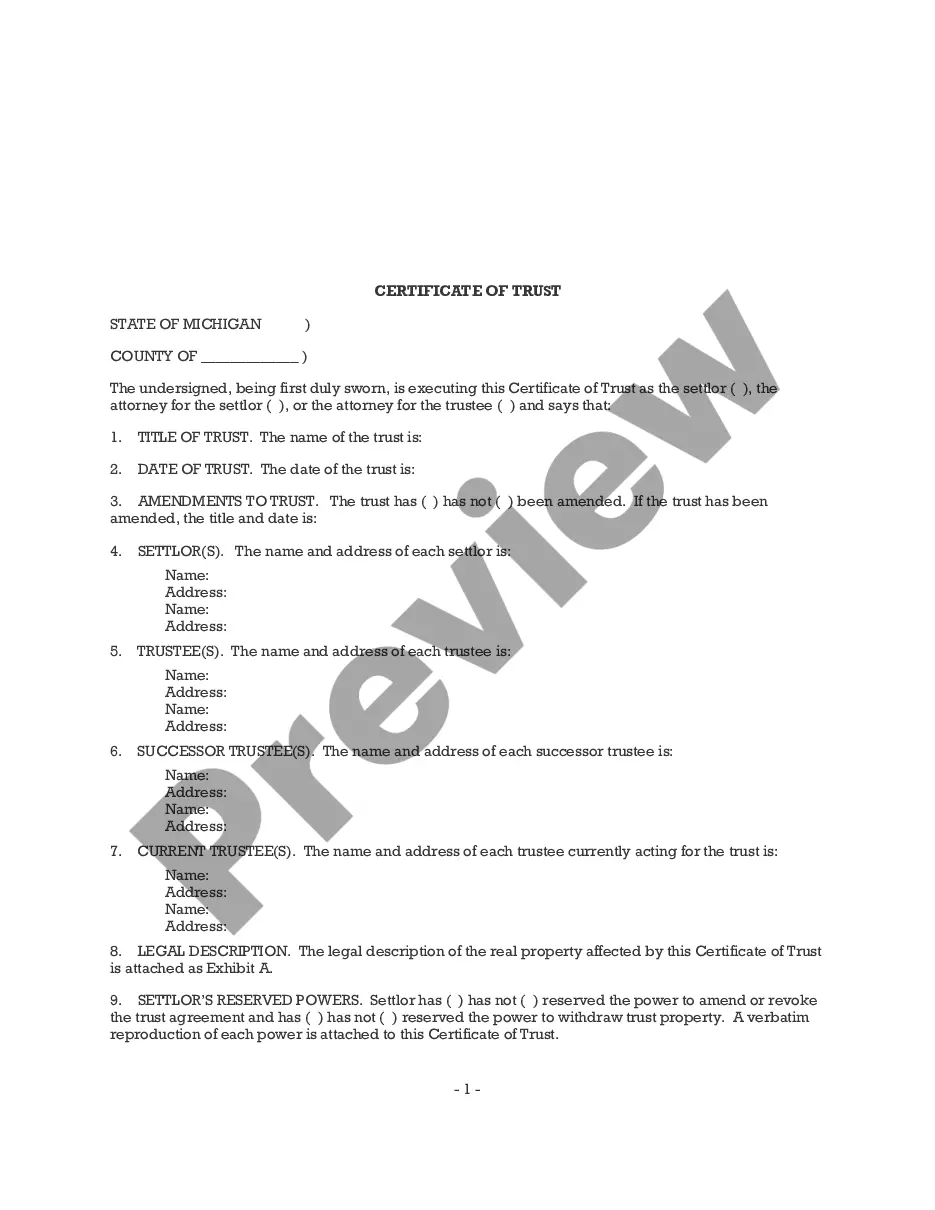

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

Michigan Certificate of Trust

Description

Key Concepts & Definitions

Certificate of Trust: A legal document that serves as evidence of a trusts existence and outlines the powers assigned to the trustee without revealing the detailed assets or the identities of the trust beneficiaries.

Step-by-Step Guide to Obtaining a Certificate of Trust

- Contact the Trustee: The first step is to contact the trustee managing the trust. They are responsible for issuing certificates of trust.

- Request Documentation: Request a copy of the certificate from the trustee. You may need to provide proof of interest or involvement with the trust.

- Verification: Verify the details included in the certificate, such as the trust's name, date of establishment, powers of the trustee, and the trusteeship duration.

- Notarization: Once received, ensure the certificate is notarized to affirm its validity, especially if it will be used in legal transactions.

- Use Appropriately: Utilize the certificate as needed for financial or legal processes, ensuring to keep it confidential and secure.

Risk Analysis

- Privacy Concerns: Improper handling of a certificate of trust can lead to unintentional disclosure of sensitive information.

- Fraud Risks: Fraudulent certificates can be created, which might mislead banks or legal authorities, leading to financial loss or legal issues.

- Legal Disputes: Disputes over the validity of a certificate can lead to prolonged legal battles among beneficiaries or between trustees and third parties.

Key Takeaways

Certificates of trust are crucial for proving the existence and authority of a trust without revealing sensitive details. Securing and verifying these documents are vital for any transactions involving the trust.

Common Mistakes & How to Avoid Them

- Not Verifying the Trustee: Always ensure that the issuing trustee is legally appointed and verified.

- Ignoring Notarization: Notarizing the certificate is crucial for its legal standing in transactions. Never overlook this step.

- Lack of Confidentiality: Maintain the confidentiality of the certificate to protect against unauthorized use or information leakage.

FAQ

What is a certificate of trust used for? It is used to prove the trust's existence to banks or financial institutions during transactions without divulging detailed beneficiary information.

Who can request a certificate of trust? Typically, people who have a direct interest in the trust, such as trustees, banks, or legal entities needing verification of the trusts existence and terms.

How to fill out Michigan Certificate Of Trust?

Access any template from 85,000 legal documents including the Michigan Certificate of Trust online with US Legal Forms.

Each template is crafted and refreshed by attorneys licensed in the state.

If you hold a subscription, Log In. Once you are on the form's page, click the Download button and navigate to My documents to obtain it.

With US Legal Forms, you will always have immediate access to the correct downloadable template. The service provides you with access to forms and categorizes them to ease your search. Use US Legal Forms to acquire your Michigan Certificate of Trust swiftly and conveniently.

- Verify the state-specific criteria for the Michigan Certificate of Trust you want to utilize.

- Examine the description and preview the prototype.

- When you are confident that the example fits your needs, simply click Buy Now.

- Select a subscription option that aligns with your financial plan.

- Establish a personal account.

- Complete the payment through one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two formats are provided (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is downloaded, print it or save it on your device.

Form popularity

FAQ

Filing a trust in Michigan involves creating the trust document itself, which is usually not filed with a court. However, if the trust holds assets like real estate, you may need to record related deeds or documents. Using a Michigan Certificate of Trust can simplify interactions with financial and legal institutions. For accurate guidance, consider utilizing platforms like US Legal Forms to access templates and advice tailored to your needs.

Trusts in Michigan, including a Michigan Certificate of Trust, may need to file tax returns with the IRS under certain circumstances. Whether a trust must file depends on its classification and income. Generally, trusts that generate taxable income will have filing obligations. It’s advisable to consult a tax professional to navigate these requirements and ensure compliance with IRS regulations.

In Michigan, a certificate of trust generally does not require notarization; it becomes effective when properly signed. However, having it notarized can offer an added layer of assurance if needed for specific transactions. This step can enhance the document's trustworthiness when presenting it to financial institutions. For any questions about notarization, consider consulting professionals who can guide you effectively.

You typically do not file a Michigan Certificate of Trust with the court. Instead, you may present this document to banks, real estate agents, and other entities involved in managing trust assets. It is vital to keep copies of the certificate in a secure location for your records. By maintaining a well-organized trust structure, you ensure easier management and oversight.

A certificate of trust is a legal document that summarizes a trust’s essential details, showing its validity and the authority of its trustee. Essentially, it allows trustees to manage and distribute assets without revealing the entire trust document. This is particularly useful when dealing with financial institutions or real estate transactions. Thus, a Michigan Certificate of Trust serves as proof of the trust's legitimacy while protecting sensitive information.

In Michigan, you do not need to file a trust with the court. However, if your trust holds property, you may need to record some documents, like a Michigan Certificate of Trust, to prove its existence. It is essential to follow practical steps to ensure that your trust operates effectively without court supervision. This process helps to maintain privacy and simplify management.

In Michigan, the specifics of a trust are not considered public record, which means the details of the trust are generally kept private. However, a Certificate of Trust can be presented when necessary, allowing the trustee to prove their authority without revealing the entire trust document. This protects the privacy of your estate while facilitating smooth transactions. For more information on maintaining your privacy, uslegalforms offers useful resources.

A Certificate of Trust document serves as a legal statement confirming the existence of a trust and the appointed trustee's authority. This document summarizes important information from the full trust agreement and enables the trustee to act on behalf of the trust. It is an essential tool for managing trust affairs efficiently. If you're looking for a template or further assistance, uslegalforms can help streamline the creation process.

In Michigan, a Certificate of Trust generally does not need to be recorded with a court. However, it can be presented to financial institutions and other parties to establish the authority of the trustee. This flexibility allows for easier management of trust assets without unnecessary public disclosure. If you need clarity on this process, uslegalforms provides guidance tailored to your needs.

In Michigan, a certificate of trust must include key details such as the name of the trust, the date it was created, and the identity of the trustee. Additionally, it should outline the powers granted to the trustee. This document serves to verify the authority of the trustee while keeping the full trust document private. If you need a reliable template, uslegalforms offers resources to help you get it right.