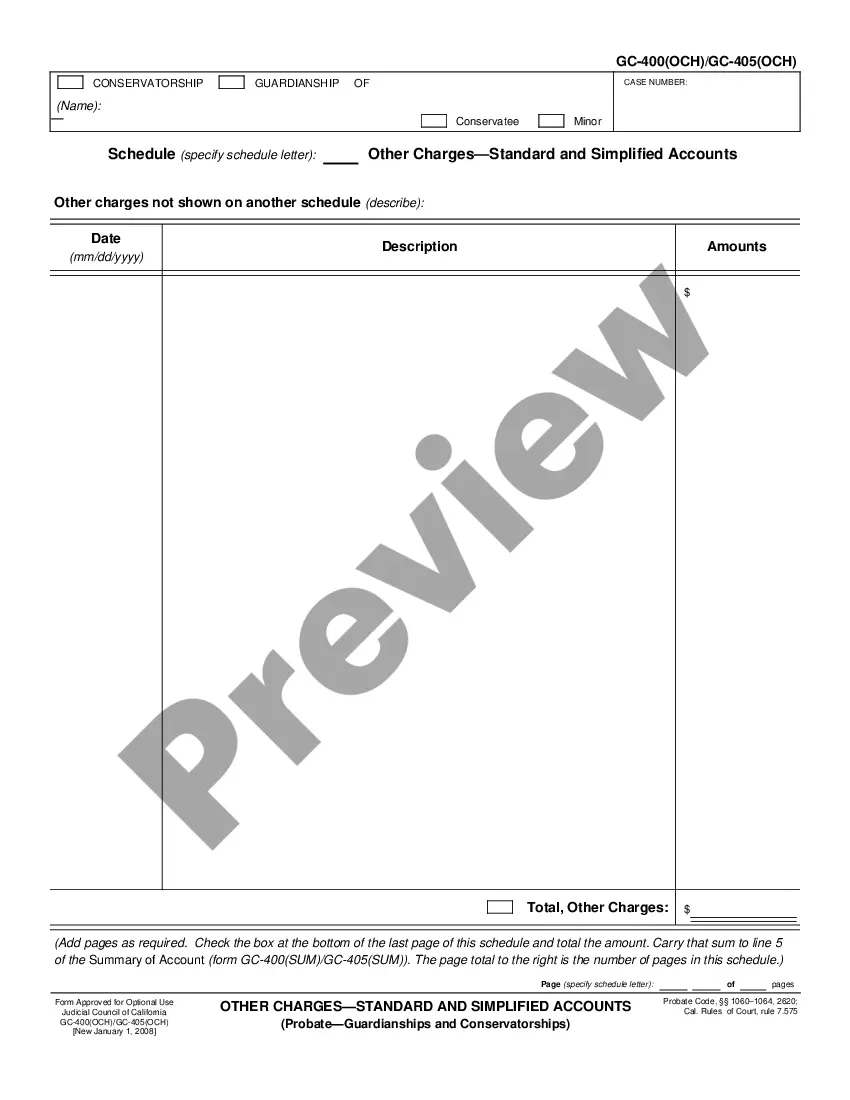

California Other Charges - Standard and Simplified Accounts

Description

How to fill out California Other Charges - Standard And Simplified Accounts?

If you're in search of precise California Other Charges - Standard and Simplified Accounts templates, US Legal Forms is precisely what you require; access documents provided and reviewed by state-certified legal experts.

Utilizing US Legal Forms not only alleviates your concerns about legal documents; furthermore, you save time, effort, and money! Downloading, printing, and completing a professional form is much less expensive than hiring a lawyer to prepare it for you.

And that's it. With just a few simple clicks, you get an editable California Other Charges - Standard and Simplified Accounts. After setting up your account, all future requests will be processed even more smoothly. Once you have a US Legal Forms subscription, simply Log In to your profile and click the Download option visible on the form's page. Then, whenever you need to use this template again, you'll always find it in the My documents section. Don't waste your time comparing numerous forms on different websites. Acquire accurate documents from a single trusted service!

- To begin, complete your registration process by submitting your email and creating a password.

- Follow the instructions below to establish an account and obtain the California Other Charges - Standard and Simplified Accounts template to address your issues.

- Use the Preview feature or review the document description (if available) to ensure that the sample is what you need.

- Verify its legality in your residing state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable file format and save the document.

Form popularity

FAQ

Relief from entry of default in California allows a party to challenge a default judgment under certain conditions. It typically involves demonstrating valid reasons for the default, such as lack of notice or an excusable delay. California Other Charges - Standard and Simplified Accounts can help you navigate this process by providing legal forms and guidance to support your case.

After an entry of default occurs in California, the opposing party may seek a default judgment without your input. This means they can win the case based solely on the default, which can lead to significant consequences for you. To avoid this situation, consider learning more about California Other Charges - Standard and Simplified Accounts, which outlines steps to prevent unfavorable outcomes.

To set aside an entry of default in California, you need to file a motion with the court where the case is pending. This process involves submitting certain documents, such as a declaration explaining the reasons for the default. Utilizing California Other Charges - Standard and Simplified Accounts can provide you with important tools and templates to facilitate this process.

A notice of motion to set aside default is a formal request to the court, asking to cancel a previous default judgment. This notice allows a party to present their case and explain why the default should be removed. Using the resources available through California Other Charges - Standard and Simplified Accounts can guide you in preparing this motion effectively.

To vacate a default judgment in California, you must file a motion with valid reasons, such as inadequate notice or a mistake. After submission, the court will review your case, and if approved, the judgment will be set aside. Making use of resources like US Legal Forms can provide essential guidance through this process and help you understand California Other Charges - Standard and Simplified Accounts.

Certain assets are exempt from probate in California, including life insurance policies with designated beneficiaries, real estate held in joint tenancy, and trust accounts. Understanding these exemptions can save time and reduce costs associated with California Other Charges - Standard and Simplified Accounts during the probate process.

In California, you typically have 180 days to file a default judgment after a party fails to respond to a lawsuit. However, it's crucial to consult an attorney to understand specific timelines relevant to your case. Awareness of California Other Charges - Standard and Simplified Accounts assists in meeting legal deadlines and financial obligations effectively.

A motion to set aside settlement in California requests that the court nullifies a prior settlement agreement, often based on reasons like fraud or misunderstanding. This motion allows a party to renegotiate terms or seek better outcomes, especially if significant changes occur. Understanding California Other Charges - Standard and Simplified Accounts helps parties navigate potential financial implications.

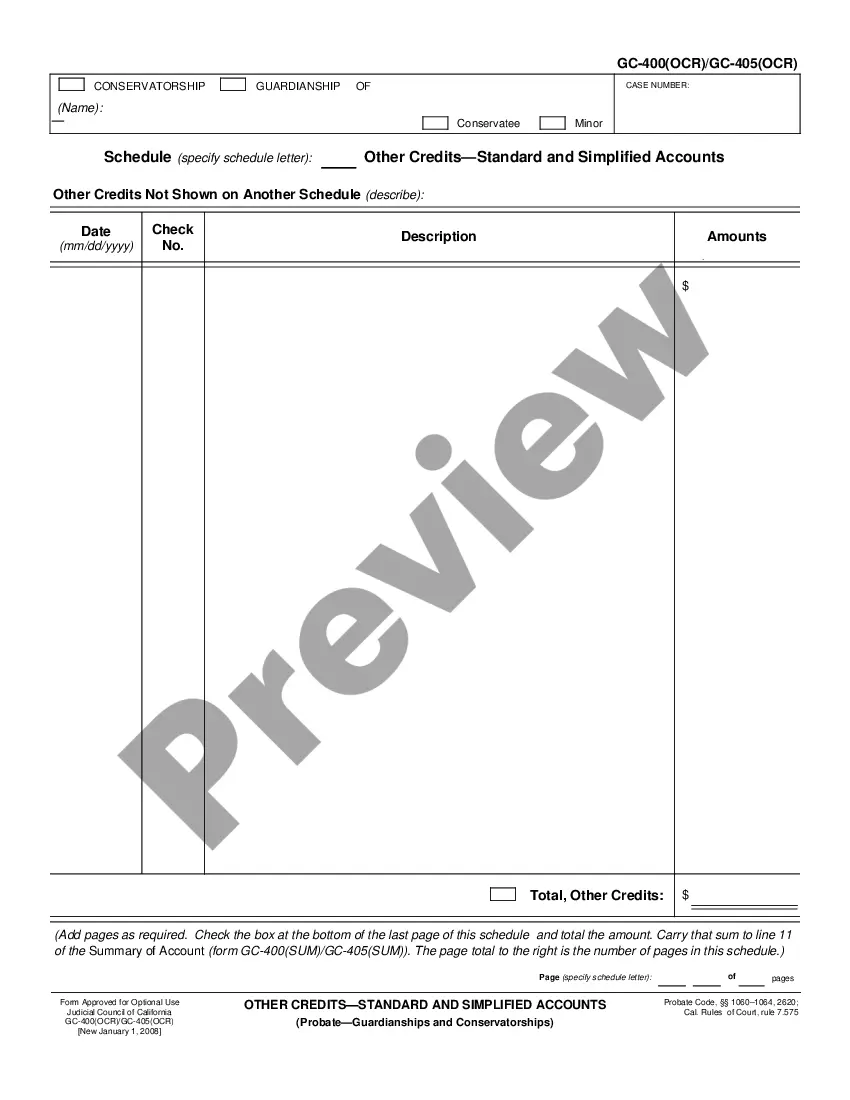

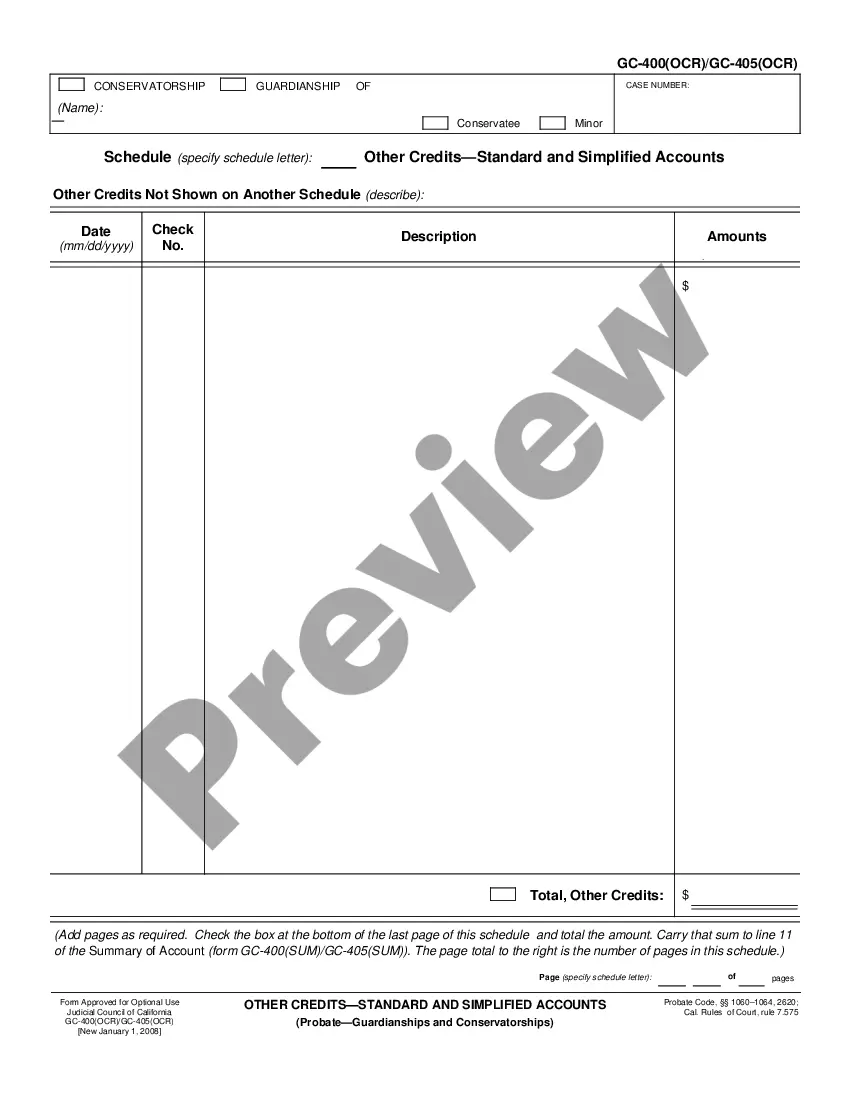

Probate accounting involves summarizing all financial transactions related to the deceased's estate during the probate process. You'll need to track income, expenses, and distributions accurately, and prepare reports for submission to the court and beneficiaries. Familiarizing yourself with California Other Charges - Standard and Simplified Accounts can simplify your accounting tasks and ensure compliance.

Yes, in California, executors must provide an accounting to beneficiaries, detailing all income, expenses, and distributions related to the estate. This transparency helps maintain trust and clarity among all parties. Learning about California Other Charges - Standard and Simplified Accounts can further assist executors in fulfilling their duties properly.