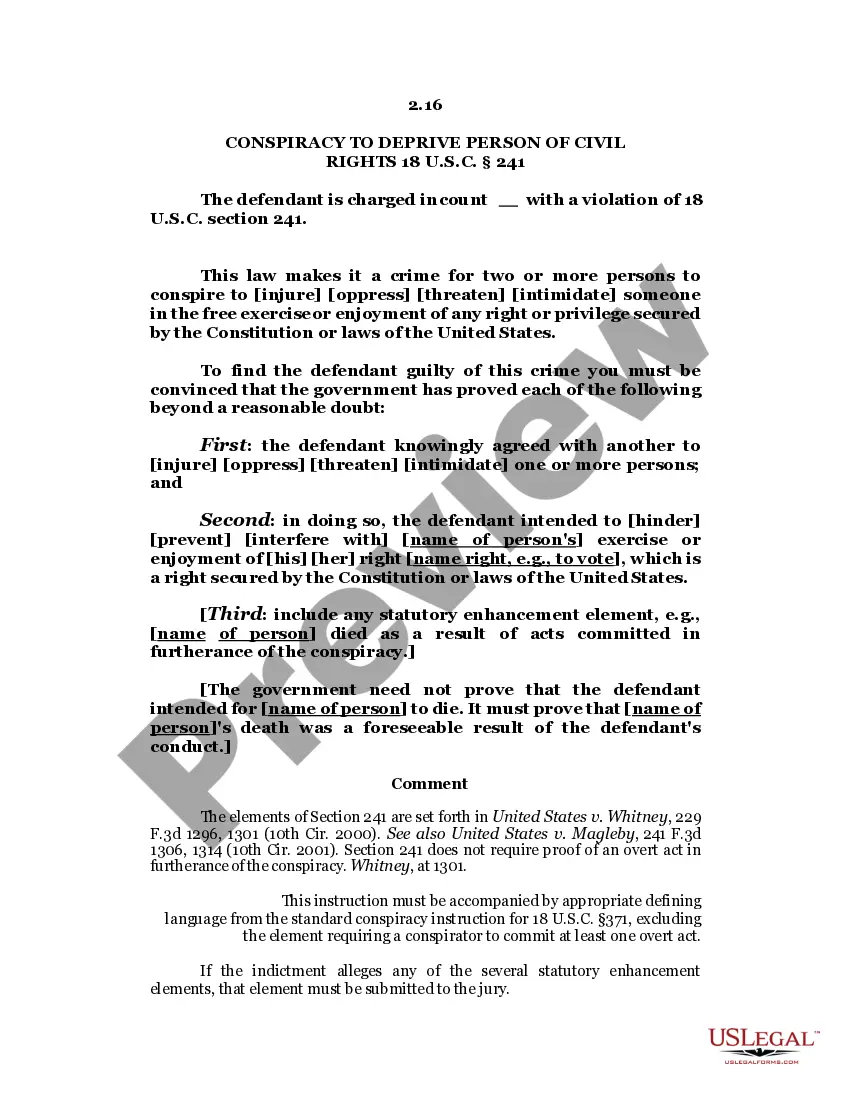

This is a due diligence contract provision that a company will provide reimbursement for any losses that the director may incur in business transactions.

Director Favorable Director Indemnification Agreement

Description

How to fill out Director Favorable Director Indemnification Agreement?

When it comes to drafting a legal document, it is easier to leave it to the specialists. However, that doesn't mean you yourself can’t get a sample to use. That doesn't mean you yourself can’t get a sample to utilize, however. Download Director Favorable Director Indemnification Agreement right from the US Legal Forms website. It gives you numerous professionally drafted and lawyer-approved documents and templates.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. As soon as you are registered with an account, log in, find a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Director Favorable Director Indemnification Agreement fast:

- Make confident the form meets all the necessary state requirements.

- If available preview it and read the description before buying it.

- Click Buy Now.

- Select the suitable subscription to suit your needs.

- Create your account.

- Pay via PayPal or by credit/visa or mastercard.

- Choose a needed format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Director Favorable Director Indemnification Agreement is downloaded you may complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Indemnification. Indemnification is an undertaking by the company to defend the director and officer against the cost of certain claims, including legal fees, litigation awards and settlement costs.

Permitted indemnity provision (737251c68a3176845f4c511f689d6587), in relation to. a company, means a provision that (a) provides for indemnity against liability incurred by a. director of the company to a third party; and.

Identify Time Periods for Asserting Indemnification Rights. Provide Notice in a Timely Fashion. Notify All Concerned Parties. Understand Limitations on Recovery. Exclusive Remedy. Scope of Damages. Claims Process/Dispute Resolution.

What does "Corporate Indemnification" mean?In the context of business organizations, a limited liability company or corporation will often indemnify its officers and directors, covering their expenses (including legal fees) and judgment amounts incurred by such persons as a result of their service to the entity.

A company can indemnify its directors against personal liability so long as the indemnity does not cover:other liabilities (such as legal costs) in criminal cases where the director is convicted, or in civil cases brought by the company where the final judgment goes against the director.

Indemnification under Companies Act, 2013: While Section 201 of the erstwhile Companies Act, 1956 had restricted a company from indemnifying the directors of the company, the Companies Act, 2013 does not have any such restriction and therefore, directors can now be indemnified by companies against liabilities.

Indemnity is a comprehensive form of insurance compensation for damages or loss.Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

To indemnify someone is to absolve that person from responsibility for damage or loss arising from a transaction. Indemnification is the act of not being held liable for or being protected from harm, loss, or damages, by shifting the liability to another party.