Agreement to Execute Mutual Wills

What this document covers

The Agreement to Execute Mutual Wills is a legal document that allows two parties, often spouses or family members, to agree on how their property will be distributed upon their deaths. This agreement ensures that each party's will reflects the mutual understanding regarding the disposition of their assets, thereby providing legal guidance to manage their estate wishes effectively. Unlike standard wills, this agreement binds both parties to the provisions outlined within their respective wills, facilitating an organized transfer of property and minimizing potential disputes after one or both parties pass away.

Key components of this form

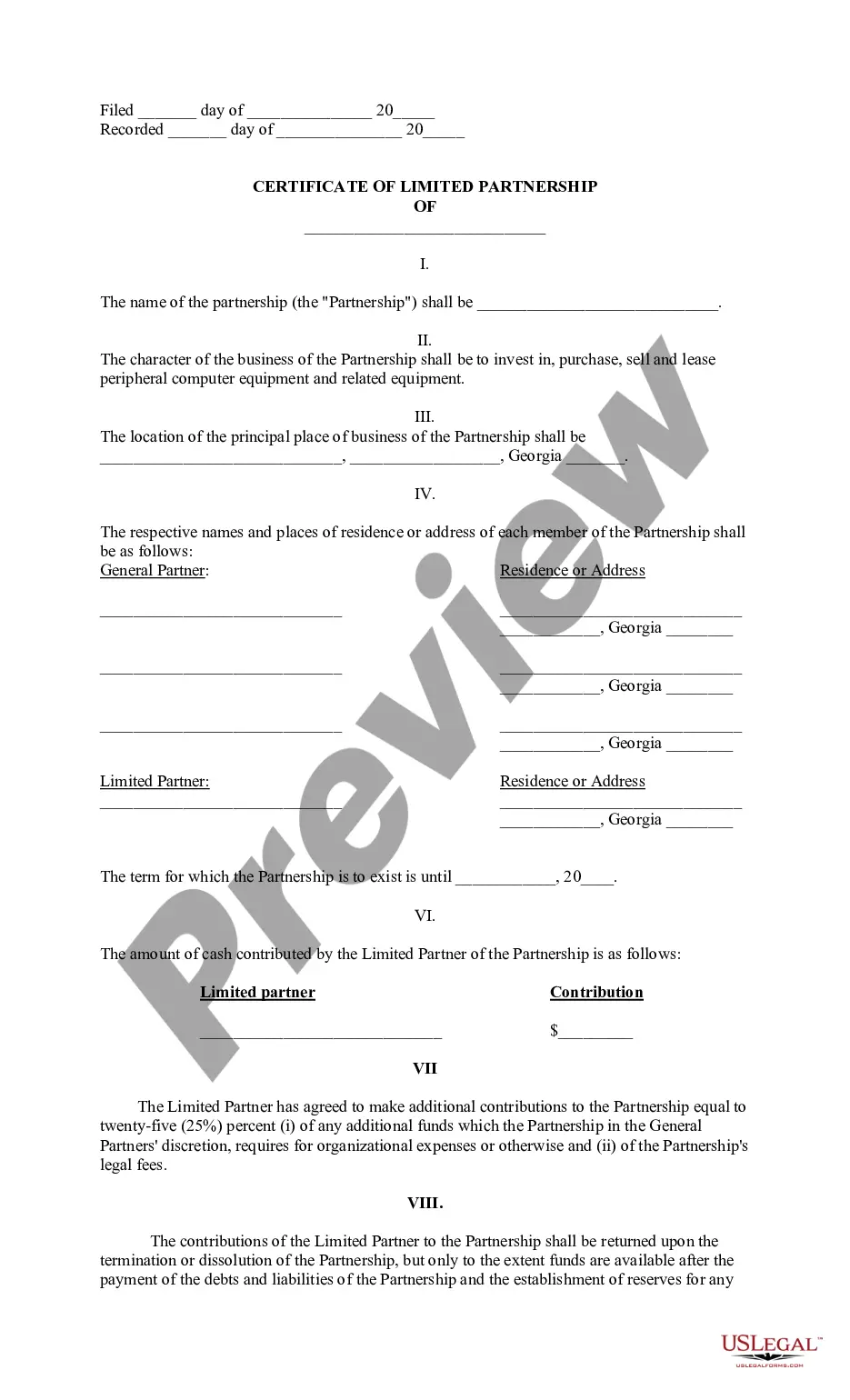

- Date of the agreement and the names of both parties.

- Declaration of the relationship between the parties.

- Provision for the execution of separate wills by each party.

- Disposition of property upon the death of the survivor.

- Agreement not to revoke the mutually agreed wills.

- Custody details for the agreement and the wills.

Common use cases

This form is ideal in situations where two parties wish to ensure their assets are distributed according to a mutual understanding. You should consider using this agreement if you are entering into a marriage, forming a long-term partnership, or wish to confirm inheritance plans with family members. It ensures that both parties have a legally enforceable plan for asset distribution, providing peace of mind during estate planning.

Intended users of this form

- Couples planning their estates together.

- Parents wishing to arrange inheritance for their children.

- Partners desiring to solidify their financial arrangements.

- Individuals looking to minimize disputes over property after death.

- Anyone wanting a clear and legally binding agreement regarding their will.

How to prepare this document

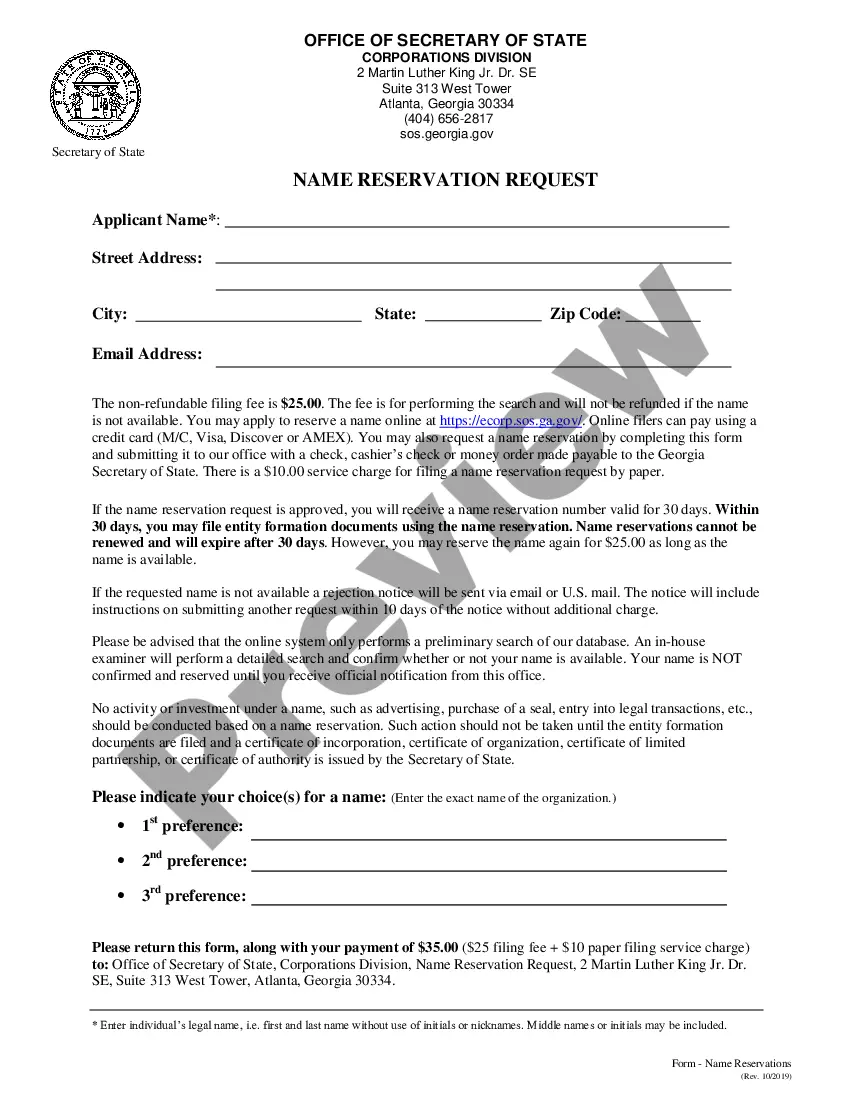

- Identify the parties involved by filling in their names and contact information.

- Specify the nature of the relationship between the parties.

- Establish provisions for the execution of separate wills.

- Select the beneficiary for the property after the survivor's death.

- Ensure both parties sign and date the agreement, and retain copies for their records.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all necessary details about the parties.

- Not specifying how property is to be distributed upon the survivor's death.

- Forgetting to sign and date the agreement, rendering it unenforceable.

- Neglecting to update the agreement if circumstances change.

Benefits of completing this form online

- Convenient access to legally sound templates without needing to visit a law office.

- Editable options allow for customization based on individual needs.

- Quick download and immediate use, facilitating timely estate planning.

- Professional legal drafting ensures reliability and adherence to legal standards.

Legal use & context

- This agreement ensures that the wishes of both parties are legally recognized.

- It helps to prevent potential disputes among heirs after the death of either party.

- Legal enforceability may depend on proper execution per state law.

Summary of main points

- The form establishes a binding agreement for mutual property bequests.

- It requires each party to create a reciprocal will to uphold their promises.

- Clarity in specific terms helps prevent future disputes among beneficiaries.

Looking for another form?

Form popularity

FAQ

As mutual wills are binding, the key purpose of such wills is to ensure that property flows to intended, agreed, beneficiaries. They are generally used to ensure that a testator's property can be enjoyed by another during his or her lifetime, but then passes to a third party, the 'ultimate beneficiary.

Procedure to get a Will executed The execution of a Will is to be done by the executor appointed for the purpose by the testator. It is nothing but the distribution of property of the deceased according his/her intent as worded in the Will. In order to start his duties as an executor of a Will, a probate is necessary.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Mutual Wills are Wills drawn up by at least two people and are signed following an agreement between the individuals which it is intended should bind the survivor of them. Each individual agrees with the other not to alter their Will after the other dies.

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice. You should always get legal advice if, for example: the terms of a will are not clear.

However, mutual Wills cannot be altered upon the death of one of the testators. Changes can be made to the Will(s) prior to the death of any of the testators but upon the death of a testator all other testators will be bound by the terms of the mutual Wills and any subsequent Wills executed will be held invalid.

1. Handle the care of any dependents and/or pets. This first responsibility may be the most important one. Usually, the person who died (the decedent) made some arrangement for the care of a dependent spouse or children.

One of the most popular ways to avoid probate is through the use of a revocable living trust. Assets are placed in the trust, but they can used by the trust creator during his or her lifetime. Upon death, assets in the trust are passed to the trust beneficiaries just by operation of the trust document.