Minnesota Return Authorization Form

Description

How to fill out Return Authorization Form?

Are you in a position where you require documents for either professional or personal purposes almost every workday.

There are numerous legal document templates accessible online, but locating reliable ones isn’t easy.

US Legal Forms offers a vast array of form templates, such as the Minnesota Return Authorization Form, which are designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Return Authorization Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/region.

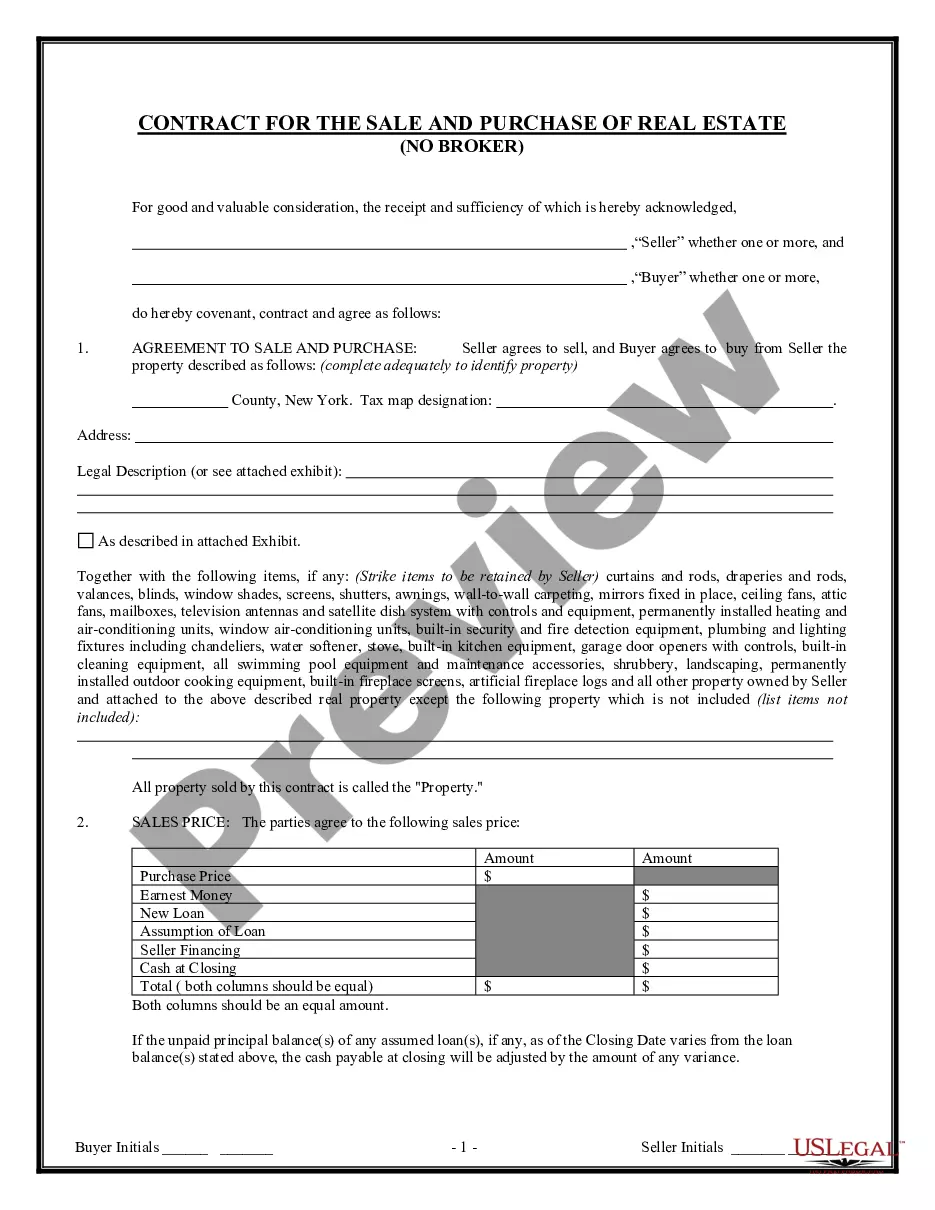

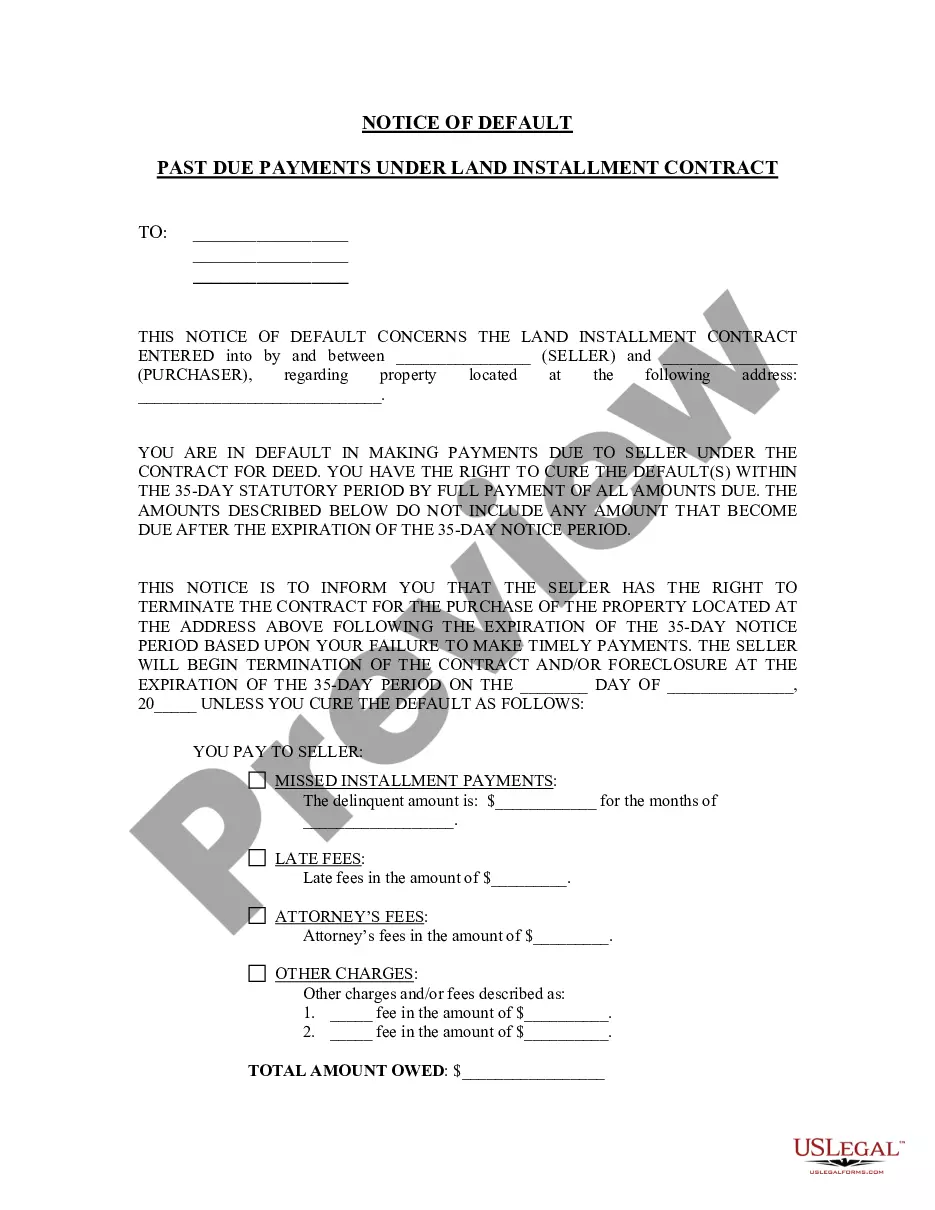

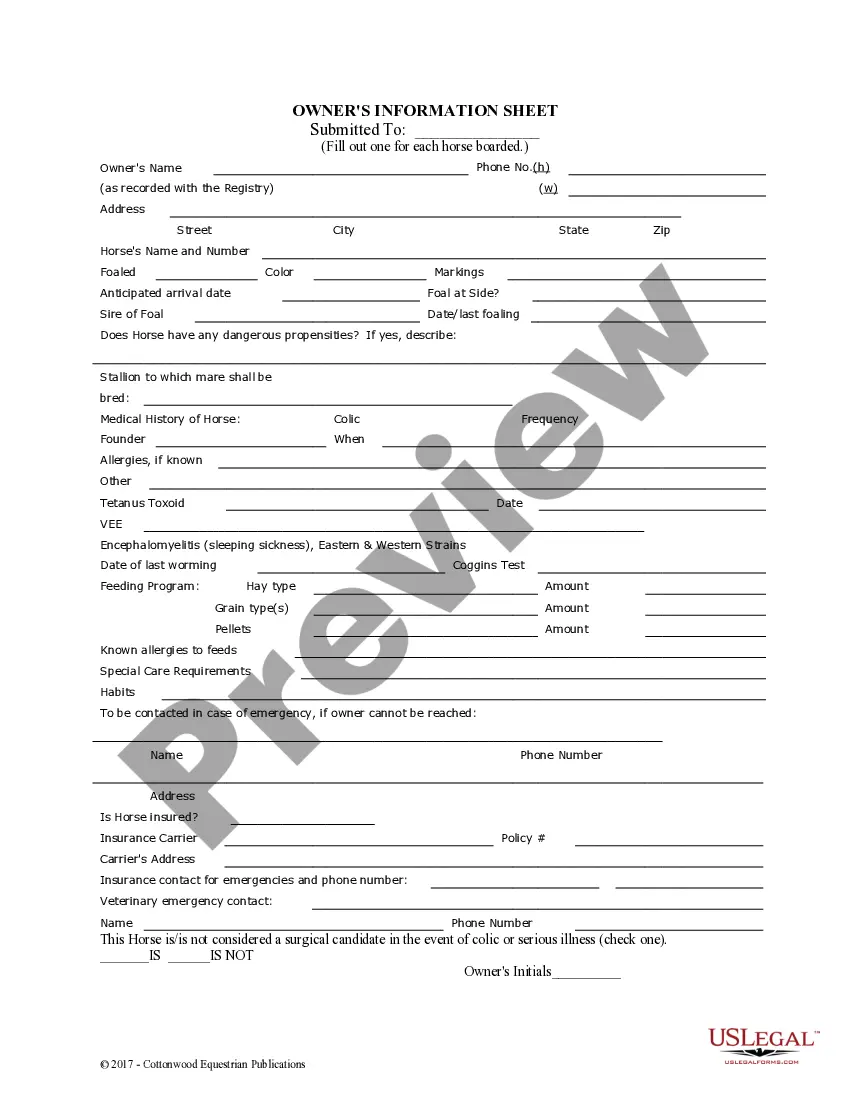

- Utilize the Review button to examine the form.

- Read the details to confirm you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and criteria.

- Once you find the correct form, click Get now.

- Select the payment plan you prefer, provide the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient paper format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of Minnesota Return Authorization Form anytime if needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

You can find your M1PR form on the Minnesota Department of Revenue's official website. They provide the form as a downloadable PDF for convenience. Additionally, utilizing the Minnesota Return Authorization Form can assist you in getting support while you complete the M1PR form.

To file for a property tax refund in Minnesota, you will need to complete the M1PR form and submit it to the Minnesota Department of Revenue. You can easily access this form online, along with the Minnesota Return Authorization Form for any additional needs. Ensure you gather all relevant documentation, including your property tax statement, to streamline the process.

A tax authorization form allows an individual to grant permission to another party to discuss or handle their tax matters. In Minnesota, the Minnesota Return Authorization Form can serve this purpose. It's important to fill it out correctly to ensure that your information is kept secure while allowing designated individuals access.

You should report your Minnesota property tax refund on Line 10 of your IRS Form 1040 if you itemized deductions in the prior year. It is important to accurately reflect this amount, as it can affect your tax refund. Using the Minnesota Return Authorization Form can help clarify this process and guide you through reporting.

To apply for a Minnesota property tax refund, you need to complete the M1PR form. This document requires details about your property taxes and income. Accompanying this, the Minnesota Return Authorization Form may also be useful for ensuring your application is processed smoothly.

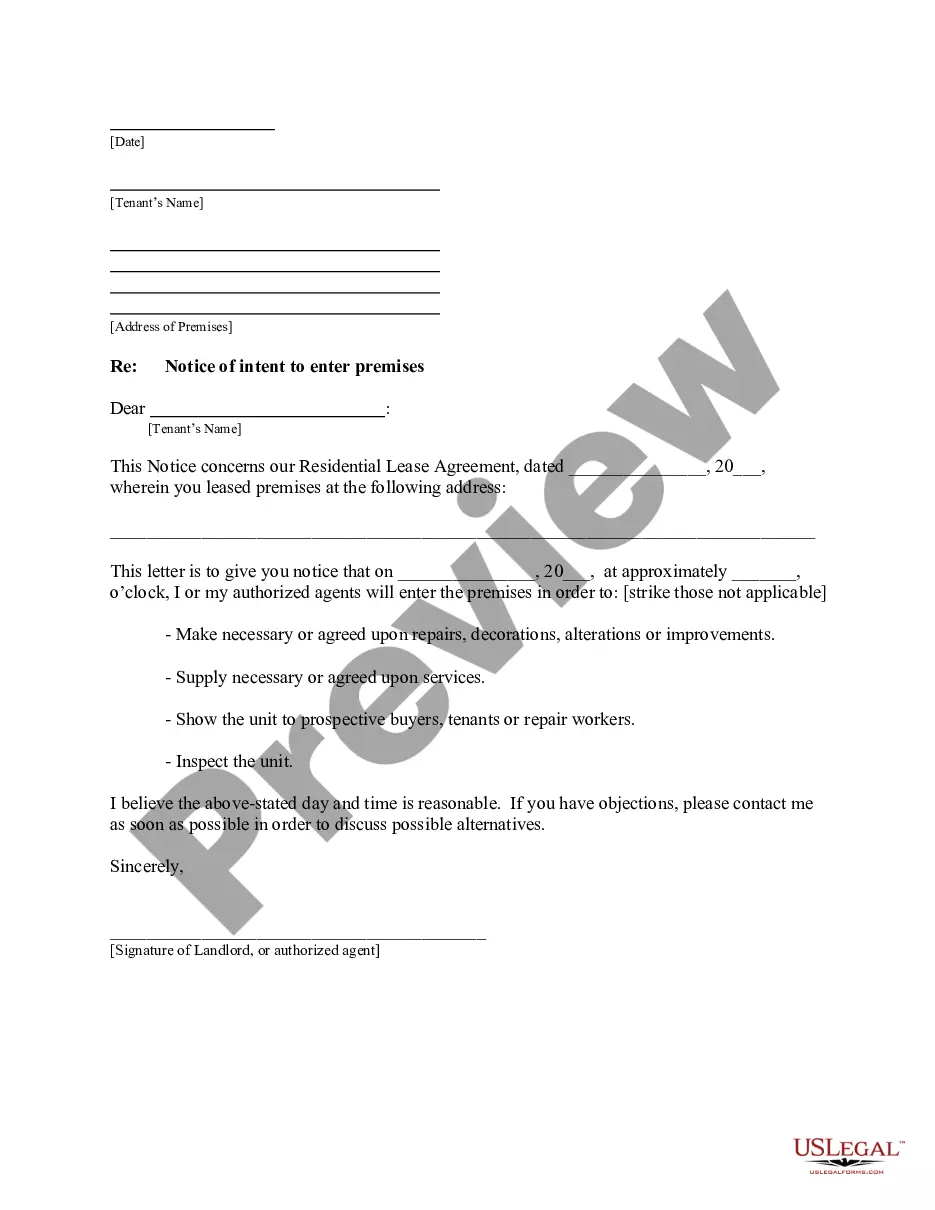

When submitting your Minnesota tax return, you must include the Minnesota Return Authorization Form along with your completed M1 tax form. It's crucial to ensure that all necessary supporting documents, such as W-2 forms and other income statements, are attached. This will help speed up the processing of your tax return and avoid any delays.

While some post offices may offer limited tax forms, it’s advisable to access them online for a wider selection. The Minnesota Department of Revenue’s website has all required forms, including the Minnesota Return Authorization Form, readily available. This method provides a more efficient and up-to-date approach to obtaining your necessary tax paperwork.

Form M1 is the primary tax form used by individuals to file their state income tax in Minnesota. It caters to residents and part-year residents, allowing for reporting income and claiming credits. Be sure to include the Minnesota Return Authorization Form to aid in the accurate processing of your tax return.

You can find Minnesota Department of Revenue forms on their official website, where they provide a comprehensive list of all tax forms including the M1. For convenience, you can also access the Minnesota Return Authorization Form through various online platforms like uslegalforms. This ensures you have all the necessary forms for your tax filing.

The M1 form is the official name for Minnesota's individual income tax return. This form is required for residents and those who were part-year residents during the tax year. When filing, include the Minnesota Return Authorization Form to simplify the submission of your return.