Minnesota Material Return Record

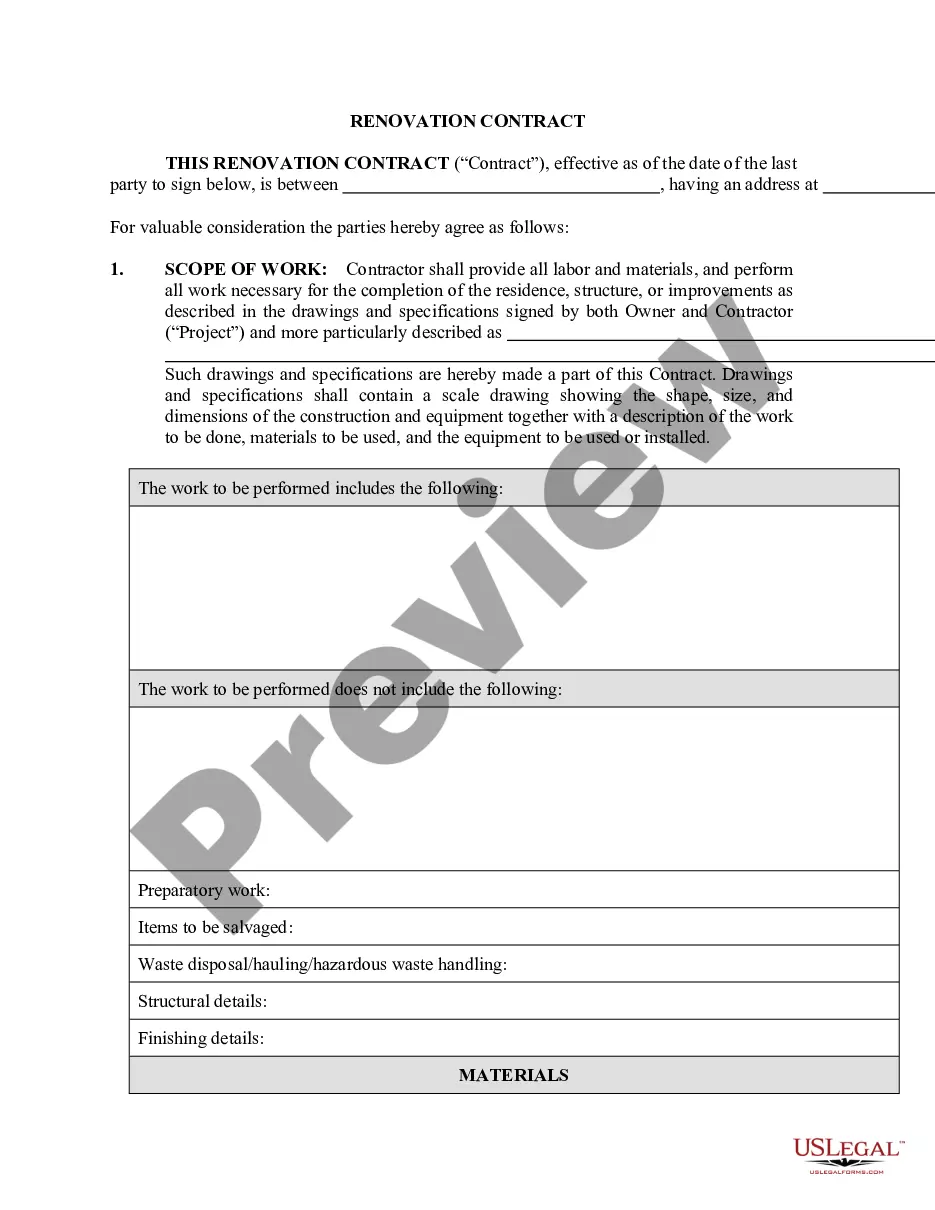

Description

How to fill out Material Return Record?

It is feasible to spend hours online searching for the authentic format that meets the federal and state specifications you require. US Legal Forms offers thousands of authentic forms that are evaluated by experts.

You can obtain or print the Minnesota Material Return Record from the service.

If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Minnesota Material Return Record. Every authentic format you purchase is yours for a lifetime. To acquire an additional copy of a purchased form, visit the My documents tab and click the respective button.

Make modifications to your file if necessary. You can complete, edit, sign, and print the Minnesota Material Return Record. Download and print thousands of form templates using the US Legal Forms website, which offers the largest collection of authentic forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the region/city of your choice. Review the form description to verify that you have chosen the right one. If available, utilize the Preview button to review the format as well.

- If you wish to find another variation of the form, use the Search field to locate the format that fits your needs and requirements.

- Once you have found the format you need, click Get now to proceed.

- Select the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the authentic form.

- Choose the format of the file and download it to your device.

Form popularity

FAQ

To get a transcript, taxpayers can:Order online. They can use the Get Transcript tool on IRS.gov.Order by mail. Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts.Complete and send either 4506-T or 4506T-EZ to the IRS.

Order a TranscriptOnline Using Get Transcript. They can use Get Transcript Online on IRS.gov to view, print or download a copy of all transcript types.By phone. The number is 800-908-9946.By mail. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946.

Prior year tax returns are available from the IRS for a fee. Taxpayers can request a copy of a tax return by completing and mailing Form 4506 to the IRS address listed on the form. There's a $43 fee for each copy and these are available for the current tax year and up to seven years prior.

An IRS Tax Return Transcript can be obtained: ONLINE: Visit . Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

What Tax Records Should I Keep? You should keep every tax return and supporting forms. This includes W-2s, 1099s, expense tracking, mileage logs, records supporting itemized deductions and other documents.

The State of Minnesota sends out income tax refunds very quickly. Sometimes, it can take as little as 2-3 days. Property tax refunds are normally sent in July for renters and in September for home owners.

Complete and send Form M100, Request for Copy of Tax Return. Send us a letter requesting a copy....In your letter, include:Your full name, address, and Social Security Number.The years and types of returns requested.Your daytime phone number.Indication if you need certified copies.Your signature.

An IRS Tax Return Transcript can be obtained: ONLINE: Visit . Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

To view this, sign in using your Government Gateway user ID and password and choose 'View statements' from the left-hand menu.