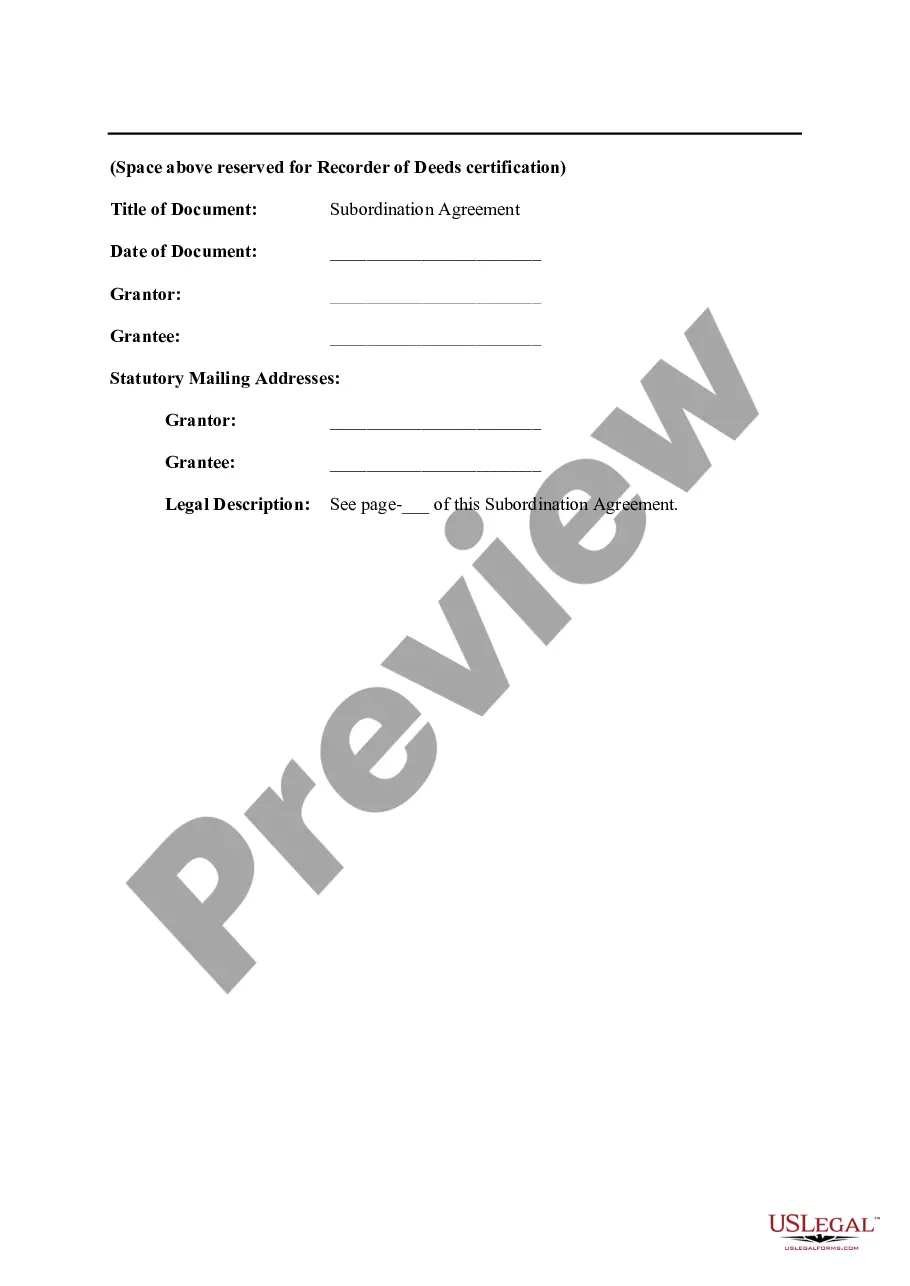

Missouri Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Subordination Agreement?

Obtain any template from 85,000 legal documents like the Missouri Subordination Agreement online with US Legal Forms. Each template is prepared and revised by state-licensed lawyers.

If you possess a subscription, Log In. When you’re on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the steps outlined below.

With US Legal Forms, you’ll always have instant access to the relevant downloadable sample. The platform provides you with access to forms and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Missouri Subordination Agreement quickly and efficiently.

- Verify the state-specific prerequisites for the Missouri Subordination Agreement you wish to utilize.

- Review the description and view the sample.

- Once you are confident the template meets your needs, simply click Buy Now.

- Select a subscription plan that fits your budget.

- Set up a personal account.

- Pay using one of two acceptable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents tab.

- When your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

To obtain a subordination agreement in Missouri, you can start by contacting your lender or mortgage broker. They can guide you through the process and provide you with the necessary forms. Additionally, platforms like uslegalforms can simplify this process by offering templates and resources tailored for creating a Missouri Subordination Agreement. With the right tools, you can efficiently secure the agreement you need.

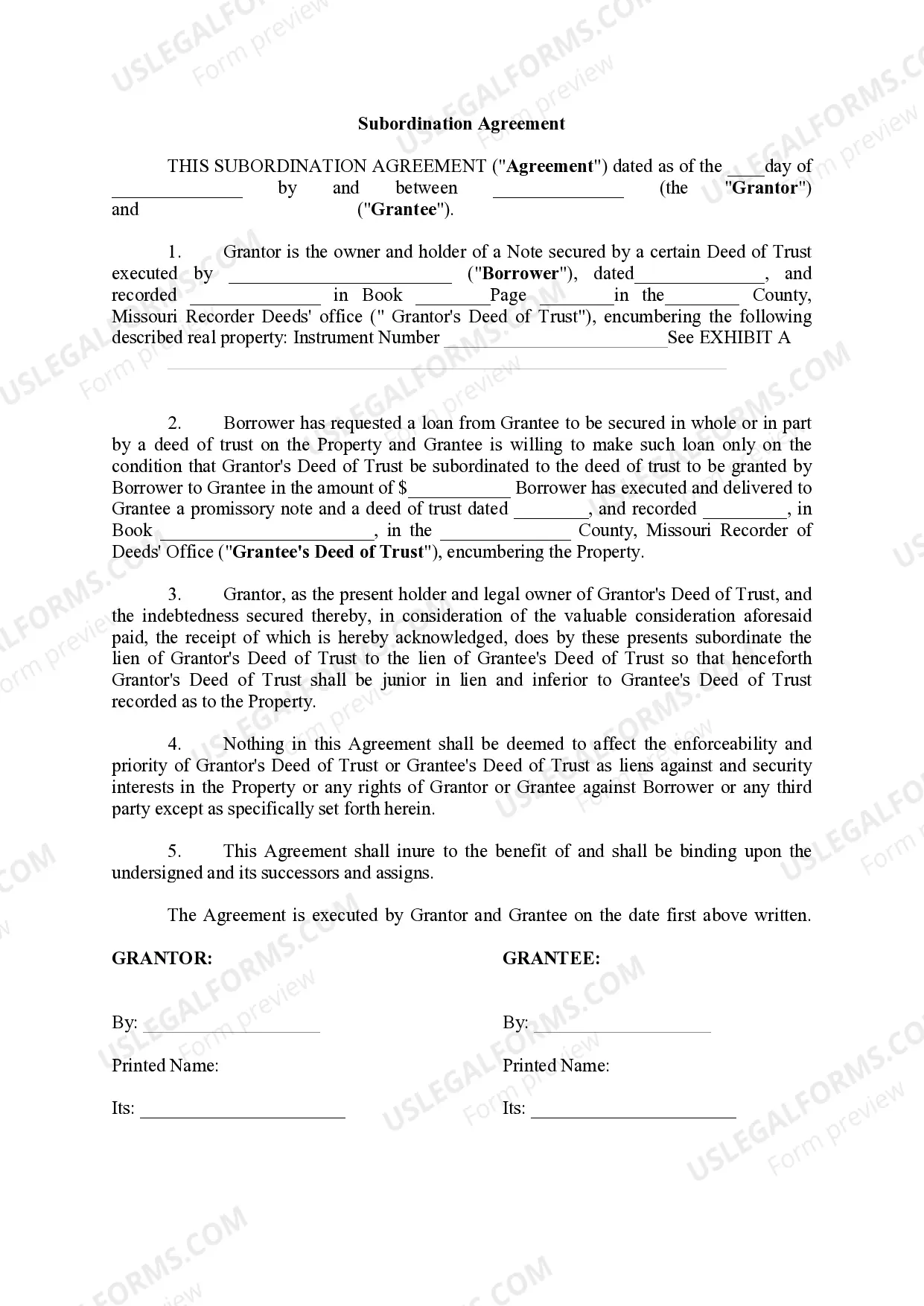

A subordination agreement in Missouri establishes the priority of debts in the event of default. Essentially, it allows a lender to agree that their claim on the property is subordinate to another lender's claim. This arrangement can facilitate refinancing or help secure new financing by making it easier for the new lender to take a first priority position. Understanding how a Missouri Subordination Agreement works can help you make informed decisions about your financial commitments.

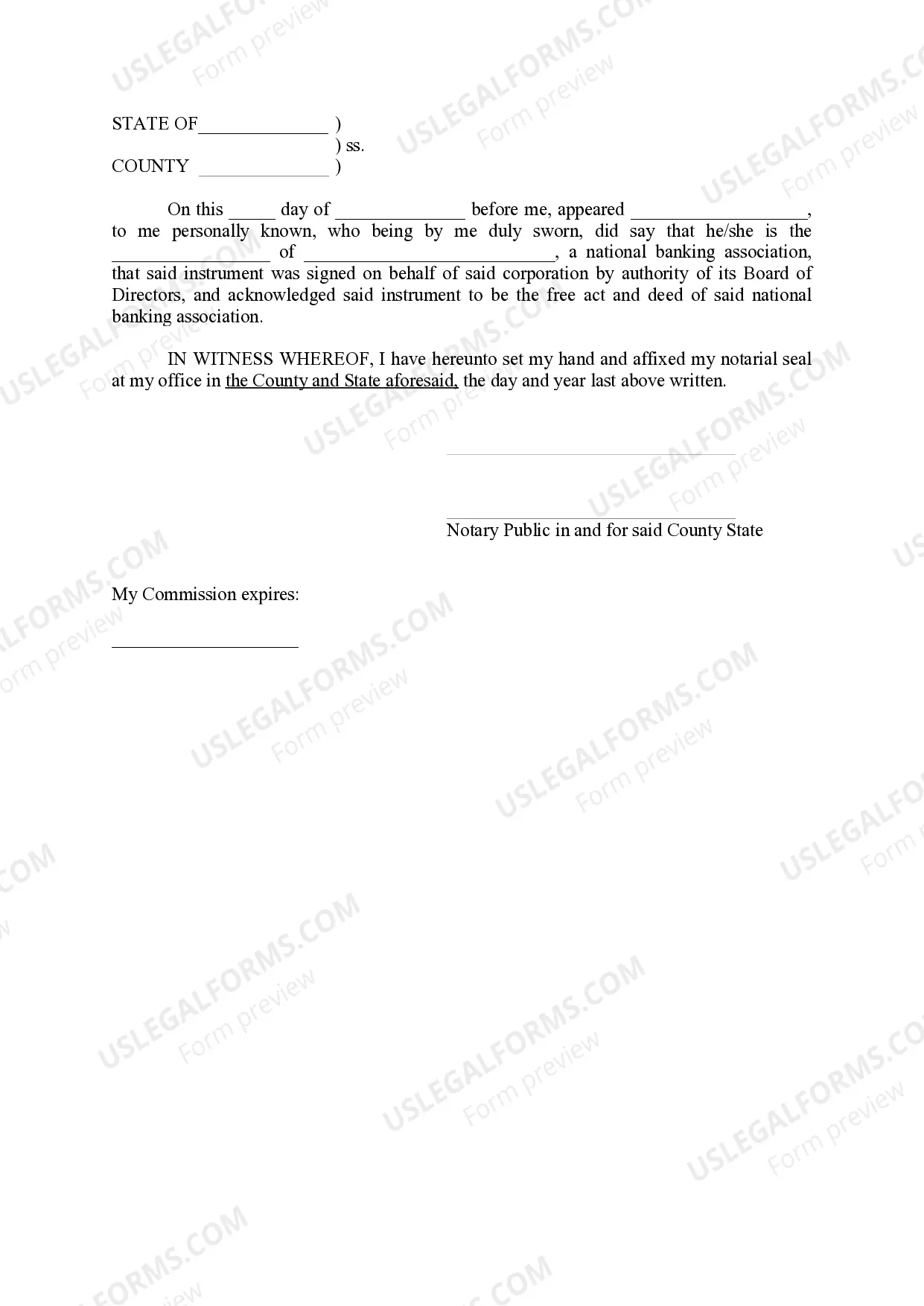

In Missouri, a subordination agreement typically needs to be notarized to ensure its legality and enforceability. Notarization provides an added layer of authenticity, which can be crucial in legal proceedings. By having your Missouri Subordination Agreement notarized, you can protect your interests and ensure that all parties are held accountable. It's always a good idea to consult with a legal professional for guidance on this process.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

What is a Subordinate Mortgage? Subordinate mortgages are loans that have a lower priority status than any other recorded liens (or debts) against a property. When you get the loan you need to purchase your home, this loan is typically recorded as the first repayment priority on your deed after closing.

A subordination agreement often comes up when a home has a first and a second mortgage, and the borrower wants to refinance the first mortgage. If you have two mortgages on your home and refinance the first loan, the refinancing lender might require a subordination agreement.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Fffd There is no provision in the Uniform Commercial Code to file a subordination agreement. Not filing a subordination agreement does not harm any other creditor.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.