Subordination Agreement of Deed of Trust

Overview of this form

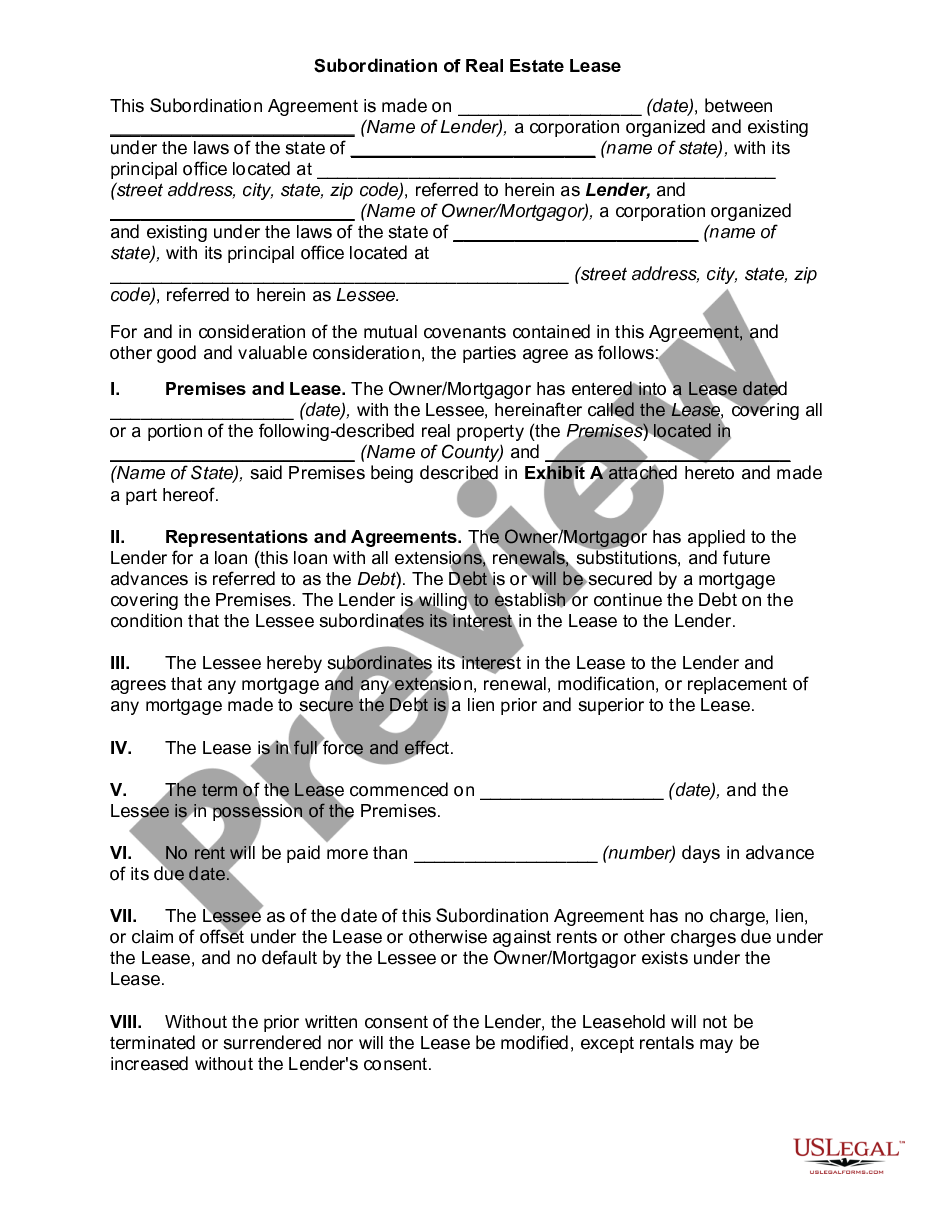

The Subordination Agreement of Deed of Trust is a legal document that allows one lien holder to place their lien behind another lien holder's. This agreement alters the priority of liens on a property, ensuring that the subordinate lien holder recognizes the superiority of the other lien. Unlike a standard Deed of Trust, this form specifically addresses lien priorities, making it essential for parties involved in real estate transactions where multiple liens exist.

Main sections of this form

- Date of the agreement

- Identification of parties involved

- Details of the original Deed of Trust

- Terms defining the subordination of the lien

- Execution and acknowledgment by a Notary Public

Common use cases

This form is used when a lien holder agrees to subordinate their interest to another lien holder. This situation often arises during refinancing, property sales, or when an additional loan is secured against the same real estate. It is critical for ensuring the correct priority of liens to protect the interests of new or existing lenders.

Who should use this form

- Lenders who wish to adjust lien priority

- Borrowers securing additional financing while managing existing loans

- Real estate attorneys facilitating transactions involving multiple liens

Instructions for completing this form

- Identify and enter the date of the agreement.

- Specify the parties involved, including the lien holders.

- Provide details of the existing Deed of Trust including dates and recording information.

- Clearly state the terms of lien subordination.

- Gather required signatures and ensure notarization for validity.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Mistakes to watch out for

- Failing to include complete details of both Deeds of Trust.

- Not having the document notarized when required.

- Omitting signatures from all relevant parties.

- Incorrectly dating the agreement or entering incorrect information.

Benefits of using this form online

- Convenient access to a legally compliant form ready for download.

- Editability allows personalization for specific circumstances.

- Secure and easy retrieval of documents whenever needed.

Jurisdiction-specific notes

This is a general template intended for use in various states. Laws and formatting rules differ, so confirm the document meets your state’s requirements before using it.

Form popularity

FAQ

A subordination clause or subordination agreement is used to lower the priority of a first recorded deed of trust or mortgage in favor of a later or junior recorded deed of trust or mortgage.

A Subordination Deed includes provisions where the junior creditor agrees not to be paid by the debtor until the senior creditor has been repaid in full.

The borrower (trustor) benefits the most from a subordination clause since this makes it easier to obtain an additional loan on their property. For example, the buyer of vacant land can obtain a construction loan more easily if the loan against the land will be subordinated to the construction loan.

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

A subordination clause or subordination agreement is used to lower the priority of a first recorded deed of trust or mortgage in favor of a later or junior recorded deed of trust or mortgage.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.