Assignment of Deed of Trust

Description

Key Concepts & Definitions

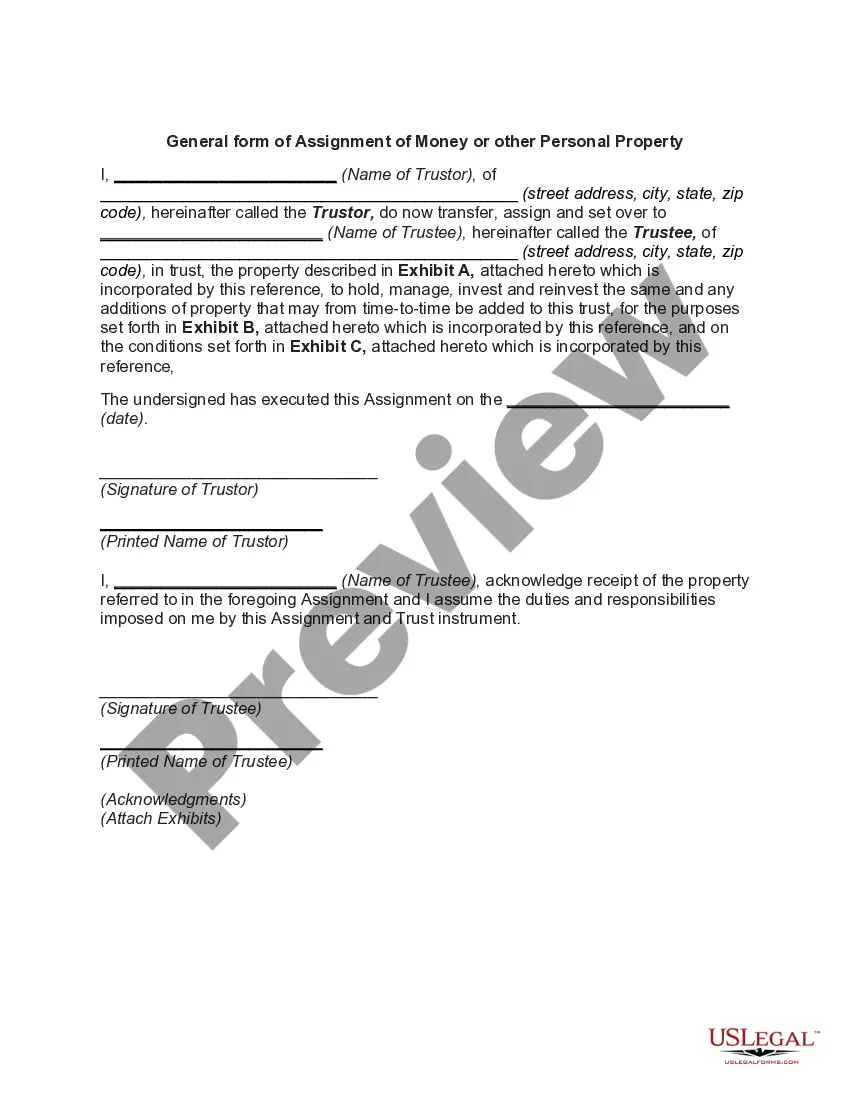

Assignment of Deed of Trust is a legal process in the United States where the original lender transfers the rights and responsibilities under the deed of trust to another party. This document serves as evidence that the mortgage loan associated with the property has been transferred from the original lender to a new party. This process is essential in real estate transactions involving a financed property.

Step-by-Step Guide

- Review the Original Loan Agreement: Confirm terms permit assignment and understand any limitations or conditions.

- Find a Suitable Assignee: Lender identifies a party willing to take over the deed of trust, often another financial institution or investor.

- Execute an Assignment Agreement: Both parties sign a document that legally transfers the lenders interest in the trust deed to the assignee.

- Record the Assignment: File the assignment agreement with the county recorders office where the property is located to make the transfer public record.

- Notify the Borrower: Inform the borrower of the change in the trustee or loan holder to maintain transparency.

Risk Analysis

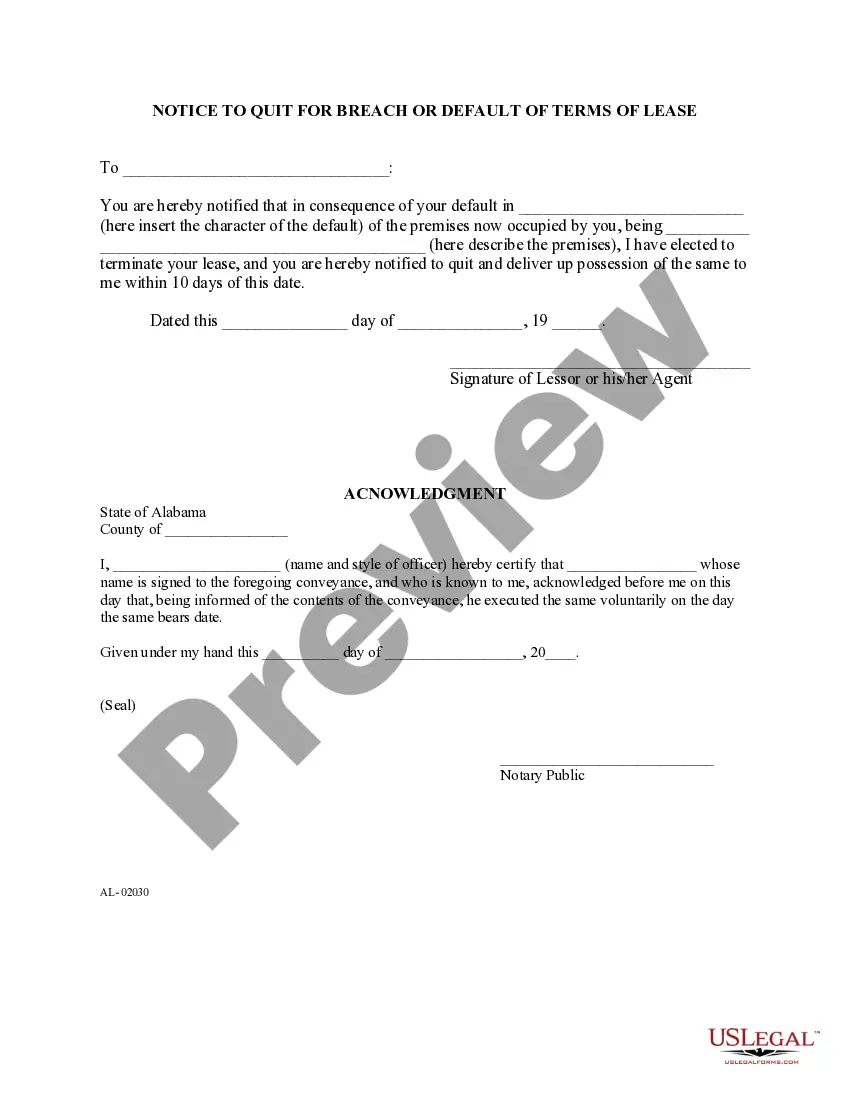

- Legal Risks: Incorrect execution or recording of the assignment could lead to disputes or legal challenges.

- Financial Risks: If the new party fails to manage the loan effectively, it could impact financial returns or lead to default.

- Reputation Risks: Poor management or communication during the process might tarnish the reputations of the institutions involved.

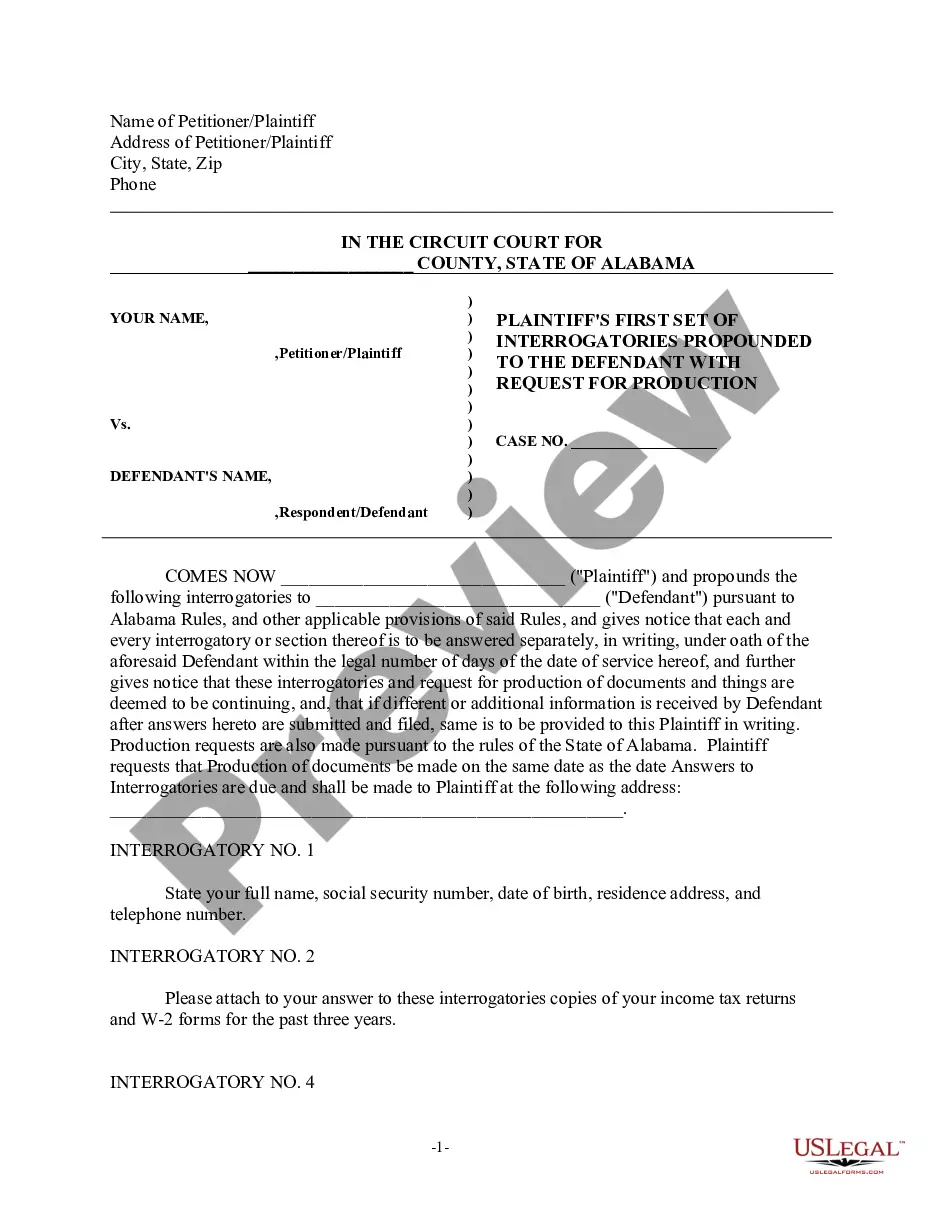

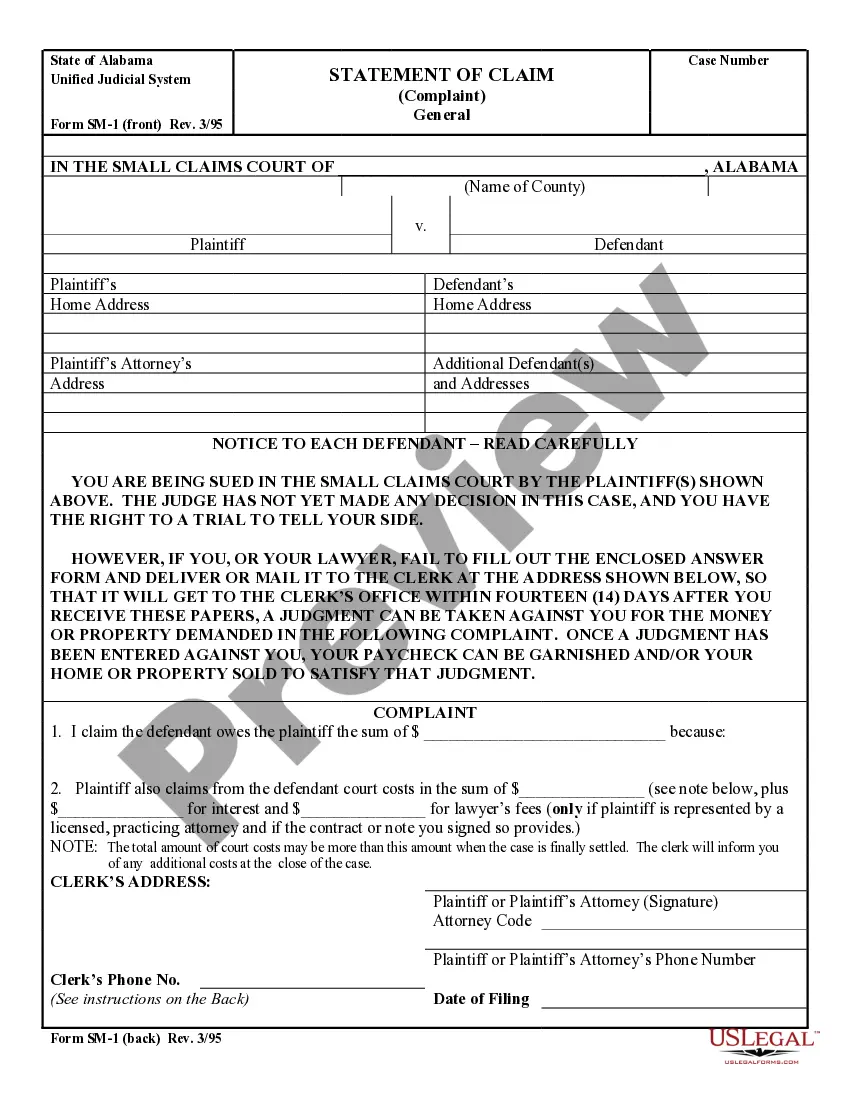

How to fill out Assignment Of Deed Of Trust?

Aren't you tired of choosing from numerous samples each time you want to create a Assignment of Deed of Trust? US Legal Forms eliminates the lost time millions of American citizens spend searching the internet for perfect tax and legal forms. Our skilled team of attorneys is constantly changing the state-specific Forms library, so that it always provides the proper files for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription should complete a few simple actions before having the capability to get access to their Assignment of Deed of Trust:

- Make use of the Preview function and read the form description (if available) to be sure that it is the correct document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right example for the state and situation.

- Use the Search field at the top of the webpage if you have to look for another file.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your sample in a required format to complete, create a hard copy, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the capacity to sign in and download whatever document you will need for whatever state you want it in. With US Legal Forms, finishing Assignment of Deed of Trust samples or any other legal paperwork is simple. Begin now, and don't forget to look at the examples with accredited lawyers!

Form popularity

FAQ

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

A deed of assignment is used to assign just the beneficial interest in land/property from one party to another. A deed of trust can also be used to do this, however it also includes other clauses such as how to sell the property.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed of trust is a legal document that is the security for a real estate loan. The document itself is recorded with the county recorder or registrar of titles in the county where the real estate is located.

A deed of trust is a written instrument with three parties: The trustor, who is the borrower and homeowner. The beneficiary, who is the lender. The trustee, who is a third party such as an insurance company or escrow management agency that holds actual title to the property in trust for the beneficiary.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.