Minnesota Authorization to Release Financial Records and Information - 2 Samples

What is this form?

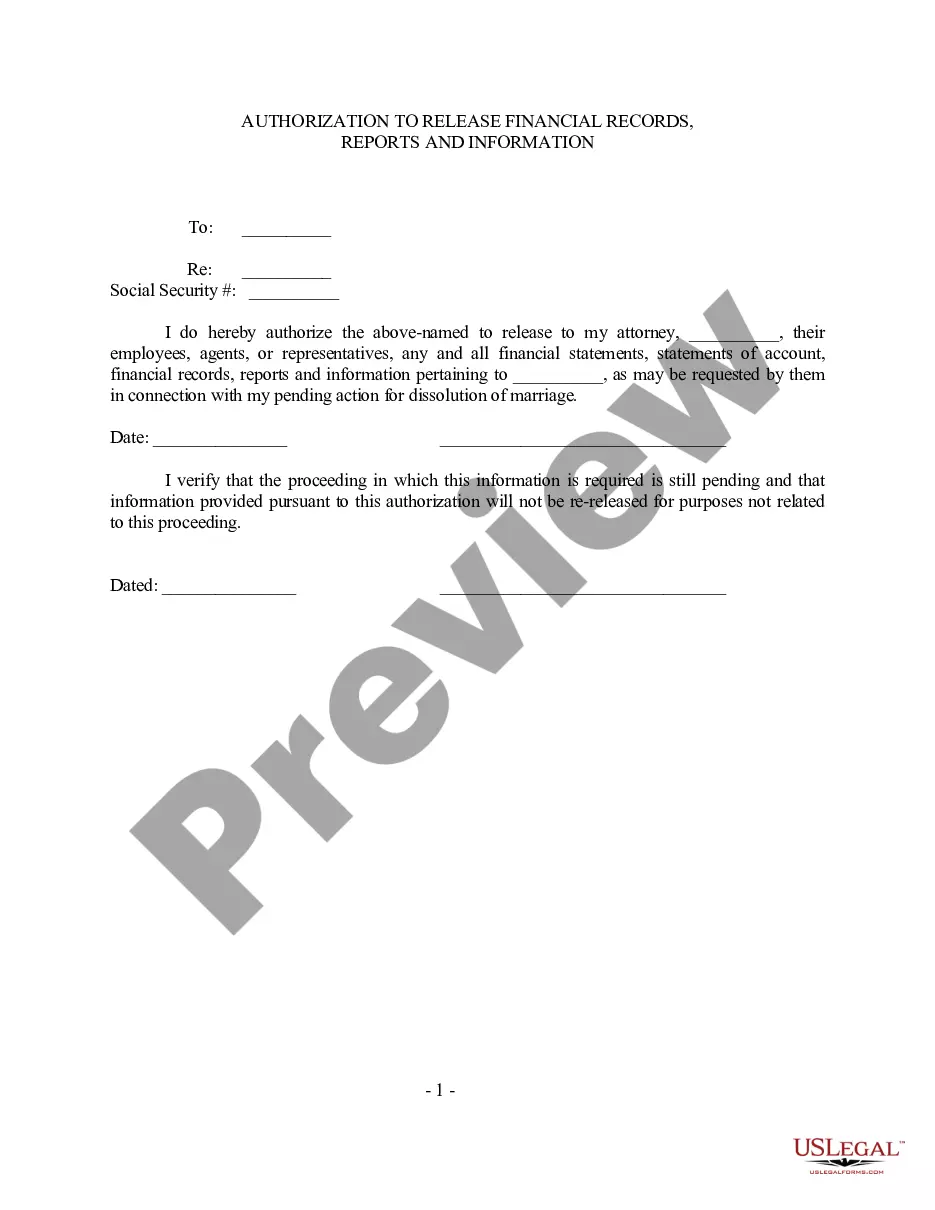

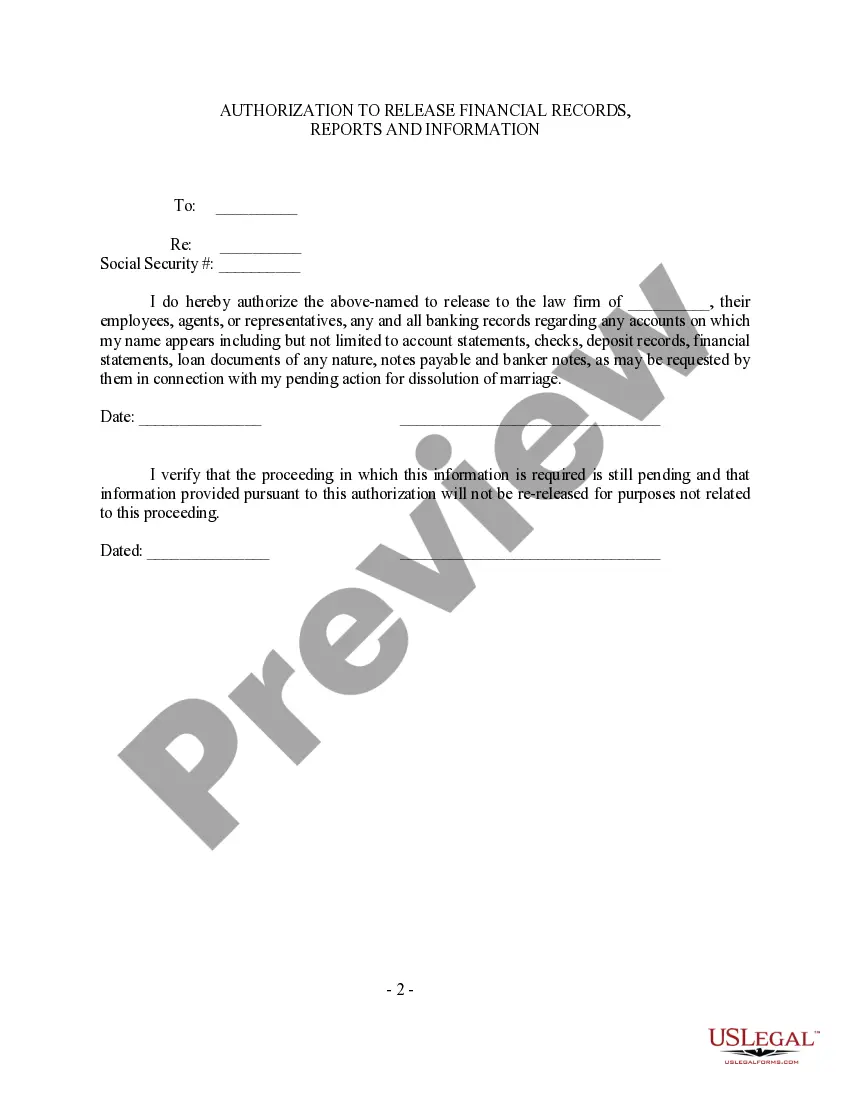

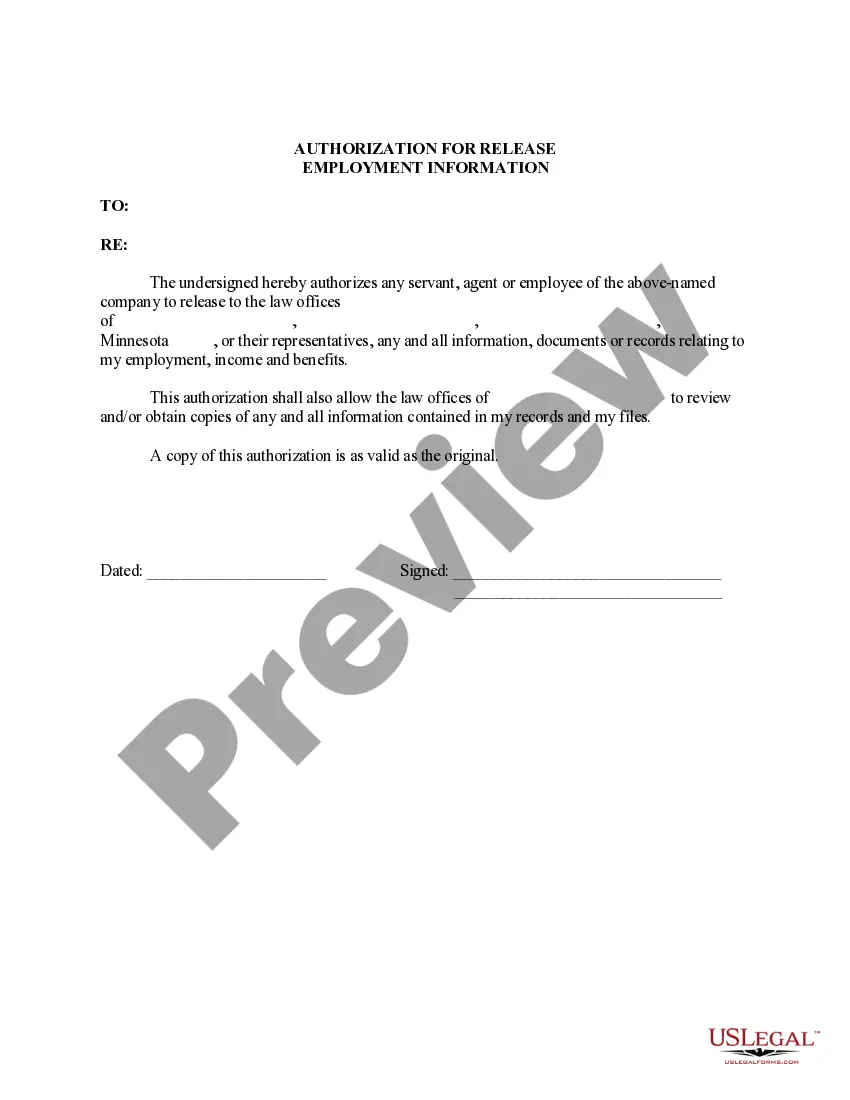

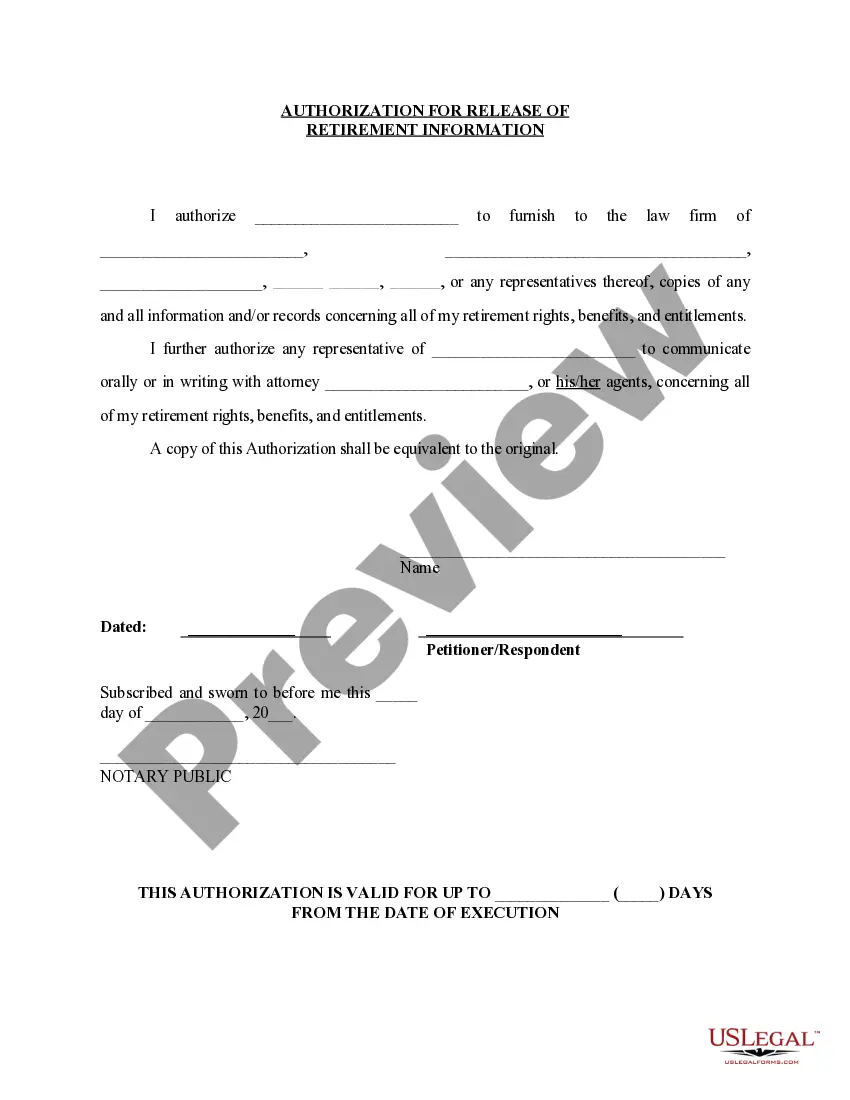

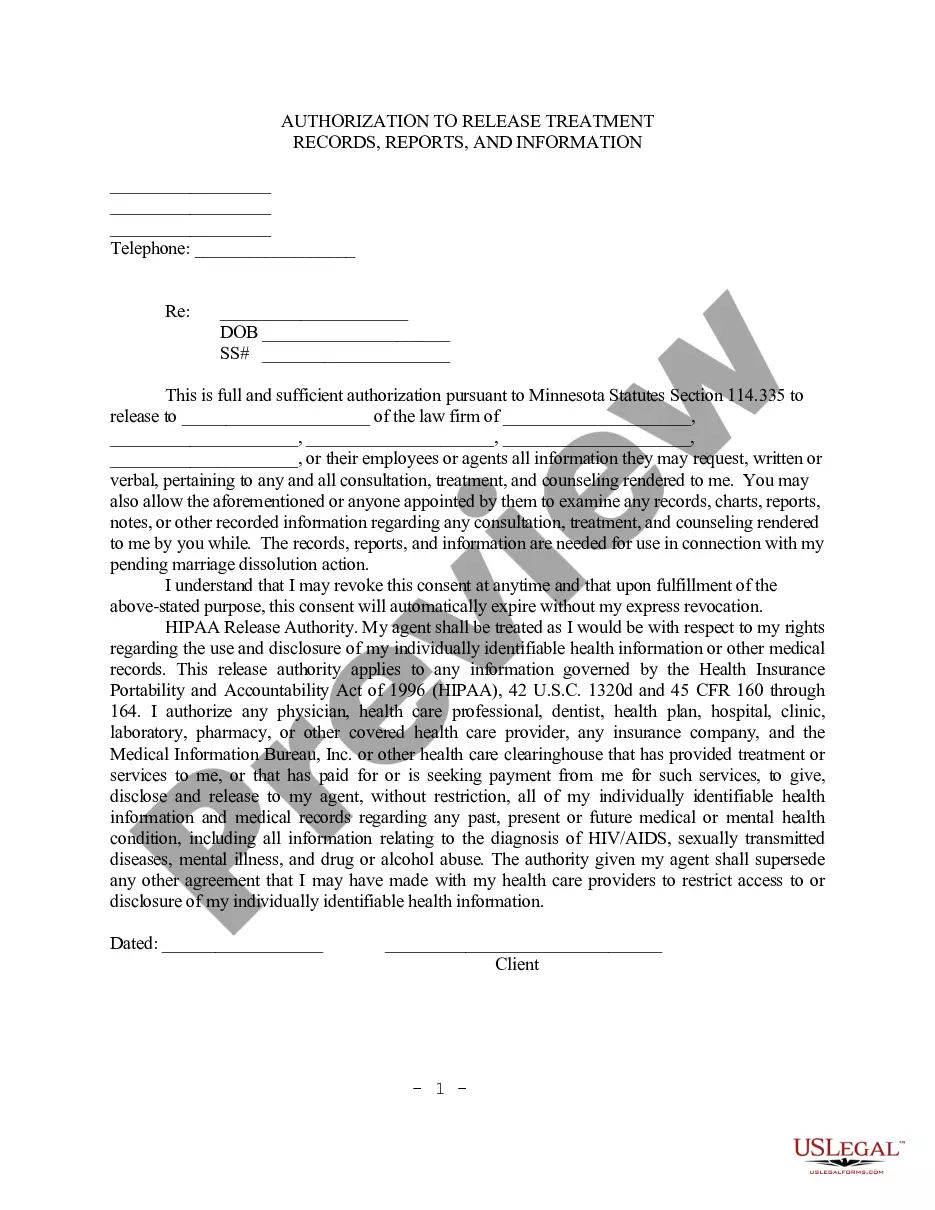

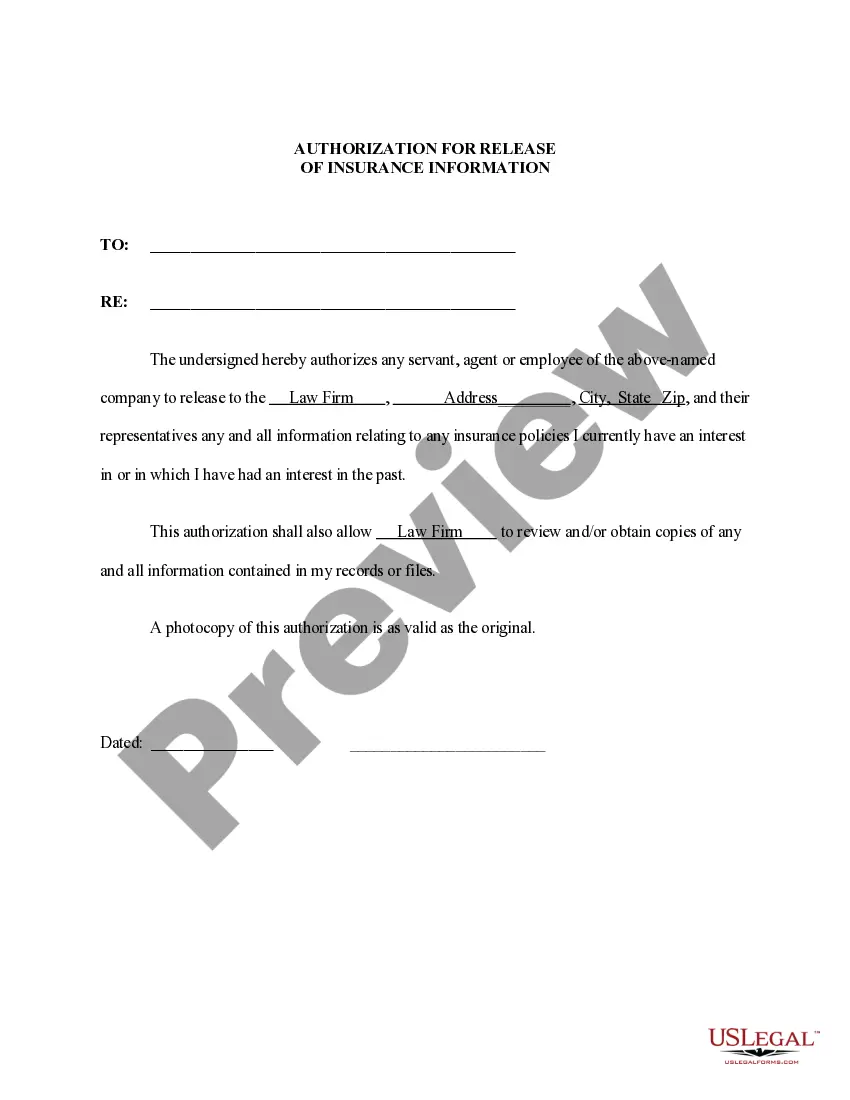

This Authorization to Release Financial Records and Information form allows a client to authorize their attorney to obtain financial records and statements related to their case, specifically in the context of a pending divorce. This type of form is essential for legal representatives to gain access to necessary information from financial institutions or other entities while maintaining confidentiality and compliance with legal standards.

Key parts of this document

- Authorization section: Identifies the parties involved and the attorney receiving the information.

- Details of information requested: Specifies the types of financial records to be released, such as bank records and financial statements.

- Verification clause: Confirms that the information is needed for a pending dissolution of marriage case.

- Date fields: Records the dates of authorization to ensure timelines are documented.

- Signature section: Requires the clientâs signature to validate the authorization.

When to use this document

This form is used when an individual is involved in a divorce proceeding and needs to provide their attorney with access to their financial records. It is essential at any stage of the divorce process where financial documentation is required, such as during negotiations or court hearings.

Who should use this form

- Individuals currently undergoing a divorce seeking legal assistance.

- Clients who need to provide financial details to their attorneys for legal purposes.

- Anyone who must authorize the release of their financial information to comply with legal requirements or court orders.

How to prepare this document

- Identify the parties involved, including yourself and your attorney.

- Specify the financial institutions or entities from which records will be released.

- Clearly detail the types of financial records to be accessed.

- Enter the necessary dates for authorization.

- Sign and date the form to confirm your consent.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all parties' names correctly, which could render the authorization invalid.

- Not specifying the exact financial records needed for the divorce case.

- Missing dates or signatures, which are crucial for the formâs validity.

Benefits of using this form online

- Convenience: Complete and download the form from anywhere at any time.

- Editability: Make necessary changes before finalizing the document.

- Reliability: Access templates drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Your financial records can be accessed by various entities, including the government, under specific legal conditions. Individuals or organizations with your consent can also access these records. Knowing who has the right to view your financial information is essential for protecting your privacy. The Minnesota Authorization to Release Financial Records and Information - 2 Samples provides clarity on who can request access and under what circumstances.

A government authority can access your financial institution records through a valid court order or a subpoena. These legal documents must specify the information needed and the reason for the request. This process is in place to ensure that access is justified and necessary. Utilizing resources like the Minnesota Authorization to Release Financial Records and Information - 2 Samples can help you prepare for such requests.

The Right to Financial Privacy Act requires federal agencies to obtain a court order to access your financial information. This law is designed to protect your privacy and limit government access to sensitive data. By understanding your rights under this act, you can better navigate financial requests. The Minnesota Authorization to Release Financial Records and Information - 2 Samples provides a useful framework for managing such situations.

When the government seeks your financial records, the first step is to provide a written request to your financial institution. This request usually includes a detailed explanation of the information needed and the legal basis for the request. It is crucial for you to know that this process aims to protect your rights. Familiarizing yourself with the Minnesota Authorization to Release Financial Records and Information - 2 Samples can clarify what to expect.

The Right to Financial Privacy Act (RFPA) governs how the federal government can access your financial information. Under this law, authorities must obtain a court order before accessing customer financial records. This ensures your privacy is respected and that there is a justifiable reason for the request. Using the Minnesota Authorization to Release Financial Records and Information - 2 Samples can help you understand these legal processes better.

To fill out an authorization for release of information form effectively, start by clearly identifying the individual or organization authorized to disclose the financial records. Next, provide your personal information, including your name, address, and any relevant identification numbers. Be sure to specify the types of records you wish to access, as well as the purpose for which you need them. Lastly, review the Minnesota Authorization to Release Financial Records and Information - 2 Samples available on the US Legal platform for guidance and to ensure you complete the form correctly.

By signing an authorization to release information, a party is consenting to provide another party with access to otherwise confidential information or records about an individual. However, signing a release doesn't mean the complete loss of confidentiality because most authorization forms are subject to limitations.

Written statement by a creditor to the effect that a debtor has either paid off the debt or the debt is otherwise discharged. A creditor may release a lien if the loan has been paid or if other collateral has been offered.

Under the law, agencies enforce the Financial Privacy Rule, which governs how financial institutions can collect and disclose customers' personal financial information; the Safeguards Rule, which requires all financial institutions to maintain safeguards to protect customer information; and another provision designed

Government agencies like the Consumer Financial Protection Bureau and the Federal Trade Commission provide enforcement for financial privacy regulations.